Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Baron Limited (Baron) incurred the following during the month of July 2019: $360,000 for the purchase a new machine. The new machine was purchased

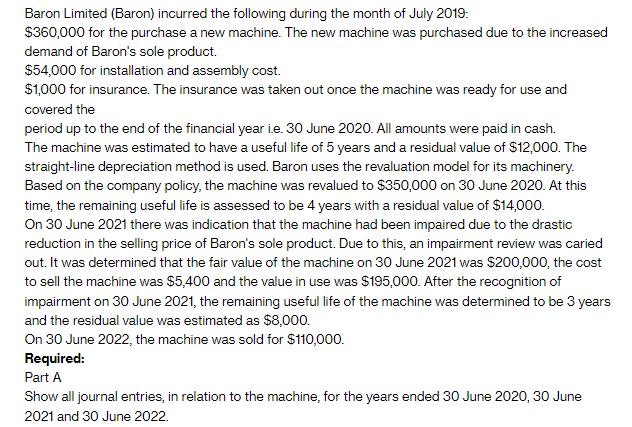

Baron Limited (Baron) incurred the following during the month of July 2019: $360,000 for the purchase a new machine. The new machine was purchased due to the increased demand of Baron's sole product. $54,000 for installation and assembly cost. $1,000 for insurance. The insurance was taken out once the machine was ready for use and covered the period up to the end of the financial year i.e. 30 June 2020. All amounts were paid in cash. The machine was estimated to have a useful life of 5 years and a residual value of $12,000. The straight-line depreciation method is used. Baron uses the revaluation model for its machinery. Based on the company policy, the machine was revalued to $350,000 on 30 June 2020. At this time, the remaining useful life is assessed to be 4 years with a residual value of $14,000. On 30 June 2021 there was indication that the machine had been impaired due to the drastic reduction in the selling price of Baron's sole product. Due to this, an impairment review was caried out. It was determined that the fair value of the machine on 30 June 2021 was $200,000, the cost to sell the machine was $5,400 and the value in use was $195,000. After the recognition of impairment on 30 June 2021, the remaining useful life of the machine was determined to be 3 years and the residual value was estimated as $8,000. On 30 June 2022, the machine was sold for $110,000. Required: Part A Show all journal entries, in relation to the machine, for the years ended 30 June 2020, 30 June 2021 and 30 June 2022.

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Lets prepare the journal entries for the machine for the years ended 30 June 2020 30 June 2021 and 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started