Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Baran is trying to decide between investing $ 1 0 0 0 0 into a savings accounts at a 1 0 % . yearly interest

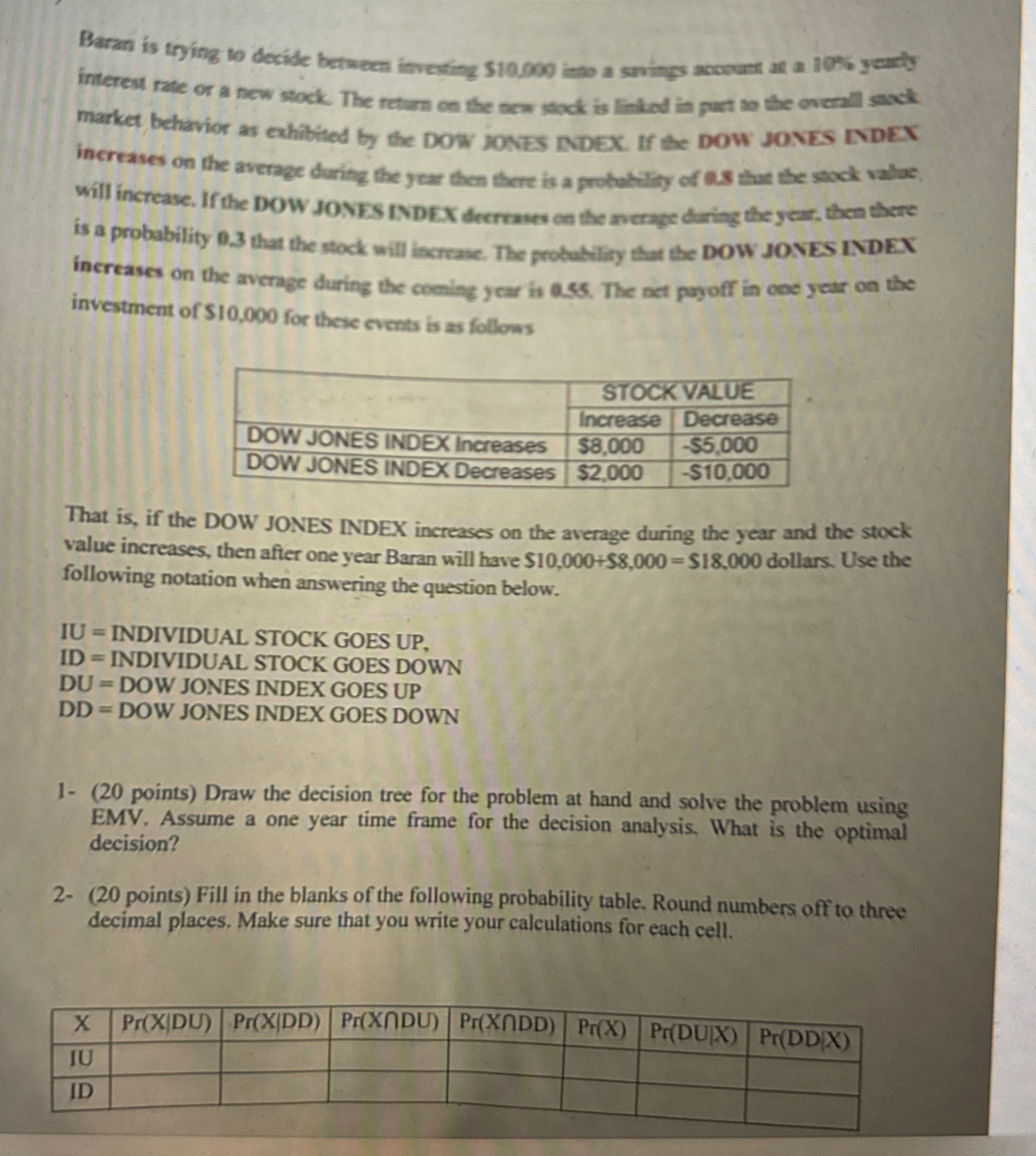

Baran is trying to decide between investing $ into a savings accounts at a yearly interest rate or a new stock. The return on the new stock is linked in part to the overall stock market behavior as exhibited by the DOW JONES NDEX. If the DOW JONES INDEX increases on the average during the year then there is a probability of that the stock value will increase. If the DOW JONES INDEX decrases on the average during the year, then there is a probability that the stock will increase. The probability that the DOW JONES INDEX increases on the average during the coming ycar is The set payoff in one year on the investment of $ for these events is as follows

tableSTOCK VALUEIncreaseDecreaseDOW JONES INDEX Increases,$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started