Answered step by step

Verified Expert Solution

Question

1 Approved Answer

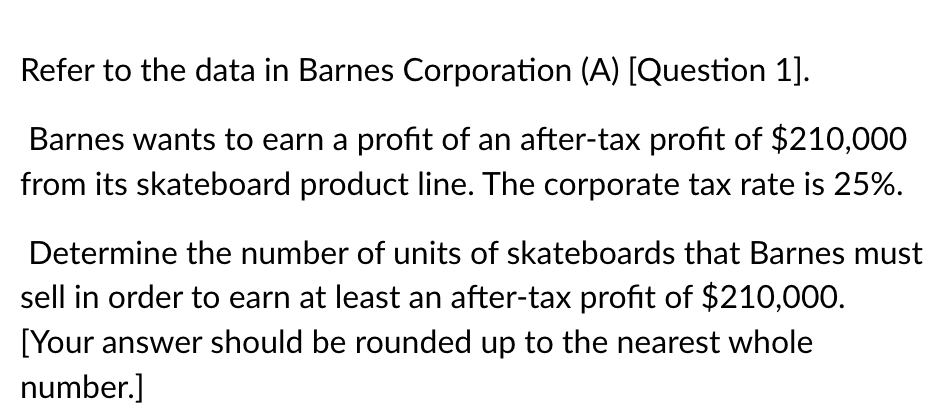

Barnes wants to earn a profit of an after-tax profit of $210,000 from its skateboard product line. The corporate tax rate is 25%. Determine the

Barnes wants to earn a profit of an after-tax profit of $210,000 from its skateboard product line. The corporate tax rate is 25%. Determine the number of units of skateboards that Barnes must sell in order to earn at least an after-tax profit of $210,000.

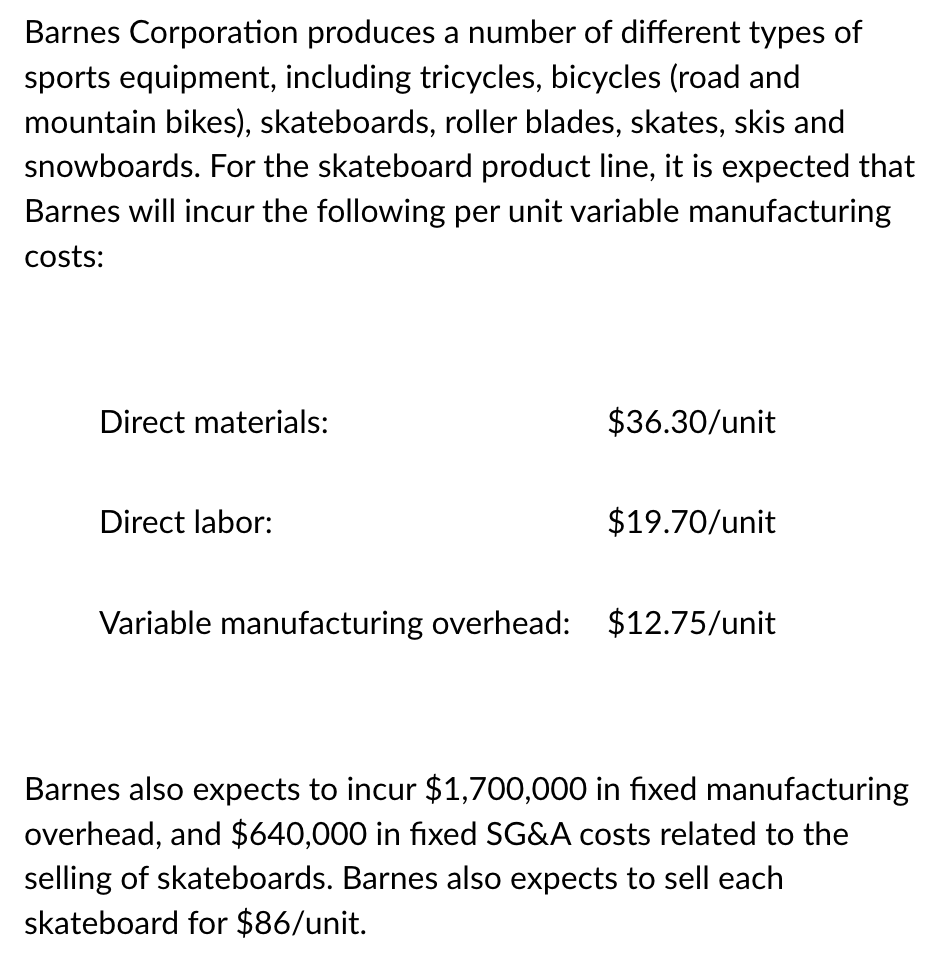

Barnes Corporation produces a number of different types of sports equipment, including tricycles, bicycles (road and mountain bikes), skateboards, roller blades, skates, skis and snowboards. For the skateboard product line, it is expected that Barnes will incur the following per unit variable manufacturing costs: Direct materials: Direct labor: $36.30/unit $19.70/unit Variable manufacturing overhead: $12.75/unit Barnes also expects to incur $1,700,000 in fixed manufacturing overhead, and $640,000 in fixed SG&A costs related to the selling of skateboards. Barnes also expects to sell each skateboard for $86/unit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the number of units of skateboards that Barnes must sell in order to earn at least an a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started