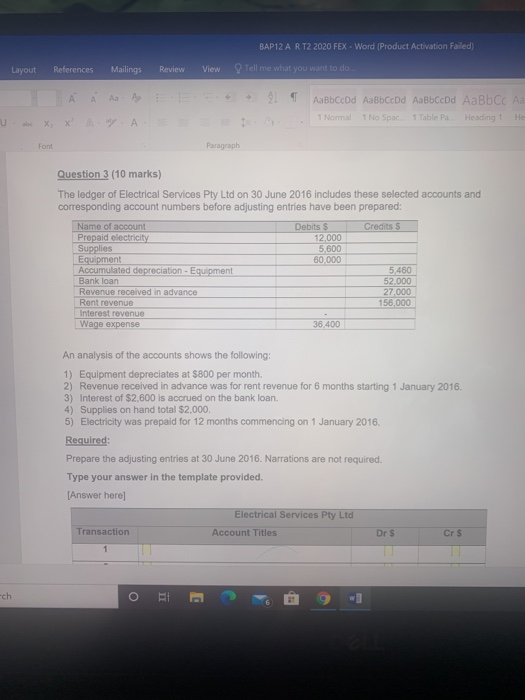

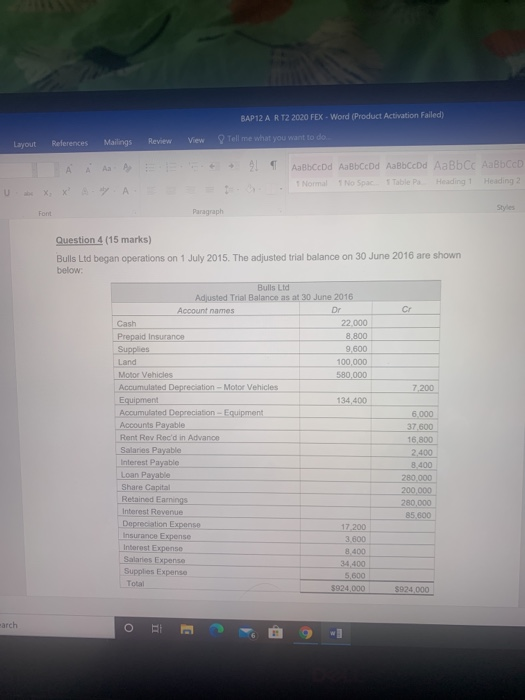

BAP12 A R T2 2020 FEX. Word (Product Activation Failed) Layout References Mailings Review View Tell me what you want to do... 2 AaBbCcDd AaBbCcDd AaBbCcDd Aa Bbcc Aa Nom 1 No Space Table Pa Heading U Font Paragraph Question 3 (10 marks) The ledger of Electrical Services Pty Ltd on 30 June 2016 includes these selected accounts and corresponding account numbers before adjusting entries have been prepared: Name of account Debits Credits Prepaid electricity 12,000 Supplies 5,600 Equipment 60.000 Accumulated depreciation - Equipment 5,460 Bank loan 52.000 Revenue received in advance 27,000 Rent revenue 156,000 Interest revenue Wage expense 36,400 An analysis of the accounts shows the following: 1) Equipment depreciates at $800 per month 2) Revenue received in advance was for rent revenue for 6 months starting 1 January 2016 3) Interest of $2,600 is accrued on the bank loan. 4) Supplies on hand total $2,000. 5) Electricity was prepaid for 12 months commencing on 1 January 2016 Required: Prepare the adjusting entries at 30 June 2016. Narrations are not required. Type your answer in the template provided. [Answer here) Electrical Services Pty Ltd Account Titles Transaction Dr S Crs 1 -ch BAP12 A RT2 2020 FEX - Word (Product Activation Failed) Layout References Mailings Review Tell me what you want to do View AL AaBbceDd AaBbcod AaBbcod AaBbcc AaBbcc 1 Normal No Spar Table Pa Heading Heading 2 Font Paragraph Styles Question 4 (15 marks) Bulls Ltd began operations on 1 July 2015. The adjusted trial balance on 30 June 2016 are shown below: CH 7,200 Bulls Ltd Adjusted Trial Balance as at 30 June 2016 Account names Dr Cash 22.000 Prepaid Insurance 8.800 Supplies 9.600 Land 100,000 Motor Vehicles 580.000 Accumulated Depreciation - Motor Vehicles Equipment 134,400 Accumulated Depreciation - Equipment Accounts Payable Rent Rev Rec'd in Advance Salarios Payable Interest Payable Loan Payable Share Capital Retained Earnings Interest Revenue Depreciation Expense 17200 Insurance Expense 3.800 Interest Expense 8.400 Salaries Expense 34 400 Supplies Expense 5.600 Total 3924.000 6.000 37.500 16,800 2.400 8.400 280.000 200.000 280.000 85 600 $924 000 arch o E 2