Answered step by step

Verified Expert Solution

Question

1 Approved Answer

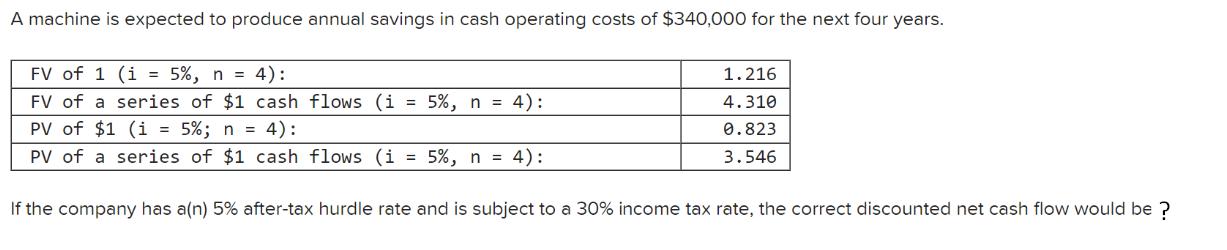

A machine is expected to produce annual savings in cash operating costs of $340,000 for the next four years. FV of 1 (i 5%,

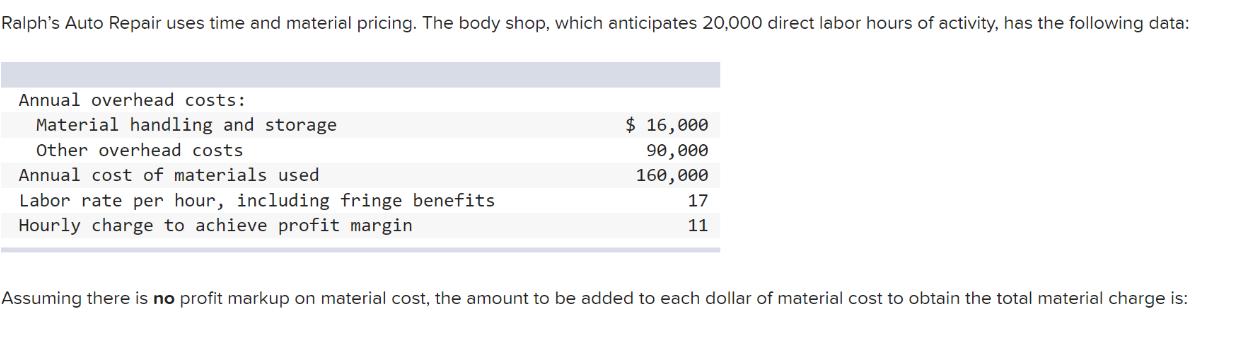

A machine is expected to produce annual savings in cash operating costs of $340,000 for the next four years. FV of 1 (i 5%, n = 4): FV of a series of $1 cash flows (i PV of $1 (i = 5%; n = 4): PV of a series of $1 cash flows (i = 5%, n = 4): = 5%, n = 4): 1.216 4.310 0.823 3.546 If the company has a(n) 5% after-tax hurdle rate and is subject to a 30% income tax rate, the correct discounted net cash flow would be ? Ralph's Auto Repair uses time and material pricing. The body shop, which anticipates 20,000 direct labor hours of activity, has the following data: Annual overhead costs: Material handling and storage Other overhead costs Annual cost of materials used Labor rate per hour, including fringe benefits Hourly charge to achieve profit margin $ 16,000 90,000 160,000 17 11 Assuming there is no profit markup on material cost, the amount to be added to each dollar of material cost to obtain the total material charge is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the correct discounted net cash flow for the machine producing annual savings of 340000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started