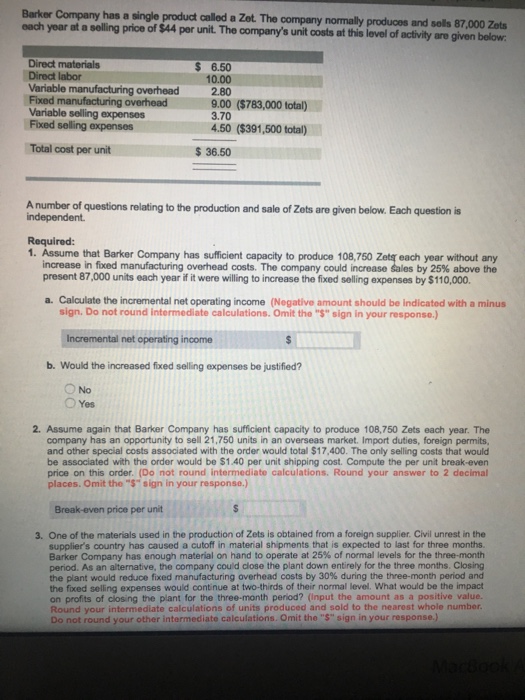

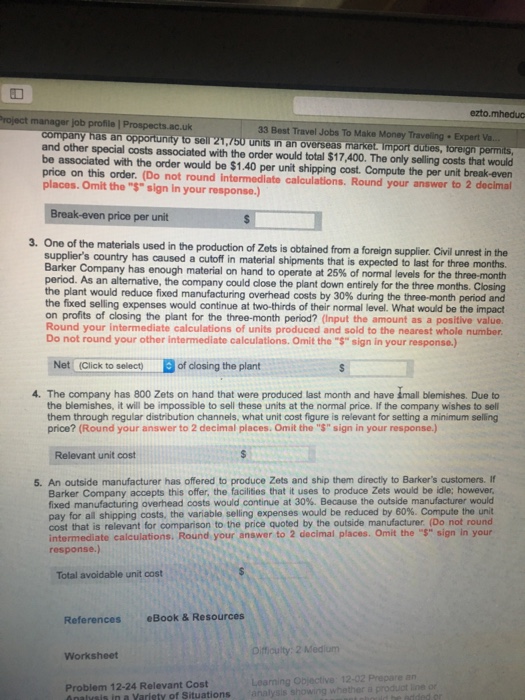

Barker Company has a single product called a oach yoar at a selling price of $44 per unit. The company's unit costs at this level of activity are given below Zet. The company normally produces and solls 87,000 Zets Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses $ 6.50 10.00 2.80 9.00 ($783,000 total) 3.70 4.50 ($391,500 total) Total cost per unit $36.50 Anumber of questions relating to the production and sale of Zots are given below. Each question is Required: 1. Assume that Barker Company has sufficient capacity to produce 108,750 Zets each year without any increase in fixed manufacturing overhead costs. The company could increase sales by 25% above the present 87,000 units each year if it were willing to increase the fixed selling expenses by $110,000 a. Calculate the incremental net operating income (Negative amount should be indicated with a minus sign. Do not round intermediate calculations. Omit the "$" sign in your response.) Incremental net operating income b. Would the increased fixed selling expenses be justified? No Yes 2. Assume again that Barker Company has sufficient capacity to produce 108,750 Zets each year. The company has an opportunity to sell 21,750 units in an overseas market. Import duties, foreign permits, and other special costs associated with the order would total $17,400. The only selling costs that would be associated with the order would be $1.40 per unit shipping cost. Compute the per unit break-even price on this order. (Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) Break-even price per unit 3. One of the materials used in the production of Zets is obtained from a foreign supplier. Civil unrest in the suppliers country has caused a cutoff in material shipments that is expected to last for three months. Barker Company has enough material on hand to operate at 25% of normal levels for the three-month period. As an alternative, the company could close the plant down entirely for the three months. Closing the plant would reduce fixed manufacturing overhead costs by 30% during the three-month period and the fioxed selling expenses would continue at two-thirds of their normal level. What would be the impact on profits of closing the plant for the three-month period? (Input the amount as a positive value. Round your intermediate calculations of units produced and sold to the nearest whole number. Do not round your other intermediate calculations. Omit the "$" sign in your response.)