Question

Barnes Company reports the following operating results for the month of August: sales $325,000 (units 5,000); variable costs $215,000; and fixed costs $71,500. Management

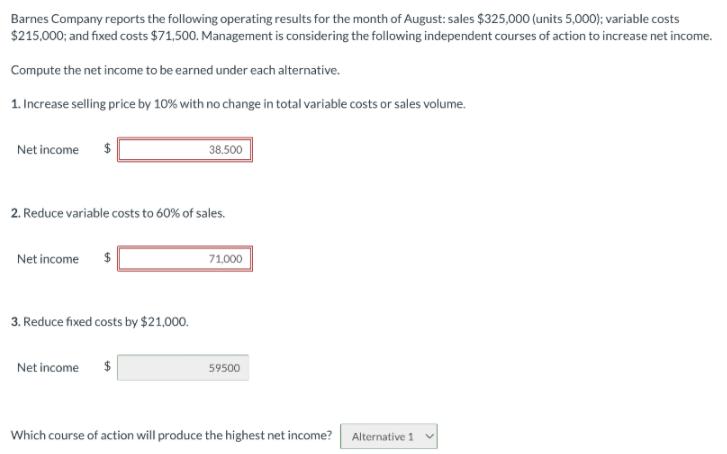

Barnes Company reports the following operating results for the month of August: sales $325,000 (units 5,000); variable costs $215,000; and fixed costs $71,500. Management is considering the following independent courses of action to increase net income. Compute the net income to be earned under each alternative. 1. Increase selling price by 10% with no change in total variable costs or sales volume. Net income 38.500 2. Reduce variable costs to 60% of sales. Net income $ 71.000 3. Reduce fixed costs by $21,000. Net income 59500 Which course of action will produce the highest net income? Alternative 1

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Sales 325000 Number of units sold 5000 Variable costs 215000 Fixed costs 71500 Selling price per u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Tools for business decision making

Authors: kimmel, weygandt, kieso

4th Edition

978-0470117262, 9780470534786, 470117265, 470534788, 978-0470095461

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App