Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barclays Bank bought a call option with 3 years to expiration from a hedge fund. The expected value of the option and the probabilities of

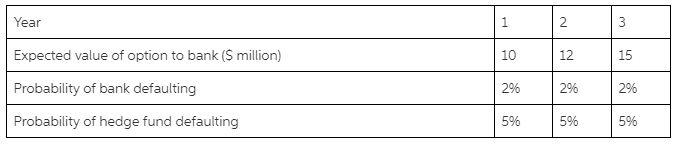

Barclays Bank bought a call option with 3 years to expiration from a hedge fund. The expected value of the option and the probabilities of default are given below:

Assume that the option is uncollateralized, there is no recovery in the case of default and there are no other open positions with the hedge fund. The appropriate equivalent annual interest rate is 5% for all maturities.

1. What is the bank's CVA (in $ million)?

2. What is the bank's DVA (in $ million)?

Year Expected value of option to bank ($ million) Probability of bank defaulting Probability of hedge fund defaulting 1 10 2% 5% 2 12 296 5% 3 15 2% 5%

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 CVA Credit Valuation Adjustment represents the potential loss that a bank could incur due to the default of its counterparty while DVA Debt Valuatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started