Answered step by step

Verified Expert Solution

Question

1 Approved Answer

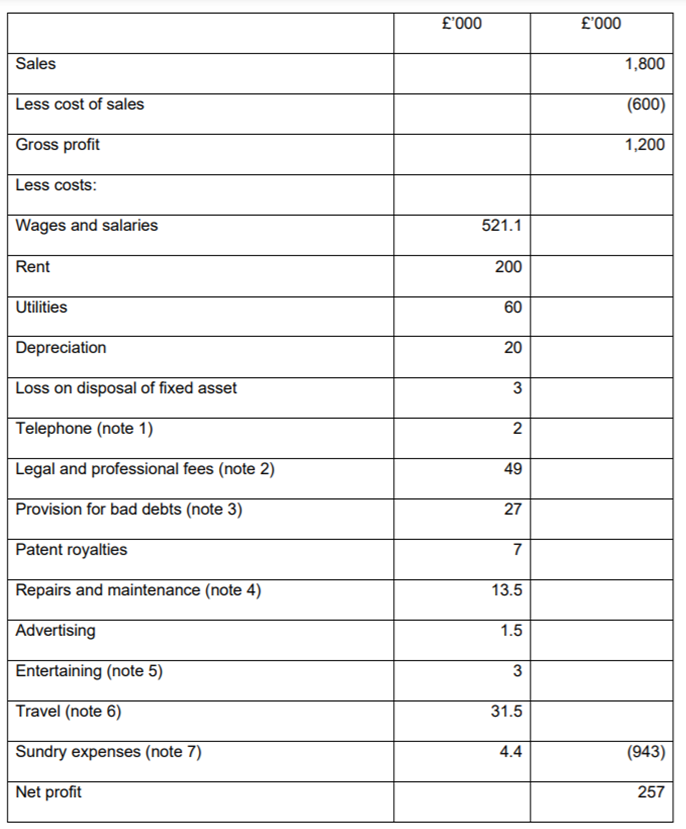

Barton Ltd manufactures and sells garden ornaments. It prepares accounts to 31 December. The income statement for the year ended 31 December 2020 is as

Barton Ltd manufactures and sells garden ornaments. It prepares accounts to 31 December. The income statement for the year ended 31 December 2020 is as follows:

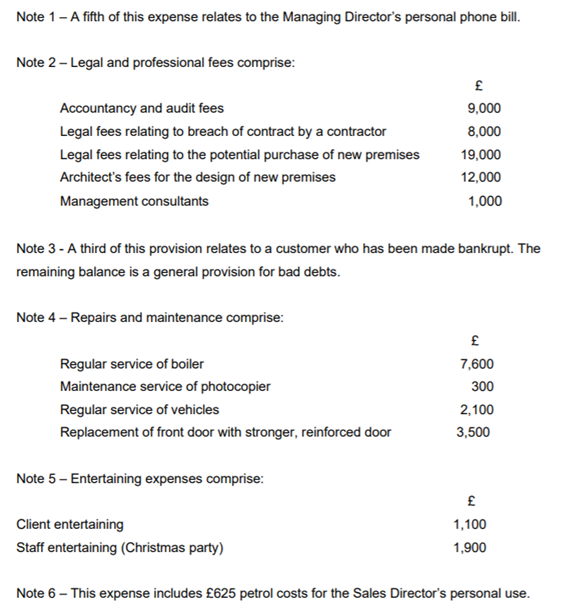

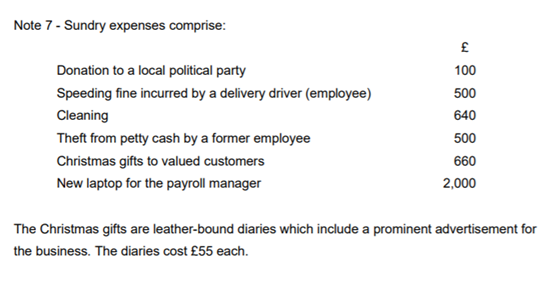

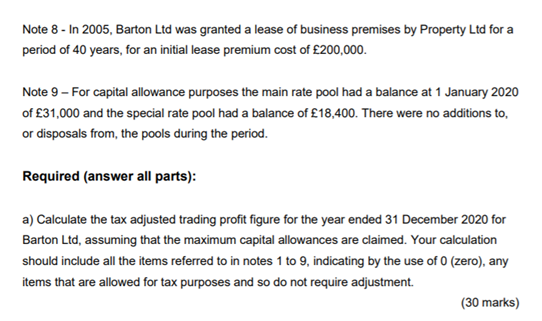

'000 '000 Sales 1,800 Less cost of sales (600) Gross profit 1,200 Less costs: Wages and salaries 521.1 Rent 200 Utilities 60 Depreciation 20 Loss on disposal of fixed asset 3 Telephone (note 1) N Legal and professional fees (note 2) 49 Provision for bad debts (note 3) 27 Patent royalties 7 Repairs and maintenance (note 4) 13.5 Advertising 1.5 Entertaining (note 5) 3 Travel (note 6) 31.5 Sundry expenses (note 7) 4.4 (943) Net profit 257 Note 1 - A fifth of this expense relates to the Managing Director's personal phone bill. Note 2 - Legal and professional fees comprise: Accountancy and audit fees Legal fees relating to breach of contract by a contractor Legal fees relating to the potential purchase of new premises Architect's fees for the design of new premises Management consultants 9,000 8,000 19,000 12,000 1,000 Note 3 - A third of this provision relates to a customer who has been made bankrupt. The remaining balance is a general provision for bad debts. Note 4 - Repairs and maintenance comprise: Regular service of boiler Maintenance service of photocopier Regular service of vehicles Replacement of front door with stronger, reinforced door 7,600 300 2,100 3,500 Note 5 - Entertaining expenses comprise: Client entertaining Staff entertaining (Christmas party) 1,100 1,900 Note 6 - This expense includes 625 petrol costs for the Sales Director's personal use. Note 7 - Sundry expenses comprise: 100 500 Donation to a local political party Speeding fine incurred by a delivery driver (employee) Cleaning Theft from petty cash by a former employee Christmas gifts to valued customers New laptop for the payroll manager 640 500 660 2,000 The Christmas gifts are leather-bound diaries which include a prominent advertisement for the business. The diaries cost 55 each. Note 8 - In 2005, Barton Ltd was granted a lease of business premises by Property Ltd for a period of 40 years, for an initial lease premium cost of 200,000 Note 9 - For capital allowance purposes the main rate pool had a balance at 1 January 2020 of 31,000 and the special rate pool had a balance of 18,400. There were no additions to or disposals from the pools during the period. Required (answer all parts): a) Calculate the tax adjusted trading profit figure for the year ended 31 December 2020 for Barton Ltd, assuming that the maximum capital allowances are claimed. Your calculation should include all the items referred to in notes 1 to 9, indicating by the use of 0 (zero), any items that are allowed for tax purposes and so do not require adjustment. (30 marks) '000 '000 Sales 1,800 Less cost of sales (600) Gross profit 1,200 Less costs: Wages and salaries 521.1 Rent 200 Utilities 60 Depreciation 20 Loss on disposal of fixed asset 3 Telephone (note 1) N Legal and professional fees (note 2) 49 Provision for bad debts (note 3) 27 Patent royalties 7 Repairs and maintenance (note 4) 13.5 Advertising 1.5 Entertaining (note 5) 3 Travel (note 6) 31.5 Sundry expenses (note 7) 4.4 (943) Net profit 257 Note 1 - A fifth of this expense relates to the Managing Director's personal phone bill. Note 2 - Legal and professional fees comprise: Accountancy and audit fees Legal fees relating to breach of contract by a contractor Legal fees relating to the potential purchase of new premises Architect's fees for the design of new premises Management consultants 9,000 8,000 19,000 12,000 1,000 Note 3 - A third of this provision relates to a customer who has been made bankrupt. The remaining balance is a general provision for bad debts. Note 4 - Repairs and maintenance comprise: Regular service of boiler Maintenance service of photocopier Regular service of vehicles Replacement of front door with stronger, reinforced door 7,600 300 2,100 3,500 Note 5 - Entertaining expenses comprise: Client entertaining Staff entertaining (Christmas party) 1,100 1,900 Note 6 - This expense includes 625 petrol costs for the Sales Director's personal use. Note 7 - Sundry expenses comprise: 100 500 Donation to a local political party Speeding fine incurred by a delivery driver (employee) Cleaning Theft from petty cash by a former employee Christmas gifts to valued customers New laptop for the payroll manager 640 500 660 2,000 The Christmas gifts are leather-bound diaries which include a prominent advertisement for the business. The diaries cost 55 each. Note 8 - In 2005, Barton Ltd was granted a lease of business premises by Property Ltd for a period of 40 years, for an initial lease premium cost of 200,000 Note 9 - For capital allowance purposes the main rate pool had a balance at 1 January 2020 of 31,000 and the special rate pool had a balance of 18,400. There were no additions to or disposals from the pools during the period. Required (answer all parts): a) Calculate the tax adjusted trading profit figure for the year ended 31 December 2020 for Barton Ltd, assuming that the maximum capital allowances are claimed. Your calculation should include all the items referred to in notes 1 to 9, indicating by the use of 0 (zero), any items that are allowed for tax purposes and so do not require adjustment. (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started