Answered step by step

Verified Expert Solution

Question

1 Approved Answer

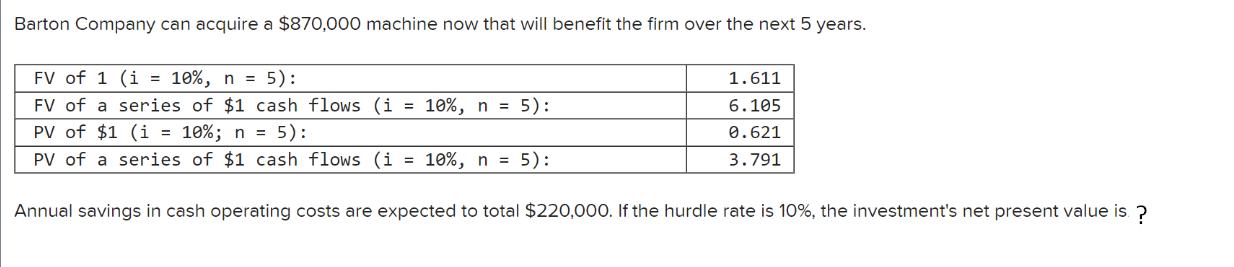

Barton Company can acquire a $870,000 machine now that will benefit the firm over the next 5 years. FV of 1 (i = 10%,

Barton Company can acquire a $870,000 machine now that will benefit the firm over the next 5 years. FV of 1 (i = 10%, n = 5): FV of a series of $1 cash flows (i = 10%, n = 5): PV of $1 (i = 10%; n = 5): PV of a series of $1 cash flows (i = 10%, n = 5): 1.611 6.105 0.621 3.791 Annual savings in cash operating costs are expected to total $220,000. If the hurdle rate is 10%, the investment's net present value is ? The Pines Company, which manufactures office equipment, is ready to introduce a new line of portable copiers. The following copier data are available: Variable manufacturing cost Variable selling and administrative cost Applied fixed manufacturing cost Allocated fixed selling and administrative cost $181 91 61 76 What price will the company charge if the firm uses cost-plus pricing based on total variable cost and a markup percentage of 125%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the machine acquisition we need to take into account the a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started