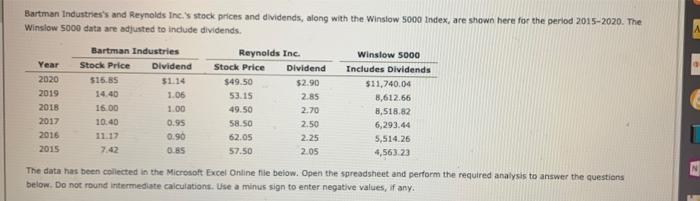

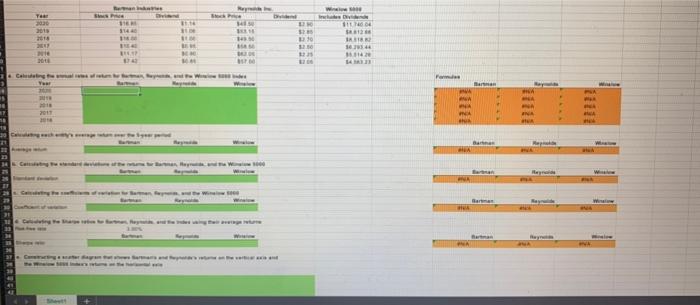

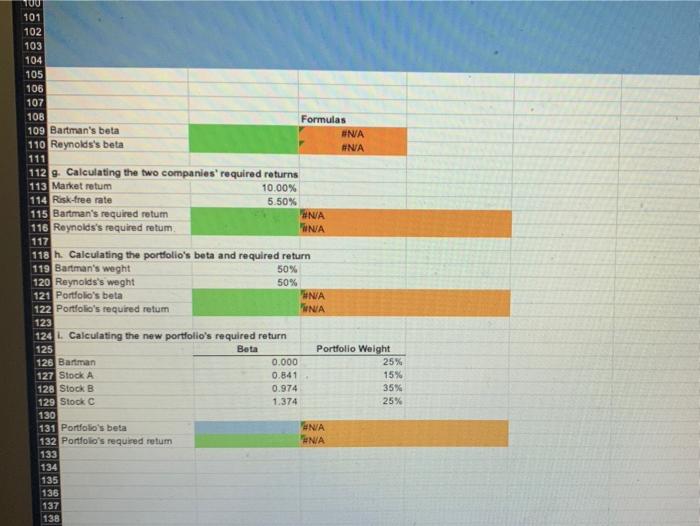

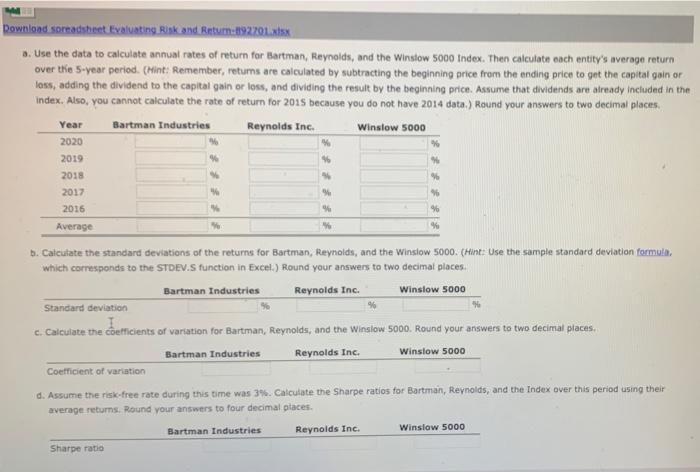

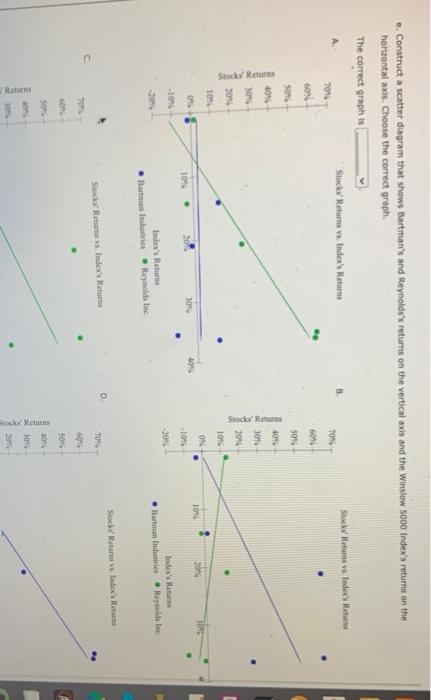

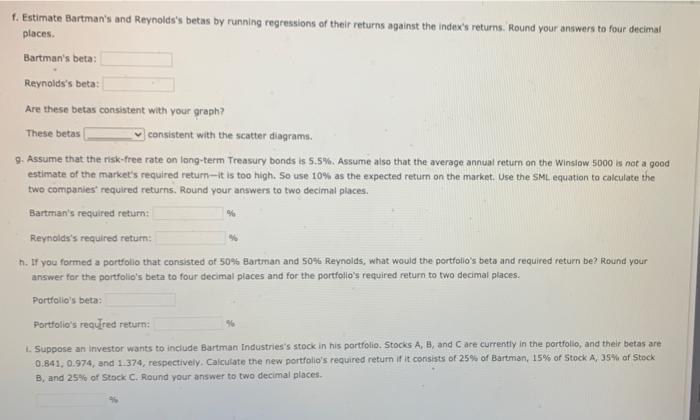

Bartman Industries's and Reynolds Inc.'s stock prices and dividends, along with the Winslow S000 Index, are shown here for the period 2015-2020. The Winslow 5000 data are adjusted to indude dividends. Bartman Industries Reynolds Inc. Winslow 5000 Year Stock Price Dividend Stock Price Dividend Includes Dividends 2020 515.85 51.14 $49.50 $2.90 $11,740.04 2019 14.40 1.06 53.15 2.85 8.612.66 2018 16.00 1.00 49.50 2.70 8,518.82 2017 10.40 0.95 58.50 2.50 6,293.44 2016 11.17 0.90 62.05 2.25 2015 7.42 0.85 5,514.26 4,563.23 57.50 2.05 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. Wine RUB 03 2013 18 114 B 20 1634 we Cat Maran 30 2013 ANA E W RE 100 101 102 103 104 105 106 107 Formulas 108 109 Bartman's beta 110 Reynolds's beta #NA #NA 111 112 9. Calculating the two companies' required returns 113 Market retum 114 Risk-free rate 115 Bartman's required retum 116 Reynolds's required retum WNA 10.00% 5.50% #NA 117 118 h. Calculating the portfolio's beta and required return 119 Bartman's weght 50% 120 Reynolds's weght 50% 121 Portfolio's beta WNA 122 Portfolio's required retum WA 123 124 L. Calculating the new portfolio's required return 125 Beta Portfolio Weight 126 Bartman 0.000 25% 127 Stock A 0.841 15% 128 Stock B 0.974 35% 129 Stock C 1.374 25% 130 131 Portfolio's beta WNA 132 Portfolio's required retum N/A 133 134 135 136 137 138 Download spreadsheet Evaluating Risk and Return:192701.xlsx . Use the data to calculate annual rates of return for Bartman, Reynolds, and the Winstow 5000 Index. Then calculate each entity's average return over the 5-year period. (Hint: Remember, returns are calculated by subtracting the beginning orice from the ending price to get the capital gain or loss, adding the dividend to the capital gain or loss, and dividing the result by the beginning price. Assume that dividends are already included in the index. Also, you cannot calculate the rate of return for 2015 because you do not have 2014 data.) Round your answers to two decimal places Bartman Industries Winslow 5000 Year Reynolds Inc. 2020 % 2019 96 2018 2017 % 2016 % Average 4 b. Calculate the standard deviations of the returns for Bartman, Reynolds, and the Winslow 5000. (Hint: Use the sample standard deviation formula which corresponds to the STDEV.S function in Excel) Round your answers to two decimal places Winslow 5000 Bartman Industries Reynolds Inc. Standard deviation c. Calculate the coefficients of variation for Bartman, Reynolds, and the Winslow 5000. Round your answers to two decimal places. Bartman Industries Reynolds Inc. Winslow 5000 Coefficient of variation d. Assume the risk-free rate during this time was 3%. Calculate the Sharpe ratios for Bartman, Reynolds, and the Index over this period using their average returns. Round your answers to four decimal places. Bartman Industries Reynolds Inc. Sharpe ratio Winslow 5000 e. Construct a scatter diagram that shows Bartman's and Reynolds's returns on the vertical axis and the Winslow sooo Index's retums on the horizontal axis. Choose the correct graph The correct graphis Stock Returns vs Index's Return Stock Returns w Index's Returns A 701 70% son 609 50% 50% 40% 40% 30 309 204 Stacks Stack 20 10 109 09 10 2014 09 10 30 . -1073 2046 Inte's R . Hartman Industries Reynolds Inc. 20 Index Return Bar Industries Reynolds the Stock Returns Index Return Stock Retura vs Index's Retur 70% . sor 50% 50 son 30 Returns ocks Re f. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's returns. Round your answers to four decimal places. Bartman's beta Reynolds's beta: Are these betas consistent with your graph? These betas consistent with the scatter diagrams. 9. Assume that the risk-free rate on long-term Treasury bonds is 5.5%. Assume also that the average annual return on the Winslow 5000 is not a good estimate of the market's required return--it is too high. So use 10% as the expected return on the market. Use the SML equation to calculate the two companies' required returns. Round your answers to two decimal places. Bartman's required returns % Reynolds's required return; h. If you formed a portfolio that consisted of 50% Bartman and 50% Reynolds, what would the portfolio's beta and required return be? Round your answer for the portfolio's beta to four decimal places and for the portfolio's required return to two decimal places. Portfolio's beta: Portfolio's required return 1. Suppose an investor wants to include Bartman Industries's stock in his portfolio. Stocks A, B, and are currently in the portfolio, and their betas are 0.841, 0.974, and 1.374, respectively. Calculate the new portfolio's required return if it consists of 25% of Bartman, 15% of Stock A, 35% of Stock B, and 25% of Stock C. Round your answer to two decimal places