Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barcelona Machine Tools. Oriol D'ez Miguel S.R.L., a manufacturer of heavy duty machine tools near Barcelona, ships an order to a buyer in Jordan.

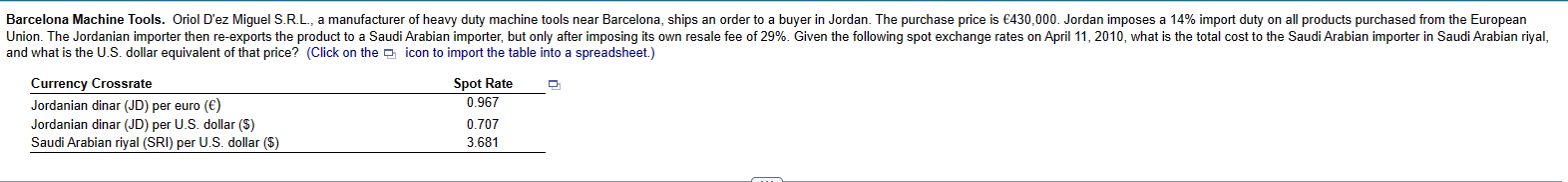

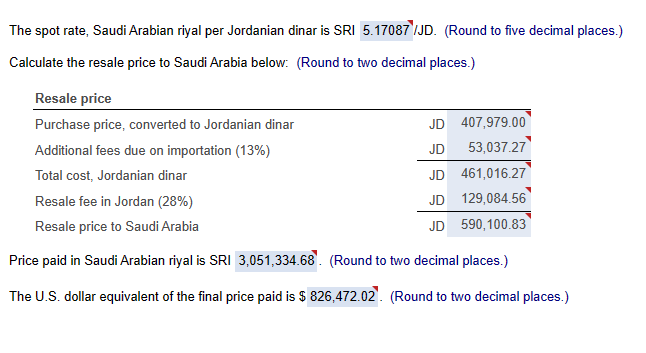

Barcelona Machine Tools. Oriol D'ez Miguel S.R.L., a manufacturer of heavy duty machine tools near Barcelona, ships an order to a buyer in Jordan. The purchase price is 430,000. Jordan imposes a 14% import duty on all products purchased from the European Union. The Jordanian importer then re-exports the product to a Saudi Arabian importer, but only after imposing its own resale fee of 29%. Given the following spot exchange rates on April 11, 2010, what is the total cost to the Saudi Arabian importer in Saudi Arabian riyal, and what is the U.S. dollar equivalent of that price? (Click on the icon to import the table into a spreadsheet.) Currency Crossrate Jordanian dinar (JD) per euro () Jordanian dinar (JD) per U.S. dollar ($) Saudi Arabian riyal (SRI) per U.S. dollar ($) Spot Rate 0.967 0.707 3.681 The spot rate, Saudi Arabian riyal per Jordanian dinar is SRI 5.17087/JD. (Round to five decimal places.) Calculate the resale price to Saudi Arabia below: (Round to two decimal places.) Resale price Purchase price, converted to Jordanian dinar Additional fees due on importation (13%) Total cost, Jordanian dinar Resale fee in Jordan (28%) JD 407,979.00 JD 53,037.27 JD 461,016.27 JD 129,084.56 JD 590,100.83 Resale price to Saudi Arabia Price paid in Saudi Arabian riyal is SRI 3,051,334.68. (Round to two decimal places.) The U.S. dollar equivalent of the final price paid is $ 826,472.02. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started