based off the information provided, please record the january transactions and adjustments. need ASAP please

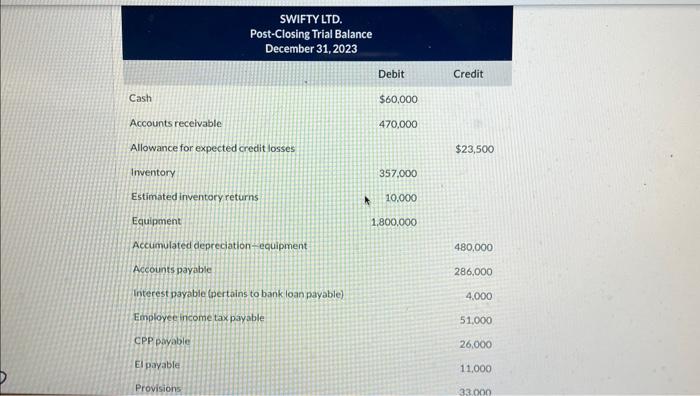

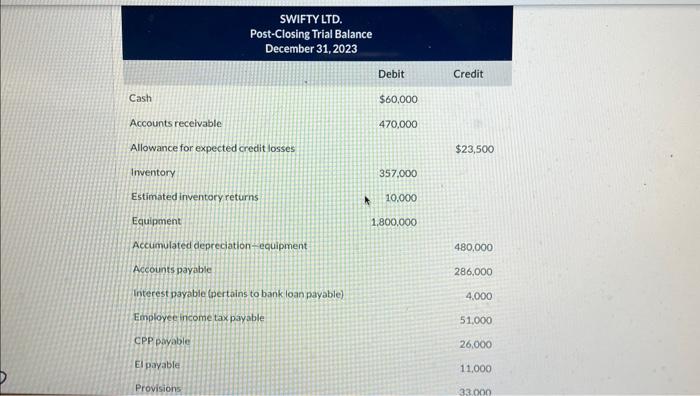

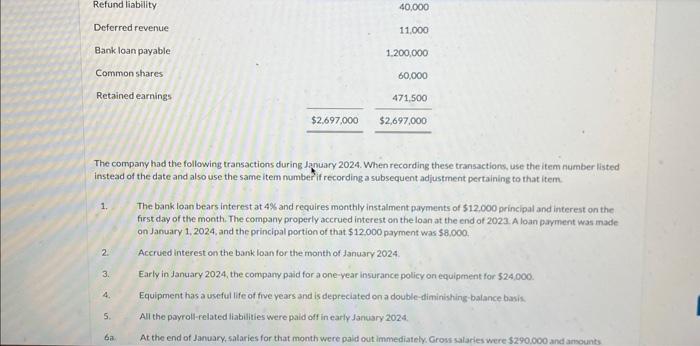

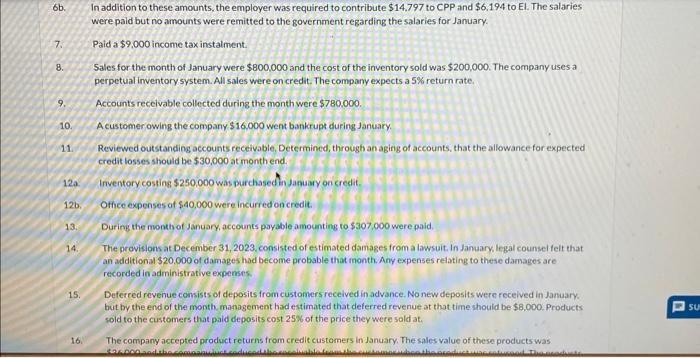

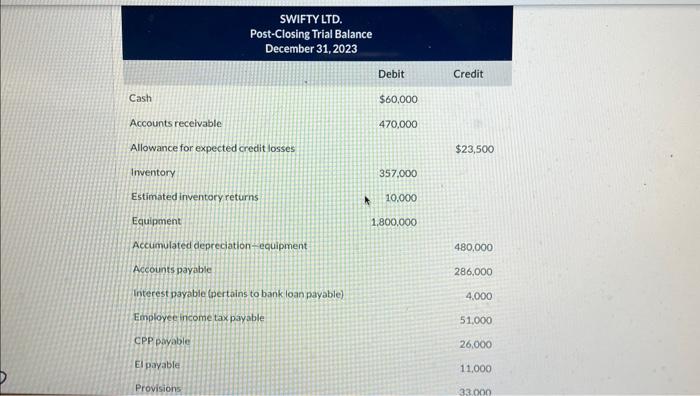

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{c} SWIFTY LTD. \\ Post-Closing Trial Balance \\ December 31,2023 \end{tabular}} \\ \hline & Debit & Credit \\ \hline Cash & $60,000 & \\ \hline Accounts receivable & 470,000 & \\ \hline Allowance for expected credit losses & & $23,500 \\ \hline Inventory & 357,000 & \\ \hline Estimated inventory returns & 10,000 & \\ \hline Equipment & 1,800,000 & \\ \hline Accumulated depreciation-equipment & & 480,000 \\ \hline Accounts payable: & & 286,000 \\ \hline Interest payabic (pertains to bank loan payable) & & 4.000 \\ \hline Employec income taxpayable & & 51,000 \\ \hline CPP pryable & & 26,000 \\ \hline Elpayable & & 11,000 \\ \hline Provisions & & 33000 \\ \hline \end{tabular} The company had the following transactions during January 2024. When recording these transactions, use the item number listed instead of the date and also use the same item number? if recording a subsequent adjustment pertaining to that item. 1. The bank loan bears interest at 4% and requires monthly instalment payments of $12,000 princlipal and interest on the first day of the month. The company properly accrued interest on the loan at the end of 2023 . A loan payment was made on January 1,2024, and the principat portion of that $12,000 payment was $8,000. 2. Accrued interest on the bank loan for the month of January 2024 3. Early in January 2024, the company paid for a one-vear insurance policy on equipment for $24,000. 4. Equipment has a useful life of five years and is depreciated on a double-diminishing-balance basis. 5. All the payroll-related liabilities were paid off in early Janciary 2024 6a. At the end of January, salaries for that month were pald out immediately, Gross salaries were $290.000 and ansounts 6b. In addition to these amounts, the employer was required to contribute $14,797 to CPP and $6,194 to El. The salaries were paid but no amounts were remitted to the government regarding the salaries for January. 7. Paid a $9,000 income tax instalment. 8. Sales for the month of January were $800,000 and the cost of the inventory sold was $200,000. The company uses a perpetual inventory system. All sales were on credit. The company expects a 5% return rate. 9. Accounts receivable collected during the month were $780.000. 10. Acustomer owing the company $16,000 went bankrupt during January. 11. Reviewed outstanding accounts receivable, Determined, through an aging of accounts, that the allowance for expected credit losses should be $30,000 at month end. 12a. Inventory costins $250,000 was purchased hin January on credit. 12b. Ofhec expenses of $40,000 were incurred on credit. 13. Dufing the month of January, accounts payble amounting to $307,000 were paid. 14. The provisions at December 31,2023, consisted of estimated damages from a lawsuit. In January, legal counsel felt that an additional $20,000 of damages had become probable that month. Any expenses relating to these damages are recorded in administrative expenses: 15. Defered revenue consists of deposits from customers received in advance. No new deposits were received in January. but by the end of the month. management had estimated that deferred revenue at that time should be $8,000. Products sold to the customers that paid deposits cost 25% of the price they were sold at, 16. The company accepted product returns from credit customers in January. The sales value of these products was 16. The company accepted product returns from credit customers in January. The sales value of these products was $36,000 and the company just reduced the receivable from the customer when the product was returned. The products returned were not damaged and cost 25% of the price they were sold at. 17. The company declared and paid dividends amounting to $8,000 in January. (b) Record the January transactions and adjustments. (Credit occount titles are automatically indented when the omount is entered. Do not indent manually. If no entry is roquired, select "No Entry" for the occount titles and enter O for the amounts. Record joumal entries in the onder presented in the problem, tist off debit entrles before credit entries. Round answers to 0 decimal places, eg 1275.) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{c} SWIFTY LTD. \\ Post-Closing Trial Balance \\ December 31,2023 \end{tabular}} \\ \hline & Debit & Credit \\ \hline Cash & $60,000 & \\ \hline Accounts receivable & 470,000 & \\ \hline Allowance for expected credit losses & & $23,500 \\ \hline Inventory & 357,000 & \\ \hline Estimated inventory returns & 10,000 & \\ \hline Equipment & 1,800,000 & \\ \hline Accumulated depreciation-equipment & & 480,000 \\ \hline Accounts payable: & & 286,000 \\ \hline Interest payabic (pertains to bank loan payable) & & 4.000 \\ \hline Employec income taxpayable & & 51,000 \\ \hline CPP pryable & & 26,000 \\ \hline Elpayable & & 11,000 \\ \hline Provisions & & 33000 \\ \hline \end{tabular} The company had the following transactions during January 2024. When recording these transactions, use the item number listed instead of the date and also use the same item number? if recording a subsequent adjustment pertaining to that item. 1. The bank loan bears interest at 4% and requires monthly instalment payments of $12,000 princlipal and interest on the first day of the month. The company properly accrued interest on the loan at the end of 2023 . A loan payment was made on January 1,2024, and the principat portion of that $12,000 payment was $8,000. 2. Accrued interest on the bank loan for the month of January 2024 3. Early in January 2024, the company paid for a one-vear insurance policy on equipment for $24,000. 4. Equipment has a useful life of five years and is depreciated on a double-diminishing-balance basis. 5. All the payroll-related liabilities were paid off in early Janciary 2024 6a. At the end of January, salaries for that month were pald out immediately, Gross salaries were $290.000 and ansounts 6b. In addition to these amounts, the employer was required to contribute $14,797 to CPP and $6,194 to El. The salaries were paid but no amounts were remitted to the government regarding the salaries for January. 7. Paid a $9,000 income tax instalment. 8. Sales for the month of January were $800,000 and the cost of the inventory sold was $200,000. The company uses a perpetual inventory system. All sales were on credit. The company expects a 5% return rate. 9. Accounts receivable collected during the month were $780.000. 10. Acustomer owing the company $16,000 went bankrupt during January. 11. Reviewed outstanding accounts receivable, Determined, through an aging of accounts, that the allowance for expected credit losses should be $30,000 at month end. 12a. Inventory costins $250,000 was purchased hin January on credit. 12b. Ofhec expenses of $40,000 were incurred on credit. 13. Dufing the month of January, accounts payble amounting to $307,000 were paid. 14. The provisions at December 31,2023, consisted of estimated damages from a lawsuit. In January, legal counsel felt that an additional $20,000 of damages had become probable that month. Any expenses relating to these damages are recorded in administrative expenses: 15. Defered revenue consists of deposits from customers received in advance. No new deposits were received in January. but by the end of the month. management had estimated that deferred revenue at that time should be $8,000. Products sold to the customers that paid deposits cost 25% of the price they were sold at, 16. The company accepted product returns from credit customers in January. The sales value of these products was 16. The company accepted product returns from credit customers in January. The sales value of these products was $36,000 and the company just reduced the receivable from the customer when the product was returned. The products returned were not damaged and cost 25% of the price they were sold at. 17. The company declared and paid dividends amounting to $8,000 in January. (b) Record the January transactions and adjustments. (Credit occount titles are automatically indented when the omount is entered. Do not indent manually. If no entry is roquired, select "No Entry" for the occount titles and enter O for the amounts. Record joumal entries in the onder presented in the problem, tist off debit entrles before credit entries. Round answers to 0 decimal places, eg 1275.)