Answered step by step

Verified Expert Solution

Question

1 Approved Answer

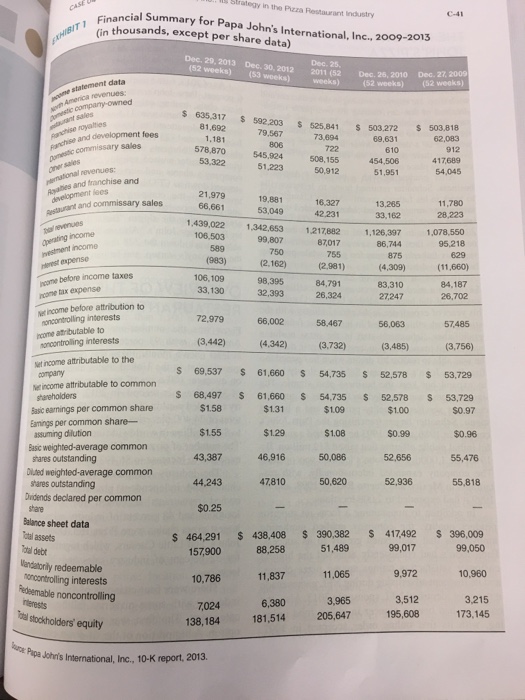

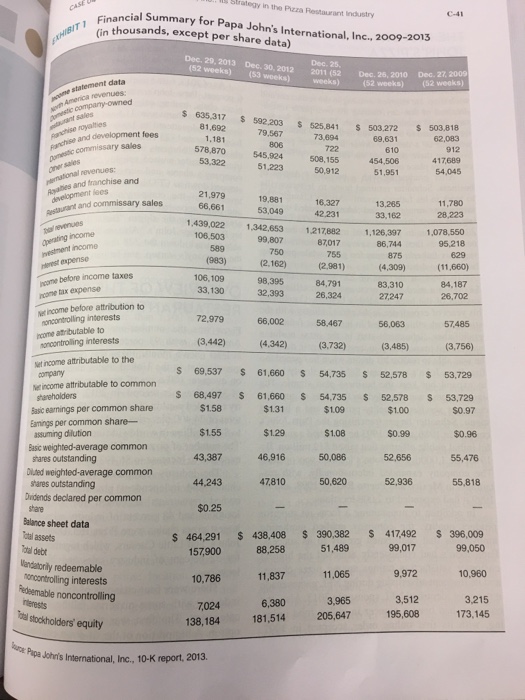

Based on careful examination, how would you assess Papa Johns financial and operating performance- improving, declining, or staying the same. s strategy in the Pizza

Based on careful examination, how would you assess Papa Johns financial and operating performance- improving, declining, or staying the same.

s strategy in the Pizza Restaurant Industry Einancial Summary for Papa John's International, Inc., 2009-2013 ousands, except per share data) Dec. 29, 2013 Dec.30,2012 Dec. 25. 2011 (52Dec. 26, 2010 (52 weeks) (53 woeks) weeks)(52 weeka Dec. 27, 2009 s 635,317 592 203 s 525.841 503.272 s 69,631 610 454,506 51,951 S 503,818 62,083 81,692 79,567 806 545,924 578,870 508,155 417,689 51.223 50,912 al revernues: 21,979 66,661 19,881 53,049 3,285 33,162 11,780 28,223 42.231 1,439,022 1,342,653 1,217882 1,126,397 1,078,550 106,503 95,218 99,807 750 (2.162) 87,017 755 (2,981) 84,791 26,324 86,744 (983) 106,109 33,130 875 (4,309) 83,310 27,247 (11,660) 98,395 32,393 84,187 28,702 t0 72,979 66,002 56,063 57,485 (3,442) (4.342) (3,732) (3,485) (3,756) 69,537 61,660 54,735 52,578 $ 53,729 s 68,497 S 61,660 54.735 52,578 S 53,729 attributable to common encore $1.31 $1.29 46,916 47,810 $0.97 $0.96 55,476 55,818 $1.09 $1.58 $1.55 43,387 common share earnings per Eamings per common share- $0.99 52,656 52,936 assuming dilution Basic weighted-average common shares outstanding Dluted weighted-average common 50,620 shares Dridends declared per common $0.25 Balance sheet data otal assets otal debt 390,382 S 417492 S 396,009 s 464,291 $ 438,408 88,258 99,050 10,960 3,215 51,489 157900 lendatorily redeemable 9,972 10,786 3,512 195,608 Redemable noncontrolling 3,965 205,647 173,145 stockholders' equity 138,184 Ppe Johris International, Inc., 10-K report, 2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started