Question

Barry's Burger Shack Barry's Burger Shack operates a single location at NEU selling burgers, fries and sodas to students and faculty. Revenues for 2012 were

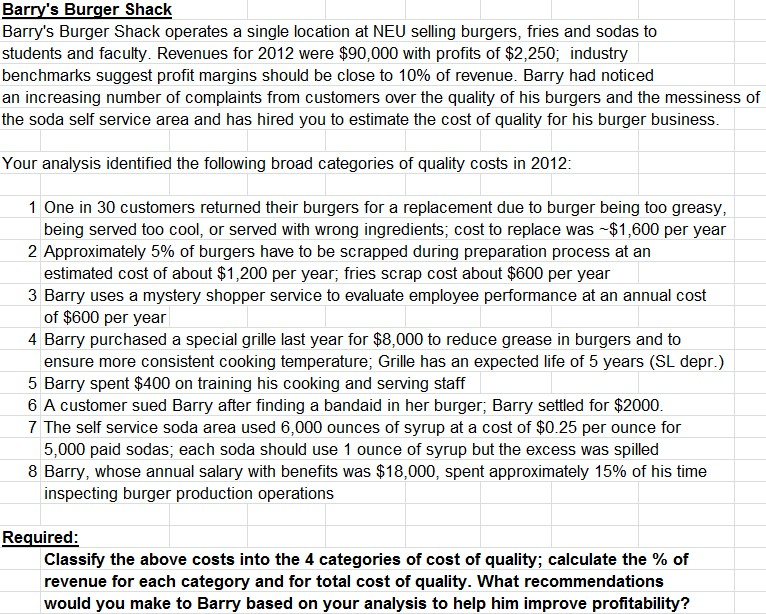

Barry's Burger Shack

Barry's Burger Shack operates a single location at NEU selling burgers, fries and sodas to

students and faculty. Revenues for 2012 were $90,000 with profits of $2,250; industry

benchmarks suggest profit margins should be close to 10% of revenue. Barry had noticed

an increasing number of complaints from customers over the quality of his burgers and the messiness of

the soda self service area and has hired you to estimate the cost of quality for his burger business.

Your analysis identified the following broad categories of quality costs in 2012:

1 One in 30 customers returned their burgers for a replacement due to burger being too greasy,

being served too cool, or served with wrong ingredients; cost to replace was ~$1,600 per year

2 Approximately 5% of burgers have to be scrapped during preparation process at an

estimated cost of about $1,200 per year; fries scrap cost about $600 per year

3 Barry uses a mystery shopper service to evaluate employee performance at an annual cost

of $600 per year

4 Barry purchased a special grille last year for $8,000 to reduce grease in burgers and to

ensure more consistent cooking temperature; Grille has an expected life of 5 years (SL depr.)

5 Barry spent $400 on training his cooking and serving staff

6 A customer sued Barry after finding a bandaid in her burger; Barry settled for $2000.

7 The self service soda area used 6,000 ounces of syrup at a cost of $0.25 per ounce for

5,000 paid sodas; each soda should use 1 ounce of syrup but the excess was spilled

8 Barry, whose annual salary with benefits was $18,000, spent approximately 15% of his time

inspecting burger production operations

Required:

Classify the above costs into the 4 categories of cost of quality; calculate the % of

revenue for each category and for total cost of quality. What recommendations

would you make to Barry based on your analysis to help him improve profitability?

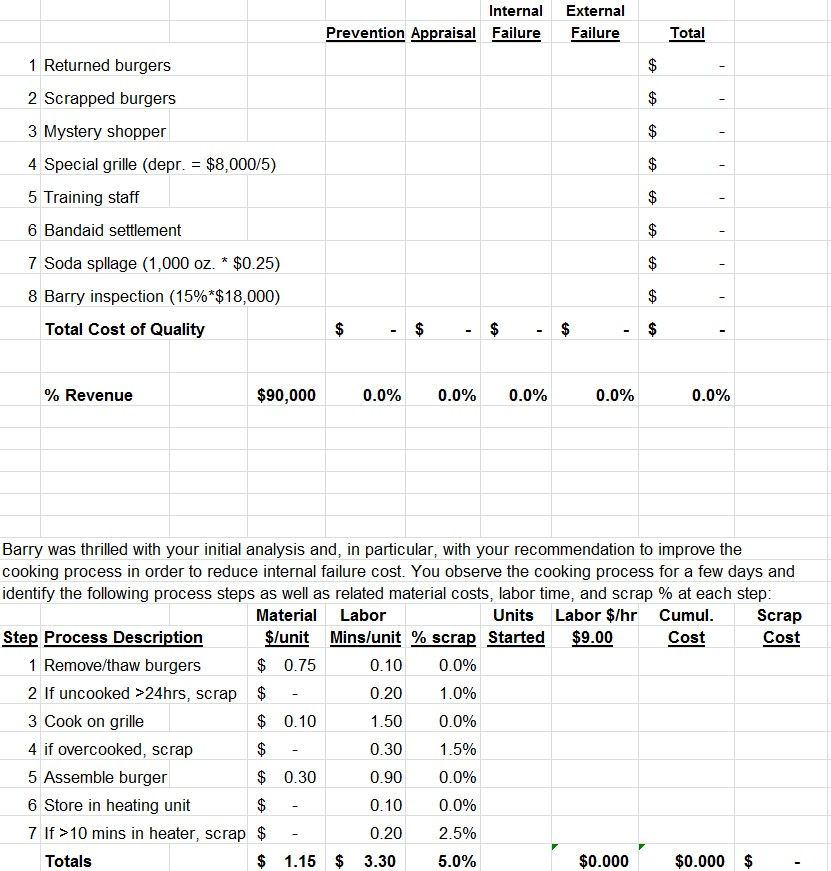

Internal External

Prevention Appraisal Failure Failure Total

1 Returned burgers $ -

2 Scrapped burgers $ -

3 Mystery shopper $ -

4 Special grille (depr. = $8,000/5) $ -

5 Training staff $ -

6 Bandaid settlement $ -

7 Soda spllage (1,000 oz. * $0.25) $ -

8 Barry inspection (15%*$18,000) $ -

Total Cost of Quality $- $ - $ - $ - $ -

% Revenue $90,000 0.0% 0.0% 0.0% 0.0% 0.0%

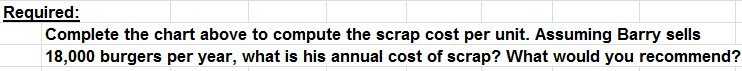

Barry was thrilled with your initial analysis and, in particular, with your recommendation to improve the

cooking process in order to reduce internal failure cost. You observe the cooking process for a few days and

identify the following process steps as well as related material costs, labor time, and scrap % at each step:

Material Labor Units Labor $/hr Cumul. Scrap

Step Process Description $/unit Mins/unit % scrap Started $9.00 Cost Cost

1 Remove/thaw burgers $0.75 0.10 0.0%

2 If uncooked >24hrs, scrap $ - 0.20 1.0%

3 Cook on grille $0.10 1.50 0.0%

4 if overcooked, scrap $ - 0.30 1.5%

5 Assemble burger $0.30 0.90 0.0%

6 Store in heating unit $ - 0.10 0.0%

7 If >10 mins in heater, scrap $ - 0.20 2.5%

Totals $1.15 $3.30 5.0% $0.000 $0.000 $ -

Required:

Complete the chart above to compute the scrap cost per unit. Assuming Barry sells

18,000 burgers per year, what is his annual cost of scrap? What would you recommend?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started