Question

Barb Carle-Thiesson, LLB, is a prominent criminal defence attorney specializing in high-profile murder and organized crime cases. Barb is a sole practitioner. It is now

Barb Carle-Thiesson, LLB, is a prominent criminal defence attorney specializing in high-profile murder and organized crime cases. Barb is a sole practitioner.

It is now August 15, 2023. A partner at your firm recently met Barb at a social function. Barb requested a meeting to discuss her tax situation. You, CPA, have been asked by the partner to sit in on the meeting and to prepare a draft report for Barb.

Barb begins, "I am in the process of purchasing a newly constructed luxury duplex from one of my clients for $837,000. The deal closes in a month. My husband, Gary, and I are planning to move into the main-floor unit and rent out the second-floor unit. We recently sold our city home for $480,000 and we also own a cottage on the lake. I've brought you some details on the three properties (Appendix I). I already pay tax at the highest rate of 50%, so I don't want to pay any more tax than I have to. How can I minimize the tax I have to pay related to these three properties?

"Also, I would also like to discuss the phone call I recently received from an auditor at the Canada Revenue Agency (CRA). She wants to meet with me next week to review my last two years' tax returns, focusing on the statement of professional activities. I have always prepared my own taxes, which I have brought for you (Appendix II) along with some other questions I have for you. If there is anything wrong with what I did, I want to be able to tell the CRA right away. Please provide your opinion on the deductions I've taken, and tell me what information I need to present to the CRA to support my position. If there are errors, can you let me kn

t the consequences will be? And how far back I am able to amend my returns?"

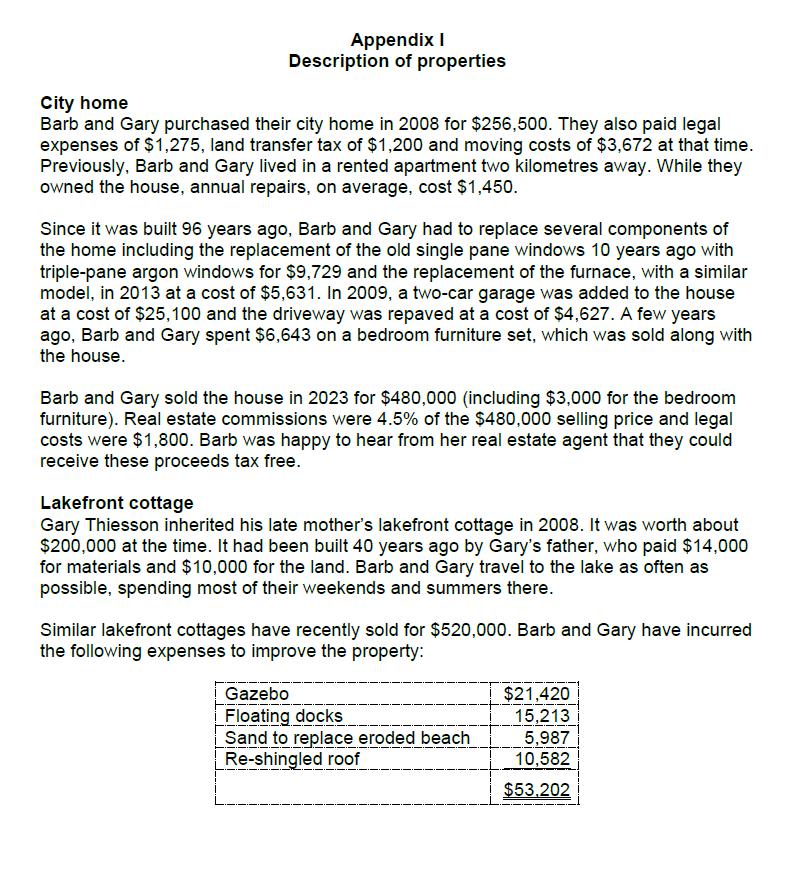

Appendix I Description of properties City home Barb and Gary purchased their city home in 2008 for $256,500. They also paid legal expenses of $1,275, land transfer tax of $1,200 and moving costs of $3,672 at that time. Previously, Barb and Gary lived in a rented apartment two kilometres away. While they owned the house, annual repairs, on average, cost $1,450. Since it was built 96 years ago, Barb and Gary had to replace several components of the home including the replacement of the old single pane windows 10 years ago with triple-pane argon windows for $9,729 and the replacement of the furnace, with a similar model, in 2013 at a cost of $5,631. In 2009, a two-car garage was added to the house at a cost of $25,100 and the driveway was repaved at a cost of $4,627. A few years ago, Barb and Gary spent $6,643 on a bedroom furniture set, which was sold along with the house. Barb and Gary sold the house in 2023 for $480,000 (including $3,000 for the bedroom furniture). Real estate commissions were 4.5% of the $480,000 selling price and legal costs were $1,800. Barb was happy to hear from her real estate agent that they could receive these proceeds tax free. Lakefront cottage Gary Thiesson inherited his late mother's lakefront cottage in 2008. It was worth about $200,000 at the time. It had been built 40 years ago by Gary's father, who paid $14,000 for materials and $10,000 for the land. Barb and Gary travel to the lake as often as possible, spending most of their weekends and summers there. Similar lakefront cottages have recently sold for $520,000. Barb and Gary have incurred the following expenses to improve the property: Gazebo Floating docks Sand to replace eroded beach Re-shingled roof $21,420 15,213 5,987 10,582 $53,202

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To help Barb minimize taxes related to her properties and address the CRA audit lets break down the situation and provide some guidance 1 Property Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started