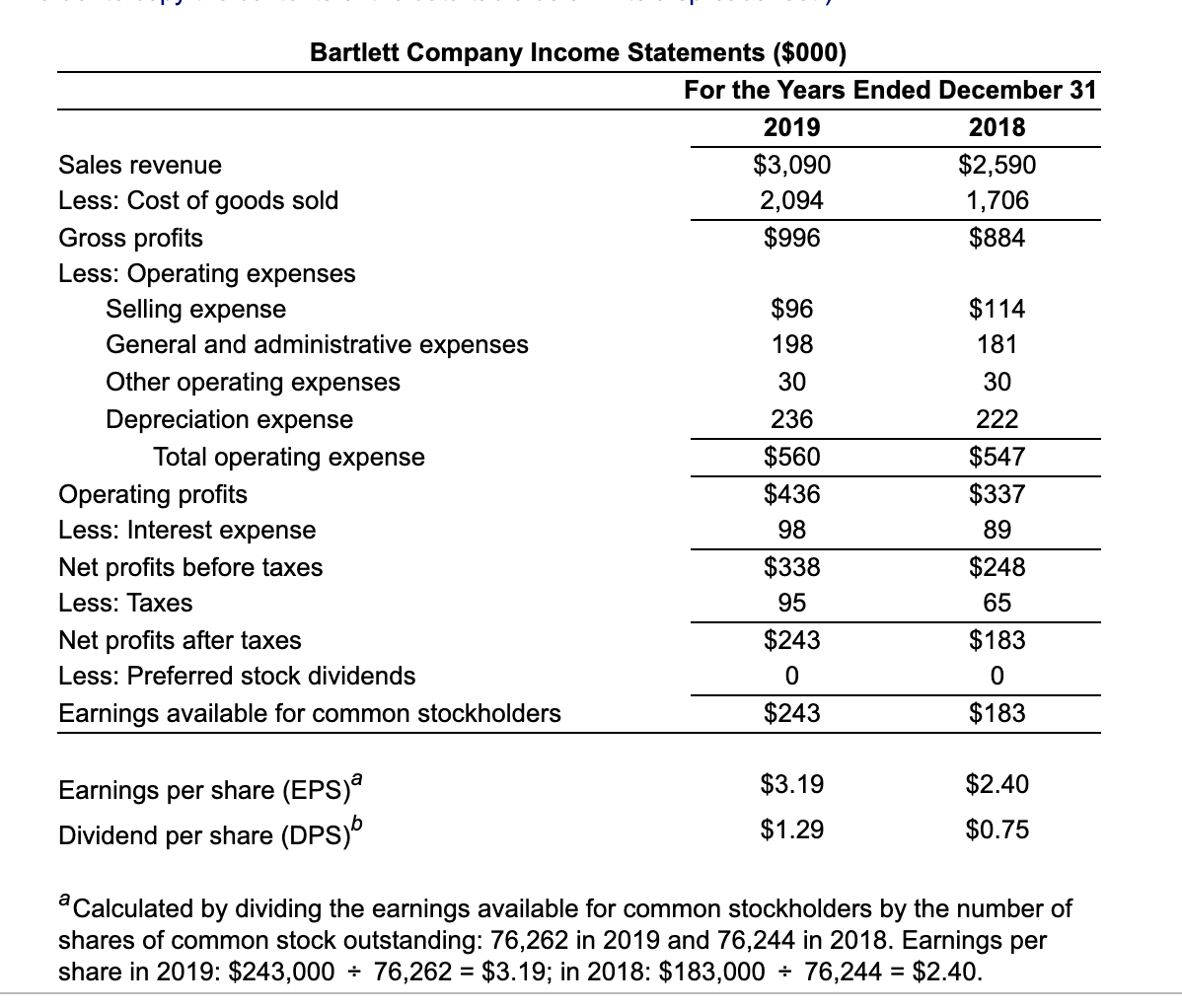

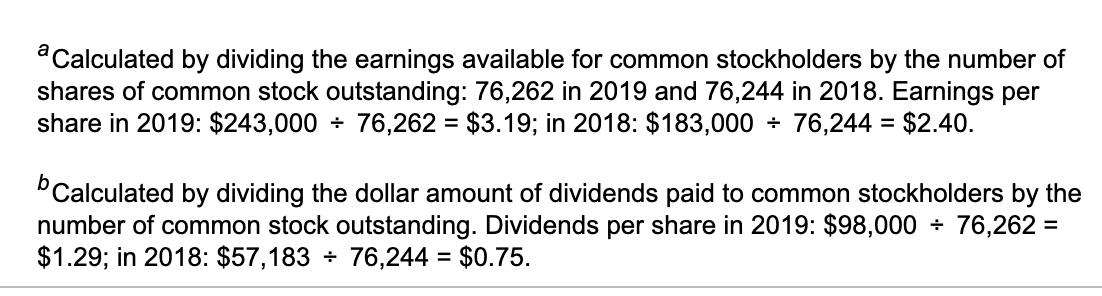

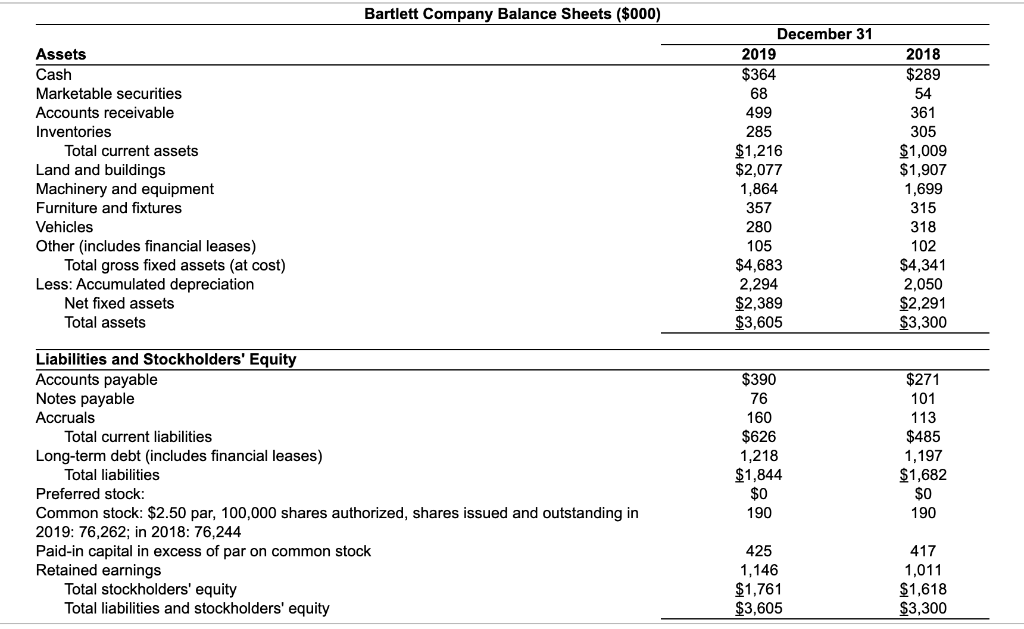

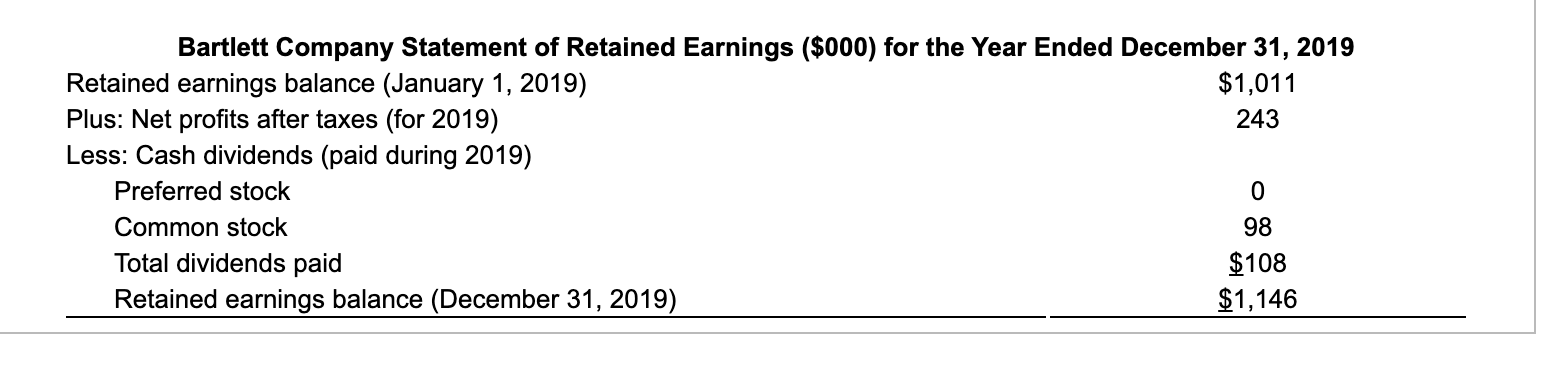

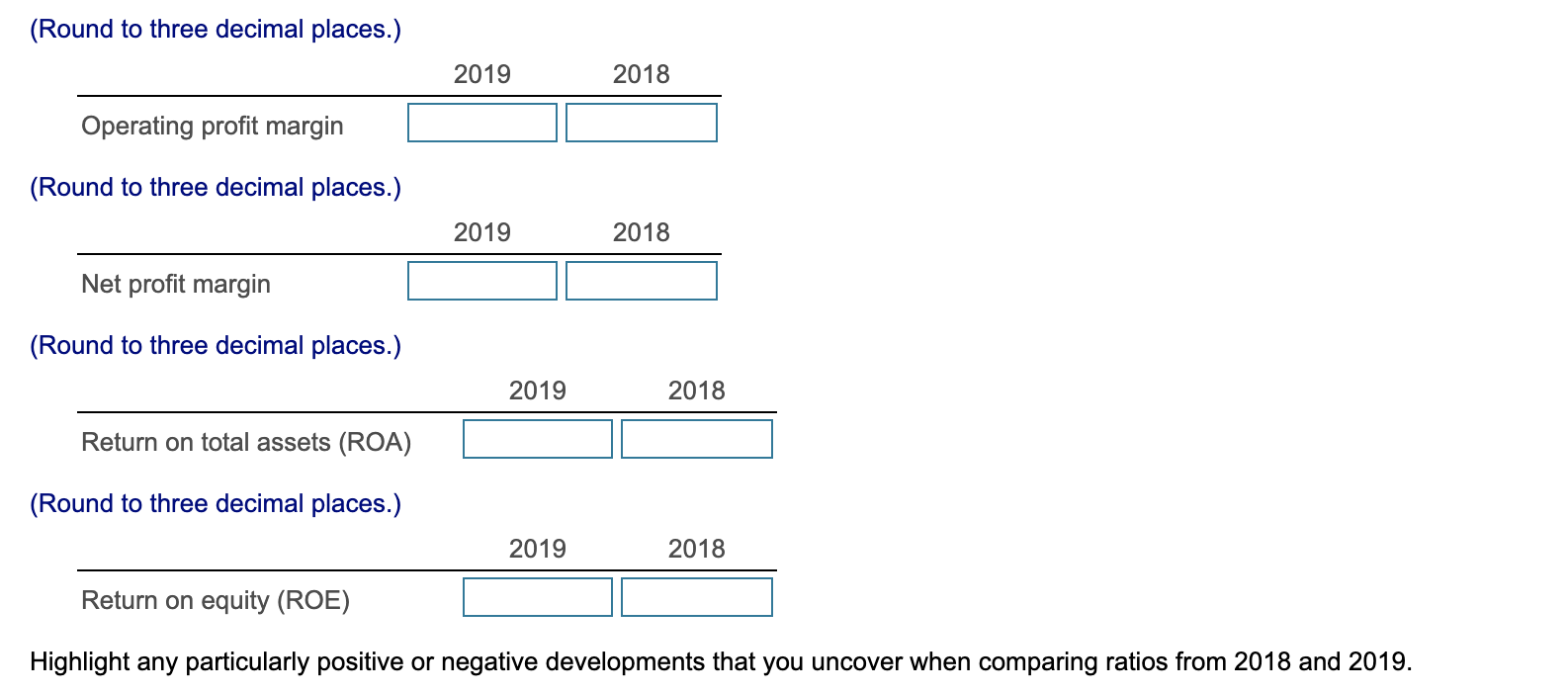

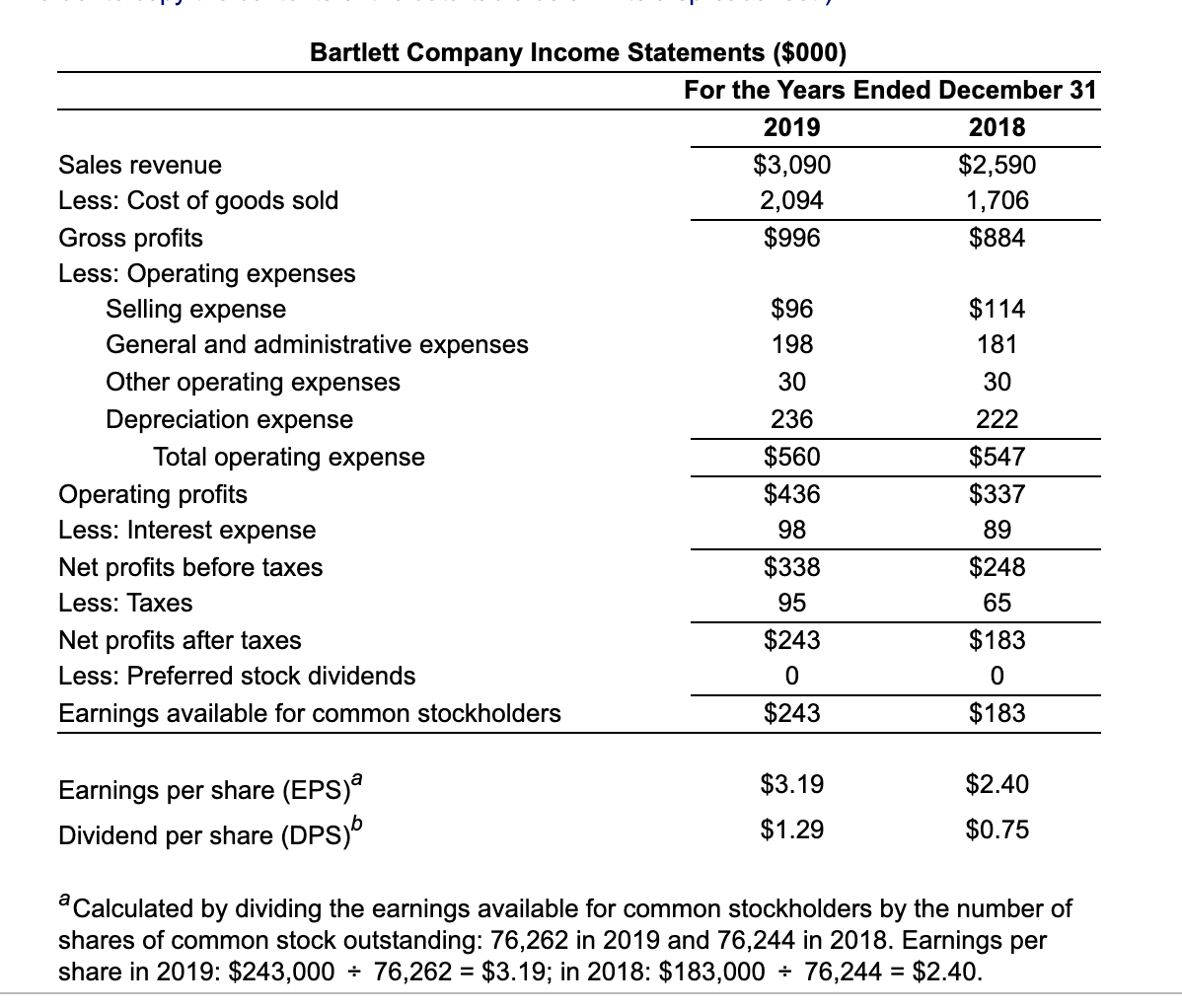

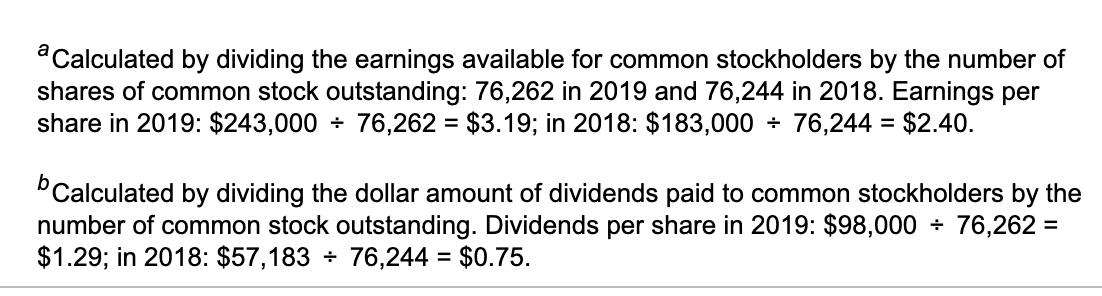

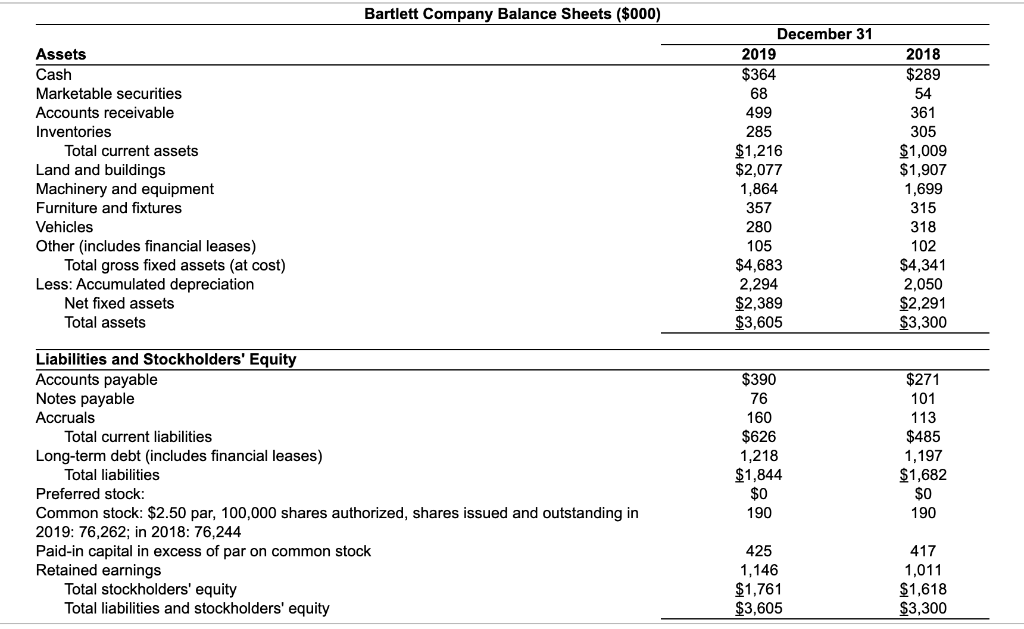

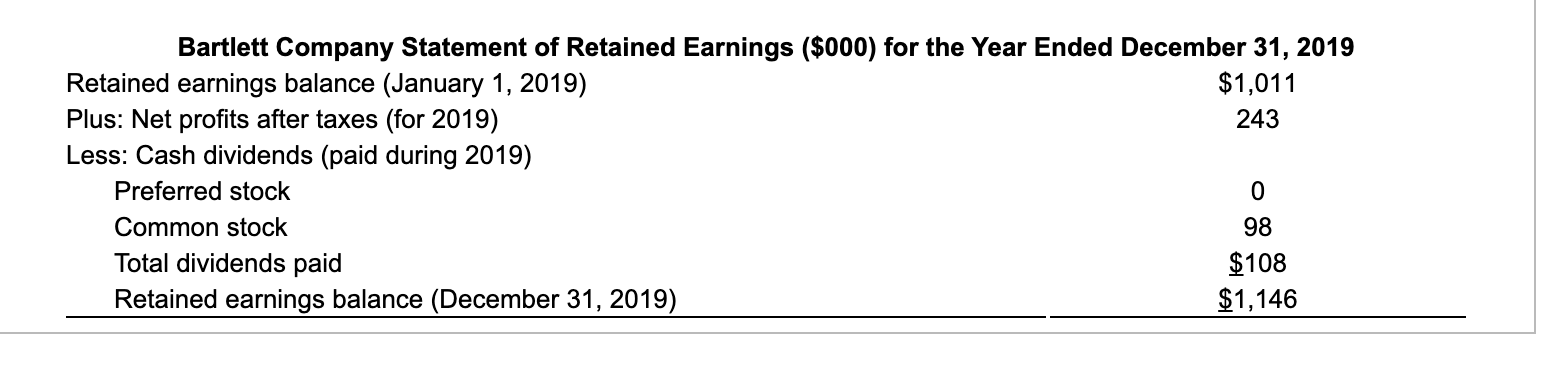

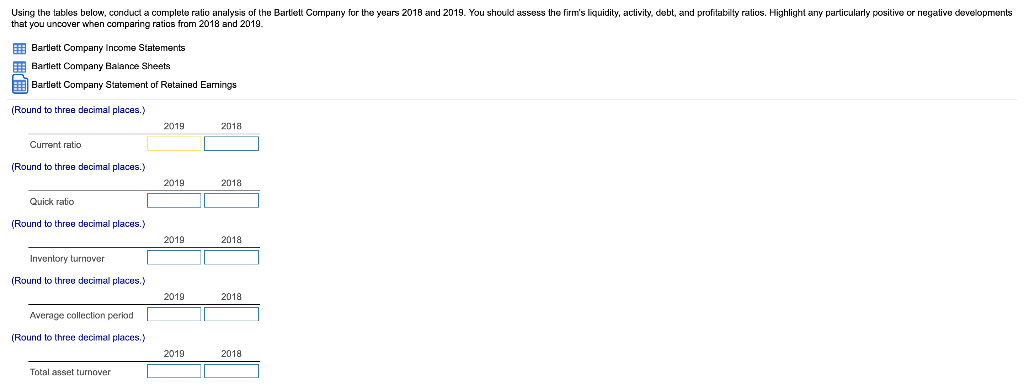

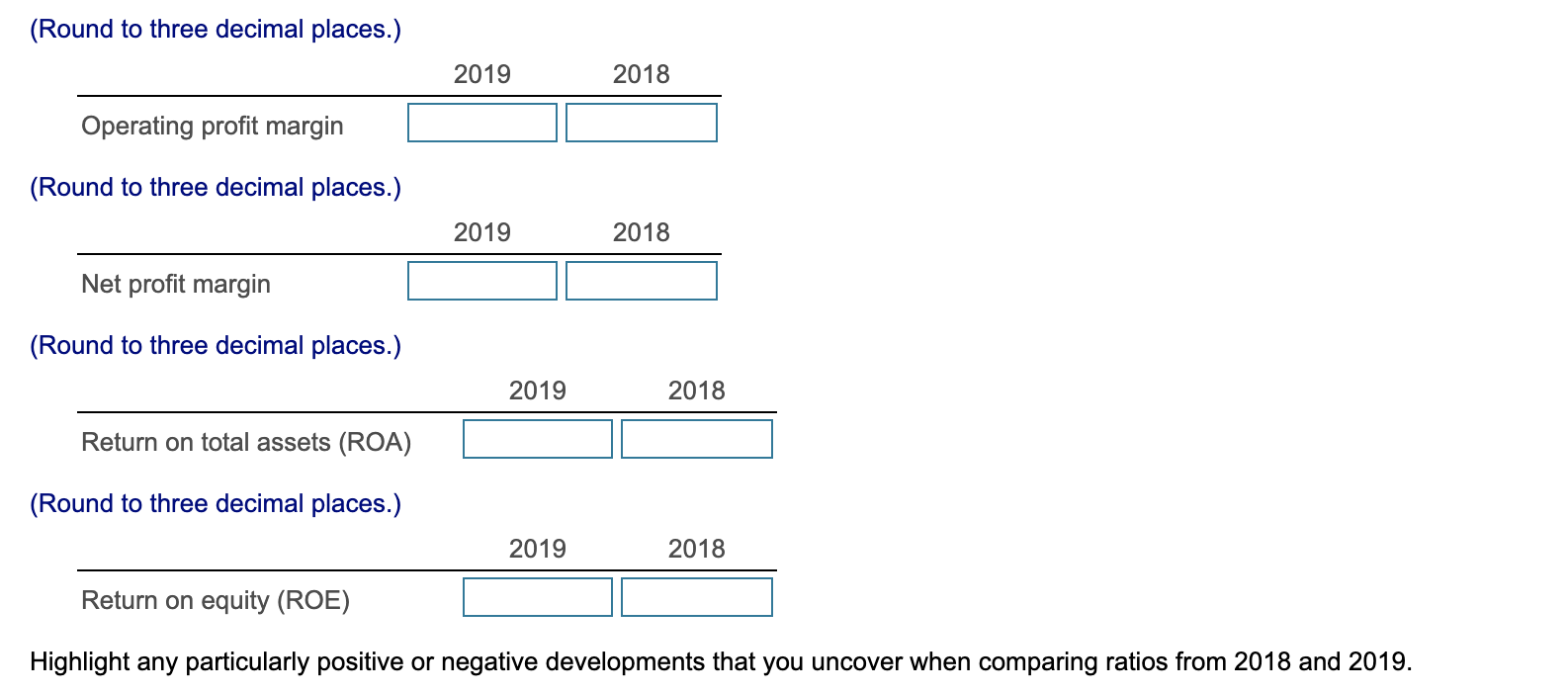

Bartlett Company Income Statements ($000) For the Years Ended December 31 2019 2018 Sales revenue $3,090 $2,590 Less: Cost of goods sold 2,094 1,706 Gross profits $996 $884 Less: Operating expenses Selling expense $96 $114 General and administrative expenses 198 181 Other operating expenses 30 30 Depreciation expense 236 222 Total operating expense $560 $547 Operating profits $436 $337 Less: Interest expense 98 89 Net profits before taxes $338 $248 Less: Taxes 95 65 Net profits after taxes $243 $183 Less: Preferred stock dividends 0 0 Earnings available for common stockholders $243 $183 $3.19 $2.40 Earnings per share (EPS)a Dividend per share (DPS) $1.29 $0.75 a Calculated by dividing the earnings available for common stockholders by the number of shares of common stock outstanding: 76,262 in 2019 and 76,244 in 2018. Earnings per share in 2019: $243,000 - 76,262 = $3.19; in 2018: $183,000 - 76,244 = $2.40. a Calculated by dividing the earnings available for common stockholders by the number of shares of common stock outstanding: 76,262 in 2019 and 76,244 in 2018. Earnings per share in 2019: $243,000 = 76,262 = $3.19; in 2018: $183,000 - 76,244 = $2.40. Calculated by dividing the dollar amount of dividends paid to common stockholders by the number of common stock outstanding. Dividends per share in 2019: $98,000 - 76,262 = $1.29; in 2018: $57,183 - 76,244 = $0.75. Bartlett Company Balance Sheets ($000) Assets Cash Marketable securities Accounts receivable Inventories Total current assets Land and buildings Machinery and equipment Furniture and fixtures Vehicles Other (includes financial leases) Total gross fixed assets (at cost) Less: Accumulated depreciation Net fixed assets Total assets December 31 2019 $364 68 499 285 $1,216 $2,077 1,864 357 280 105 $4,683 2,294 $2,389 $3,605 2018 $289 54 361 305 $1,009 $1,907 1,699 315 318 102 $4,341 2,050 $2,291 $3,300 Liabilities and Stockholders' Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt (includes financial leases) Total liabilities Preferred stock: Common stock: $2.50 par, 100,000 shares authorized, shares issued and outstanding in 2019: 76,262; in 2018: 76,244 Paid-in capital in excess of par on common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $390 76 160 $626 1,218 $1,844 $0 190 $271 101 113 $485 1,197 $1,682 $0 190 425 1,146 $1,761 $3,605 417 1,011 $1,618 $3,300 Bartlett Company Statement of Retained Earnings ($000) for the Year Ended December 31, 2019 Retained earnings balance (January 1, 2019) $1,011 Plus: Net profits after taxes (for 2019) 243 Less: Cash dividends (paid during 2019) Preferred stock 0 Common stock 98 Total dividends paid $108 Retained earnings balance (December 31, 2019) $1,146 Using the tables below, conduct a complete ratio analysis of the Bartlett Company for the years 2018 and 2019. You should assess the firm's liquidity, activity, debt, and profitabilty ratios. Highlight any particularly positive or negative developments that you uncover when comparing ratios from 2018 and 2019 Bartlett Company Income Statements E Bartlett Company Balance Sheets Bartlett Company Statement of Retained Earnings (Round to three decimal places. 2019 2018 Current ratio (Round to three decimal places.) 2019 2018 Quick ratio (Round to three decimal places.) 2019 2018 Inventory turnover (Round to three decimal places.) 2019 2018 Average collection period (Round to three decimal places.) 2019 2018 Total asset turnover (Round to three decimal places.) 2019 2018 Debt ratio (Round to three decimal places.) 2019 2018 Debt/equity ratio (Round to three decimal places.) 2019 2018 Times interest earned (Round to three decimal places.) 2019 2018 Gross profit margin (Round to three decimal places.) 2019 2018 Operating profit margin (Round to three decimal places.) 2019 2018 Operating profit margin (Round to three decimal places.) 2019 2018 Net profit margin (Round to three decimal places.) 2019 2018 Return on total assets (ROA) (Round to three decimal places.) 2019 2018 Return on equity (ROE) Highlight any particularly positive or negative developments that you uncover when comparing ratios from 2018 and 2019