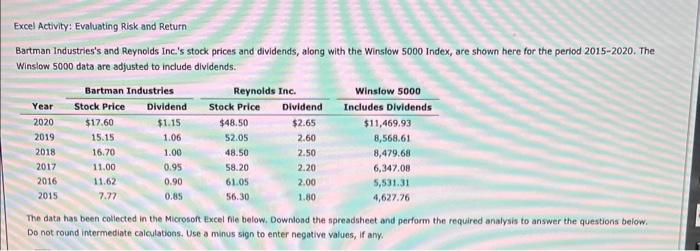

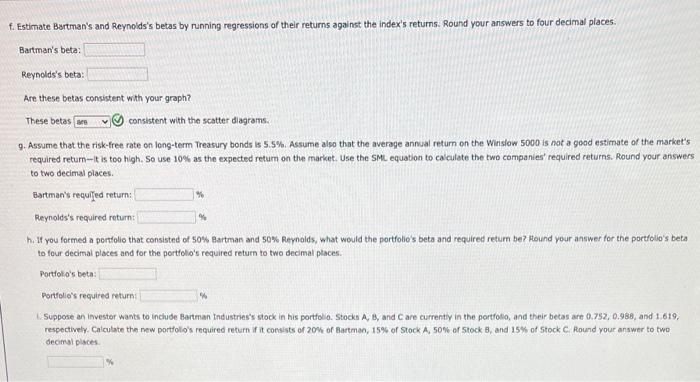

Bartman Industries's and Reynoids Inc.'s stock prices and dividends, along with the Winstow 5000 Index, are shown here for the period 2015-2020. The Winslow 5000 data are adjusted to include dividends. The data has been collected in the Microsoft Excel fle below. Downlond the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. f. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's retums. Round your answers to four decimal places. Bartman's beta: Reynolds's beta: Are these betas consigtent with your graph? These betas consistent with the scatter diagrams. 9. Assume that the risk-free rate on leng-term Treasury bonds is 5.5%. Assume also that the average annual retum on the Winslow 5000 is not a good estimate of the market's required retum-it is too high. So use 10% as the expected return on the market. Use the SML equation to caiculate the two companies' required returns. Round your answers to two decimal places. Bartman's requifed return: Pieynolds's required retum: h. If you formed a pertolio that consisted of 50% Rartman and 50% Reynolds, what would the portfolio's beta and required return be? Round your answer for the portfolio's beta to four decimal pleces and for the portfolio's required return to two decimal places. Portiolo's beta: Portfolio's recuired return: 1. Suppose an ifivestor wasts to inchude Bartman industries's stock in his portfolio. Stocks A, 8, and C are currentiy in the portfollo, and their becas are 0.752, 0.988, and 1.619, respectively. Calculate the new portfolo's required return if it consists of 20% of Bartmen, 15% of $ tock A,50% of 5 tock 8 , and 15% of 5 tock C. Round your answer to two decimal pisces. Bartman Industries's and Reynoids Inc.'s stock prices and dividends, along with the Winstow 5000 Index, are shown here for the period 2015-2020. The Winslow 5000 data are adjusted to include dividends. The data has been collected in the Microsoft Excel fle below. Downlond the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. f. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's retums. Round your answers to four decimal places. Bartman's beta: Reynolds's beta: Are these betas consigtent with your graph? These betas consistent with the scatter diagrams. 9. Assume that the risk-free rate on leng-term Treasury bonds is 5.5%. Assume also that the average annual retum on the Winslow 5000 is not a good estimate of the market's required retum-it is too high. So use 10% as the expected return on the market. Use the SML equation to caiculate the two companies' required returns. Round your answers to two decimal places. Bartman's requifed return: Pieynolds's required retum: h. If you formed a pertolio that consisted of 50% Rartman and 50% Reynolds, what would the portfolio's beta and required return be? Round your answer for the portfolio's beta to four decimal pleces and for the portfolio's required return to two decimal places. Portiolo's beta: Portfolio's recuired return: 1. Suppose an ifivestor wasts to inchude Bartman industries's stock in his portfolio. Stocks A, 8, and C are currentiy in the portfollo, and their becas are 0.752, 0.988, and 1.619, respectively. Calculate the new portfolo's required return if it consists of 20% of Bartmen, 15% of $ tock A,50% of 5 tock 8 , and 15% of 5 tock C. Round your answer to two decimal pisces