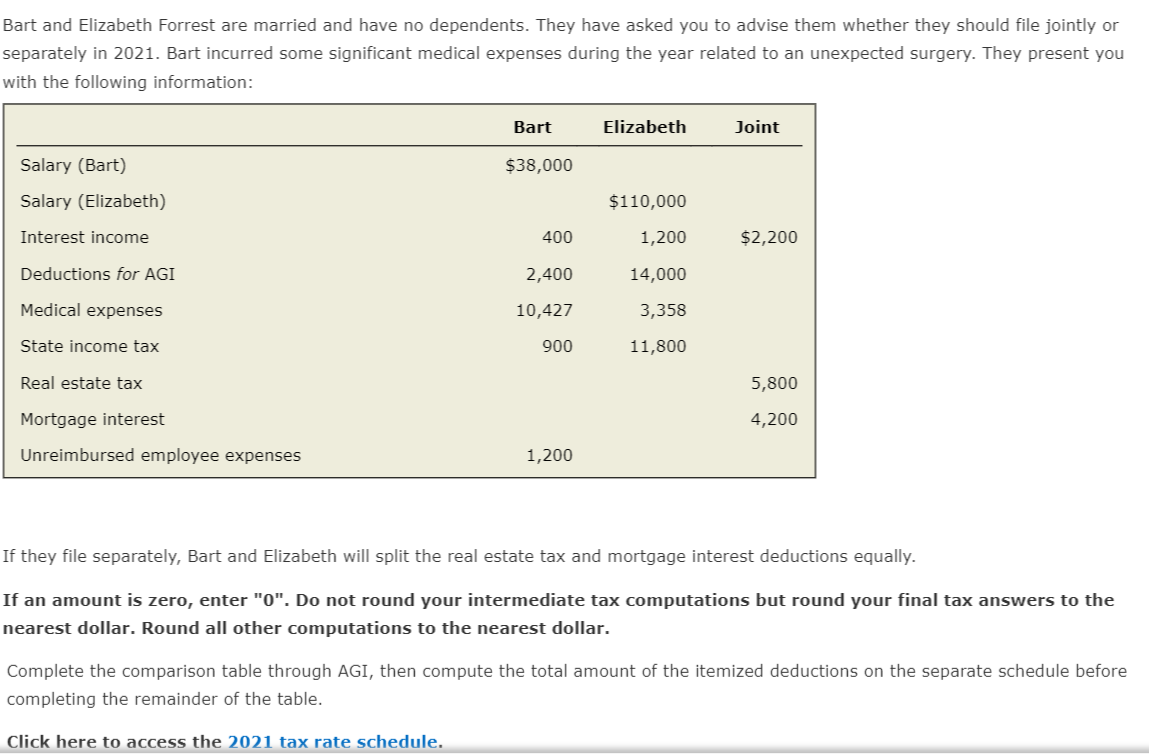

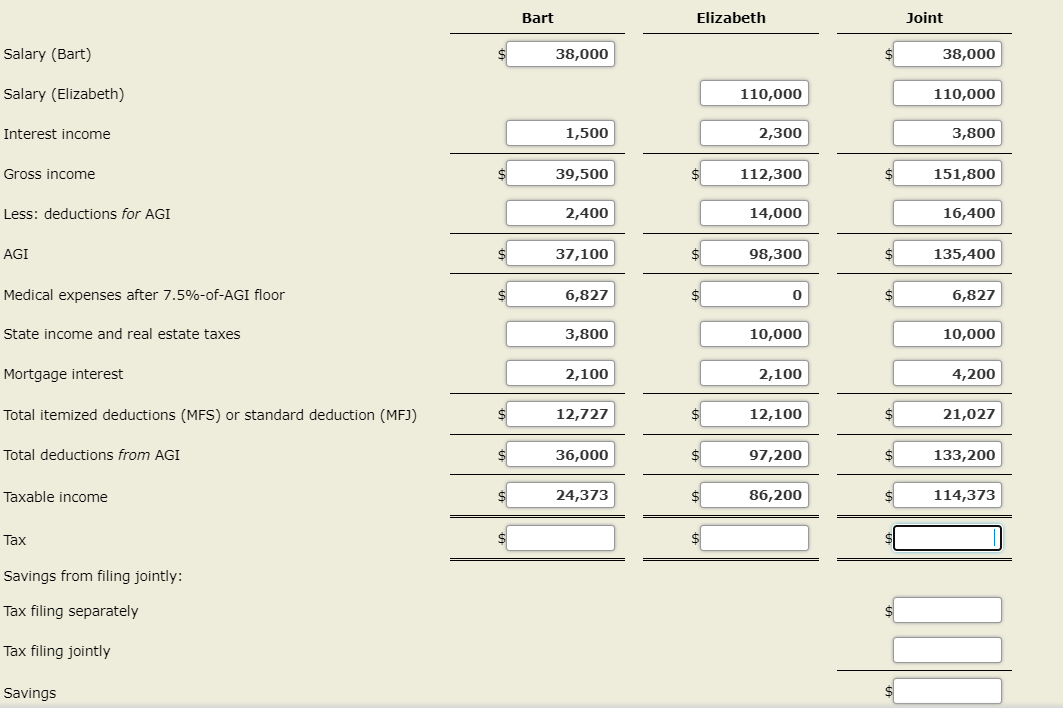

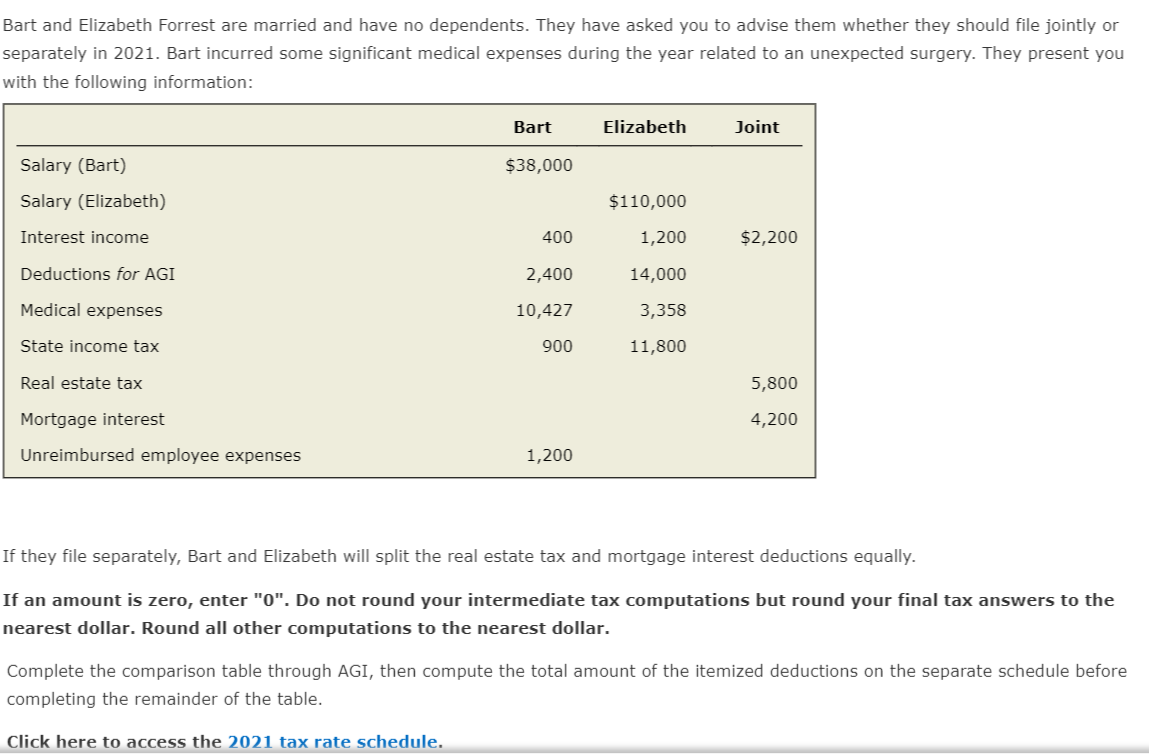

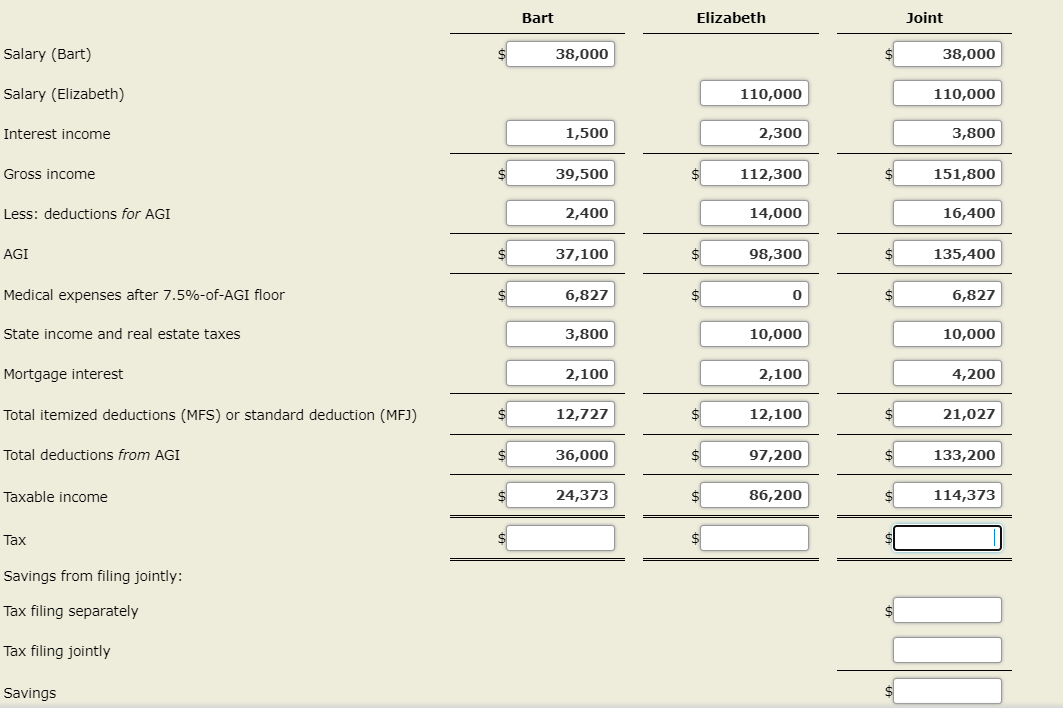

Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file jointly or separately in 2021. Bart incurred some significant medical expenses during the year related to an unexpected surgery. They present you with the following information: Bart Elizabeth Joint Salary (Bart) $38,000 Salary (Elizabeth) $110,000 Interest income 400 1,200 $2,200 Deductions for AGI 2,400 14,000 Medical expenses 10,427 3,358 State income tax 900 11,800 Real estate tax 5,800 Mortgage interest 4,200 Unreimbursed employee expenses 1,200 If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. If an amount is zero, enter "0". Do not round your intermediate tax computations but round your final tax answers to the nearest dollar. Round all other computations to the nearest dollar. Complete the comparison table through AGI, then compute the total amount of the itemized deductions the separate schedule before completing the remainder of the table. Click here to access the 2021 tax rate schedule. Bart Elizabeth Joint Salary (Bart) 38,000 38,000 Salary (Elizabeth) 110,000 110,000 Interest income 1,500 2,300 3,800 Gross income 39,500 112,300 151,800 Less: deductions for AGI 2,400 14,000 16,400 AGI 37,100 $ 98,300 135,400 Medical expenses after 7.5%-of-AGI floor 6,827 0 6,827 State income and real estate taxes 3,800 10,000 10,000 Mortgage interest 2,100 2,100 4,200 Total itemized deductions (MFS) or standard deduction (MF)) 12,727 12,100 21,027 Total deductions from AGI 36,000 97,200 133,200 Taxable income 24,373 $ 86,200 114,373 Tax Savings from filing jointly: Tax filing separately Tax filing jointly Savings Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file jointly or separately in 2021. Bart incurred some significant medical expenses during the year related to an unexpected surgery. They present you with the following information: Bart Elizabeth Joint Salary (Bart) $38,000 Salary (Elizabeth) $110,000 Interest income 400 1,200 $2,200 Deductions for AGI 2,400 14,000 Medical expenses 10,427 3,358 State income tax 900 11,800 Real estate tax 5,800 Mortgage interest 4,200 Unreimbursed employee expenses 1,200 If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. If an amount is zero, enter "0". Do not round your intermediate tax computations but round your final tax answers to the nearest dollar. Round all other computations to the nearest dollar. Complete the comparison table through AGI, then compute the total amount of the itemized deductions the separate schedule before completing the remainder of the table. Click here to access the 2021 tax rate schedule. Bart Elizabeth Joint Salary (Bart) 38,000 38,000 Salary (Elizabeth) 110,000 110,000 Interest income 1,500 2,300 3,800 Gross income 39,500 112,300 151,800 Less: deductions for AGI 2,400 14,000 16,400 AGI 37,100 $ 98,300 135,400 Medical expenses after 7.5%-of-AGI floor 6,827 0 6,827 State income and real estate taxes 3,800 10,000 10,000 Mortgage interest 2,100 2,100 4,200 Total itemized deductions (MFS) or standard deduction (MF)) 12,727 12,100 21,027 Total deductions from AGI 36,000 97,200 133,200 Taxable income 24,373 $ 86,200 114,373 Tax Savings from filing jointly: Tax filing separately Tax filing jointly Savings