Based on Google's consolidated cash flow, consolidated statement of income and consolidated balance sheet for their 10-Q 2020 filing can you determine the company's following:

1. Liquidity of Short-Term Assets

Current Ratio

Cash Ratio

Quick Ratio

2. Long-Term Debt-paying Ability

Debt Ratio

Debt-equity Ratio

Times Interest Earned

3. Profitability

Net Income / Sales (Profit Margin)

Net Income / Assets (ROA)

Net Income / Shareholder Equity (ROE)

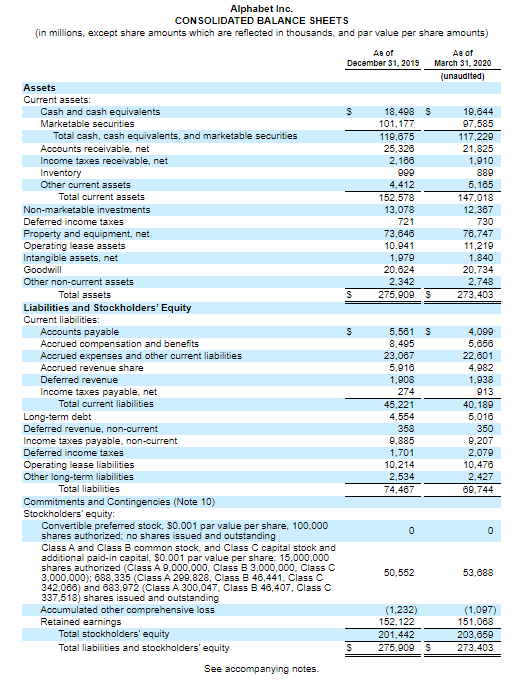

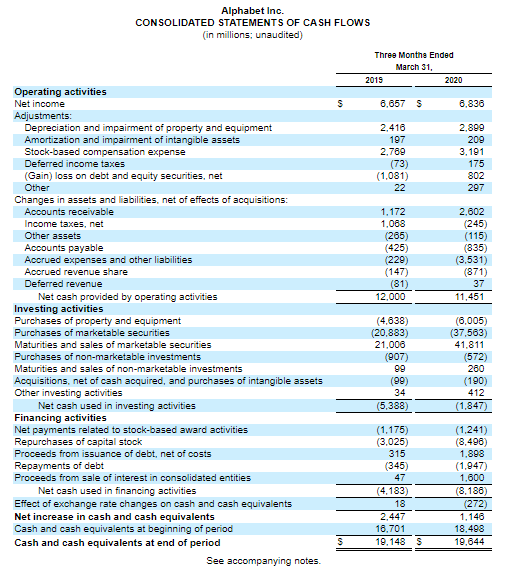

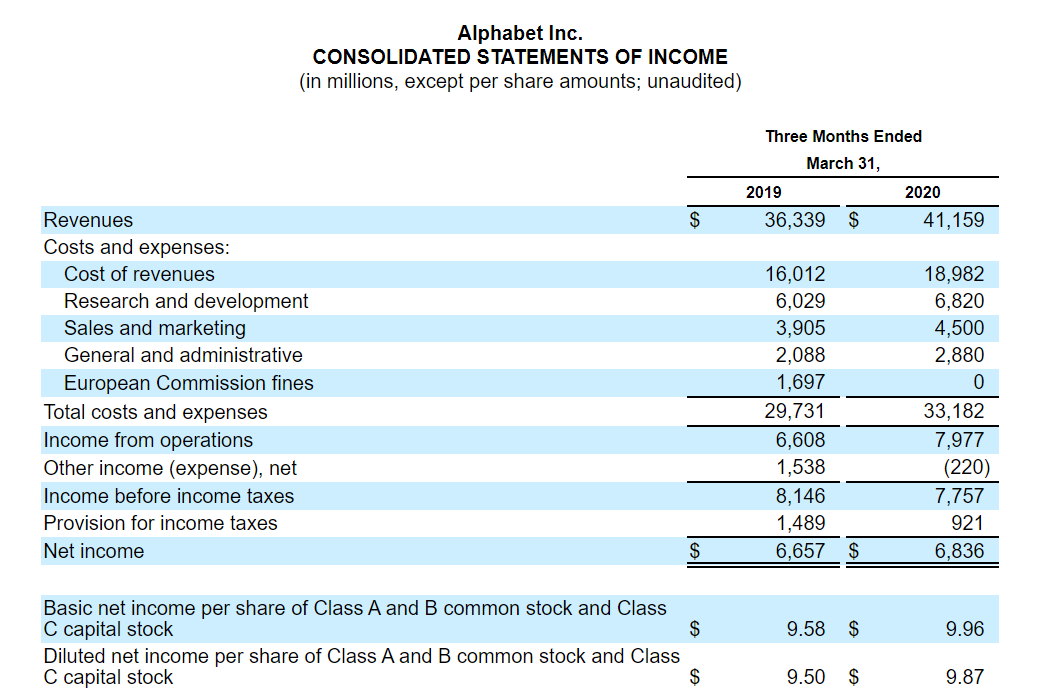

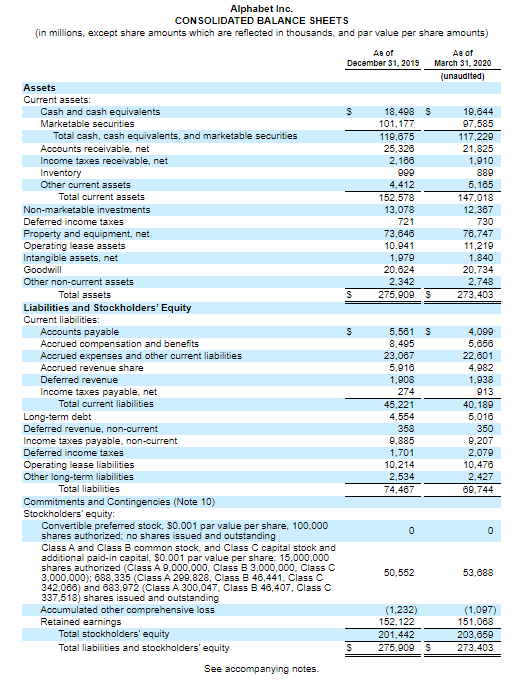

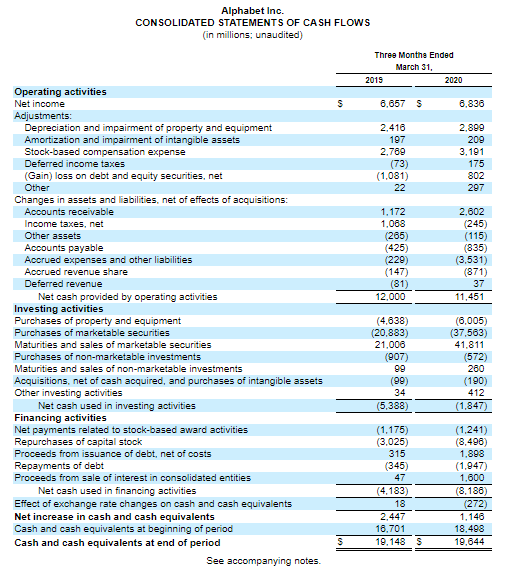

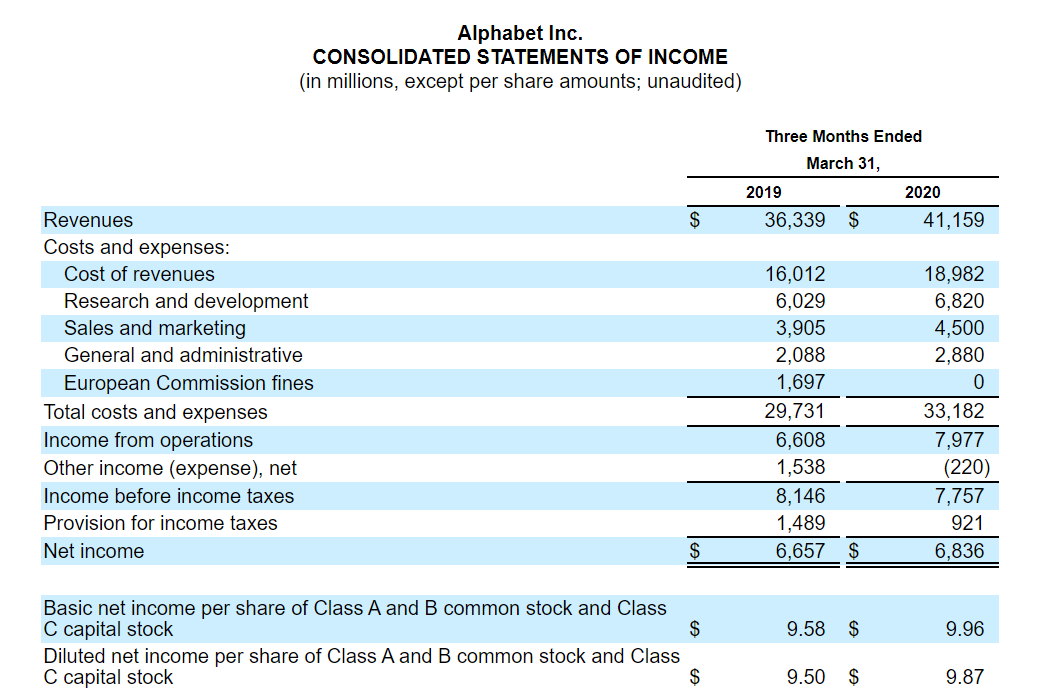

Alphabet Inc. CONSOLIDATED BALANCE SHEETS (in millions, except share amounts which are reflected in thousands, and par value per share amounts) As of As of December 31, 2019 March 31, 2020 (unaudited) Assets Current assets: Cash and cash equivalents S 18,498 $ 19.644 Marketable securities 101,177 97,585 Total cash, cash equivalents, and marketable securities 119.875 117,229 Accounts receivable, net 25.328 21,825 Income taxes receivable, net 2,166 1.910 Inventory 999 889 Other current assets 4,412 5,165 Total current assets 152,578 147,018 Non-marketable investments 13.078 12,387 Deferred income taxes 721 730 Property and equipment, net 73.646 78.747 Operating lease assets 10,941 11,219 Intangible assets, net 1.979 1.840 Goodwill 20.624 20.734 Other non-current assets 2.342 2,748 Total assets S 275,909 s 273,403 Liabilities and Stockholders' Equity Current liabilities: Accounts payable S 5,561 S 4,099 Accrued compensation and benefits 8,495 5.650 Accrued expenses and other current liabilities 23.067 22.601 Accrued revenue share 5,916 4,982 Deferred revenue 1,908 1,938 Income taxes payable.net 274 913 Total current liabilities 45,221 40.189 Long-term debt 4.554 5,016 Deferred revenue, non-current 358 350 Income taxes payable, non-current 9.885 9.207 Deferred income taxes 1.701 2,079 Operating lease liabilities 10.214 10.476 Other long-term liabilities 2.534 2,427 Total liabilities 74,487 69.744 Commitments and Contingencies (Note 10) Stockholders' equity: Convertible preferred stock, $0.001 par value per share, 100.000 0 0 shares authorized: no shares issued and outstanding Class A and Class B common stock and Class C capital stock and additional paid-in capital. $0.001 par value per share: 15,000,000 shares authorized (Class A 9.000.000, Class B 3,000,000. Class C 3,000,000); 688,335 (Class A 299.828, Class B 46,441. Class o 50.552 53.688 342.066) and 683.972 (Class A 300,047. Class B 46,407. Class o 337.518) shares issued and outstanding Accumulated other comprehensive loss (1,232) (1.007) Retained earnings 152,122 151,068 Total stockholders' equity 201,442 203.659 Total liabilities and stockholders' equity S 275.909 S 273,403 See accompanying notes. Alphabet Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions, unaudited) Three Monthe Ended March 31, 2020 2019 S 8,657 $ 8.836 2,416 197 2,789 (73) (1,081) 22 2,899 209 3,191 175 802 297 1.172 1,088 (265) (425) (229) (147) (81) 12.000 2,602 (245) (115) (835) (3.531) (871) 37 11,451 Operating activities Net income Adjustments: Depreciation and impairment of property and equipment Amortization and impairment of intangible assets Stock-based compensation expense Deferred income taxes (Gain) loss on debt and equity securities, net Other Changes in assets and liabilities, net of effects of acquisitions: Accounts receivable Income taxes, net Other assets Accounts payable Accrued expenses and other liabilities Accrued revenue share Deferred revenue Net cash provided by operating activities Investing activities Purchases of property and equipment Purchases of marketable securities Maturities and sales of marketable securities Purchases of non-marketable investments Maturities and sales of non-marketable investments Acquisitions, net of cash acquired, and purchases of intangible assets Other investing activities Net cash used in investing activities Financing activities Net payments related to stock-based award activities Repurchases of capital stock Proceeds from issuance of debt, net of costs Repayments of debt Proceeds from sale of interest in consolidated entities Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period See accompanying notes (4.638) (20.883) 21,006 (907) 99 (99) 34 (5,388) (6.005) (37.563) 41.811 (572) 200 (190) 412 (1.847) (1,175) (3,025) 315 (345) 47 (4,183) 18 2,447 18.701 19,148 (1,241) (8,496) 1.898 (1,947) 1.600 (8,186) (272) 1,146 18,498 19.644 S Alphabet Inc. CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share amounts; unaudited) Three Months Ended March 31, 2019 36,339 $ 2020 41,159 $ Revenues Costs and expenses: Cost of revenues Research and development Sales and marketing General and administrative European Commission fines Total costs and expenses Income from operations Other income (expense), net Income before income taxes Provision for income taxes Net income 16,012 6,029 3,905 2,088 1,697 29,731 6,608 1,538 8,146 1,489 6,657 18,982 6,820 4,500 2,880 0 33,182 7,977 (220) 7,757 921 6,836 $ $ $ 9.58 $ 9.96 Basic net income per share of Class A and B common stock and Class C capital stock Diluted net income per share of Class A and B common stock and Class C capital stock Es 9.50 $ 9.87