Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Baron Family Inc. for the last 12 months has the following financial information: Total liabilities - P9,000,000 Sales - P20,000,000 Gross Profit - P5,000,000

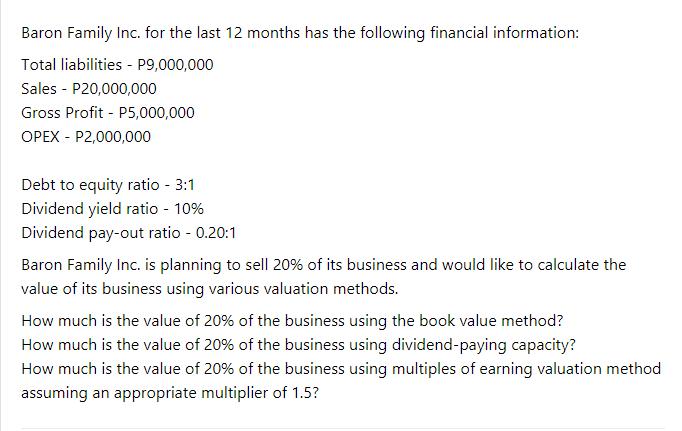

Baron Family Inc. for the last 12 months has the following financial information: Total liabilities - P9,000,000 Sales - P20,000,000 Gross Profit - P5,000,000 OPEX - P2,000,000 Debt to equity ratio - 3:1 Dividend yield ratio - 10% Dividend pay-out ratio - 0.20:1 Baron Family Inc. is planning to sell 20% of its business and would like to calculate the value of its business using various valuation methods. How much is the value of 20% of the business using the book value method? How much is the value of 20% of the business using dividend-paying capacity? How much is the value of 20% of the business using multiples of earning valuation method assuming an appropriate multiplier of 1.5?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Book Value Method The book value of the business can be calculated by subtracting the total liabilities from the total assets Since the total liabilities are given as P9000000 we need to find the tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started