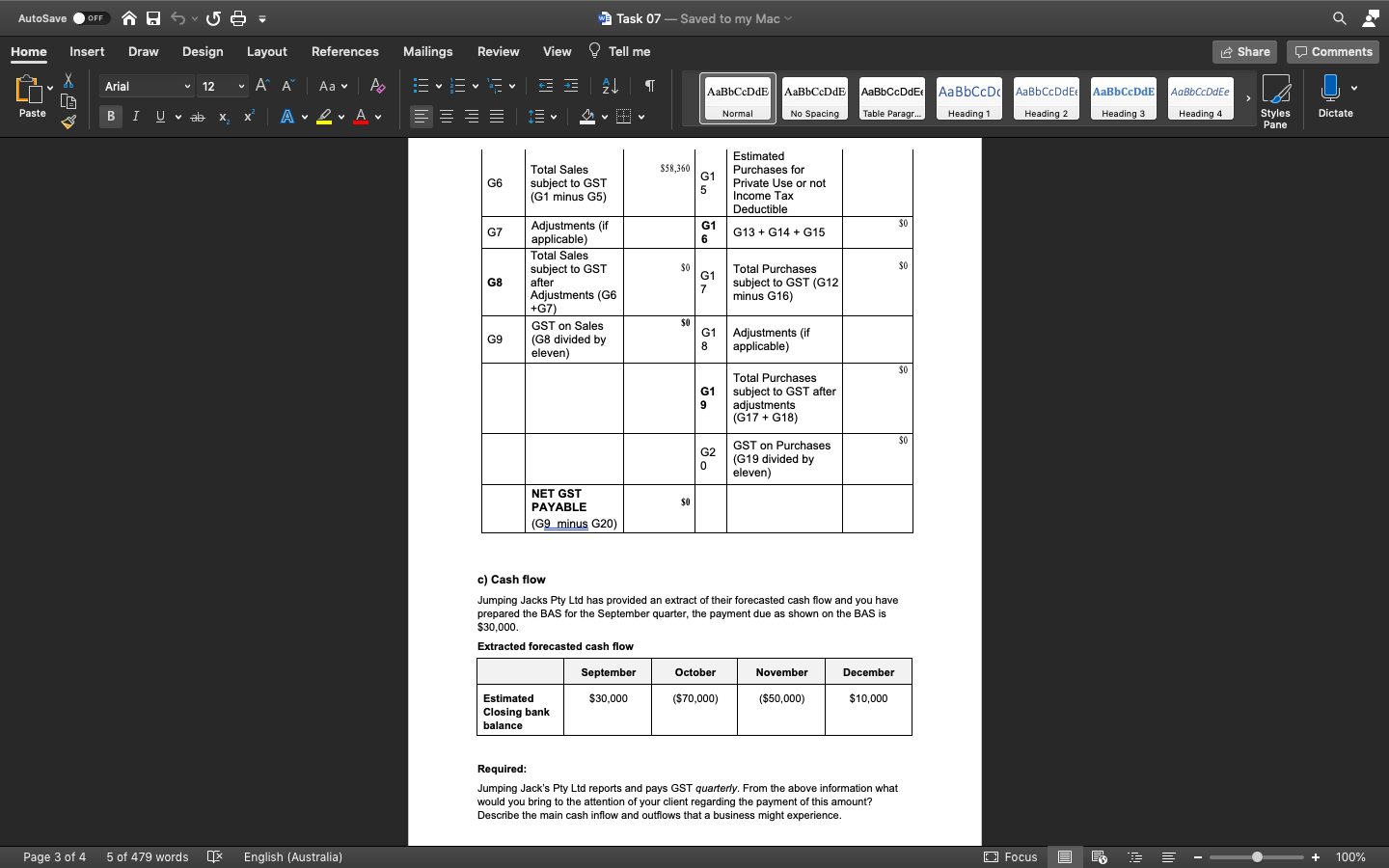

BAS using a classification worksheet

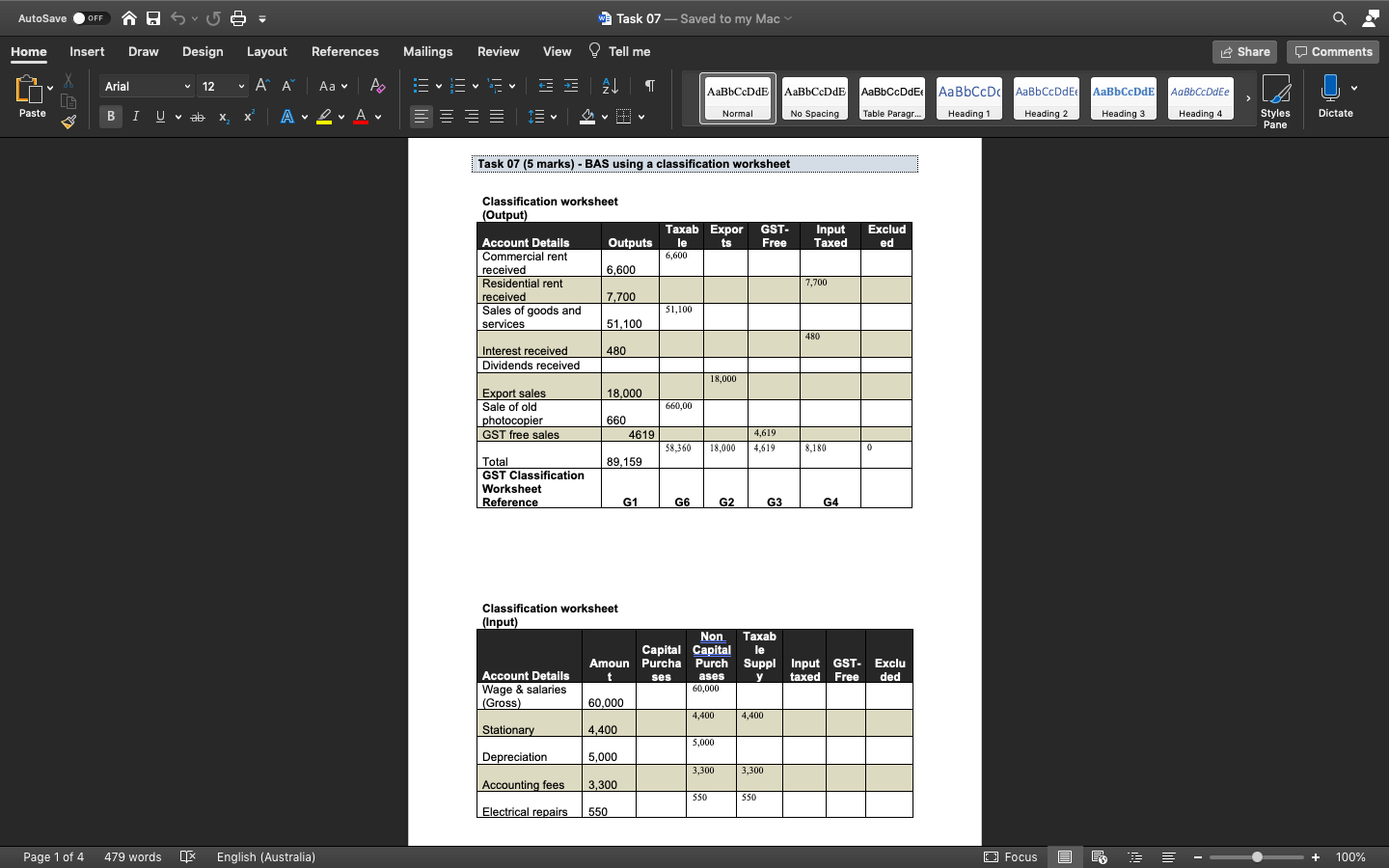

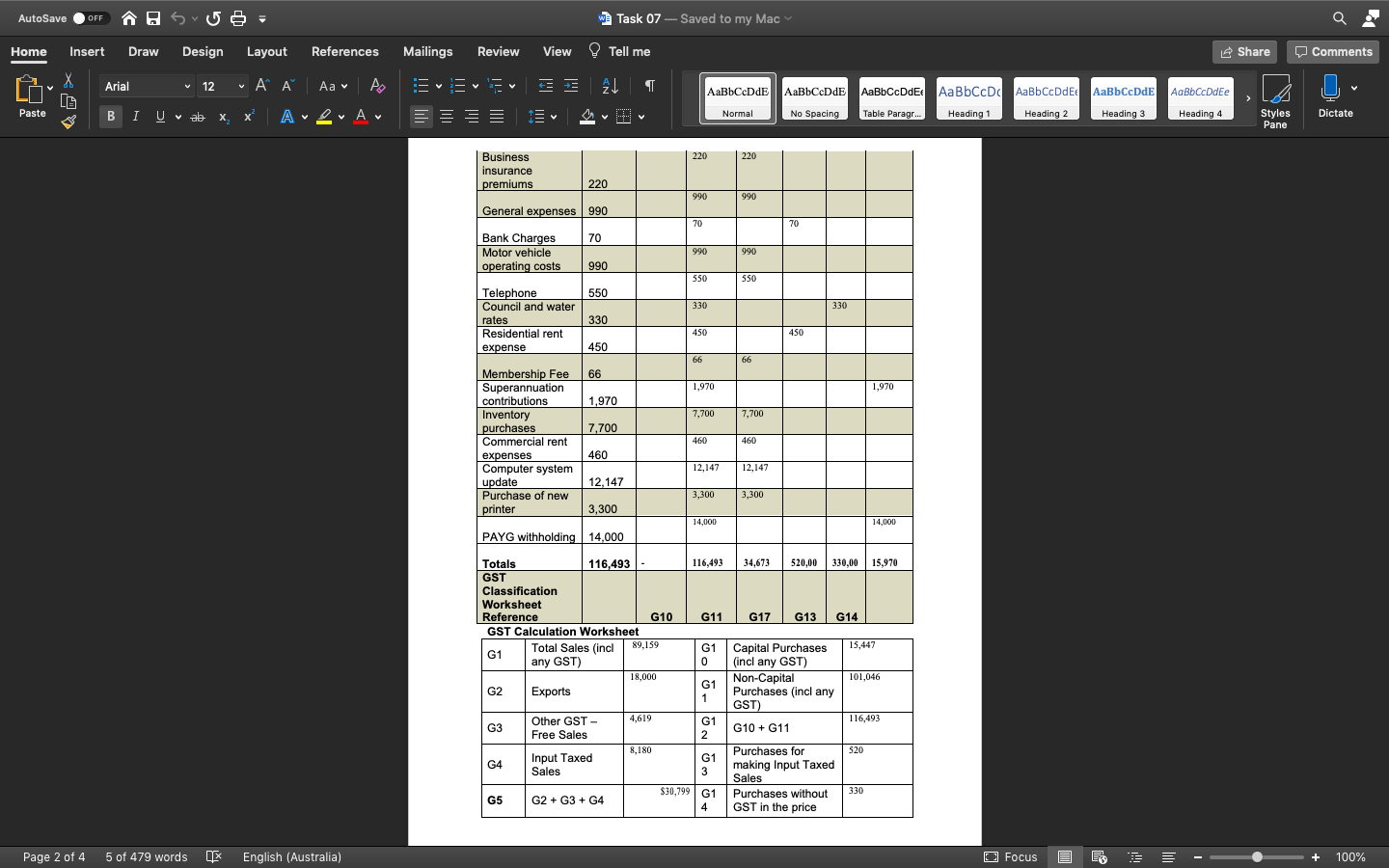

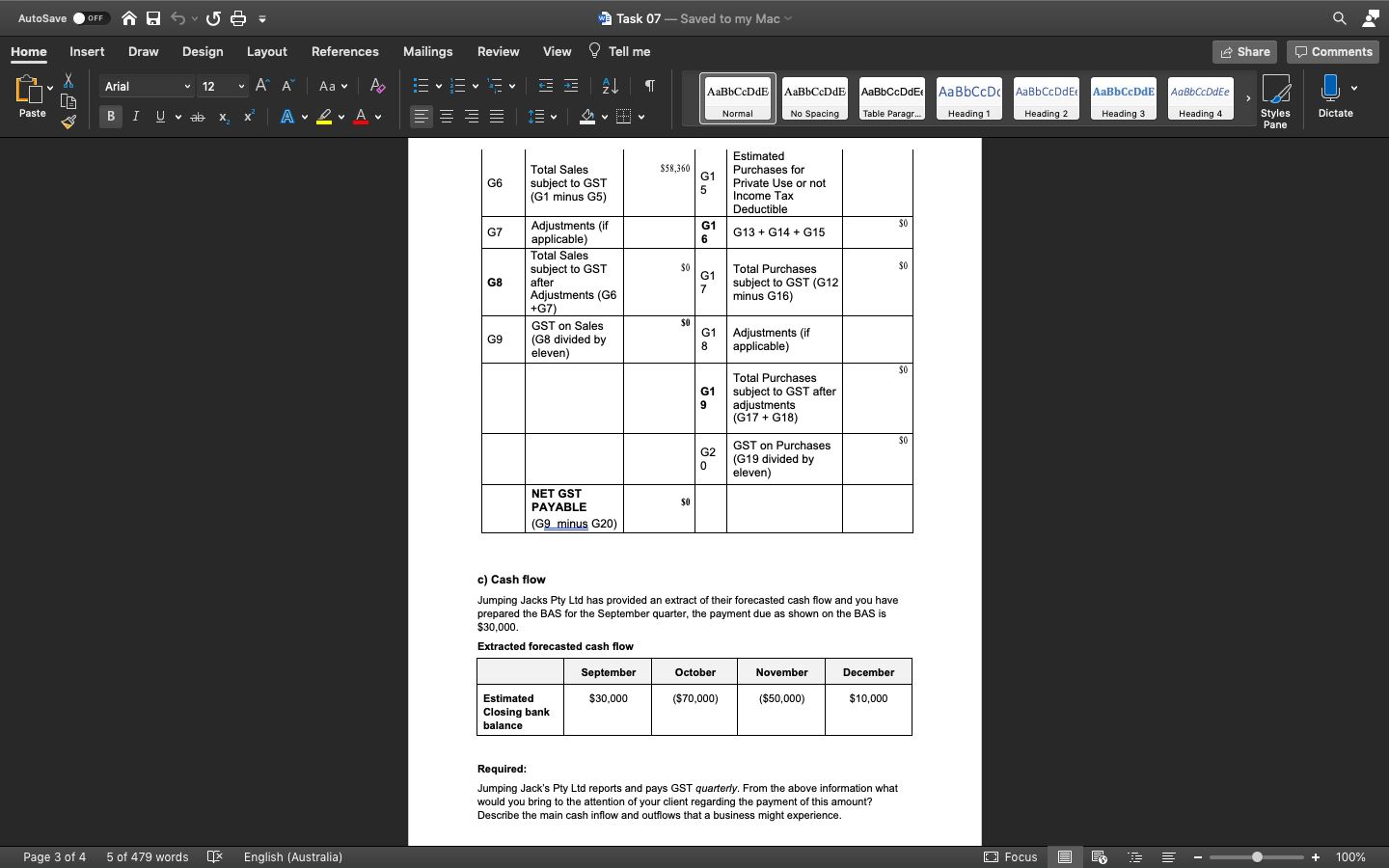

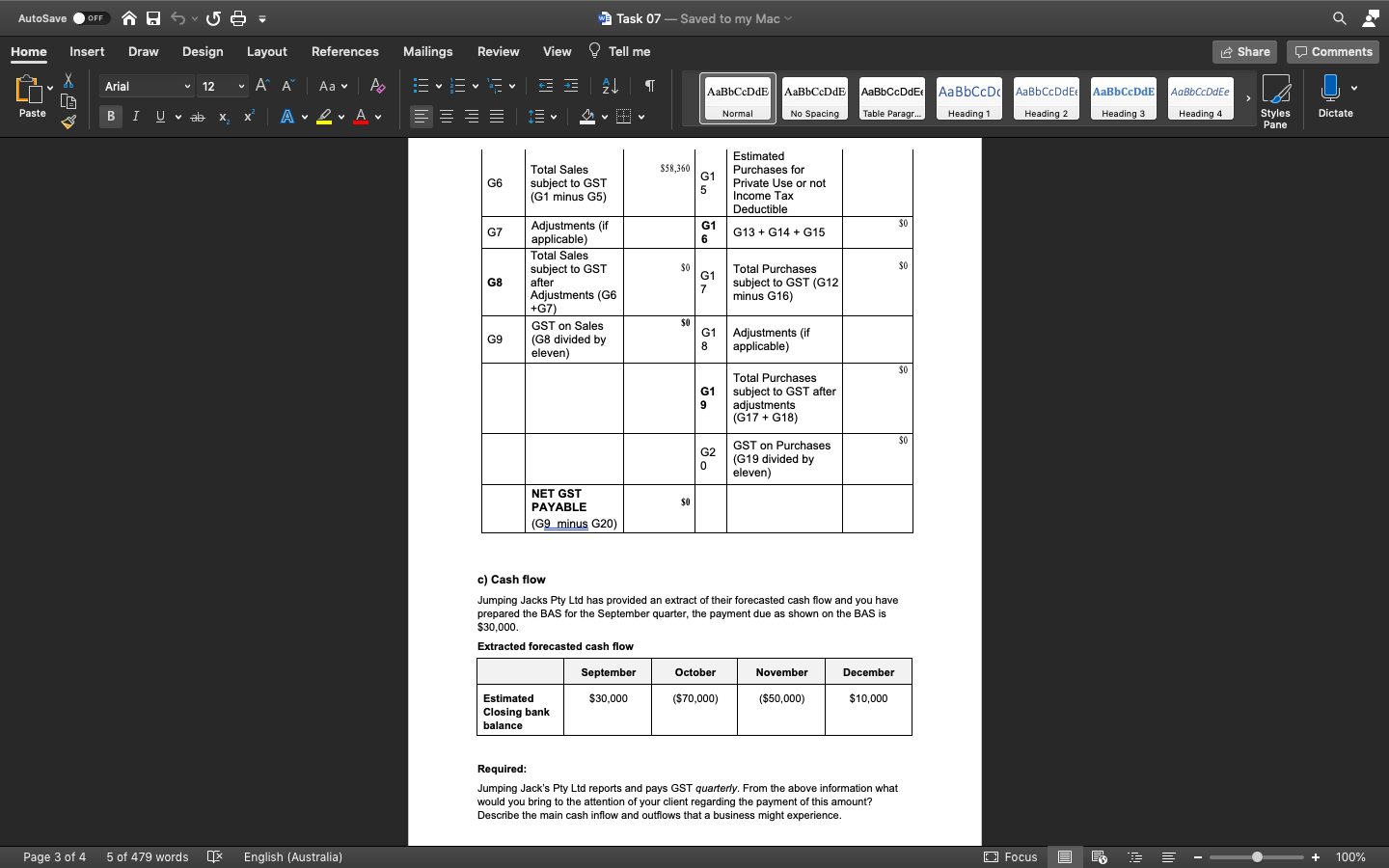

AutoSave . OFF w Task 07 - Saved to my Mac Q Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Arial Aa v Al AaBbCcDdE AaBbCcDdE AaBbCcDdE AaBbCCD AaBbCcDdE AaBbCcDdE AaBbCcDdEe Paste B I U A v . A v IEv Normal No Spacing Table Paragr... Heading 1 Heading 2 Heading 3 Heading Styles Dictate Pane Task 07 (5 marks) - BAS using a classification worksheet Classification worksheet Output Taxab | Expor GST Input Exclud Account Details Outputs le ts Free Taxed ed Commercial rent 6,600 received 6,600 Residential rent 7,700 received 7,700 Sales of goods and 51,100 services 51,100 480 Interest received 480 Dividends received 18,000 Export sales 18,000 Sale of old 660,00 photocopier 660 GST free sales 4619 4,619 58,360 18,000 4,619 8,180 Total 89,159 GST Classification Worksheet Reference G1 G6 G2 G3 G4 Classification worksheet (Input) Capital Non Taxab Capital le Amoun | Purcha Purch |Suppl Input GST- |Exclu Account Details ses ases taxed | Free ded Wage & salaries 60,000 (Gross) 60,000 4,400 4,400 Stationary 4,400 5,000 Depreciation 5,000 3,300 3,300 Accounting fees 3,300 55. 550 Electrical repairs 550 Page 1 of 4 479 words OF English (Australia) Focus + 100%AutoSave . OFF w Task 07 - Saved to my Mac Q Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Arial Aa v AaBbCcDdE AaBbCcDdE AaBbCcDdE AaBbCCD AaBbCcDdE AaBbCcDdE AaBbCcDdEe Paste B I U A v . A v Normal No Spacing Table Paragr... Heading 1 Heading 2 Heading 3 Heading Styles Dictate Pane Business 220 | 220 insurance premiums 220 990 990 General expenses | 990 70 70 Bank Charges 70 Motor vehicle 990 operating costs 990 550 Telephone 550 Council and water 330 330 rates 330 Residential rent 45 450 expense 450 66 66 Membership Fee 66 Superannuateon 1,970 1.970 contributions 1,970 Inventory 7,700 7,700 purchases 7,700 Commercial rent 46 461 expenses 460 Computer system 12,147 12,147 update 12,147 Purchase of new 3.300 3.300 printer 3,300 14,000 14,000 PAYG withholding | 14,000 Totals 116,493 116,493 14,673 520,00 330,00 15,970 GST Classification Worksheet Reference G10 G11 G17 G13 G14 GST Calculation Worksheet G1 Total Sales (incl 89,159 G1 Capital Purchases 5,447 any GST) 0 (incl any GST) 18,000 Non-Capital 101,046 G2 Exports G1 1 Purchases (incl any GST Other GST - 4,619 G1 16,493 C3 Free Sale G10+ G11 Input Taxed 8,180 Purchases for 520 G4 G Sales making Input Taxed Sales G5 G2 + G3 + G4 $30,799 G1 Purchases without 330 GST in the price Page 2 of 4 5 of 479 words OF English (Australia) Focus + 100%w Task 07 - Saved to my Mac Q AutoSave . OFF Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Arial Aa v AaBbCcDdE AaBbCcDdE AaBbCcDdE AaBbCCD AaBbCcDdE AaBbCcDdE AaBbCcDdEe Styles Paste A v Normal No Spacing Table Paragr... Heading 1 Heading 2 Heading 3 Heading Dictate B I U A v . Pane Estimated Total Sales $58,360 Purchases for GE subject to GST Private Use or not (G1 minus G5) Income Tax Deductible G7 Adjustments (if applicable) G13 + G14 + G15 Total Sales subject to GST Total Purchases $0 G after G1 subject to GST (G12 Adjustments (G6 minus G16) +G7 GST on Sales $0 Gg (G8 divided by G1 eleven) co Adjustments (if applicable) SO Total Purchases G subject to GST after adjustments (G17 + G18) GST on Purchases $0 G2 0 (G19 divided by eleven) NET GST PAYABLE (G9_minus G20) c) Cash flow Jumping Jacks Pty Ltd has provided an extract of their forecasted cash flow and you have prepared the BAS for the September quarter, the payment due as shown on the BAS is $30,000. Extracted forecasted cash flow September October November December Estimated $30,000 ($70,000) ($50,000) $10,000 Closing bank balance Required: Jumping Jack's Pty Ltd reports and pays GST quarterly. From the above information what would you bring to the attention of your client regarding the payment of this amount? Describe the main cash inflow and outflows that a business might experience. Page 3 of 4 5 of 479 words Ex English (Australia) Focus + 100%