Answered step by step

Verified Expert Solution

Question

1 Approved Answer

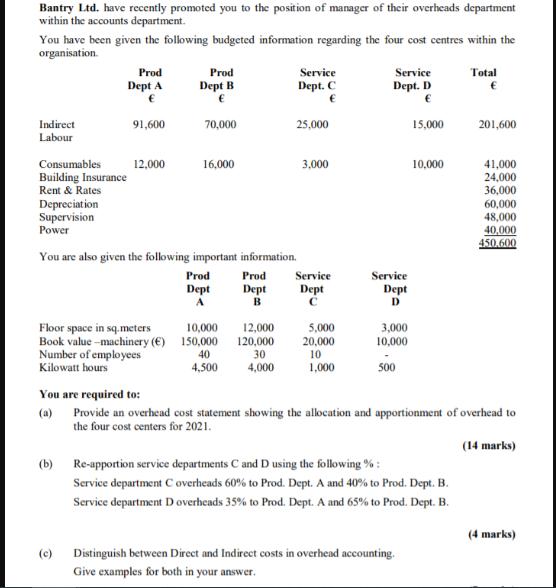

Bantry Ltd. have recently promoted you to the position of manager of their overheads department within the accounts department. You have been given the

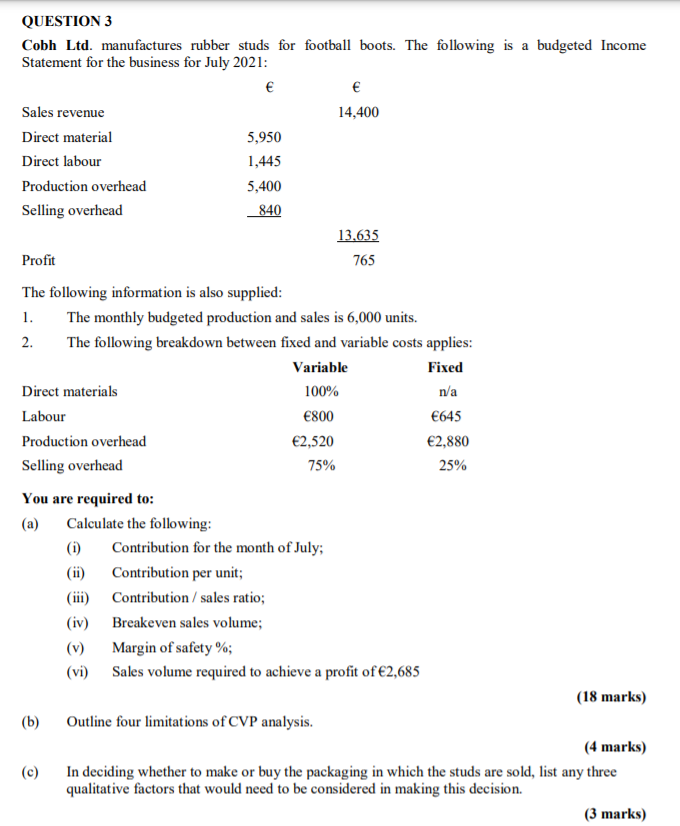

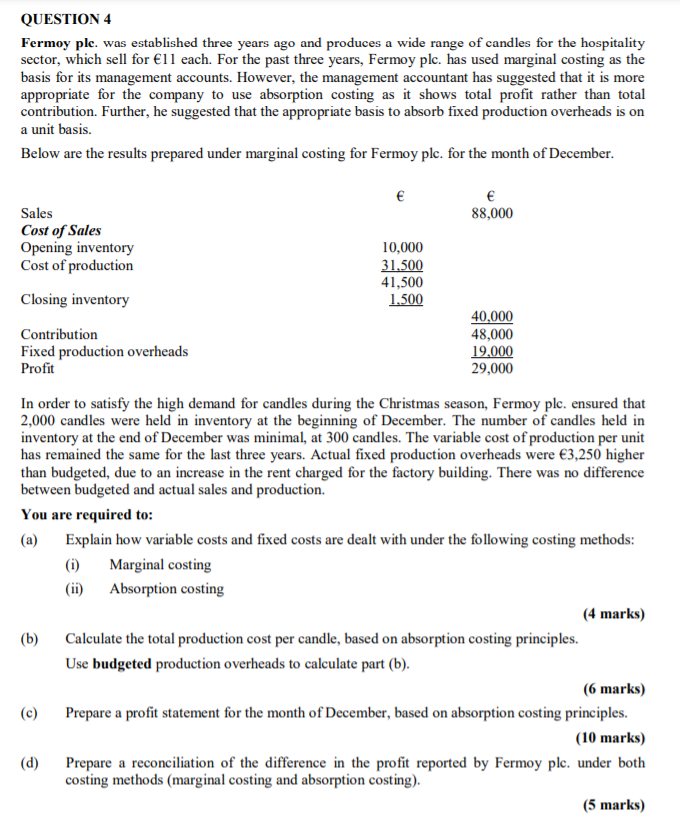

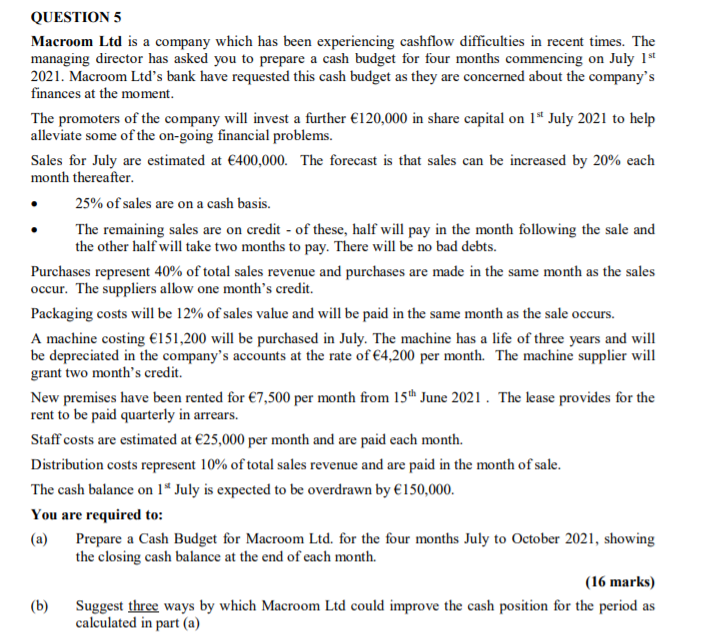

Bantry Ltd. have recently promoted you to the position of manager of their overheads department within the accounts department. You have been given the following budgeted information regarding the four cost centres within the organisation. Prod Prod Dept A Dept B Service Dept. C Service Dept. D Total Indirect 91,600 70,000 25,000 15,000 201,600 Labour Consumables 12,000 16,000 3,000 10,000 41,000 Building Insurance 24,000 Rent & Rates 36,000 Depreciation 60,000 Supervision 48,000 Power You are also given the following important information. 40,000 450.600 Prod Prod Dept Dept Service Dept Service A B Dept D Floor space in sq.meters 10,000 12,000 5,000 3,000 Book value-machinery () 150,000 120,000 20,000 10,000 Number of employees 40 30 10 Kilowatt hours 4,500 4,000 1,000 500 You are required to: (a) Provide an overhead cost statement showing the allocation and apportionment of overhead to the four cost centers for 2021. (14 marks) (b) Re-apportion service departments C and D using the following %: Service department C overheads 60% to Prod. Dept. A and 40% to Prod. Dept. B. Service department D overheads 35% to Prod. Dept. A and 65% to Prod. Dept. B. (4 marks) (c) Distinguish between Direct and Indirect costs in overhead accounting. Give examples for both in your answer. QUESTION 3 Cobh Ltd. manufactures rubber studs for football boots. The following is a budgeted Income Statement for the business for July 2021: Sales revenue 14,400 Direct material 5,950 Direct labour 1,445 Production overhead 5,400 Selling overhead 840 Profit 13.635 765 The following information is also supplied: 1. The monthly budgeted production and sales is 6,000 units. 2. The following breakdown between fixed and variable costs applies: Variable Fixed Direct materials 100% n/a Labour 800 645 Production overhead 2,520 2,880 Selling overhead 75% 25% You are required to: (a) Calculate the following: (i) Contribution for the month of July; (ii) Contribution per unit; (iii) Contribution/sales ratio; (iv) Breakeven sales volume; (v) Margin of safety %; (vi) Sales volume required to achieve a profit of 2,685 (18 marks) (b) Outline four limitations of CVP analysis. (4 marks) (c) In deciding whether to make or buy the packaging in which the studs are sold, list any three qualitative factors that would need to be considered in making this decision. (3 marks) QUESTION 4 Fermoy plc. was established three years ago and produces a wide range of candles for the hospitality sector, which sell for 11 each. For the past three years, Fermoy plc. has used marginal costing as the basis for its management accounts. However, the management accountant has suggested that it is more appropriate for the company to use absorption costing as it shows total profit rather than total contribution. Further, he suggested that the appropriate basis to absorb fixed production overheads is on a unit basis. Below are the results prepared under marginal costing for Fermoy plc. for the month of December. Sales Cost of Sales Opening inventory Cost of production Closing inventory Contribution Fixed production overheads Profit 88,000 10,000 31,500 41,500 1,500 40,000 48,000 19,000 29,000 In order to satisfy the high demand for candles during the Christmas season, Fermoy plc. ensured that 2,000 candles were held in inventory at the beginning of December. The number of candles held in inventory at the end of December was minimal, at 300 candles. The variable cost of production per unit has remained the same for the last three years. Actual fixed production overheads were 3,250 higher than budgeted, due to an increase in the rent charged for the factory building. There was no difference between budgeted and actual sales and production. You are required to: (a) Explain how variable costs and fixed costs are dealt with under the following costing methods: (i) Marginal costing (ii) Absorption costing (4 marks) (b) Calculate the total production cost per candle, based on absorption costing principles. Use budgeted production overheads to calculate part (b). (6 marks) (c) Prepare a profit statement for the month of December, based on absorption costing principles. (10 marks) (d) Prepare a reconciliation of the difference in the profit reported by Fermoy plc. under both costing methods (marginal costing and absorption costing). (5 marks) QUESTION 5 Macroom Ltd is a company which has been experiencing cashflow difficulties in recent times. The managing director has asked you to prepare a cash budget for four months commencing on July 1st 2021. Macroom Ltd's bank have requested this cash budget as they are concerned about the company's finances at the moment. The promoters of the company will invest a further 120,000 in share capital on 1st July 2021 to help alleviate some of the on-going financial problems. Sales for July are estimated at 400,000. The forecast is that sales can be increased by 20% each month thereafter. 25% of sales are on a cash basis. The remaining sales are on credit - of these, half will pay in the month following the sale and the other half will take two months to pay. There will be no bad debts. Purchases represent 40% of total sales revenue and purchases are made in the same month as the sales occur. The suppliers allow one month's credit. Packaging costs will be 12% of sales value and will be paid in the same month as the sale occurs. A machine costing 151,200 will be purchased in July. The machine has a life of three years and will be depreciated in the company's accounts at the rate of 4,200 per month. The machine supplier will grant two month's credit. New premises have been rented for 7,500 per month from 15th June 2021. The lease provides for the rent to be paid quarterly in arrears. Staff costs are estimated at 25,000 per month and are paid each month. Distribution costs represent 10% of total sales revenue and are paid in the month of sale. The cash balance on 1 July is expected to be overdrawn by 150,000. You are required to: (a) (b) Prepare a Cash Budget for Macroom Ltd. for the four months July to October 2021, showing the closing cash balance at the end of each month. (16 marks) Suggest three ways by which Macroom Ltd could improve the cash position for the period as calculated in part (a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started