Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barry's Beer and Bacon Barn is a local brewery and bacon smokery based in West Kelowna, B.C. that caters to a varied clientele. Their

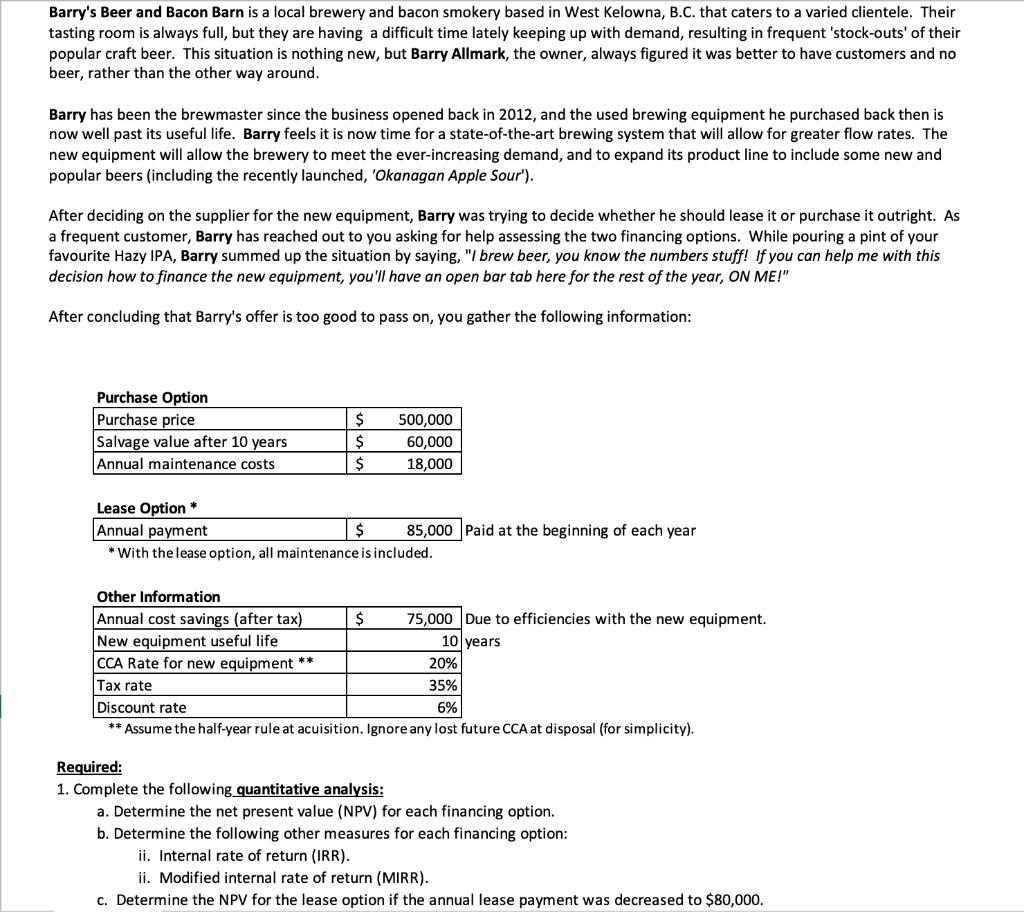

Barry's Beer and Bacon Barn is a local brewery and bacon smokery based in West Kelowna, B.C. that caters to a varied clientele. Their tasting room is always full, but they are having a difficult time lately keeping up with demand, resulting in frequent 'stock-outs' of their popular craft beer. This situation is nothing new, but Barry Allmark, the owner, always figured it was better to have customers and no beer, rather than the other way around. Barry has been the brewmaster since the business opened back in 2012, and the used brewing equipment he purchased back then is now well past its useful life. Barry feels it is now time for a state-of-the-art brewing system that will allow for greater flow rates. The new equipment will allow the brewery to meet the ever-increasing demand, and to expand its product line to include some new and popular beers (including the recently launched, 'Okanagan Apple Sour'). After deciding on the supplier for the new equipment, Barry was trying to decide whether he should lease it or purchase it outright. As a frequent customer, Barry has reached out to you asking for help assessing the two financing options. While pouring a pint of your favourite Hazy IPA, Barry summed up the situation by saying, "I brew beer, you know the numbers stuff! If you can help me with this decision how to finance the new equipment, you'll have an open bar tab here for the rest of the year, ON ME!" After concluding that Barry's offer is too good to pass on, you gather the following information: Purchase Option Purchase price Salvage value after 10 years Annual maintenance costs $ $ $ Other Information Annual cost savings (after tax) New equipment useful life CCA Rate for new equipment ** Tax rate Lease Option * Annual payment $ * With the lease option, all maintenance is included. 500,000 60,000 18,000 $ 85,000 Paid at the beginning of each year 75,000 Due to efficiencies with the new equipment. 10 years 20% 35% Discount rate 6% ** Assume the half-year rule at acuisition. Ignore any lost future CCA at disposal (for simplicity). Required: 1. Complete the following quantitative analysis: a. Determine the net present value (NPV) for each financing option. b. Determine the following other measures for each financing option: ii. Internal rate of return (IRR). ii. Modified internal rate of return (MIRR). c. Determine the NPV for the lease option if the annual lease payment was decreased to $80,000.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Quantitative Analysis of Financing Options for Barrys Beer and Bacon Barn 1 Purchase Option a Net Present Value NPV Year Cash Flow Discount Factor 6 P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started