Answered step by step

Verified Expert Solution

Question

1 Approved Answer

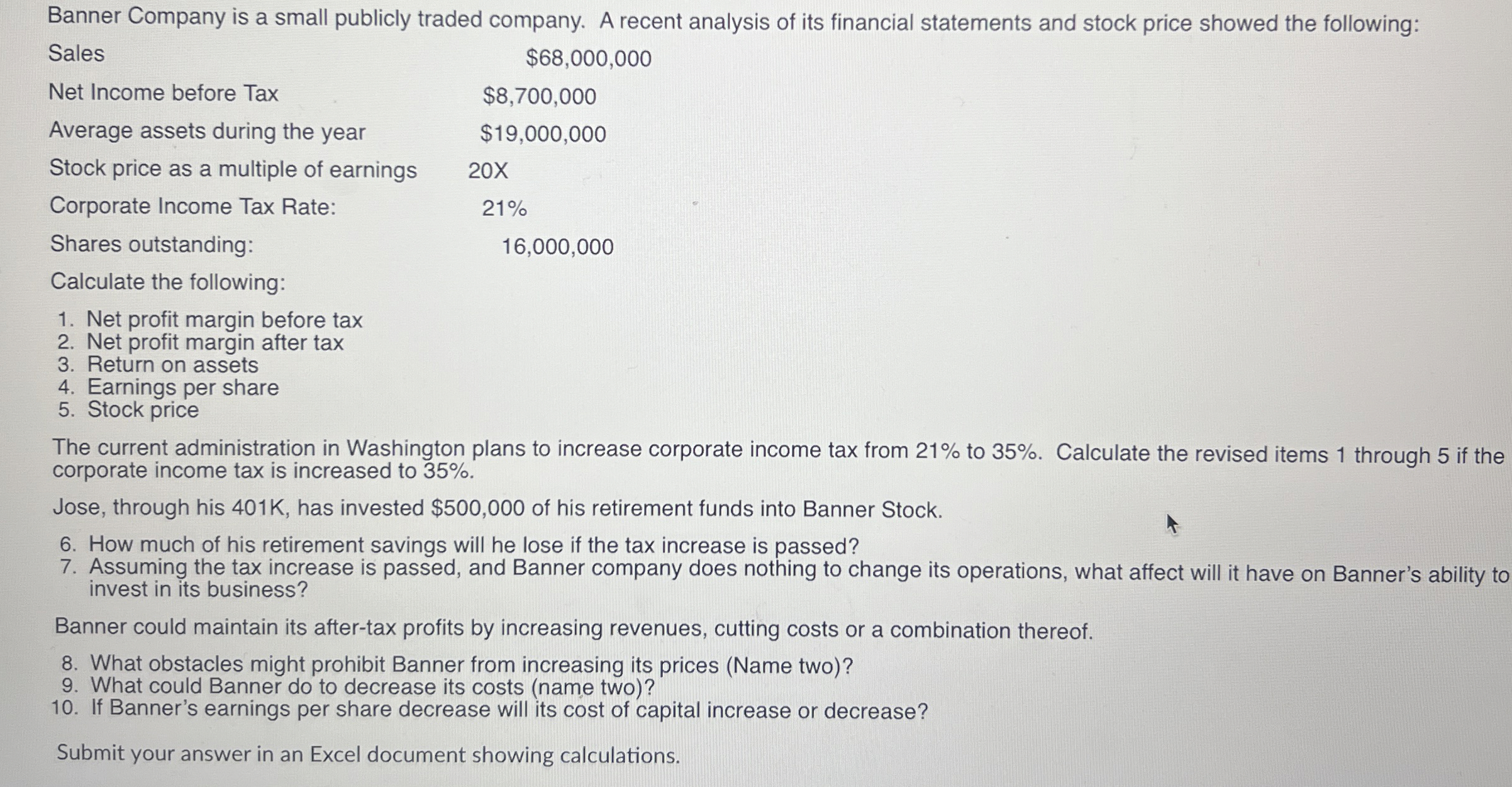

Banner Company is a small publicly traded company. A recent analysis of its financial statements and stock price showed the following: Sales Net Income before

Banner Company is a small publicly traded company. A recent analysis of its financial statements and stock price showed the following:

Sales

Net Income before Tax

$

Average assets during the year

$

Stock price as a multiple of earnings

$

Corporate Income Tax Rate:

X

Shares outstanding:

Calculate the following:

Net profit margin before tax

Net profit margin after tax

Return on assets

Earnings per share

Stock price

The current administration in Washington plans to increase corporate income tax from to Calculate the revised items through if the

corporate income tax is increased to

Jose, through his K has invested $ of his retirement funds into Banner Stock.

How much of his retirement savings will he lose if the tax increase is passed?

Assuming the tax increase is passed, and Banner company does nothing to change its operations, what affect will it have on Banner's ability to

invest in its business?

Banner could maintain its aftertax profits by increasing revenues, cutting costs or a combination thereof.

What obstacles might prohibit Banner from increasing its prices Name two

What could Banner do to decrease its costs name two

If Banner's earnings per share decrease will its cost of capital increase or decrease?

Submit your answer in an Excel document showing calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started