Question

Chandler and Cassidy are married and file a joint return. Chandler is age 66, and Cassidy is age 68. They report the following income

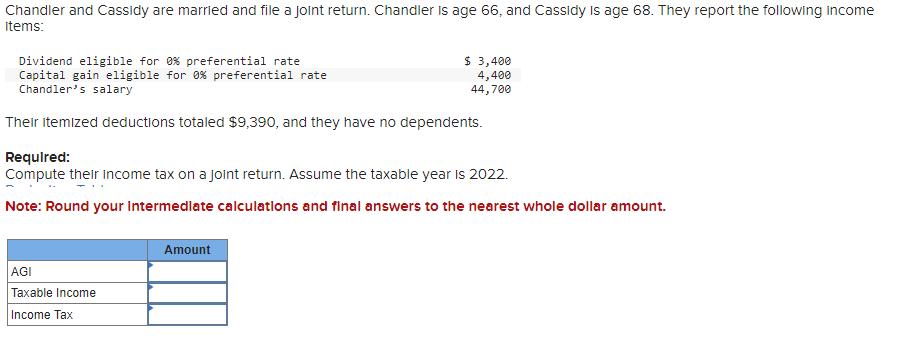

Chandler and Cassidy are married and file a joint return. Chandler is age 66, and Cassidy is age 68. They report the following income Items: Dividend eligible for 0% preferential rate Capital gain eligible for 0% preferential rate Chandler's salary Their itemized deductions totaled $9,390, and they have no dependents. Required: Compute their income tax on a joint return. Assume the taxable year is 2022. Note: Round your Intermediate calculations and final answers to the nearest whole dollar amount. AGI Taxable Income Income Tax Amount $ 3,400 4,400 44,700

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer Taxable Income 51500 Tax Liability 494150 Tax Calculation Standard D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

9th Edition

978-0470317549, 9780470387085, 047031754X, 470387084, 978-0470533475

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App