Based on Amazon's consolidated cash flow, consolidated statement of income and consolidated balance sheet for their 10-Q 2020 filing can you determine the company's following:

1. Liquidity of Short-Term Assets

Current Ratio

Cash Ratio

Quick Ratio

2. Long-Term Debt-paying Ability

Debt Ratio

Debt-equity Ratio

Times Interest Earned

3. Profitability

Net Income / Sales (Profit Margin)

Net Income / Assets (ROA)

Net Income / Shareholder Equity (ROE)

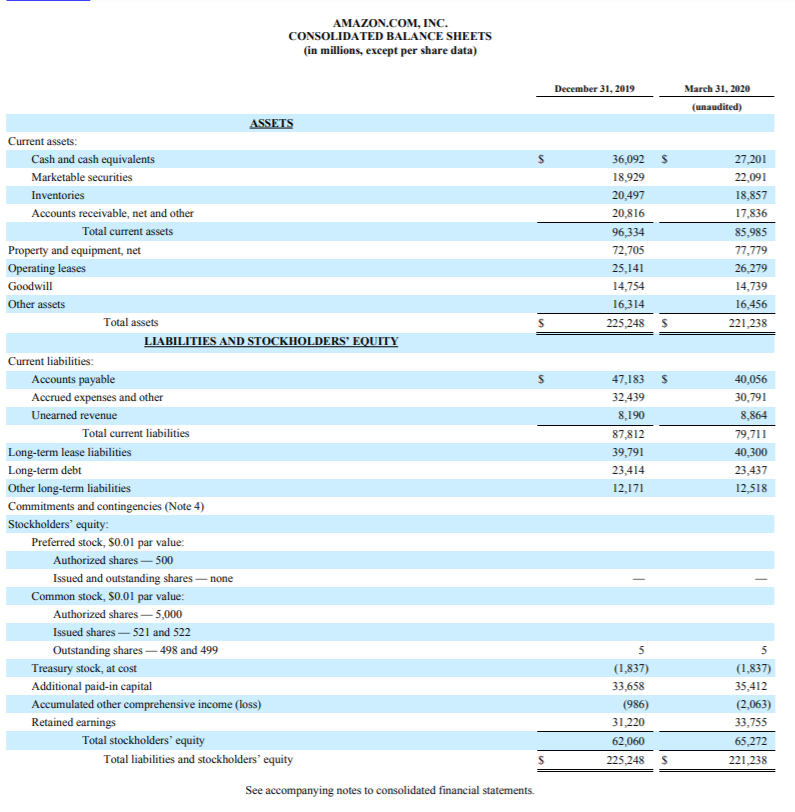

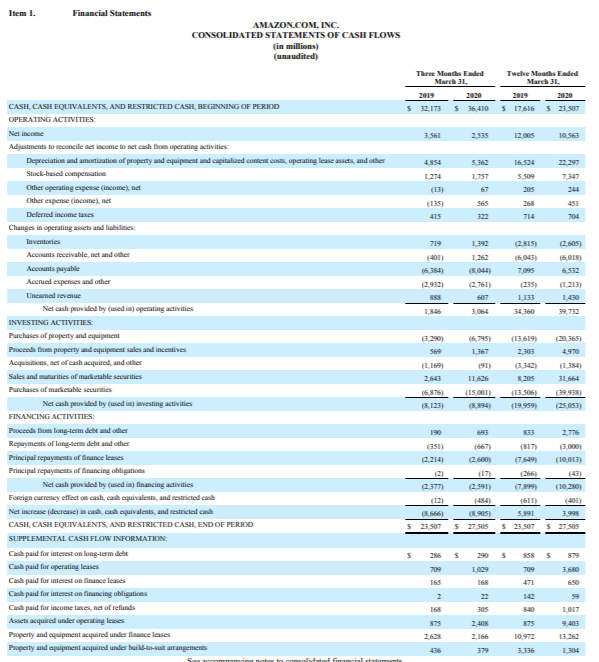

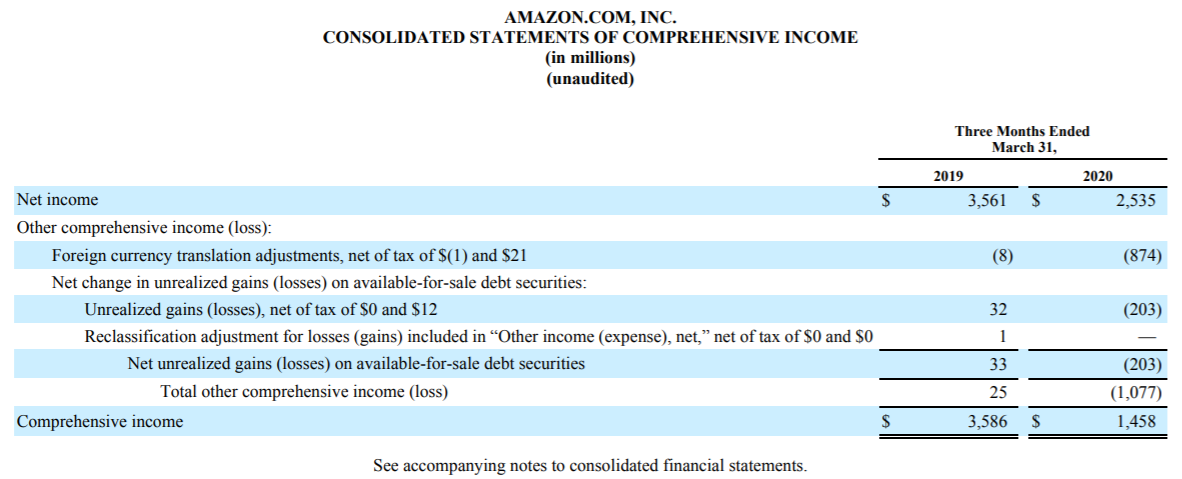

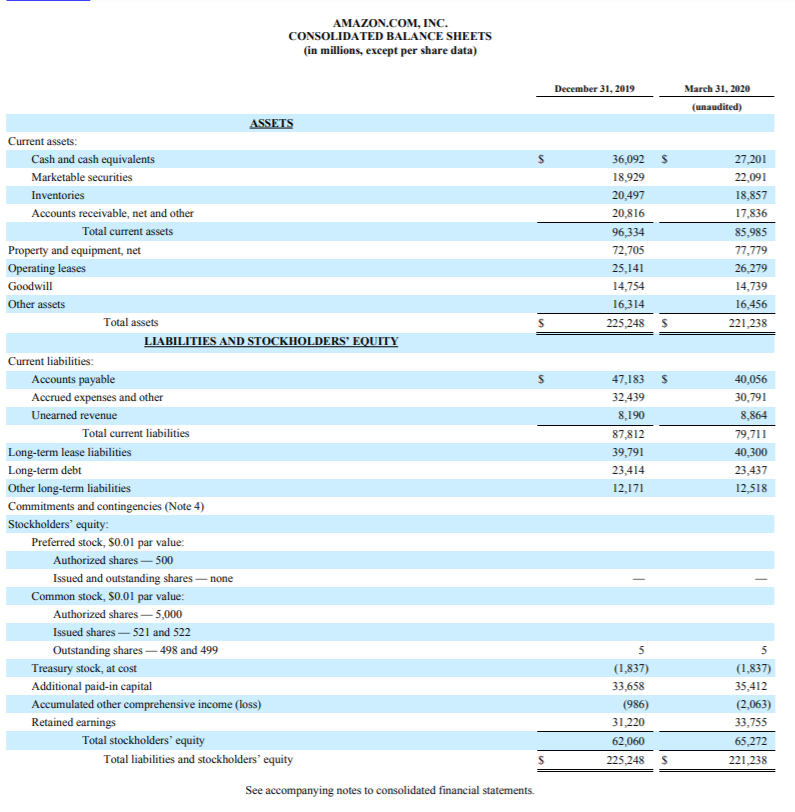

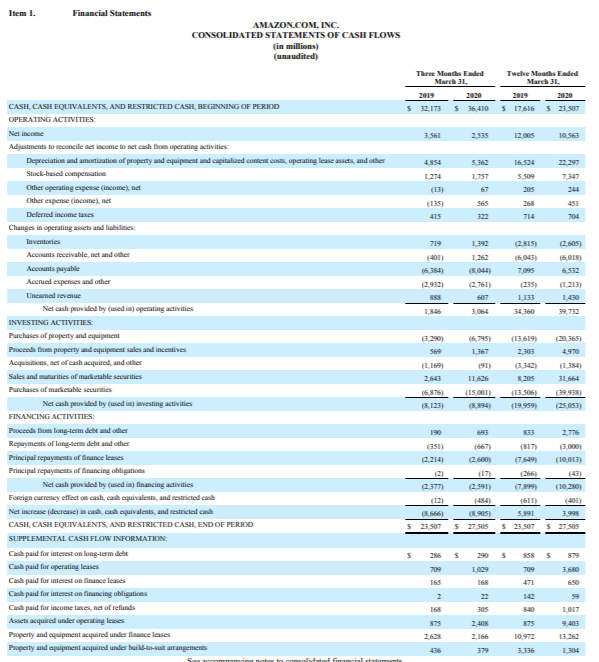

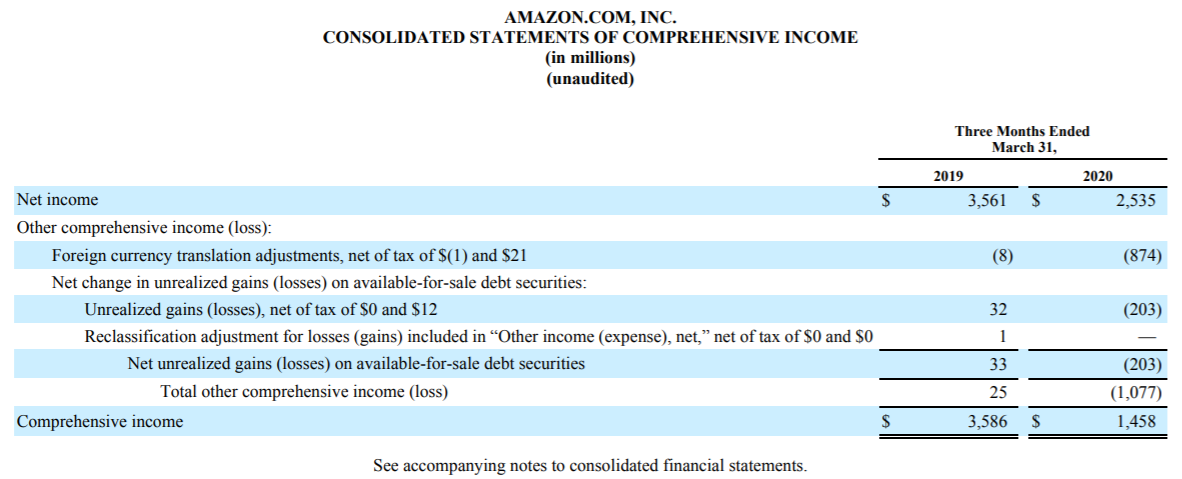

AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) December 31, 2019 March 31, 2020 (unaudited) S s 27,201 22,091 18,857 17,836 36,092 18,929 20,497 20,816 96,334 72,705 25,141 14,754 16,314 225.248 85,985 77,779 26,279 14,739 16,456 221,238 s $ s s ASSETS Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 4) Stockholders' equity Preferred stock, $0.01 par value: Authorized shares - 500 Issued and outstanding shares - none Common stock, $0.01 par value: Authorized shares - 5,000 Issued shares - 521 and 522 Outstanding shares 498 and 499 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 47,183 32,439 8,190 87,812 39,791 23,414 12,171 40,056 30,791 8,864 79,711 40,300 23,437 12,518 5 (1,837) 33,658 (986) 31.220 62,060 225.248 5 (1,837) 35,412 (2,063) 33,755 65,272 221,238 S $ See accompanying notes to consolidated financial statements. Item L. Financial Statements AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited) Three Montes de March 31 2019 $ 52,173 $36.410 Twehe Meaths Ended March 31, 2019 2020 $ 17,616 $ 23,507 3.561 2.535 12.00 10:56 4854 22297 5.362 1,757 1.274 (13) 16534 5.509 205 265 714 7347 244 565 451 704 415 719 1.392 405 15 (6,043) (401) 16354) (2932) 705 6.532 (8.04) 2.761) 607 (1.213) (235) 1,133 34360 18:46 3.290) 16,795) (13.619) 2,303 4970 CASH CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash from operating activities Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other Stock-based compensation Other operating expense (income), net Other expense (income, net Deferred income taxes Changes in operating assets and liabilities Inventories Accounts receivable net and other Accounts payable Acenual expenses and other Uneamed revenue Net cash provided by used in operating activities INVESTING ACTIVITIES Purchases of property and equipment Proceeds from property and equipment sales and incentives Acquisitions, net of cash acquired and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by used in) investing activities FINANCING ACTIVITIES: Proceeds from long-term de and other Repayments of long-term debt and other Principal repayments of finance less Principal repayments of financing obligations Net cash provided by used in) financing activities Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease in cas, cash equivalents, and restricted cash CASH CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION Cash paid for interest on long-term debe Cash paid for operating leases Caspaid for interest on finance lowes Cash paid for interest on financing obligations Cash paid for income taxes, net of refunds Assets acquired under operating leases Property and equipment acquired under finance leases Property and equipment acquired under built-to-suit arrangements (1.354) 31,664 (1.169) 2.643 16.78 8,123) 11,626 (15 001) 20 (13.506) (19.959) 190 333 2.776 (351) (517) 3 000) (667) (2.600 (10,013) (17) (2.591) 2.377) (7.1999 (102) (401) (905) 3.99 5891 S 23.507 5 23 507 S 27 SOS $ 27.5OS 5 290 5 358 S 879 709 1 029 709 3.680 165 168 22 305 99 168 540 1,017 875 2.400 875 2.623 2.166 10972 13.262 436 379 1304 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) (unaudited) Three Months Ended March 31, 2019 2020 2,535 $ 3,561 $ (8) (874) Net income Other comprehensive income (loss): Foreign currency translation adjustments, net of tax of $(1) and $21 Net change in unrealized gains (losses) on available-for-sale debt securities: Unrealized gains (losses), net of tax of $0 and $12 Reclassification adjustment for losses (gains) included in "Other income (expense), net, net of tax of $0 and $0 Net unrealized gains (losses) on available-for-sale debt securities Total other comprehensive income (loss) Comprehensive income 32 (203) 1 33 25 (203) (1,077) 1,458 3,586 S See accompanying notes to consolidated financial statements