Answered step by step

Verified Expert Solution

Question

1 Approved Answer

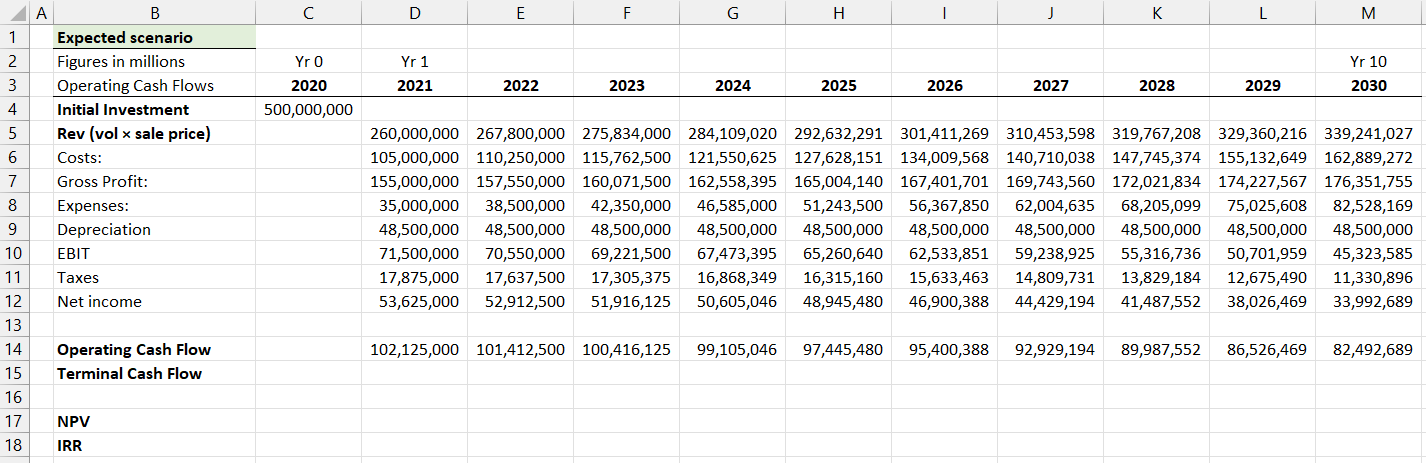

Based off the information above calculate the NPV and IRR for the company. D E F G H J K L L M 1 Yr

Based off the information above calculate the NPV and IRR for the company.

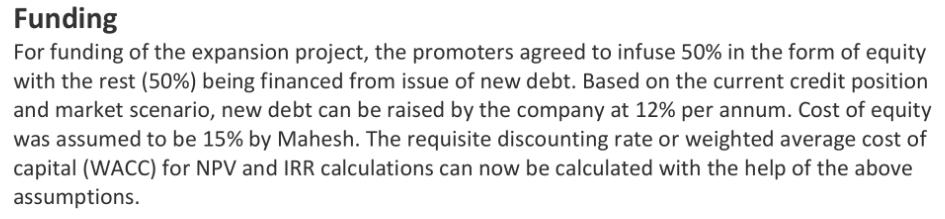

D E F G H J K L L M 1 Yr 0 Yr 1 Yr 10 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2 3 4 5 6 500,000,000 A B Expected scenario Figures in millions Operating Cash Flows Initial Investment Rev (vol x sale price) Costs: Gross Profit: Expenses: Depreciation EBIT Taxes Net income 7 260,000,000 267,800,000 275,834,000 284,109,020 292,632,291 301,411,269 310,453,598 319,767,208 329,360,216 339,241,027 105,000,000 110,250,000 115,762,500 121,550,625 127,628,151 134,009,568 140,710,038 147,745,374 155,132,649 162,889,272 155,000,000 157,550,000 160,071,500 162,558,395 165,004,140 167,401,701 169,743,560 172,021,834 174,227,567 176,351,755 35,000,000 38,500,000 42,350,000 46,585,000 51,243,500 56,367,850 62,004,635 68,205,099 75,025,608 82,528,169 48,500,000 48,500,000 48,500,000 48,500,000 48,500,000 48,500,000 48,500,000 48,500,000 48,500,000 48,500,000 71,500,000 70,550,000 69,221,500 67,473,395 65,260,640 62,533,851 59,238,925 55,316,736 50,701,959 45,323,585 17,875,000 17,637,500 17,305,375 16,868,349 16,315,160 15,633,463 14,809,731 13,829,184 12,675,490 11,330,896 53,625,000 52,912,500 51,916,125 50,605,046 48,945,480 46,900,388 44,429,194 41,487,552 38,026,469 33,992,689 8 9 9 10 11 12 13 14 15 16 17 18 102,125,000 101,412,500 100,416,125 99,105,046 97,445,480 95,400,388 92,929,194 89,987,552 86,526,469 82,492,689 Operating Cash Flow Terminal Cash Flow NPV IRR Funding For funding of the expansion project, the promoters agreed to infuse 50% in the form of equity with the rest (50%) being financed from issue of new debt. Based on the current credit position and market scenario, new debt can be raised by the company at 12% per annum. Cost of equity was assumed to be 15% by Mahesh. The requisite discounting rate or weighted average cost of capital (WACC) for NPV and IRR calculations can now be calculated with the help of the above assumptionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started