Question

BARCELONA INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 Assets Cash $ 86,300 $ 41,700 Accounts receivable, net 78,000 61,000 Inventory 66,000

| BARCELONA INC. Comparative Balance Sheets June 30, 2019 and 2018 | ||||||||

| 2019 | 2018 | |||||||

| Assets | ||||||||

| Cash | $ | 86,300 | $ | 41,700 | ||||

| Accounts receivable, net | 78,000 | 61,000 | ||||||

| Inventory | 66,000 | 92,000 | ||||||

| Prepaid expenses | 5,000 | 6,300 | ||||||

| Total current assets | 235,300 | 201,000 | ||||||

| Equipment | 153,000 | 142,000 | ||||||

| Accum. depreciationEquipment | (39,000 | ) | (13,000 | ) | ||||

| Total assets | $ | 349,300 | $ | 330,000 | ||||

| Liabilities and Equity | ||||||||

| Accounts payable | $ | 30,000 | $ | 36,000 | ||||

| Wages payable | 8,000 | 19,000 | ||||||

| Income taxes payable | 3,600 | 4,000 | ||||||

| Total current liabilities | 41,600 | 59,000 | ||||||

| Notes payable (long term) | 38,000 | 75,000 | ||||||

| Total liabilities | 79,600 | 134,000 | ||||||

| Equity | ||||||||

| Common stock, $5 par value | 220,000 | 160,000 | ||||||

| Retained earnings | 49,700 | 36,000 | ||||||

| Total liabilities and equity | $ | 349,300 | $ | 330,000 | ||||

| BARCELONA INC. Income Statement For Year Ended June 30, 2019 | ||||||

| Sales | $ | 803,000 | ||||

| Cost of goods sold | 491,000 | |||||

| Gross profit | 312,000 | |||||

| Operating expenses | ||||||

| Depreciation expense | $ | 68,000 | ||||

| Other expenses | 77,000 | |||||

| Total operating expenses | 145,000 | |||||

| 167,000 | ||||||

| Other gains (losses) | ||||||

| Gain on sale of equipment | 3,300 | |||||

| Income before taxes | 170,300 | |||||

| Income taxes expense | 52,130 | |||||

| Net income | $ | 118,170 | ||||

Additional Information

- A $38,000 note payable is retired at its $38,000 carrying (book) value in exchange for cash.

- The only changes affecting retained earnings are net income and cash dividends paid.

- New equipment is acquired for $67,000 cash.

- Received cash for the sale of equipment that had cost $56,000, yielding a $3,300 gain.

- Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

- All purchases and sales of inventory are on credit.

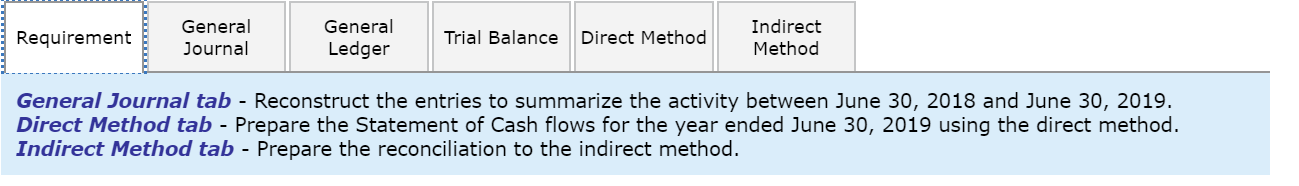

Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the June 30, 2019 balances.

Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the June 30, 2019 balances.

2) June 30) Reconstruct the journal entry for cash payments for inventory, incorporating the change in the related balance sheet account(s), if any.

2) June 30) Reconstruct the journal entry for cash payments for inventory, incorporating the change in the related balance sheet account(s), if any.

3) June 30) Reconstruct the journal entry for depreciation expense, incorporating the change in the related balance sheet account(s), if any.

4) June 30) Reconstruct the journal entry for cash paid for operating expenses, incorporating the change in the related balance sheet account(s), if any.

5) June 30) Reconstruct the journal entry for the sale of equipment at a gain, incorporating the change in the related balance sheet account(s), if any.

6) June 30) Reconstruct the journal entry for income taxes expense, incorporating the change in the related balance sheet account(s), if any.

7) June 30) Reconstruct the entry to record the retirement of the $38,000 note payable at its $38,000 carrying (book) value in exchange for cash.

8) June 30 ) Reconstruct the entry for the purchase of new equipment.

9) June 30) Reconstruct the entry for the issuance of common stock.

10) June 30) Close all revenue and gain accounts to income summary.

11) June 30) Close all expense accounts to income summary.

12) June 30) Close Income Summary to Retained Earnings.

13) June 30) Reconstruct the journal entry for cash dividends paid.

Options For the Account Title

- 000: No journal entry required

- 101: Cash

- 106: Accounts receivable, net

- 120: Inventory

- 125: Prepaid expenses

- 150: Equipment

- 151: Accumulated depreciation - Equipment

- 201: Accounts payable

- 202: Wages payable

- 210: Income taxes payable

- 220: Notes payable (short-term)

- 251: Notes payable (long-term)

- 310: Common stock, $5 par value

- 312: Paid-in capital in excess of par - Common

- 318: Retained earnings

- 401: Sales

- 413: Sales discounts

- 414: Sales returns and allowances

- 502: Cost of goods sold

- 610: Depreciation expense

- 615: Other expenses

- 620: Loss on sale of equipment

- 621: Gain on sale of equipment

- 630: Income taxes expense

- 700: Income summary

continued

continued

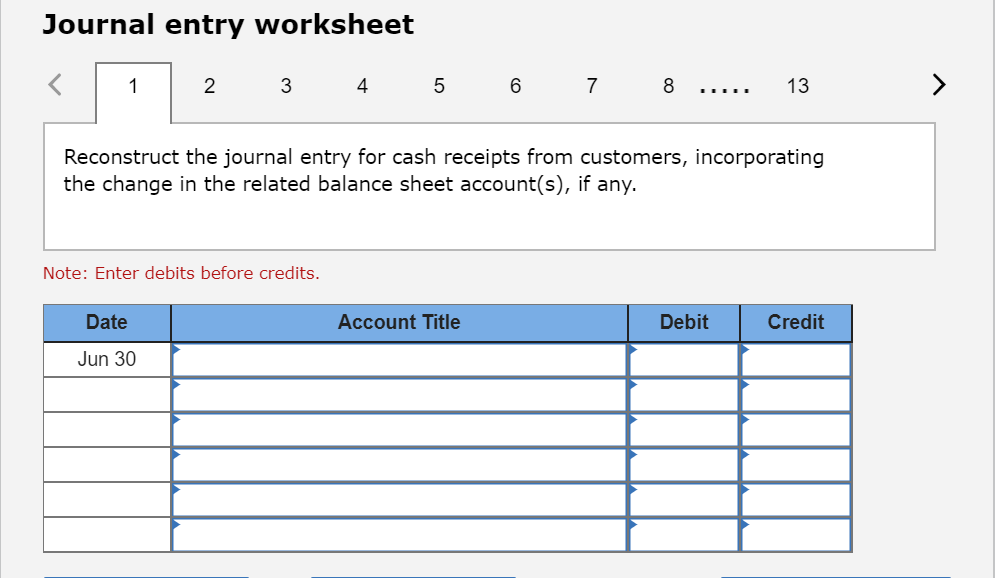

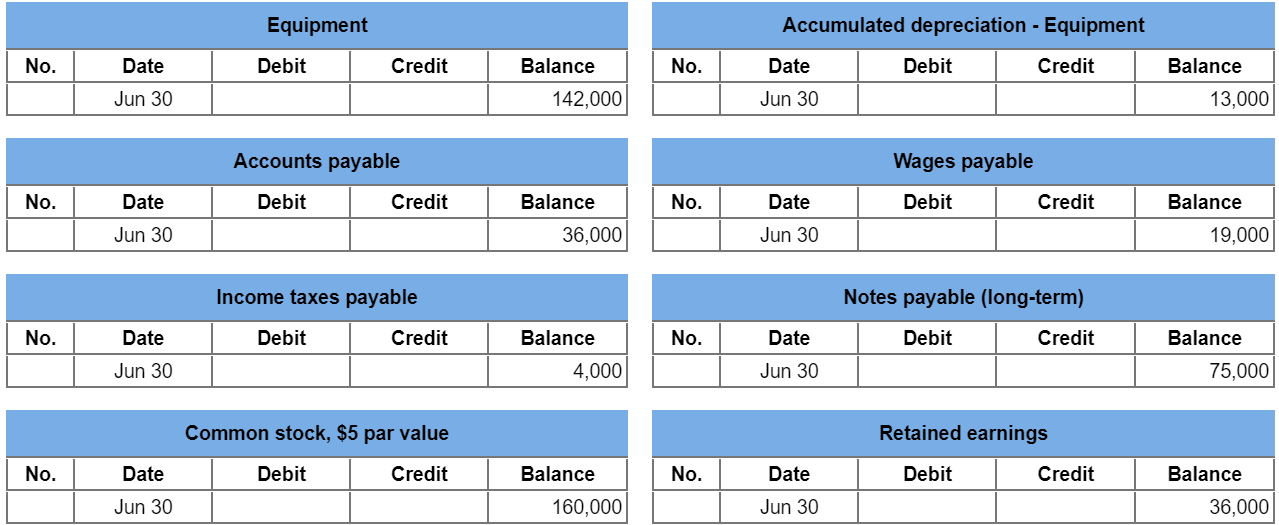

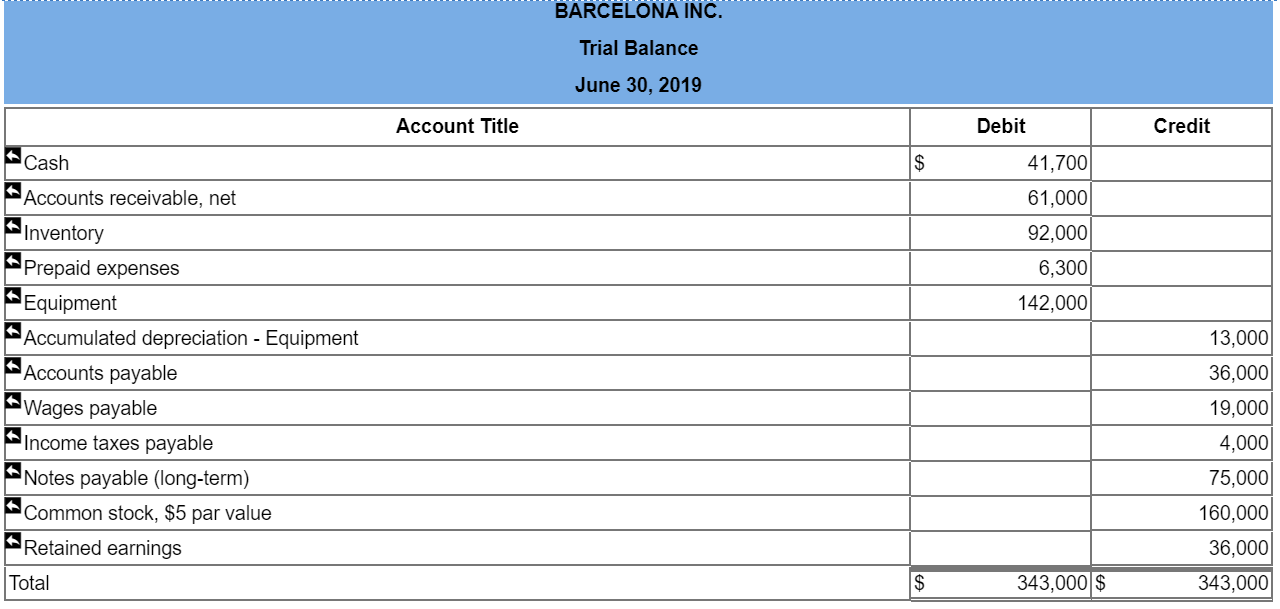

Begin by selecting "Post-closing" from the drop-down menu. Verify that each balance agrees with the June 30, 2019 balance sheet above.

Begin by selecting "Post-closing" from the drop-down menu. Verify that each balance agrees with the June 30, 2019 balance sheet above.

Continued

Continued

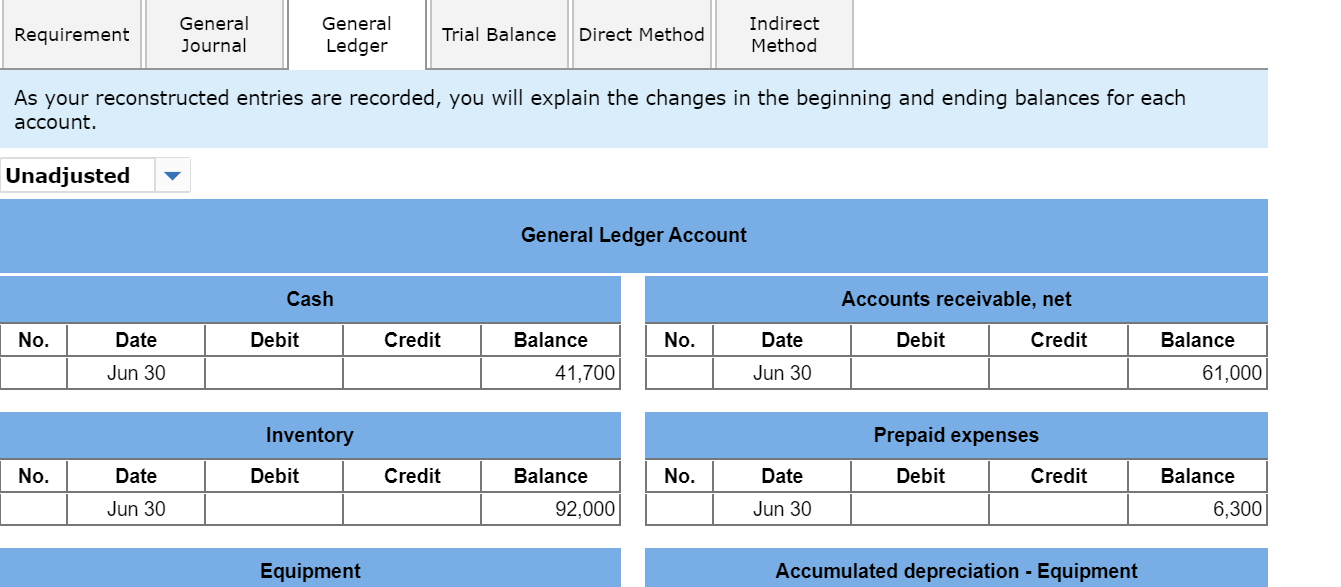

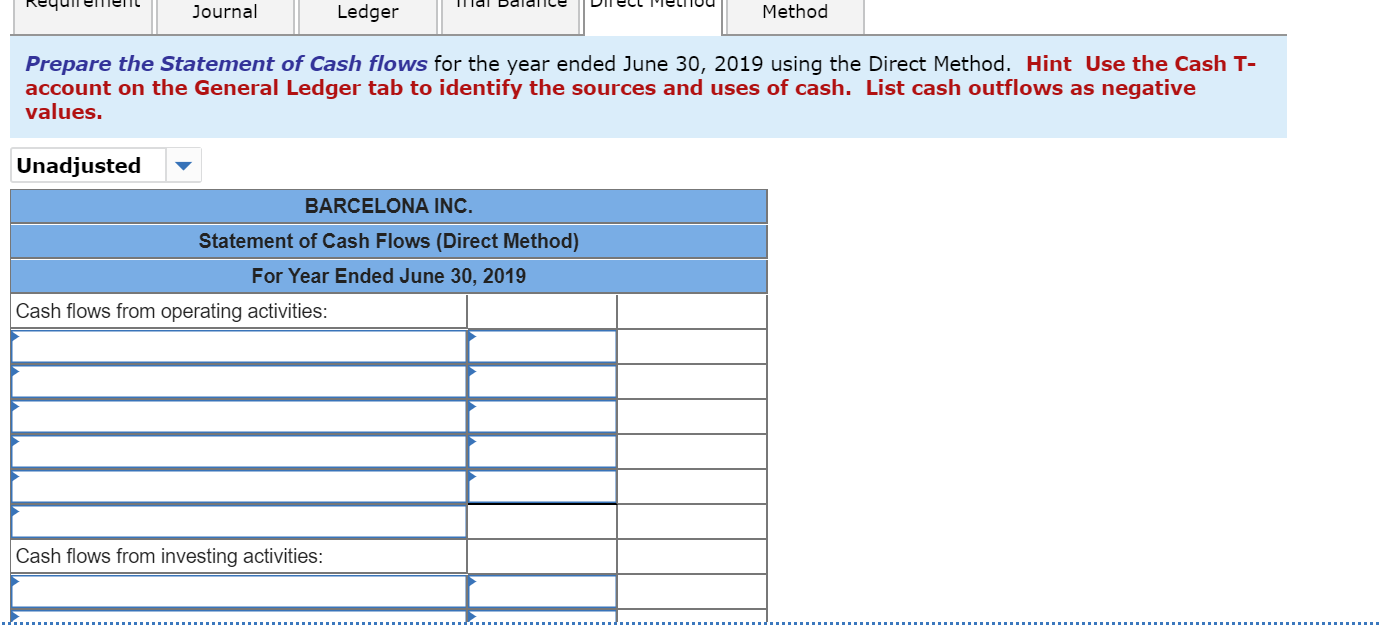

Options for the left column except for the last boxes of all the cash flows

- Amortization expense

- Cash paid for dividends

- Cash paid for equipment

- Cash paid for income taxes

- Cash paid for merchandise

- Cash paid for operating expenses

- Cash paid to retire notes

- Cash received from customers

- Cash received from sale of equipment

- Cash received from stock issuance

- Decrease in accounts payable

- Decrease in accounts receivable

- Decrease in income taxes payable

- Decrease in inventory

- Decrease in prepaid expenses

- Decrease in wages payable

- Depreciation expense

- Gain on sale of equipment

- Increase in accounts payable

- Increase in accounts receivable

- Increase in income taxes payable

- Increase in inventory

- Increase in prepaid expenses

- Increase in wages payable

- Loss on sale of equipment

- Net income

Options for the remaining boxes of all the cash flows

- Net cash provided by financing activities

- Net cash provided by investing activities

- Net cash provided by operating activities

- Net cash used by financing activities

- Net cash used by investing activities

- Net cash used by operating activities

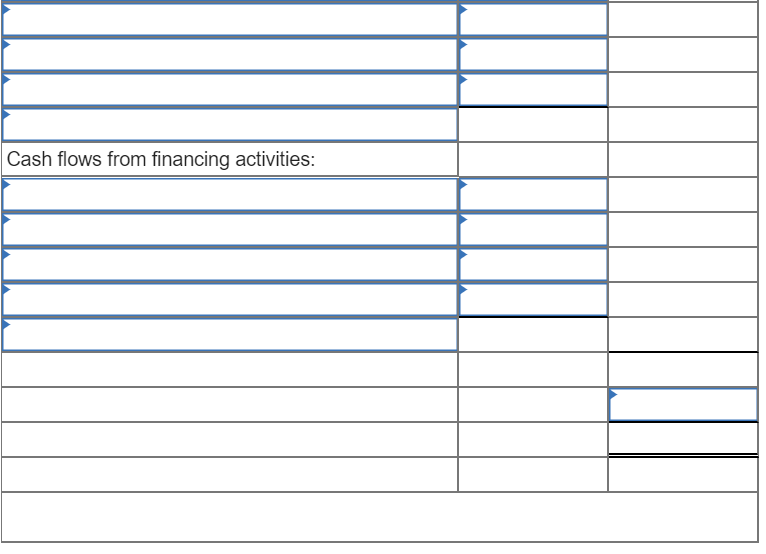

Prepare the operating activities section of the statement of cash flows using the indirect method. Enter reductions to net cash provided by operating activities as negative values.

Options for the left column except for the last box

- Amortization expense

- Cash paid for dividends

- Cash paid for equipment

- Cash paid for income taxes

- Cash paid for merchandise

- Cash paid for operating expenses

- Cash paid to retire notes

- Cash received from customers

- Cash received from sale of equipment

- Cash received from stock issuance

- Decrease in accounts payable

- Decrease in accounts receivable

- Decrease in income taxes payable

- Decrease in inventory

- Decrease in prepaid expenses

- Decrease in wages payable

- Depreciation expense

- Gain on sale of equipment

- Increase in accounts payable

- Increase in accounts receivable

- Increase in income taxes payable

- Increase in inventory

- Increase in prepaid expenses

- Increase in wages payable

- Loss on sale of equipment

- Net income

Options for the last box

- Net cash provided by financing activities

- Net cash provided by investing activities

- Net cash provided by operating activities

- Net cash used by financing activities

- Net cash used by investing activities

- Net cash used by operating activities

Requirement General Journal General Ledger Trial Balance Direct Method Indirect Method General Journal tab - Reconstruct the entries to summarize the activity between June 30, 2018 and June 30, 2019. Direct Method tab - Prepare the Statement of Cash flows for the year ended June 30, 2019 using the direct method. Indirect Method tab - Prepare the reconciliation to the indirect method. Journal entry worksheet 2 3 4 5 6 7 8 ..... 13 Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Date Account Title Debit Credit Jun 30 Requirement General Journal General Ledger Trial Balance Direct Method Indirect Method As your reconstructed entries are recorded, you will explain the changes in the beginning and ending balances for each account. Unadjusted General Ledger Account Cash Accounts receivable, net No. Debit Credit No. Debit Credit Date Jun 30 Balance 41,700 Date Jun 30 Balance 61,000 Inventory Debit Prepaid expenses Debit Credit No. Credit No. Date Jun 30 Balance 92,000 Date Jun 30 Balance 6,300 Equipment Accumulated depreciation - Equipment Equipment Accumulated depreciation - Equipment No. Debit Credit No. Debit Credit Date Jun 30 Balance 142,000 Date Jun 30 Balance 13,000 Wages payable Accounts payable Debit Credit No. Date No. Debit Credit Balance 36,000 Date Jun 30 Balance 19,000 Jun 30 Notes payable (long-term) Income taxes payable Debit Credit No. Date No. Debit | Credit Balance 4,000 Date Jun 30 Balance 75,000 Jun 30 Common stock, $5 par value Retained earnings Debit Credit No. Debit Credit No. Date Jun 30 Balance 160,000 Date Jun 30 Balance 36,000 BARCELONA INC. Trial Balance June 30, 2019 Account Title Debit Credit $ 41,700 61,000 92,000 6,300 142,000 Cash Accounts receivable, net Inventory Prepaid expenses Equipment Accumulated depreciation - Equipment Accounts payable Wages payable Income taxes payable Notes payable (long-term) Common stock, $5 par value Retained earnings Total 13,000 36,000 19,000 4,000 75,000 160,000 36,000 343,000 $ 343,000 $ Requirement uIELT CL Journal Illal balance Ledger Method Prepare the Statement of Cash flows for the year ended June 30, 2019 using the Direct Method. Hint Use the Cash T- account on the General Ledger tab to identify the sources and uses of cash. List cash outflows as negative values. Unadjusted BARCELONA INC. Statement of Cash Flows (Direct Method) For Year Ended June 30, 2019 Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities: Statement of Cash Flows (Indirect Method). For Year Ended June 30, 2019 Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started