Bargin Hut

Bargain HutBargain Hut

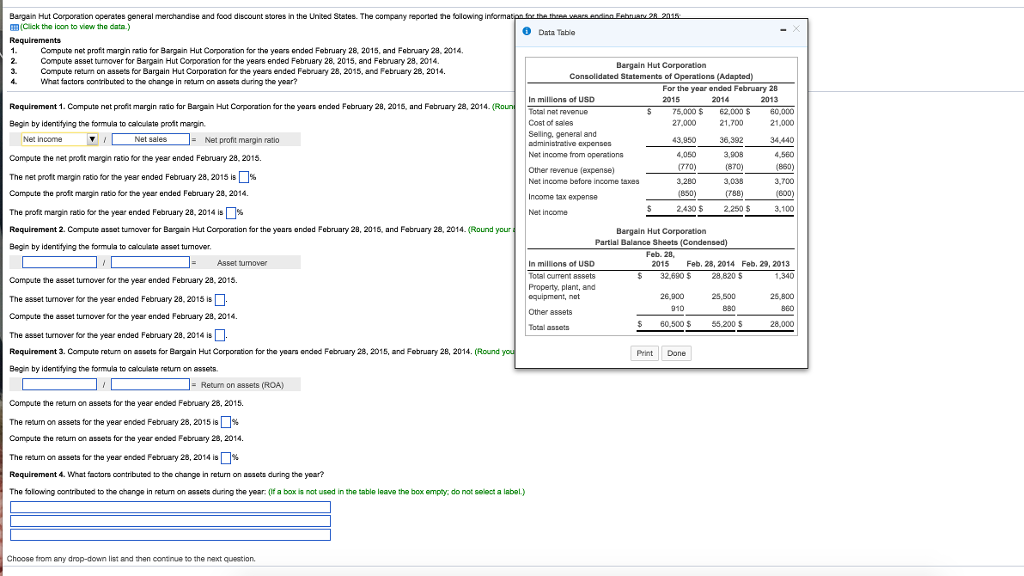

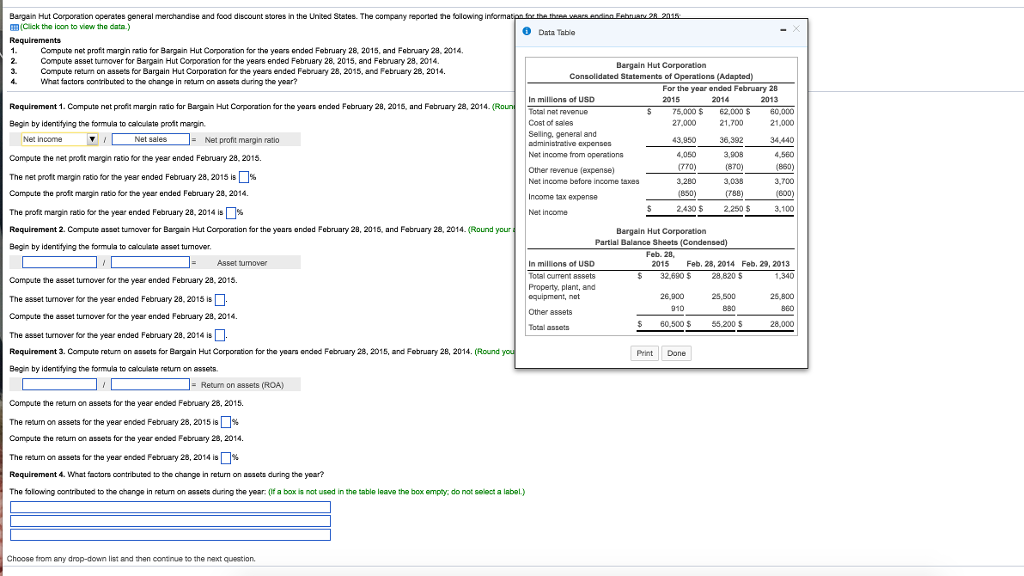

Corporation operates general merchandise and food discount stores in the United States. The company reported the following information for the three years ending

February 28, 2015

A.

| Compute net profit margin ratio B. Compute asset turnover C. Compute return on assets f D. What factors contributed to the change in return on assets during the year? |

Bargain Hut Corporation operates general merchandise and food discount stores in the United States. The company reported he folcwing (Click the ioon to vtew the data.) Data Tabio 1.Compute net profit margin ratio for Bargain Hut Corporation for the yoars ended Fobruary 28, 2015, and Fabruary 28, 2014 2. Compute asset turnover for Bargain Hut Corporaion for the yeers ended February 28, 2015, and February 28. 2014 3. Compute return on assets for Bargain Hut Corporaton for the years ended February 28, 2015, and Februery 28, 2014 4. What factors conributed to the change in retum on assata during the year? Bargain Hut Corporation For the 2015 year ended February 28 2014 In millions of USD Total nat revenue Cost of sales Seling, general and 2013 Roquiremont 1. Compute not profit margin raio for Bargain Hut Corporation for the yoars onded February 28, 2016, and Fabruary 28, 2014. 27,000 43.950 4,050 75,000 62,000 s 60,000 21.700 6,392 Begin by identfying the formula to calculate proit margin 21,000 Net income Compute ne net prot margin ratio for the year ended February 28, 2015. The net prott margin ratio for the year ended February 28, 2015 is Compute he proft margin ratio for the year ended February 28, 2014. The proft margin ratio for the year ended February 28, 2014 is Requirement 2. Compute assat turmover for Bargain Hut Corporation for the yoars onded February 28, 2016, and Fabruary 28, 2014. (Round your Begin by identifying the formula to caloulate asset turnover Net sales Net profit margin ratio dministrative expensos Nat income from operations Other revenue (expense) Net income bafore income taxes Income tax expense Net income (870) 3,700 6O0) 3.100 2430 $ 2.250 $ D- Bargain Hut Corporation Partial Balance Sheets (Condensed) Feb. 28, 2015 Asset mover In millions of USD Total curent assets Property, plant, and oquipment, not Other assets Total assets Feb, 28, 2014 Feb, 29, 2013 32,690$ 28,820 5 1,340 Compute he asset turnover for the year ended February 28, 201. The asset umoverfor me year ended February 28, 2015 is Compute he asset turnover for the year ended February 28, 2014 The asset turnover for the year ended February 28, 2014 is Roquiremont 3. Computo raturn on ancets for Bargain Hut Corporation for the yoars anded Fobruary 28, 2015, and Fobruary 28, 2014. (Round Begin by identfying the formula to calculate return on assete. 910 5.500 880 26,900 60 5 60,500 55.200 S Print Done Return on assets(ROA) Compute he reaum on assets for the year ended February 28, 2015. The reum on assets for the yeer ended February 28, 2015 is% The reurn on assets for the year ended February 28, 2015 is | |% Compute he return on assets for the year ended February 23, 2014 The reaum on assets for the year ended February 28, 2014 is Requirement 4. What footors contributed to the change in return on asaets during the yoar? The folowing contributed to the change in return on assots during the year: (If a box is not used in the table leave the box empty do not seloct a labol) Choose from any drop-down list and then continue to the next