Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barbara, the manager of Metlock, is analyzing the company's MOH costs from last year. Metlock had always followed an actual costing system when determining the

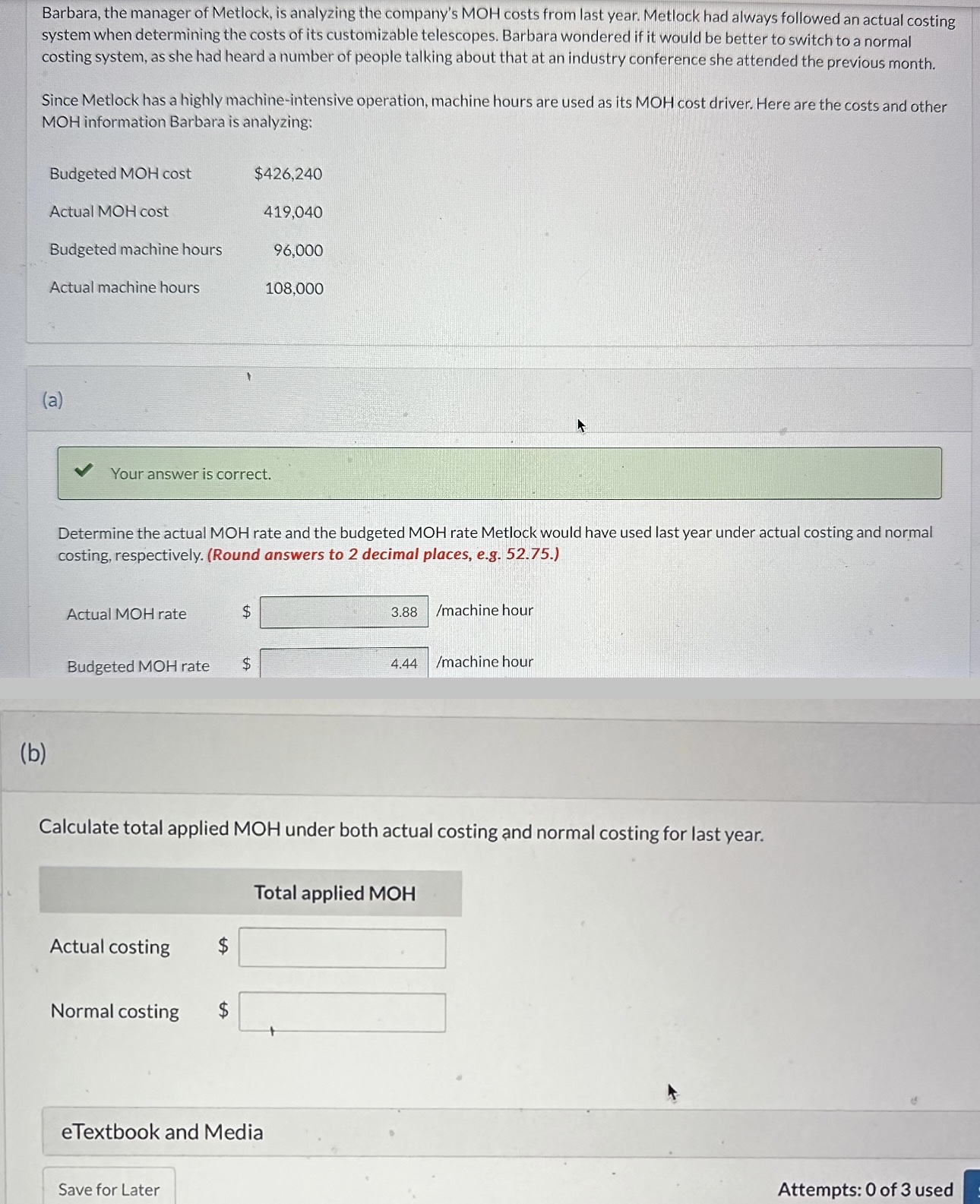

Barbara, the manager of Metlock, is analyzing the company's MOH costs from last year. Metlock had always followed an actual costing system when determining the costs of its customizable telescopes. Barbara wondered if it would be better to switch to a normal costing system, as she had heard a number of people talking about that at an industry conference she attended the previous month.

Since Metlock has a highly machineintensive operation, machine hours are used as its MOH cost driver. Here are the costs and other MOH information Barbara is analyzing:

Budgeted MOH cost

$

Actual MOH cost

Budgeted machine hours

Actual machine hours

a

Your answer is correct.

Determine the actual MOH rate and the budgeted MOH rate Metlock would have used last year under actual costing and normal costing, respectively. Round answers to decimal places, eg

Actual MOH rate

$ machine hour

Budgeted MOH rate

$

machine hour

b

Calculate total applied MOH under both actual costing and normal costing for last year.

Total applied MOH

Actual costing

Normal costing

$

eTextbook and Media

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started