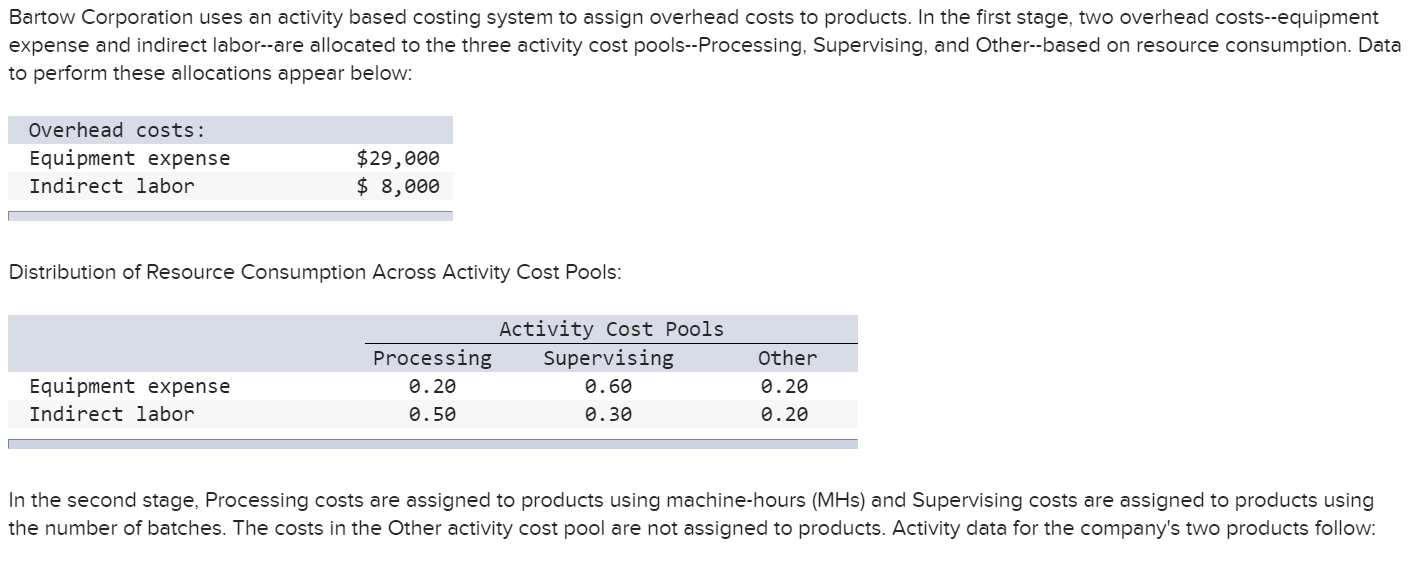

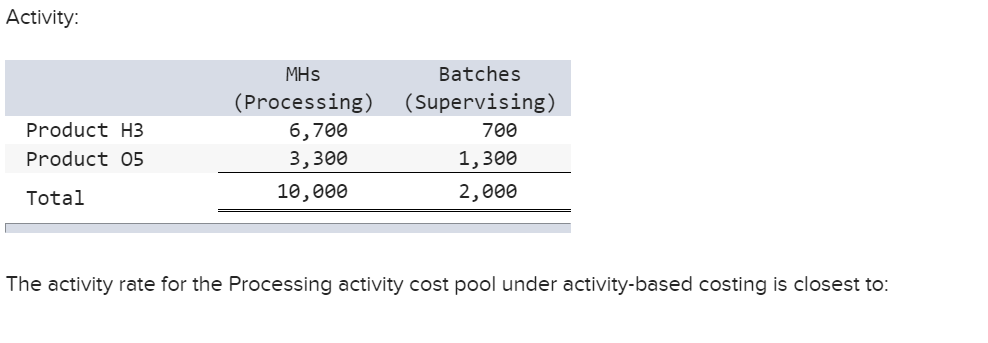

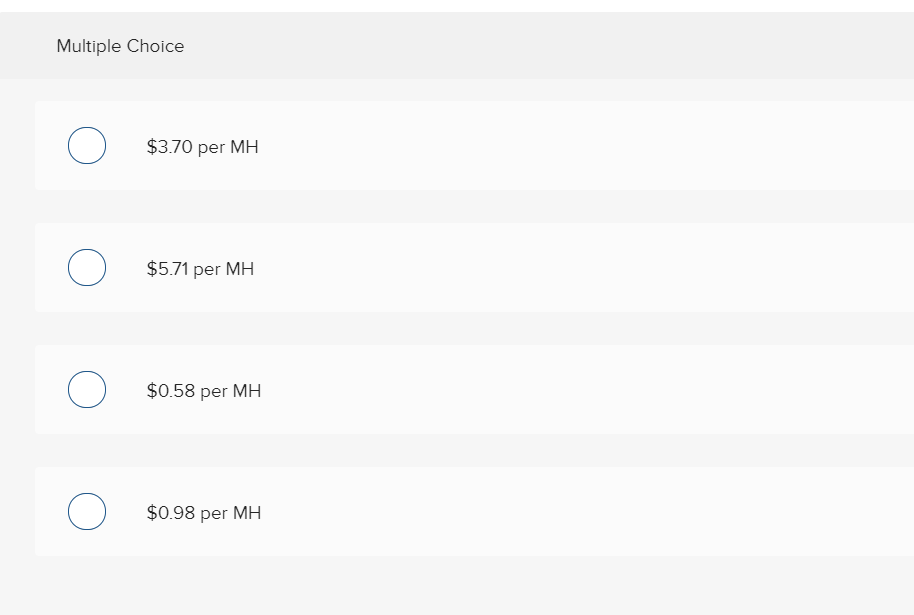

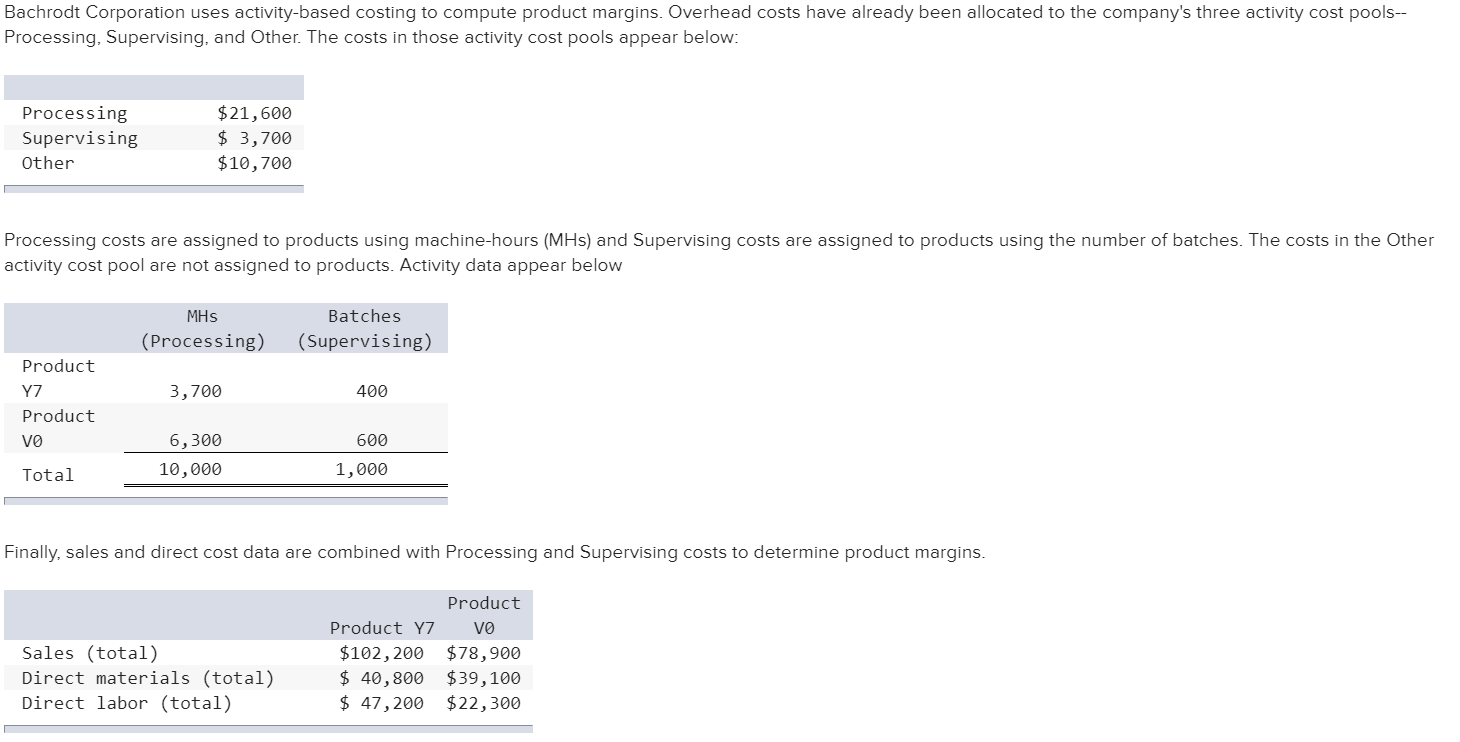

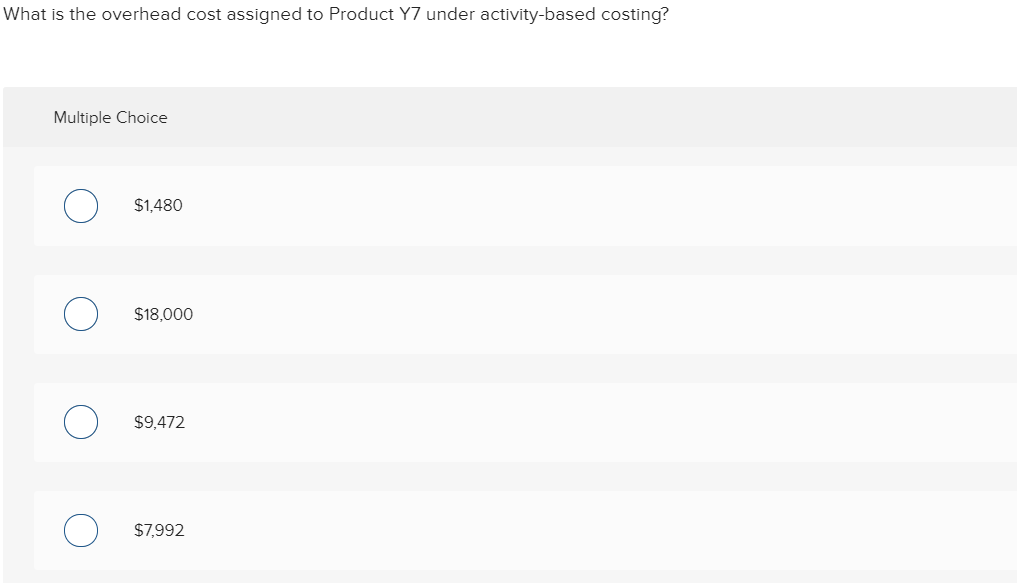

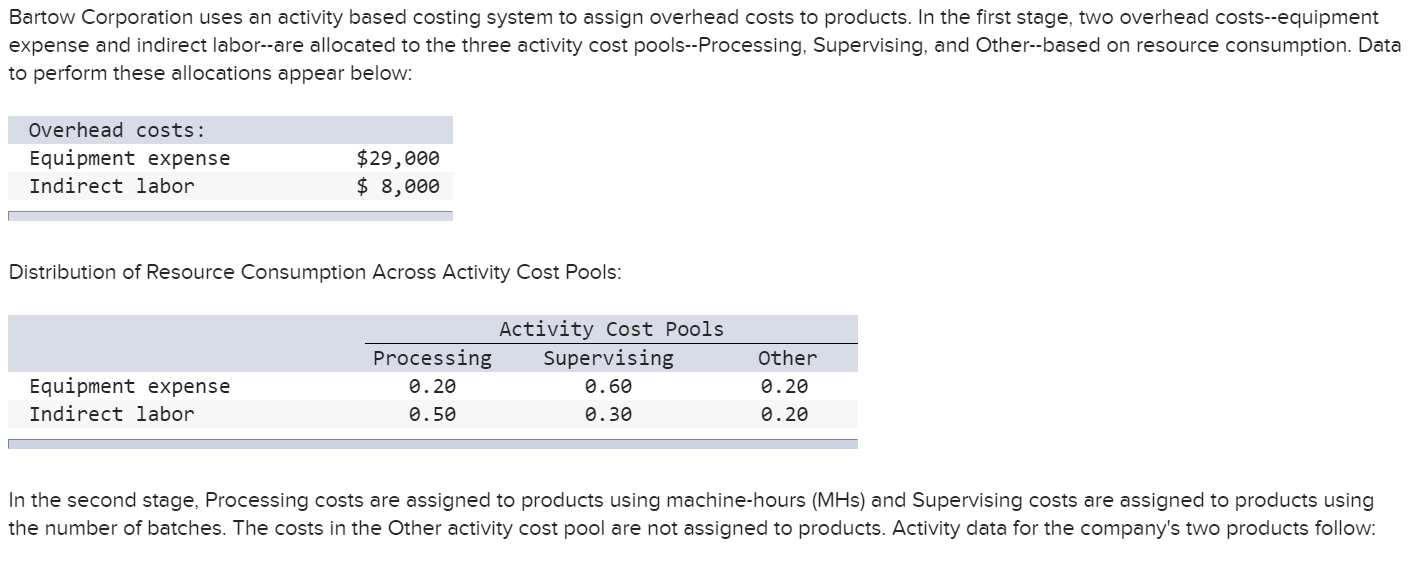

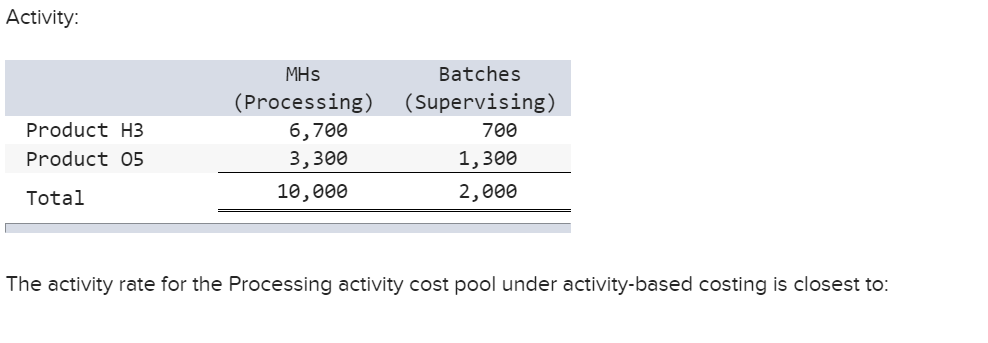

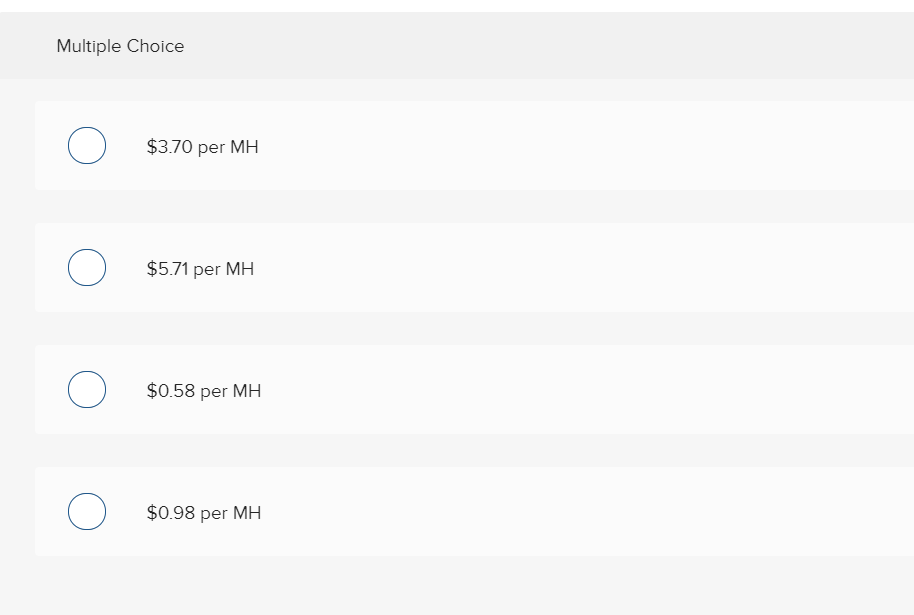

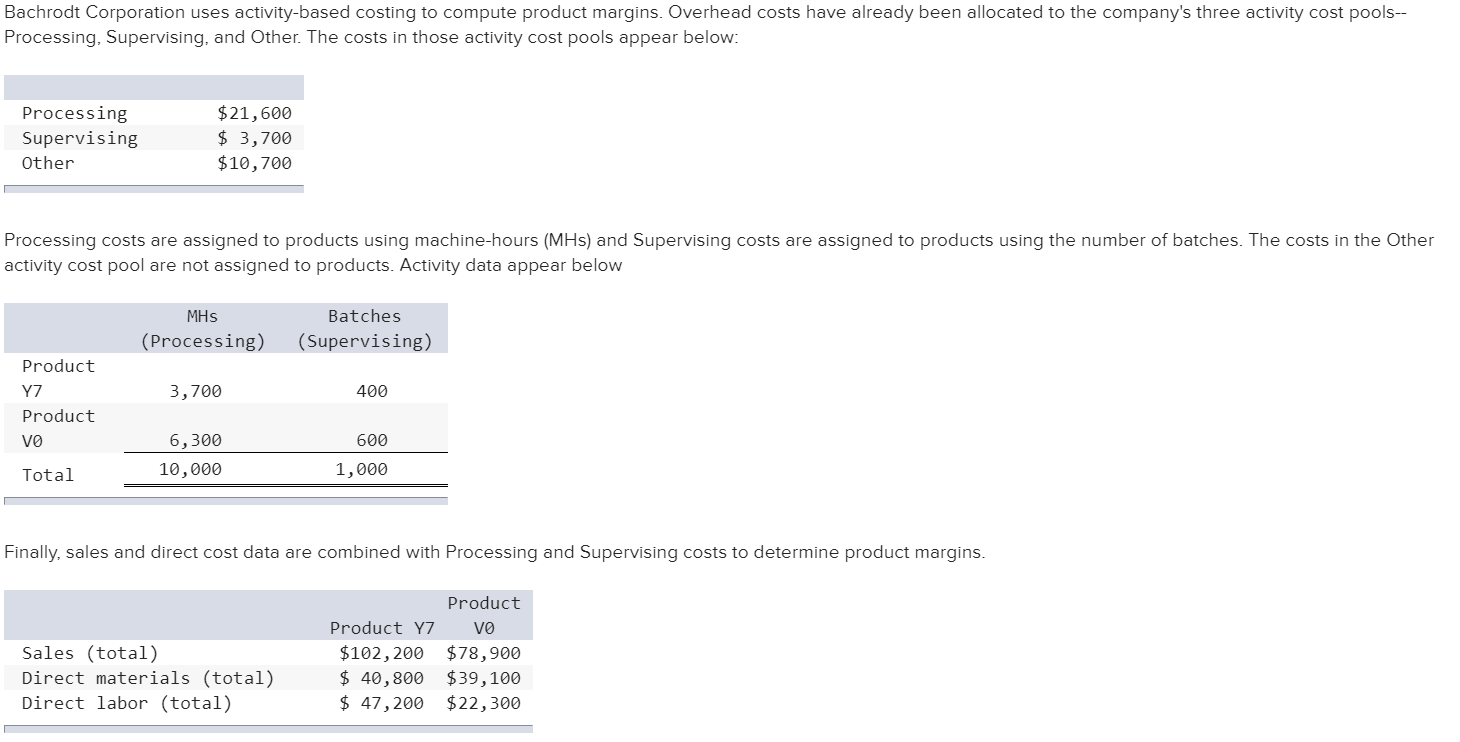

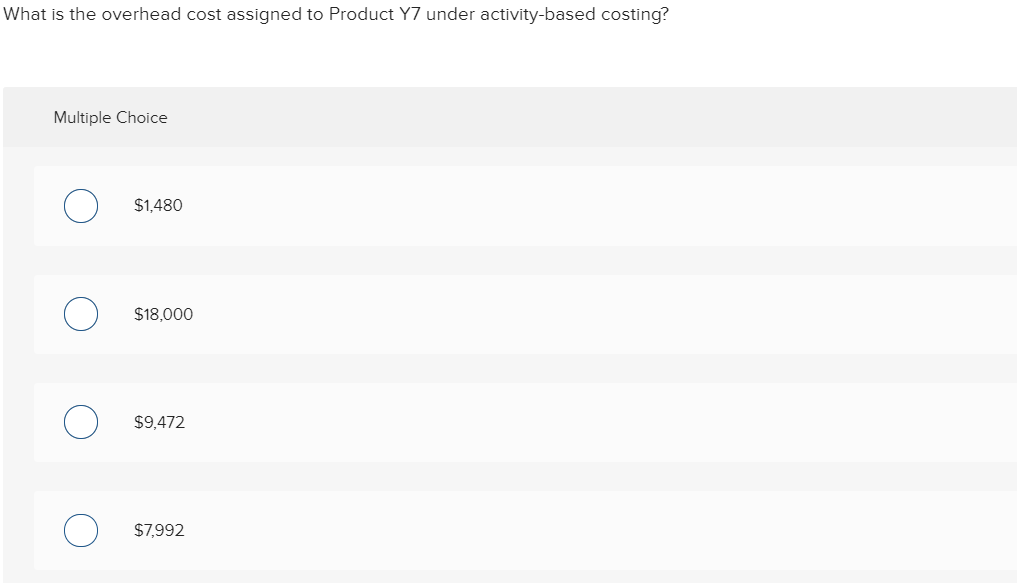

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below: Overhead costs: Equipment expense Indirect labor $29,000 $ 8,000 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Processing Supervising 0.20 0.60 0.50 0.30 Other 0.20 Equipment expense Indirect labor 0.20 In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: Product H3 Product 05 MHS (Processing) 6,700 3,300 10,000 Batches (Supervising) 700 1,300 2,000 Total The activity rate for the Processing activity cost pool under activity-based costing is closest to: Multiple Choice $3.70 per MH $5.71 per MH O $0.58 per MH $0.98 per MH Bachrodt Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-- Processing, Supervising, and Other. The costs in those activity cost pools appear below: Processing Supervising Other $21,600 $ 3,700 $10,700 Processing costs are assigned to products using machine-hours (MHS) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below MHS (Processing) Batches (Supervising) 3,700 400 Product Y7 Product vo 600 6,300 10,000 Total 1,000 Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Sales (total) Direct materials (total) Direct labor (total) Product Product Y7 VO $102,200 $78,900 $ 40, 800 $39,100 $ 47,200 $22,300 What is the overhead cost assigned to Product Y7 under activity-based costing? Multiple Choice $1,480 $18,000 $9,472 $7,992