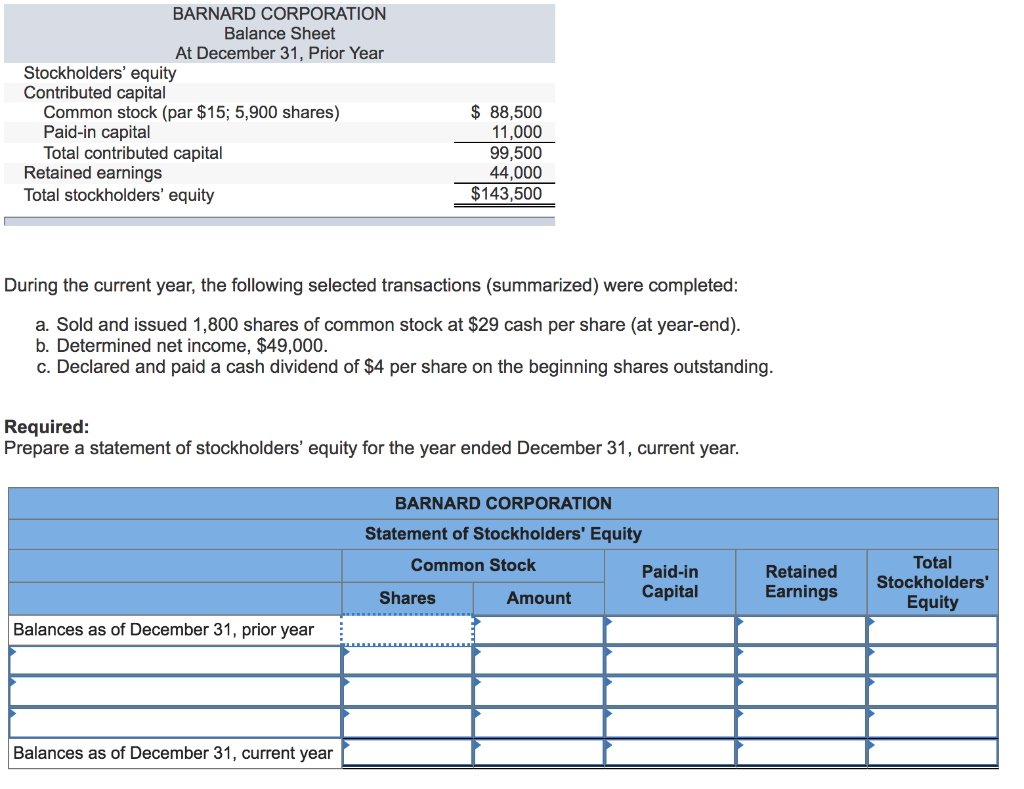

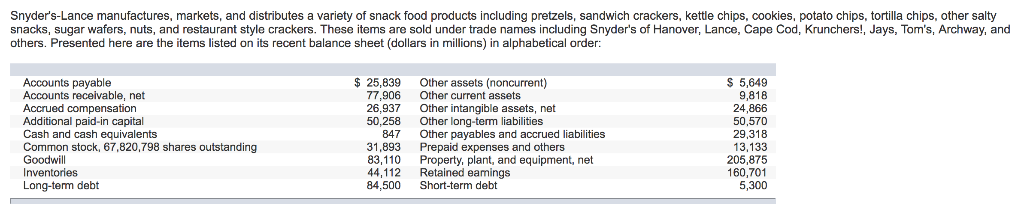

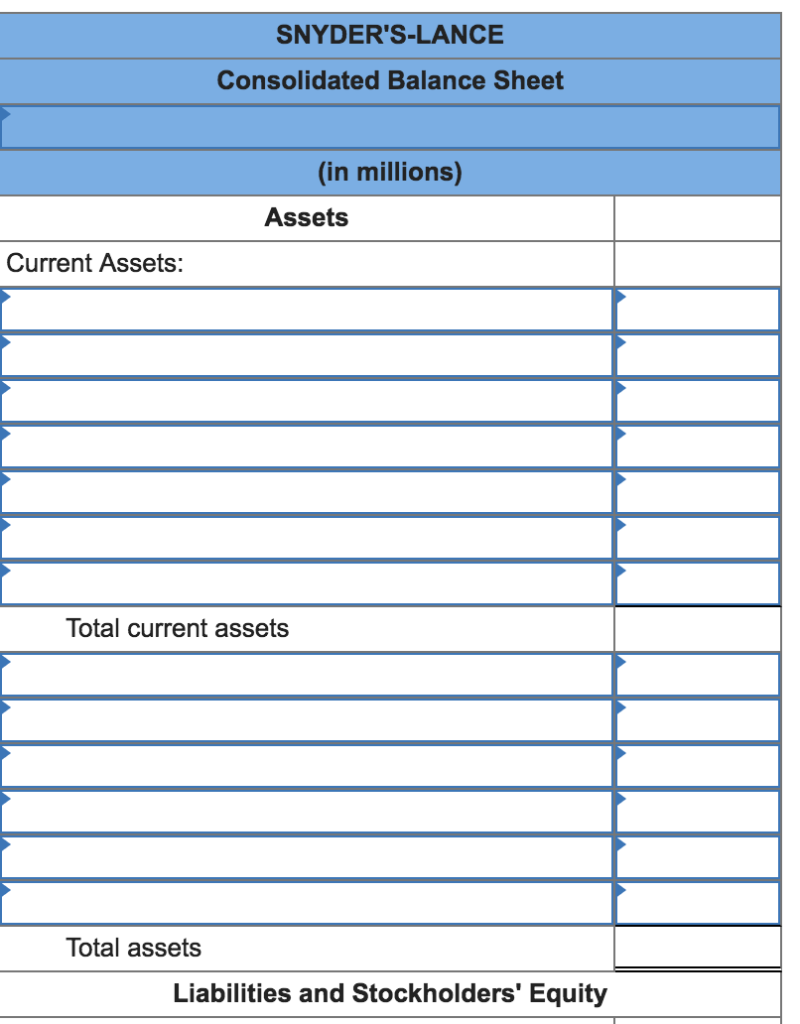

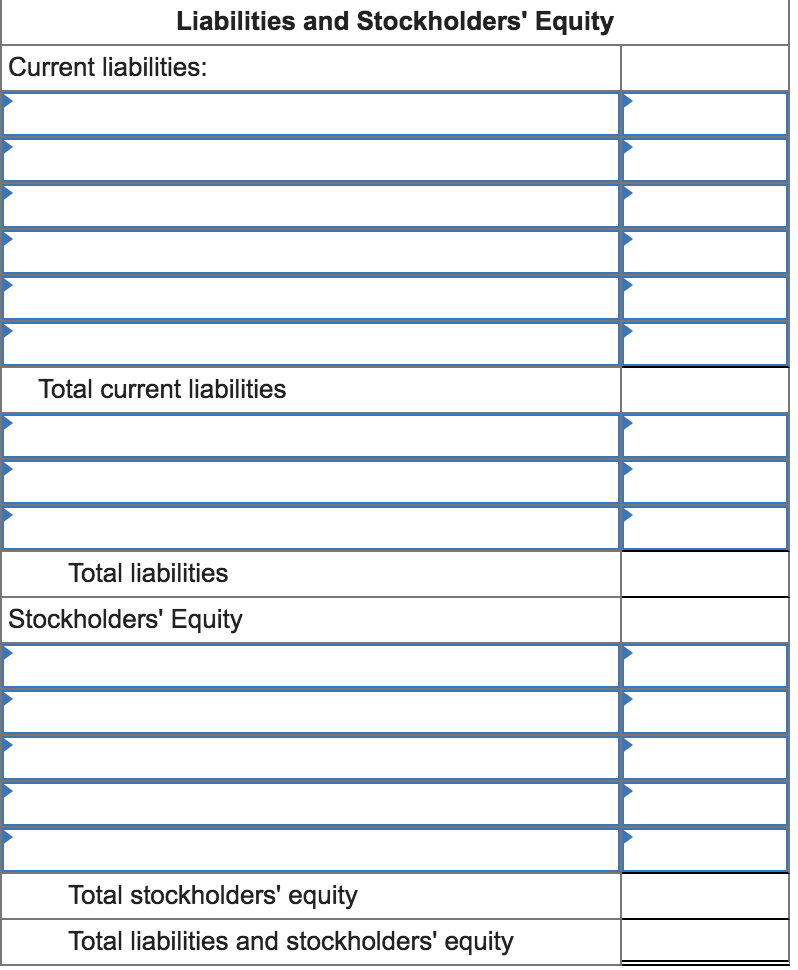

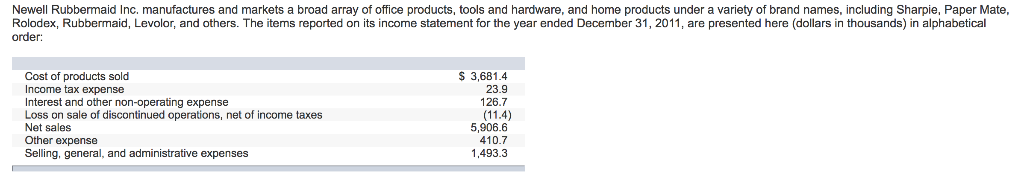

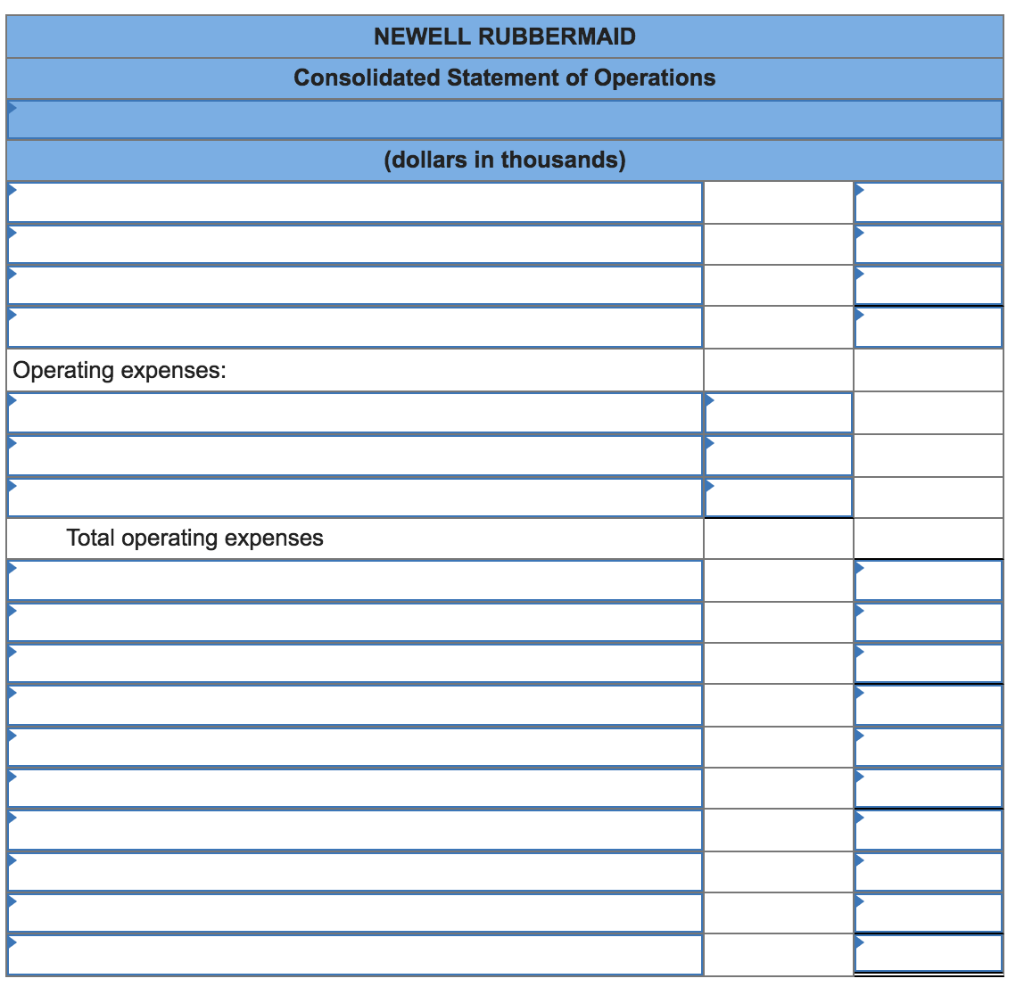

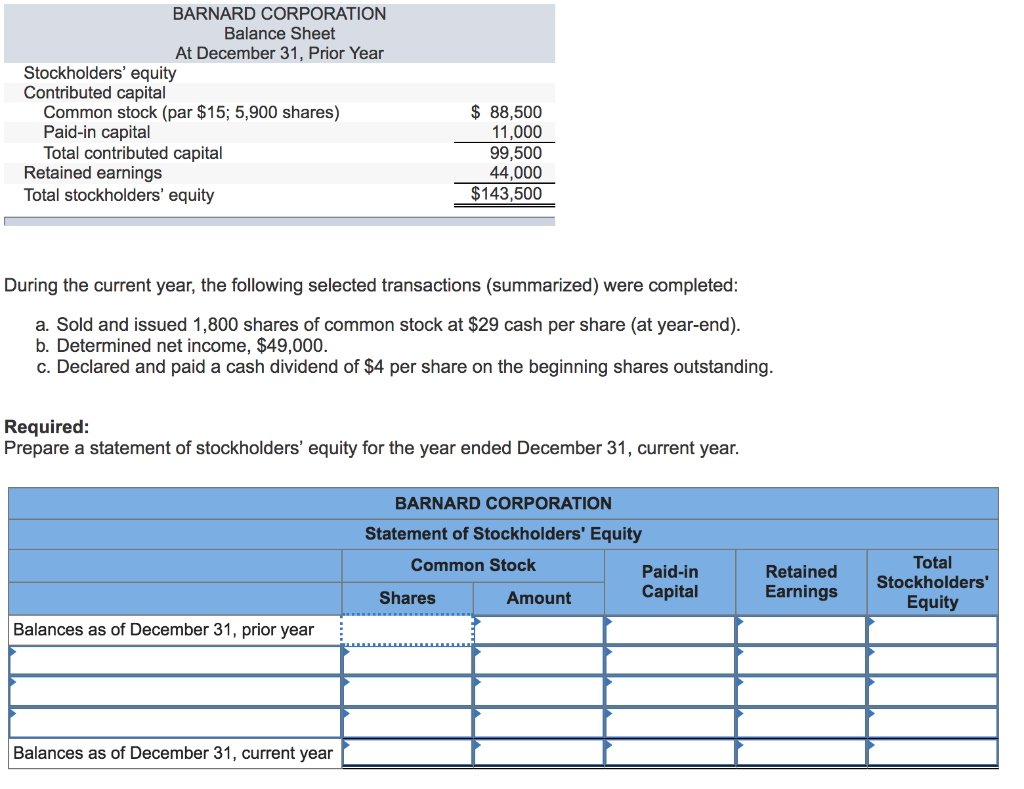

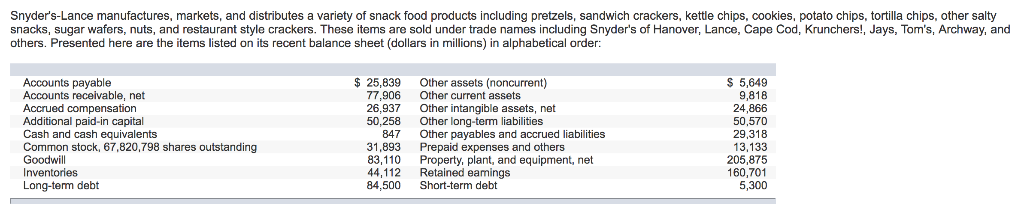

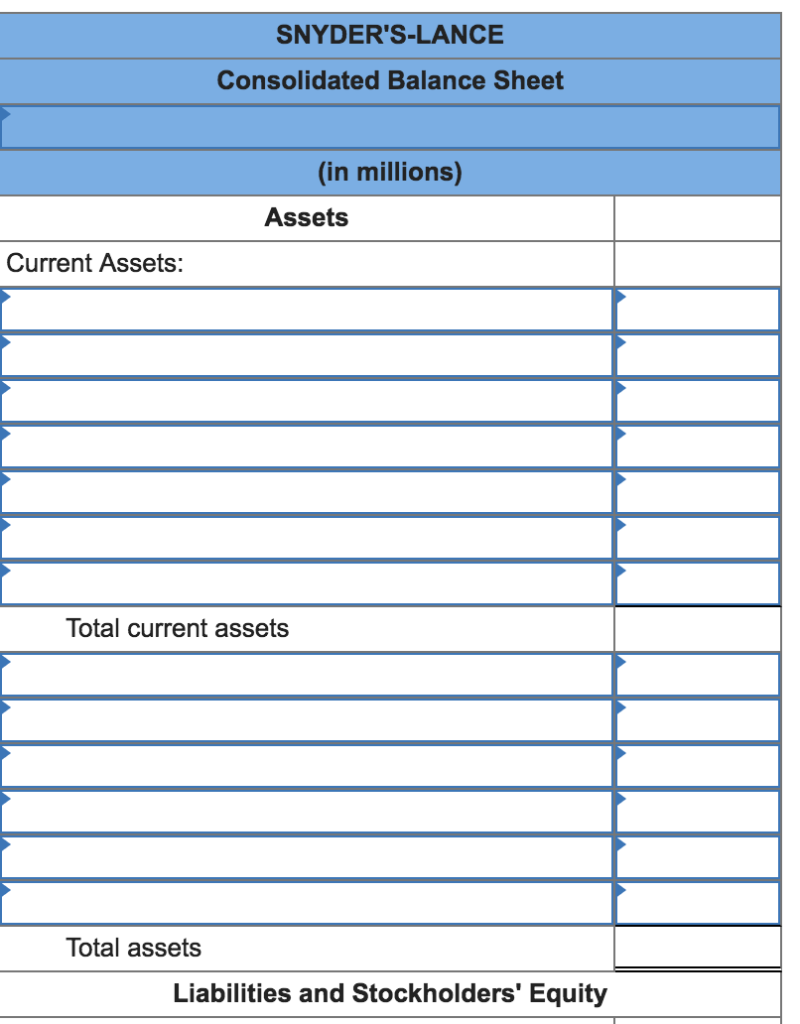

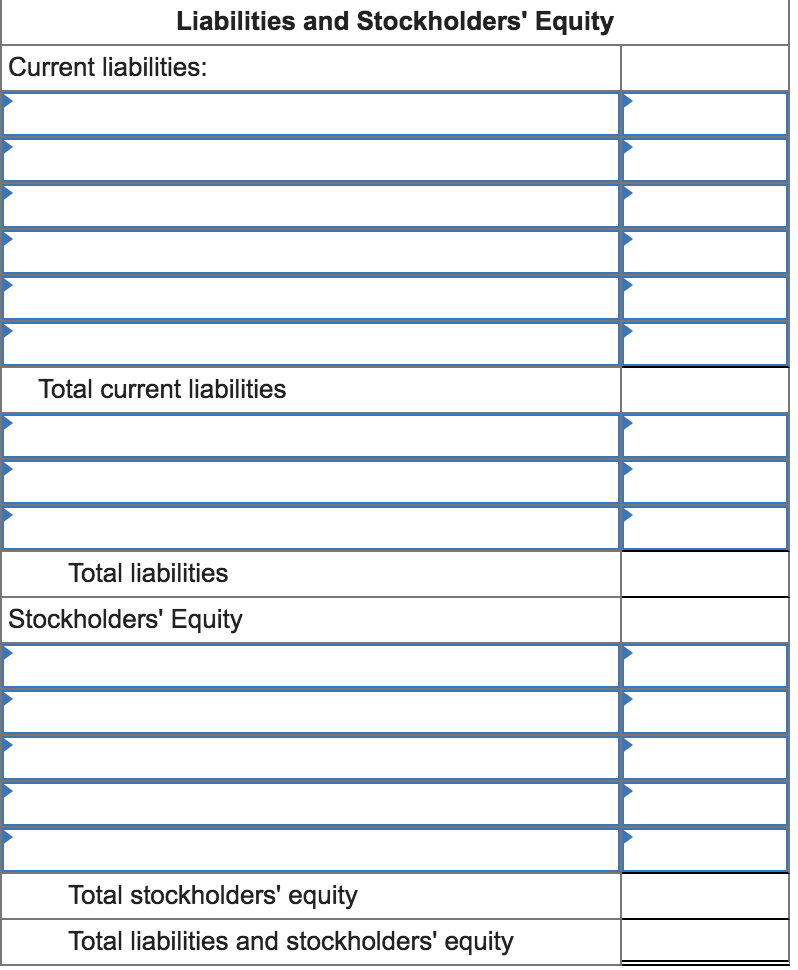

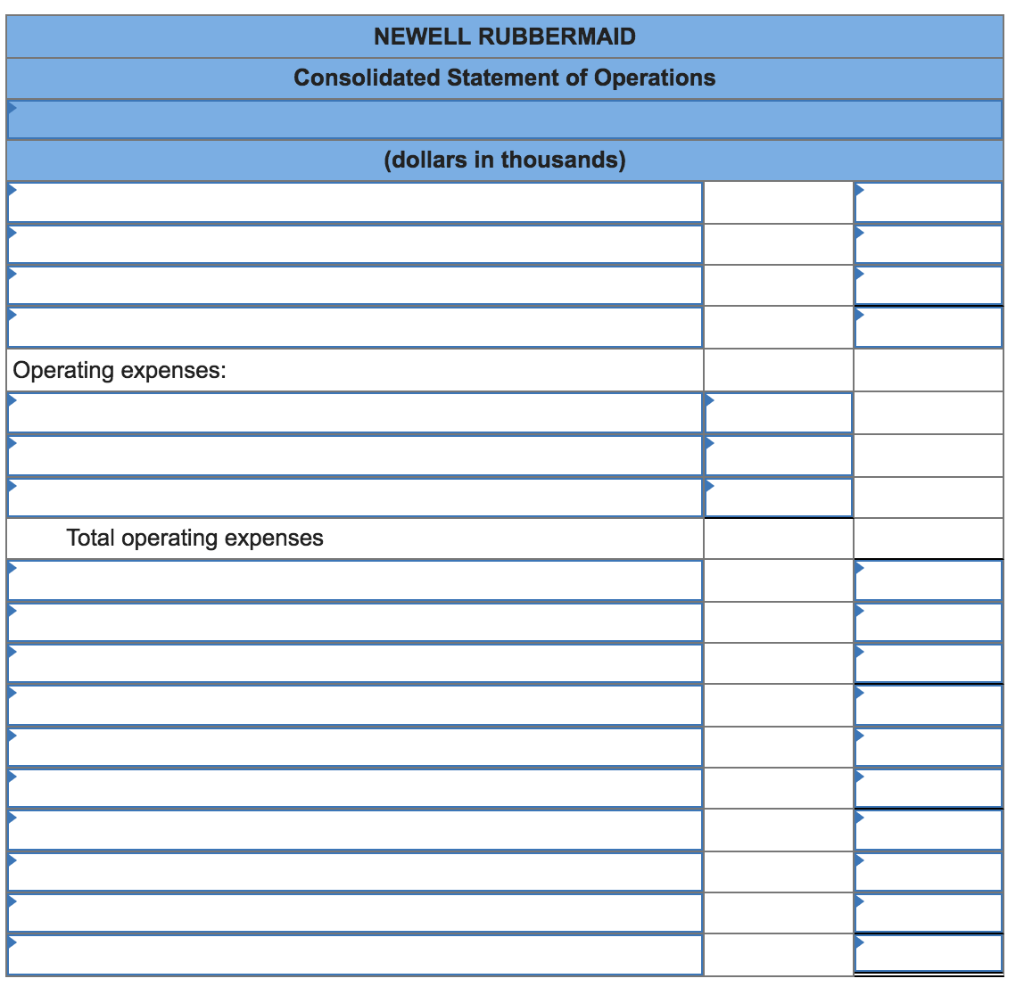

BARNARD CORPORATION Balance Sheet At December 31, Prior Year Stockholders' equity Contributed capital Common stock (par $15; 5,900 shares) Paid-in capital Total contributed capital $ 88,500 11,000 99,500 44,000 $143,500 Retained earnings Total stockholders' equity During the current year, the following selected transactions (summarized) were completed a. Sold and issued 1,800 shares of common stock at $29 cash per share (at year-end) b. Determined net income, $49,000. c. Declared and paid a cash dividend of $4 per share on the beginning shares outstanding Required: Prepare a statement of stockholders' equity for the year ended December 31, current year BARNARD CORPORATION Statement of Stockholders' Equity Common Stock Total Paid-in Capital Retained Shares Earnings Stockholders Amount Equity Balances as of December 31, prior year Balances as of December 31, current year Snyders-Lance manufactures, markets, and distributes a variety of snack food products including pretzels, sandwich crackers, kettle chips, cookies, potato chips, tortilla chips, other salty snacks, sugar wafers, nuts, and restaurant style crackers. These items are sold under trade names including Snyder's of Hanover, Lance, Cape Cod, Krunchers!, Jays, Tom's, Archway, and others. Presented here are the items listed on its recent balance sheet (dollars in millions) in alphabetical order: Accounts payable Accounts receivable, net Accrued compensation Additional paid-in capital Cash and cash equivalents Common stock, 67,820,798 shares outstanding Goodwill $25,839 77,906 26,937 50,258 847 31,893 83,110 44,112 84.500 Other assets (noncurrent) Other current assets Other intangible assets, net Other long-term liabilities Other payables and accrued liabilities Prepaid expenses and others Property, plant, and equipment, net Retained eamings Short-term debt 5,649 9,818 24,866 50,570 29,318 13,133 205,875 160,701 5,300 Long-term debt SNYDER'S-LANCE Consolidated Balance Sheet (in millions) Assets Current Assets: Total current assets Total assets Liabilities and Stockholders' Equity Liabilities and Stockholders' Equity Current liabilities: Total current liabilities Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity Newell Rubbermaid Inc. manufactures and markets a broad array of office products, tools and hardware, and home products under a variety of brand names, including Sharpie, Paper Mate, Rolodex, Rubbermaid, Levolor, and others. The items reported on its income statement for the year ended December 31, 2011, are presented here (dollars in thousands) in alphabetical order 3,681.4 23.9 126.7 Cost of products sold Income tax expense Interest and other non-operating expense Loss on sale of discontinued operations, net of income taxes Net sales Other expense Selling, general, and administrative expenses 5,906.6 410.7 1,493.3 NEWELL RUBBERMAID Consolidated Statement of Operations dollars in thousands) Operating expenses: Total operating expenses