Question: Based on information from the textbook, outside research, and knowledge gained from the videos, explain how you would oversee the design or redesign of a

Based on information from the textbook, outside research, and knowledge gained from the videos, explain how you would oversee the design or redesign of a benefits program in a large organization. Explain what you believe are best practices and the issues you would consider in your redesign. Use 2-3 concepts from the book in your answer.

Textbook: Valentine, S; Meglich, P; Mathis, R; Jackson, J. (2019). Human Resource Management, 16th edition Cengage

ISBN - 978-0-357-03385-2 (softcover)

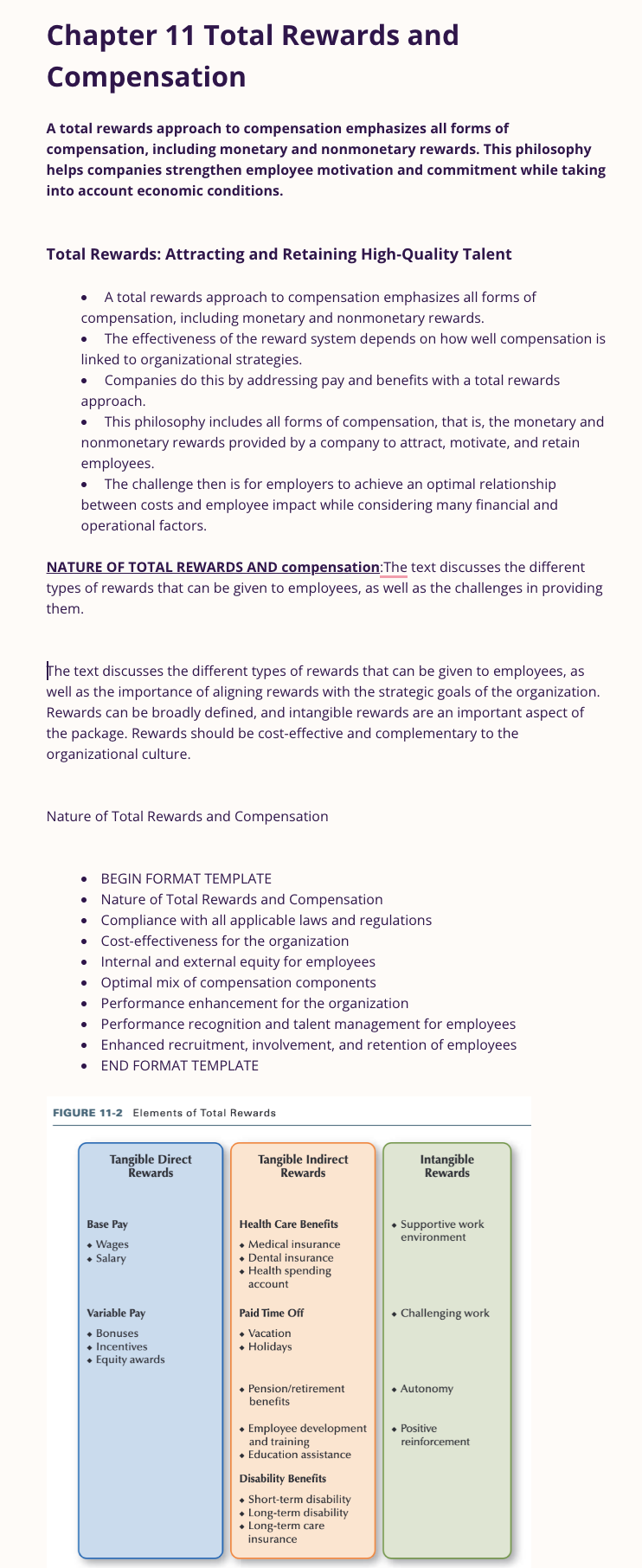

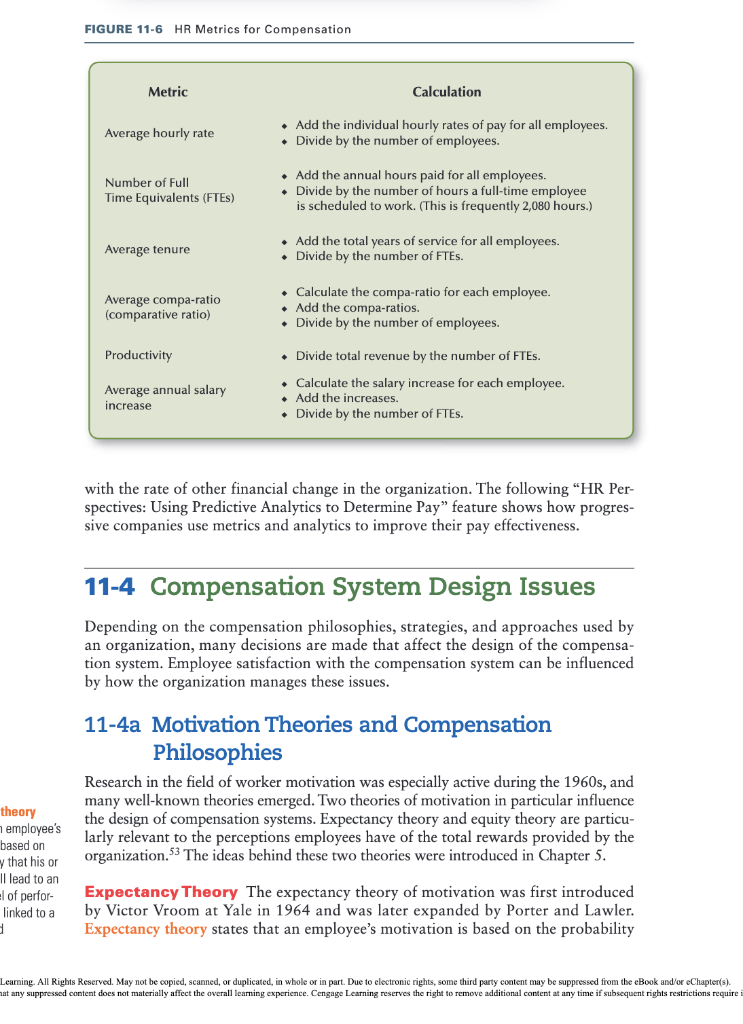

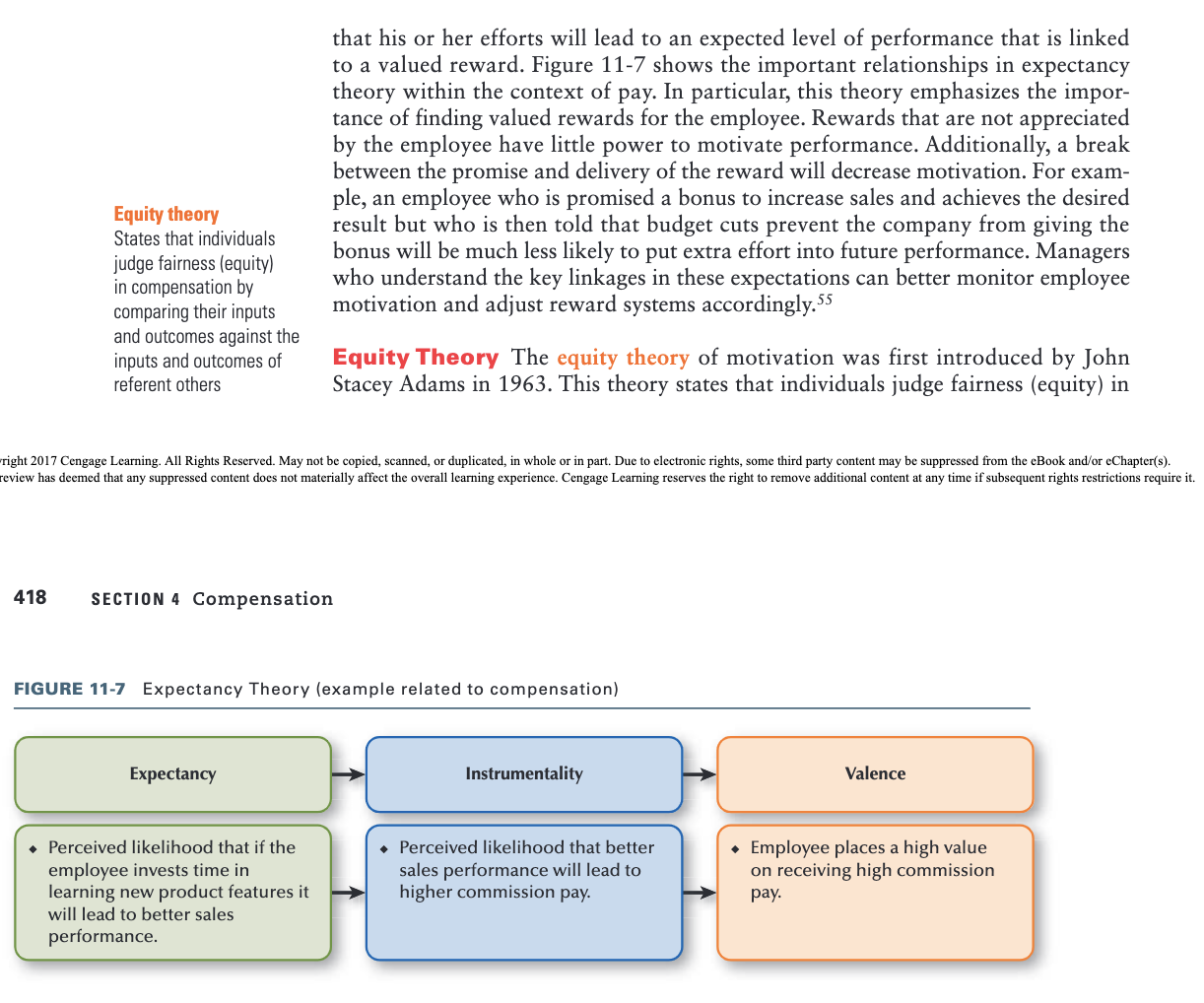

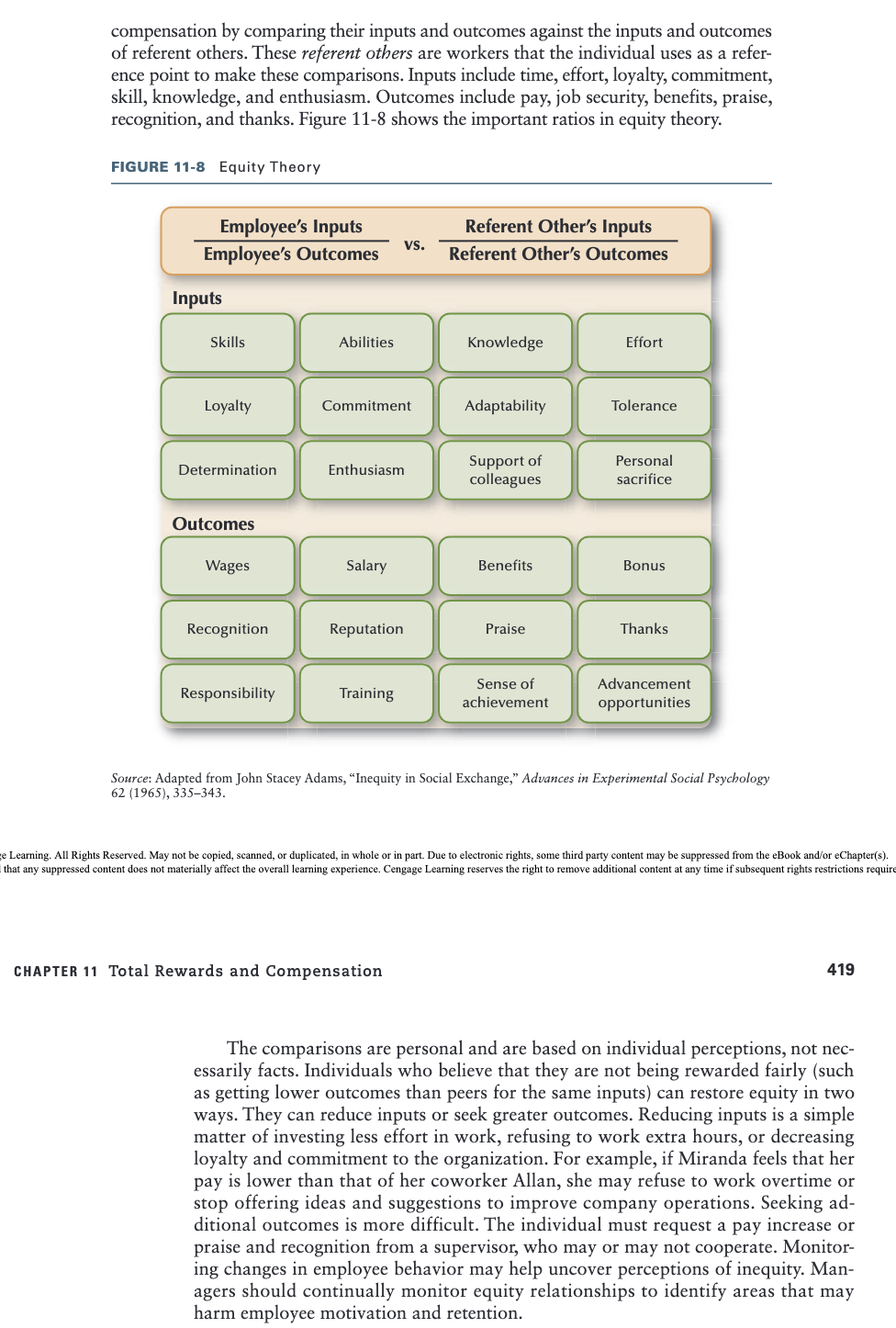

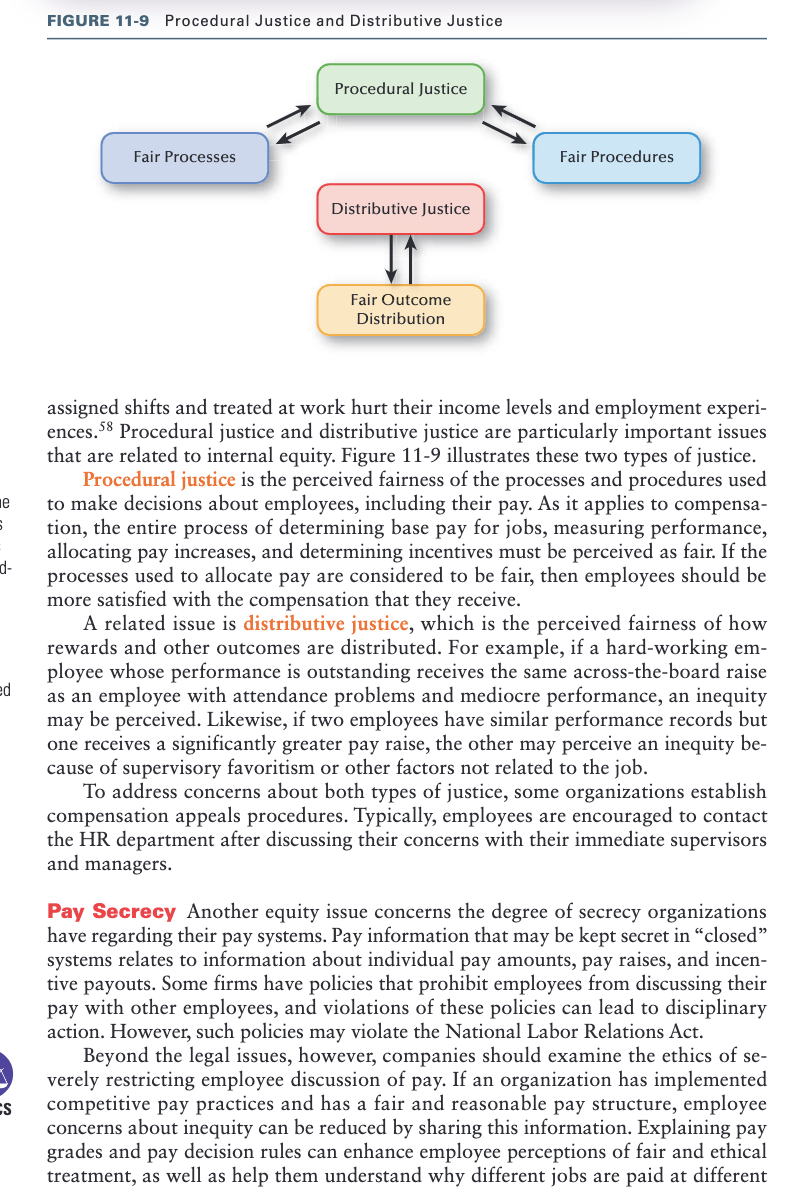

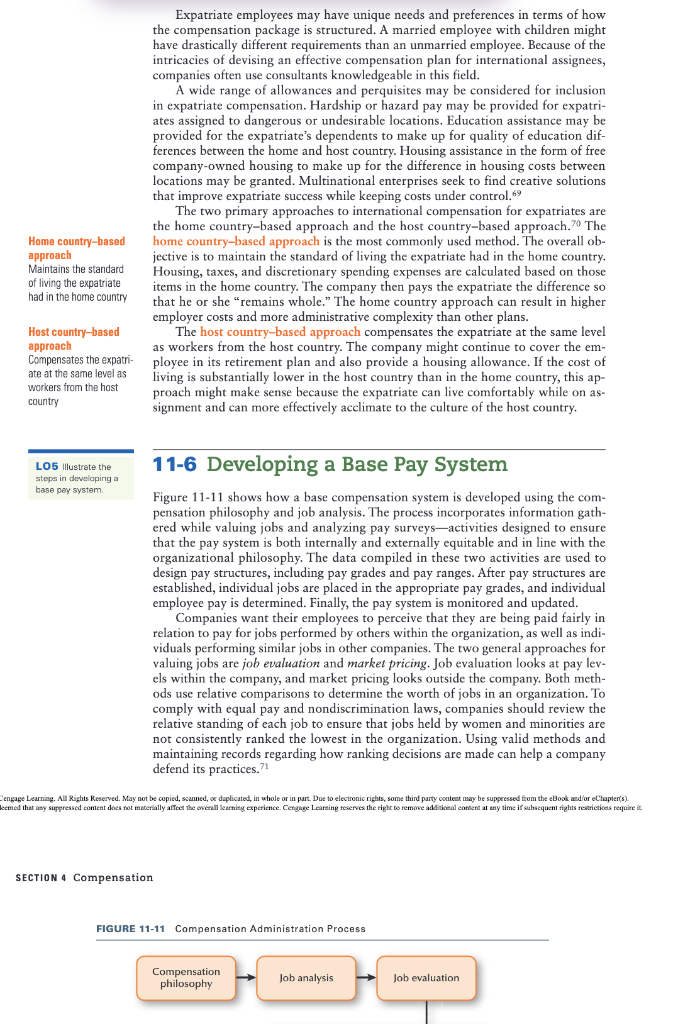

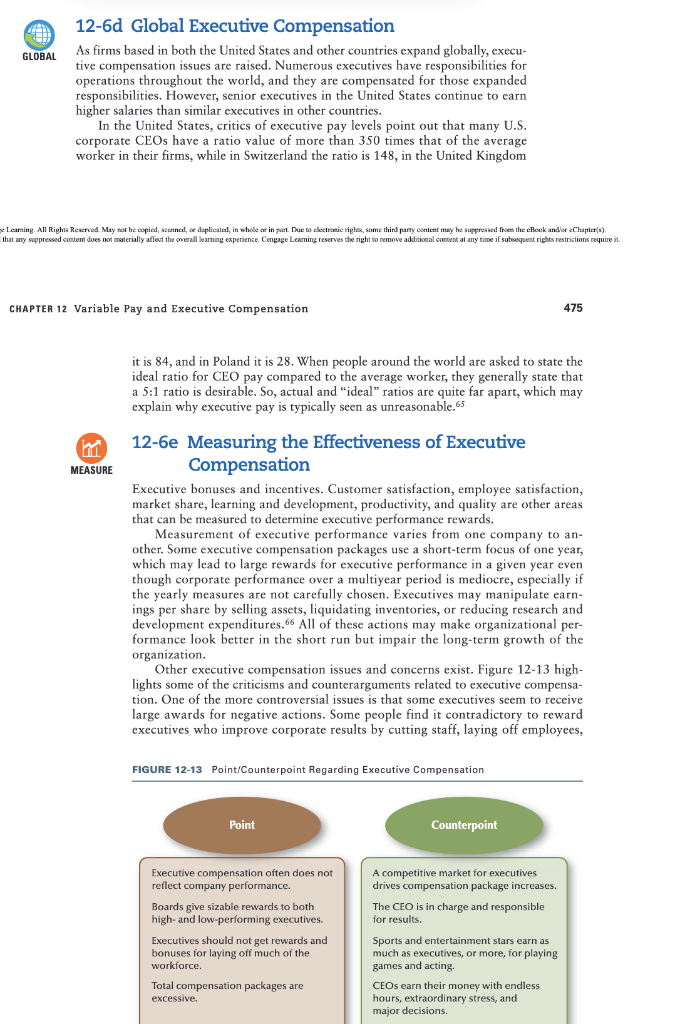

Compensation A total rewards approach to compensation emphasizes all forms of compensation, including monetary and nonmonetary rewards. This philosophy helps companies strengthen employee motivation and commitment while taking into account economic conditions. Total Rewards: Attracting and Retaining High-Quality Talent - A total rewards approach to compensation emphasizes all forms of compensation, including monetary and nonmonetary rewards. - The effectiveness of the reward system depends on how well compensation is linked to organizational strategies. - Companies do this by addressing pay and benefits with a total rewards approach. - This philosophy includes all forms of compensation, that is, the monetary and nonmonetary rewards provided by a company to attract, motivate, and retain employees. - The challenge then is for employers to achieve an optimal relationship between costs and employee impact while considering many financial and operational factors. NATURE OF TOTAL REWARDS AND compensation: The text discusses the different types of rewards that can be given to employees, as well as the challenges in providing them. The text discusses the different types of rewards that can be given to employees, as well as the importance of aligning rewards with the strategic goals of the organization. Rewards can be broadly defined, and intangible rewards are an important aspect of the package. Rewards should be cost-effective and complementary to the organizational culture. Nature of Total Rewards and Compensation - BEGIN FORMAT TEMPLATE - Nature of Total Rewards and Compensation - Compliance with all applicable laws and regulations - Cost-effectiveness for the organization - Internal and external equity for employees - Optimal mix of compensation components - Performance enhancement for the organization - Performance recognition and talent management for employees - Enhanced recruitment, involvement, and retention of employees - END FORMAT TEMPLATE 11-3c Compensation Responsibilities HR specialists and line managers work together to administer compensation programs. HR specialists develop and administer the organizational compensation system and ensure that pay practices comply with all legal requirements. Because of the complexity involved, HR specialists typically conduct job evaluations and wage surveys, and they develop base pay programs and salary structures and policies. Line managers evaluate employee performance and participate in pay decisions. They are often the first point of contact for employees with questions about pay fairness. It is advisable to train managers about how the organization develops and administers its compensation program. Payroll Administration Companies manage payroll administration in different ways. HR professionals may or may not do the actual processing of payroll. If they do, payroll staff may report to the company's HR function or the accounting function. However, this labor-intensive responsibility is often one of the first to be outsourced, so in some companies HR staff is not directly involved in processing payroll. Calculating pay and ensuring timely, accurate payroll processing is important for maintaining a positive workplace. Record keeping is particularly critical, which is why many organizations use payroll systems to manage the process. Companies can use a variety of approaches to ensure accurate record keeping such as time clocks, time sheets, and automated processes. Managers and employees can work together to record work hours, but managers are responsible for the accuracy of payroll. As highlighted in the chapter opening Headline, many organizations use automated timekeeping systems to ensure accurate payroll processing. Managers can change time records, such as when an employee forgets to clock in or clock out, but these changes should be made carefully and for good reason. 49 Companies also need to be careful that their payroll processes comply with compensation laws and do not encourage lawsuits. For instance, the medical products manufacturer Medline Industries was rounding the start times of hourly paid employees by 29 minutes, which resulted in problems for the company based on California law. 50 PetSmart paid a $1 million settlement on a class action lawsuit involving the mandatory use of ATM cards to pay individuals final wages after they were fired. Fees were incurred when the cards were used, cards were not accepted at all banks, and cards did not provide payment of full wages, which violated California law. 51 11-3d Human Resource Metrics and Compensation Employers spend a substantial amount of money on employee compensation. Just like any other area of cost, compensation expenditures should be evaluated to determine their effectiveness. Metrics can be tracked to assess the compensation program's internal performance and its external competitiveness. 52A number of widely used measures are shown in Figure 11-6. The raw data needed to calculate various measures may be found in many organizational functions. Wage rates, total payroll costs, and overtime information can be obtained from the payroll staff or vendor. Productivity numbers may be logged by the Operations Department. Tenure and pay range information may be recorded in the HRIS. Compiling all the information necessary to make proper assessments is complex and may require HR professionals to coordinate with other organizational functions. Ideally, compensation metrics should be computed each year and compared with historic results to show how the rate of compensation change compares FIGURE 11-6 HR Metrics for Compensation with the rate of other financial change in the organization. The following "HR Perspectives: Using Predictive Analytics to Determine Pay" feature shows how progressive companies use metrics and analytics to improve their pay effectiveness. 11-4 Compensation System Design Issues Depending on the compensation philosophies, strategies, and approaches used by an organization, many decisions are made that affect the design of the compensation system. Employee satisfaction with the compensation system can be influenced by how the organization manages these issues. 11-4a Motivation Theories and Compensation Philosophies Research in the field of worker motivation was especially active during the 1960 s, and many well-known theories emerged. Two theories of motivation in particular influence the design of compensation systems. Expectancy theory and equity theory are particularly relevant to the perceptions employees have of the total rewards provided by the organization. 53 The ideas behind these two theories were introduced in Chapter 5 . that his or I lead to an of perfor- Expectancy Theory The expectancy theory of motivation was first introduced linked to a by Victor Vroom at Yale in 1964 and was later expanded by Porter and Lawler. Expectancy theory states that an employee's motivation is based on the probability that his or her efforts will lead to an expected level of performance that is linked to a valued reward. Figure 11-7 shows the important relationships in expectancy theory within the context of pay. In particular, this theory emphasizes the importance of finding valued rewards for the employee. Rewards that are not appreciated by the employee have little power to motivate performance. Additionally, a break between the promise and delivery of the reward will decrease motivation. For example, an employee who is promised a bonus to increase sales and achieves the desired Equity theory result but who is then told that budget cuts prevent the company from giving the States that individuals bonus will be much less likely to put extra effort into future performance. Managers judge fairness (equity) who understand the key linkages in these expectations can better monitor employee in compensation by comparing their inputs motivation and adjust reward systems accordingly. 55 and outcomes against the inputs and outcomes of Equity Theory The equity theory of motivation was first introduced by John referent others Stacey Adams in 1963. This theory states that individuals judge fairness (equity) in 418 SECTION 4 Compensation compensation by comparing their inputs and outcomes against the inputs and outcomes of referent others. These referent others are workers that the individual uses as a reference point to make these comparisons. Inputs include time, effort, loyalty, commitment, skill, knowledge, and enthusiasm. Outcomes include pay, job security, benefits, praise, recognition, and thanks. Figure 11-8 shows the important ratios in equity theory. FIGURE 11-8 Equity Theory Source: Adapted from John Stacey Adams, "Inequity in Social Exchange," Advances in Experimental Social Psychology 62(1965),335343. e Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require CHAPTER 11 Total Rewards and Compensation 419 The comparisons are personal and are based on individual perceptions, not necessarily facts. Individuals who believe that they are not being rewarded fairly (such as getting lower outcomes than peers for the same inputs) can restore equity in two ways. They can reduce inputs or seek greater outcomes. Reducing inputs is a simple matter of investing less effort in work, refusing to work extra hours, or decreasing loyalty and commitment to the organization. For example, if Miranda feels that her pay is lower than that of her coworker Allan, she may refuse to work overtime or stop offering ideas and suggestions to improve company operations. Seeking additional outcomes is more difficult. The individual must request a pay increase or praise and recognition from a supervisor, who may or may not cooperate. Monitoring changes in employee behavior may help uncover perceptions of inequity. Managers should continually monitor equity relationships to identify areas that may harm employee motivation and retention. 11-4b Compensation Fairness and Equity Most people work for monetary rewards. Whether they receive base pay or variable pay, the extent to which employees perceive their compensation to be fair often affects their performance and how they view their jobs and their employers. These perceptions can in turn affect other important work outcomes such as job satisfaction, organizational commitment, absenteeism, turnover, and retention. This is why HR professionals and other business leaders need to be particularly aware of both external and internal equity concerns if they want to effectively manage these outcomes. External Equity If an employer's rewards are not viewed as equitable compared to other organizations, the employer is likely to experience higher turnover. This also creates greater difficulty in recruiting qualified and high-demand individuals. Depending on external labor markets, a lack of pay competitiveness from an external perspective can result in the employment of individuals who lack some of the knowledge, skills, and abilities (KSAs) necessary for them to do work effectively. It can also result in the employment of individuals who are less motivated to make valuable contributions to the organization, which can hurt firm performance. Organizations can track external equity by using pay surveys and looking at the compensation policies of competing employers. Internal Equity Internal equity means that employees are compensated fairly within the organization with regard to the KSAs they use in their jobs, as well as their responsibilities, accomplishments, and job performance. Given how fairness is emphasized, employees evaluate their ratio of effort to reward in comparison to coworkers on an ongoing basis. These evaluations often affect how willing employees are to make valuable contributions to the organization. This is why the different pay levels of employees should be compared internally to make sure that compensation is fair, particularly when individuals ask for pay increases. 56 Internal equity can also relate to differences between the pay levels of managers and employees. The Securities and Exchange Commission has proposed a rule that would require public firms to indicate how their CEOs' compensation compares to the median levels received by workers. 57 Perceptions of justice are also important managerial considerations because they indicate whether employees believe that workplace fairness is valued in a company. Two cocktail waitresses employed at Casino Queen pursued a racial discrimination and retaliation lawsuit because they believed that the way they were unfairly assigned shifts and treated at work hurt their income levels and employment experiences. 58 Procedural justice and distributive justice are particularly important issues that are related to internal equity. Figure 11-9 illustrates these two types of justice. Procedural justice is the perceived fairness of the processes and procedures used to make decisions about employees, including their pay. As it applies to compensation, the entire process of determining base pay for jobs, measuring performance, allocating pay increases, and determining incentives must be perceived as fair. If the processes used to allocate pay are considered to be fair, then employees should be more satisfied with the compensation that they receive. A related issue is distributive justice, which is the perceived fairness of how rewards and other outcomes are distributed. For example, if a hard-working employee whose performance is outstanding receives the same across-the-board raise as an employee with attendance problems and mediocre performance, an inequity may be perceived. Likewise, if two employees have similar performance records but one receives a significantly greater pay raise, the other may perceive an inequity because of supervisory favoritism or other factors not related to the job. To address concerns about both types of justice, some organizations establish compensation appeals procedures. Typically, employees are encouraged to contact the HR department after discussing their concerns with their immediate supervisors and managers. Pay Secrecy Another equity issue concerns the degree of secrecy organizations have regarding their pay systems. Pay information that may be kept secret in "closed" systems relates to information about individual pay amounts, pay raises, and incentive payouts. Some firms have policies that prohibit employees from discussing their pay with other employees, and violations of these policies can lead to disciplinary action. However, such policies may violate the National Labor Relations Act. Beyond the legal issues, however, companies should examine the ethics of severely restricting employee discussion of pay. If an organization has implemented competitive pay practices and has a fair and reasonable pay structure, employee concerns about inequity can be reduced by sharing this information. Explaining pay grades and pay decision rules can enhance employee perceptions of fair and ethical treatment, as well as help them understand why different jobs are paid at different Lead-the-Market Strategy A third-quartile strategy uses an aggressive approach to "lead the market." This strategy generally enables a company to attract and retain sufficient workers with the required capabilities and be more selective when hiring. Since it is a higher-cost approach, organizations often look for ways to increase the productivity of employees who are receiving above-market wages. Match-the-Market Strategy Most employers position themselves in the second quartile (median), the middle of the market, as determined by pay data from surveys of other employers' compensation plans. Choosing this level is an attempt to balance employer cost pressures and the need to attract and retain employees by providing compensation levels that "meet the market" for the company's jobs. Selecting a Quartile Pay structures and levels can affect organizational performance and staffing quality. Deciding which quartile position to target is a function of many considerations-financial resources available, competitiveness pressures, and the market availability of employees with different capabilities. For instance, some employers with extensive benefits programs or broad-based incentive programs may choose a first-quartile strategy so that their overall compensation costs and levels are not excessive. The decisions about compensation mix and competitive position are related and should be addressed as part of a comprehensive total rewards strategy. 11-4d Competency-Based Pay Most compensation programs are designed to reward employees for carrying out their tasks, duties, and responsibilities. The job requirements determine which employees have higher base rates. Employees receive more for doing jobs that require a greater variety of tasks, more knowledge and skills, greater physical effort, or more demanding working conditions. However, the design of some compensation programs emphasizes competencies rather than the tasks performed. Competency-based pay Competency-based pay rewards individuals for the capabilities they demonstrate Rewards individuals for and acquire. In knowledge-based pay (KBP) or skill-based pay (SBP) systems, emthe capabilities they ployees start at a base level of pay and receive increases as they learn to do other jobs dernonstrate and acquire or gain additional skills and knowledge, and thus become more valuable to the employer. For example, a manufacturing firm operates plastic molding presses of various sizes. Operating larger presses requires more skills than smaller presses. Under a KBP or SBP system, press operators increase their pay as they learn how to operate the more complex presses, even though sometimes they may operate only smaller machines. Given the inherent advantages, these plans can lead to greater workforce flexibility and productivity. 61 Research also suggests that beneficial and fair competency approaches lead to increased work effort and organizational citizenship. 62 114e Individual versus Team Rewards As some organizations have shifted to using work teams, the concern is how to develop compensation programs that support the team concept. Determining how to compensate individuals whose performance may be a result of team efforts and achievements is complicated. For base pay, employers may compensate individuals on the basis of competencies, experience, and other job factors. Then they use team incentive rewards on top of base pay. Equity concerns are particularly challenging, and designing team rewards requires careful thought and planning. 63 Team-based incentives are discussed in Chapter 12. right 2017 Cengage Leaming. All Rights Reserved. May not be copiod, seaned, or duplicaled, in whole or in port. Due to elodronic rights, some third party camient may be suppressed from the eBicok and or eChapter(s). review has deemed that any suppressed ooetem does not materially affect the overall leaming experiesoe. Cengage Leeming reserves the right to remove sdditional conteat on any tiese if subseguear righas restrictions require it 424 SECTion 4 Compensation \begin{tabular}{ll} \hline LO4Understandthechallengesofmenalingglobalcompensationsystams. & Alloftheissuesdiscussedherecanbecomeconfusingwhendealingwithglobalcompensation.Thegrowingworldeconomyhasledtoanincreaseinthenumberof \end{tabular} employees working internationally. Therefore, organizations with employees work- Lo4 Understand the challenges of 11-5 Global Compensation Issues the challenges of managing global compensation All of the issues discussed here can become confusing when dealing with global systems. compensation. The growing world economy has led to an increase in the number of employees working internationally. Therefore, organizations with employees working throughout the world face some special compensation issues. Variations in laws, living costs, tax policies, and other factors must be considered when designing the compensation for local employees and managers, as well as managers and professionals on international assignment. Fluctuations in the values of various currencies must be tracked and adjustments made as exchange rates rise or fall. With these and numerous other concerns, developing and managing a global compensation system becomes extremely complex. One significant global issue in compensation design is how to compensate employees from different countries. Local wage scales vary significantly among countries, and there are differences between developed nations where employees earn a high level of pay and developing nations where compensation rates are a fraction of those in developed nations. Costs of living standards vary a great deal between nations and compensation differences may reflect differences in purchasing power among nations. These variations in compensation levels have led to significant Oftshoring offshoring, which involves moving jobs to lower-wage countries. The movement of Moving jobs to lower- call center and information technology (IT) jobs to India and manufacturing jobs to wage countries China, the Philippines, and Mexico are examples. 64 However, U.S. manufacturers have begun to resbore (return operations to the United States) production as wages in China and Mexico have risen. 65 This shows that compensation levels certainly play a role in helping companies decide where to locate their operations. Many organizations have started to globalize their pay policies to attract and retain employees from an international talent pool. This requires management to balance the desire for consistent practices throughout the company with the need for differentiating practices based on local input and customs. This also requires companies to monitor the pay level and policy trends in other countries. For instance, evidence suggests that the differences in top manager pay that have allegedly existed between the United States and many European countries are not as large as once thought. 66 Union-led agreements and political support in Germany have also encouraged wages in that country to steadily increase, while wages is Spain have decreased. 67 Finally, employees in Venezuela and Argentina are predicted to receive the highest pay hikes in the world, but inflationary pressures will eat away most or all of these gains. The most significant pay raises are expected to be experienced in Asian and Latin American countries, while some European countries such as Greece and Switzerland may experience the lowest increases in wages. 68 11-5a International Assignees Multinational companies may staff their operations with a mixture of employees from around the world, and expatriates are often used to fill foreign positions. Regardless of how staffing is determined, compensation practices should be designed to maximize employee commitment and productivity. It has been estimated that the total employer costs for an expatriate, including all allowances, is three to four times the expatriate's salary, with the duration of a typical expatriate assignment at two or three years. The expense of sending expatriates abroad clearly warrants special attention in the global compensation approach. Fyright 2017 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party sontent may be suppressed from the ellook andior eChapter(s CHAPTER 11 Total Rewards and Compensation 425 Expatriate employees may have unique needs and preferences in terms of how the compensation package is structured. A married employee with children might have drastically different requirements than an unmarried employee. Because of the intricacies of devising an effective compensation plan for international assignees, companies often use consultants knowledgeable in this field. A wide range of allowances and perquisites may be considered for inclusion Expatriate employees may have unique needs and preferences in terms of how the compensation package is structured. A married employee with children might have drastically different requirements than an unmarried employee. Because of the intricacies of devising an effective compensation plan for international assignees, companies often use consultants knowledgeable in this field. A wide range of allowances and perquisites may be considered for inclusion in expatriate compensation. Hardship or hazard pay may be provided for expatriates assigned to dangerous or undesirable locations. Education assistance may be provided for the expatriate's dependents to make up for quality of education differences between the home and host country. Housing assistance in the form of free company-owned housing to make up for the difference in housing costs between locations may be granted. Multinational enterprises seek to find creative solutions that improve expatriate success while keeping costs under control. 69 The two primary approaches to international compensation for expatriates are the home country-based approach and the host country-based approach. 70 The Home country-based home country-based approach is the most commonly used method. The overall obapproach jective is to maintain the standard of living the expatriate had in the home country. Maintains the standard Housing, taxes, and discretionary spending expenses are calculated based on those of living the expatriate items in the home country. The company then pays the expatriate the difference so had in the home country that he or she "remains whole." The home country approach can result in higher employer costs and more administrative complexity than other plans. Host country-based The host country-based approach compensates the expatriate at the same level approach as workers from the host country. The company might continue to cover the emCompensates the expatri- ployee in its retirement plan and also provide a housing allowance. If the cost of ate at the same level as living is substantially lower in the host country than in the home country, this apworkers from the host proach might make sense because the expatriate can live comfortably while on ascountry signment and can more effectively acclimate to the culture of the host country. \begin{tabular}{ll} \hline Lo5Illustratethestepsindevelopingabasepaysystem. & 1-6 Developing a Base Pay System \\ Figure 11-11 shows how a base compensation system is developed using the com- \\ pensation philosophy and job analysis. The process incorporates information gath- \end{tabular} ered while valuing jobs and analyzing pay surveys-activities designed to ensure that the pay system is both internally and externally equitable and in line with the organizational philosophy. The data compiled in these two activities are used to design pay structures, including pay grades and pay ranges. After pay structures are established, individual jobs are placed in the appropriate pay grades, and individual employee pay is determined. Finally, the pay system is monitored and updated. Companies want their employees to perceive that they are being paid fairly in relation to pay for jobs performed by others within the organization, as well as individuals performing similar jobs in other companies. The two general approaches for valuing jobs are job evaluation and market pricing. Job evaluation looks at pay levels within the company, and market pricing looks outside the company. Both methods use relative comparisons to determine the worth of jobs in an organization. To comply with equal pay and nondiscrimination laws, companies should review the relative standing of each job to ensure that jobs held by women and minorities are not consistently ranked the lowest in the organization. Using valid methods and maintaining records regarding how ranking decisions are made can help a company defend its practices. 71 Cengape Learning. All Rights Reserved. May not be copied, scanned, or d.plicated, in whole or in part. Due to electrenic rights, some third party content may be suppressed from the eBook andior eChapieri(s). SECTION 4 Compensation FIGURE 11-11 Compensation Administration Process 11-8c Compensation Challenges A number of concerns for managers affect compensation planning and administration. Circumstances such as economic recessions and the gender pay gap that occur within and outside the organization can create employee dissatisfaction or turnover. Economic Recessions During trying economic times, many organizations address shortfalls in revenue by reducing employment-related expenses. This may include reducing the quantities and amounts of raises given to employees. Layoffs and reductions in force may be other strategies used to lower costs. Managers and HR professionals should consider the potential negative impact of these approaches and use them sparingly because employee job dissatisfaction and turnover can occur if such strategies are implemented on a long-term basis. Gender Pay Gap Despite laws prohibiting pay discrimination on the basis of sex (as discussed in Chapter 3), there is a persistent pay gap between men and women in the workplace. The wage gap is wider in some industries than others. However, women appear to have gained some ground in recent years. The pay differences between women and men seem to be decreasing generationally, with Millennials experiencing a greatly diminished pay gap. But the pay differences tend to increase in executive-level positions. 82 Continued monitoring of organizational pay levels and properly managing women's career progress are ways to address these concerns. - The concept of total rewards has become a pay systems. It requires most organizations crucial part of HR management and includes to pay a minimum wage and to comply with compensation, benefits, work-life balance overtime provisions, including appropriately practices, and performance and talent classifying employees as exempt or nonexempt management. and as independent contractors or employees. - Compensation provided by an organization can - A continuum of compensation philosophies come directly through base pay and variable exists, ranging from an entitlement philosophy pay and indirectly through benefits. to a performance philosophy. - The Fair Labor Standards Act (FLSA), as - When designing and administering amended, is the major federal law that affects compensation programs, internal and external CHAPTER 11 Total Rewards and Compensation 439 equity, organizational justice, and pay openness Once a firm has collected pay survey data, it all must be considered. can develop a pay structure, which is composed - Compensation practices for international of pay grades and pay ranges. employees can be designed using a variety of - Problems involving employees paid outside of methods to ensure equity. the pay range can be addressed in many ways. - A base pay system is developed using - Individual pay increases can be based information from valuations of jobs and pay on performance, seniority, cost-of-living surveys, both of which are designed to ensure adjustments, across-the-board increases, lumpthat the pay system is internally equitable and sum increases, or a combination of different externally competitive. approaches. - The valuation of jobs can be determined using either job evaluation or market pricing. 12-6d Global Executive Compensation As firms based in both the United States and other countries expand globally, executive compensation issues are raised. Numerous executives have responsibilities for operations throughout the world, and they are compensated for those expanded responsibilities. However, senior executives in the United States continue to earn higher salaries than similar executives in other countries. In the United States, critics of executive pay levels point out that many U.S. corporate CEOs have a ratio value of more than 350 times that of the average worker in their firms, while in Switzerland the ratio is 148, in the United Kingdom CHAPTER 12 Variable Pay and Executive Compensation 475 it is 84 , and in Poland it is 28 . When people around the world are asked to state the ideal ratio for CEO pay compared to the average worker, they generally state that a 5:1 ratio is desirable. So, actual and "ideal" ratios are quite far apart, which may explain why executive pay is typically seen as unreasonable. 65 12-6e Measuring the Effectiveness of Executive MEASURE Compensation Executive bonuses and incentives. Customer satisfaction, employee satisfaction, market share, learning and development, productivity, and quality are other areas that can be measured to determine executive performance rewards. Measurement of executive performance varies from one company to another. Some executive compensation packages use a short-term focus of one year, which may lead to large rewards for executive performance in a given year even though corporate performance over a multiyear period is mediocre, especially if the yearly measures are not carefully chosen. Executives may manipulate earnings per share by selling assets, liquidating inventories, or reducing research and development expenditures. 66 All of these actions may make organizational performance look better in the short run but impair the long-term growth of the organization. Other executive compensation issues and concerns exist. Figure 12-13 highlights some of the criticisms and counterarguments related to executive compensation. One of the more controversial issues is that some executives seem to receive large awards for negative actions. Some people find it contradictory to reward executives who improve corporate results by cutting staff, laying off employees, FIGURE 12-13 Point/Counterpoint Regarding Executive Compensation \begin{tabular}{|l|l|} \hline Executivecompensationoftendoesnotreflectcompanyperformance. & Acompetitivemarketforexecutivesdrivescompensationpackageincreases. \\ Boardsgivesizablerewardstobothhigh-andlow-performingexecutives. & TheCEOisinchargeandresponsibleforresults. \\ Executives should not get rewards and \\ bonuses for laying off much of the \\ workforce. \end{tabular}Sportsandentertainmentstarsearnasmuchasexecutives,ormore,forplayinggamesandacting.Totalcompensationpackagesareexcessive. - Variable pay, also called incentive pay, is compensation can be provided as salary only, compensation that can be linked to individual, commission only, or salary plus commission or work unit/team, and/or organizational bonuses. performance. - Measuring the effectiveness of sales incentive - Effective variable pay plans fit both business plans is a challenge that may require the strategies and organizational cultures, plans to be adjusted on the basis of success appropriately award actions, and are metrics. administered properly. - Executive compensation must be viewed - Metrics for measuring the success of variable as a total package composed of salaries, pay plans are available. bonuses, benefits, perquisites (perks), and - Piece-rate and bonus plans are commonly used both short- and long-term performanceindividual incentives. based incentives. - The design of work unit/team variable pay - Performance-based incentives often represent plans must consider how the incentives are a significant portion of an executive's to be distributed, the timing of the incentive compensation package. payments, and who will make decisions about - A compensation committee, which is a the variable payout. subgroup of the board of directors, generally - Organization-wide rewards include profit has authority over executive compensation sharing and stock ownership plans. plans. In addition, shareholders of public - Sales employees may have their compensation corporations have the right to vote on executive tied to performance on several criteria. Sales pay packages. Compensation A total rewards approach to compensation emphasizes all forms of compensation, including monetary and nonmonetary rewards. This philosophy helps companies strengthen employee motivation and commitment while taking into account economic conditions. Total Rewards: Attracting and Retaining High-Quality Talent - A total rewards approach to compensation emphasizes all forms of compensation, including monetary and nonmonetary rewards. - The effectiveness of the reward system depends on how well compensation is linked to organizational strategies. - Companies do this by addressing pay and benefits with a total rewards approach. - This philosophy includes all forms of compensation, that is, the monetary and nonmonetary rewards provided by a company to attract, motivate, and retain employees. - The challenge then is for employers to achieve an optimal relationship between costs and employee impact while considering many financial and operational factors. NATURE OF TOTAL REWARDS AND compensation: The text discusses the different types of rewards that can be given to employees, as well as the challenges in providing them. The text discusses the different types of rewards that can be given to employees, as well as the importance of aligning rewards with the strategic goals of the organization. Rewards can be broadly defined, and intangible rewards are an important aspect of the package. Rewards should be cost-effective and complementary to the organizational culture. Nature of Total Rewards and Compensation - BEGIN FORMAT TEMPLATE - Nature of Total Rewards and Compensation - Compliance with all applicable laws and regulations - Cost-effectiveness for the organization - Internal and external equity for employees - Optimal mix of compensation components - Performance enhancement for the organization - Performance recognition and talent management for employees - Enhanced recruitment, involvement, and retention of employees - END FORMAT TEMPLATE 11-3c Compensation Responsibilities HR specialists and line managers work together to administer compensation programs. HR specialists develop and administer the organizational compensation system and ensure that pay practices comply with all legal requirements. Because of the complexity involved, HR specialists typically conduct job evaluations and wage surveys, and they develop base pay programs and salary structures and policies. Line managers evaluate employee performance and participate in pay decisions. They are often the first point of contact for employees with questions about pay fairness. It is advisable to train managers about how the organization develops and administers its compensation program. Payroll Administration Companies manage payroll administration in different ways. HR professionals may or may not do the actual processing of payroll. If they do, payroll staff may report to the company's HR function or the accounting function. However, this labor-intensive responsibility is often one of the first to be outsourced, so in some companies HR staff is not directly involved in processing payroll. Calculating pay and ensuring timely, accurate payroll processing is important for maintaining a positive workplace. Record keeping is particularly critical, which is why many organizations use payroll systems to manage the process. Companies can use a variety of approaches to ensure accurate record keeping such as time clocks, time sheets, and automated processes. Managers and employees can work together to record work hours, but managers are responsible for the accuracy of payroll. As highlighted in the chapter opening Headline, many organizations use automated timekeeping systems to ensure accurate payroll processing. Managers can change time records, such as when an employee forgets to clock in or clock out, but these changes should be made carefully and for good reason. 49 Companies also need to be careful that their payroll processes comply with compensation laws and do not encourage lawsuits. For instance, the medical products manufacturer Medline Industries was rounding the start times of hourly paid employees by 29 minutes, which resulted in problems for the company based on California law. 50 PetSmart paid a $1 million settlement on a class action lawsuit involving the mandatory use of ATM cards to pay individuals final wages after they were fired. Fees were incurred when the cards were used, cards were not accepted at all banks, and cards did not provide payment of full wages, which violated California law. 51 11-3d Human Resource Metrics and Compensation Employers spend a substantial amount of money on employee compensation. Just like any other area of cost, compensation expenditures should be evaluated to determine their effectiveness. Metrics can be tracked to assess the compensation program's internal performance and its external competitiveness. 52A number of widely used measures are shown in Figure 11-6. The raw data needed to calculate various measures may be found in many organizational functions. Wage rates, total payroll costs, and overtime information can be obtained from the payroll staff or vendor. Productivity numbers may be logged by the Operations Department. Tenure and pay range information may be recorded in the HRIS. Compiling all the information necessary to make proper assessments is complex and may require HR professionals to coordinate with other organizational functions. Ideally, compensation metrics should be computed each year and compared with historic results to show how the rate of compensation change compares FIGURE 11-6 HR Metrics for Compensation with the rate of other financial change in the organization. The following "HR Perspectives: Using Predictive Analytics to Determine Pay" feature shows how progressive companies use metrics and analytics to improve their pay effectiveness. 11-4 Compensation System Design Issues Depending on the compensation philosophies, strategies, and approaches used by an organization, many decisions are made that affect the design of the compensation system. Employee satisfaction with the compensation system can be influenced by how the organization manages these issues. 11-4a Motivation Theories and Compensation Philosophies Research in the field of worker motivation was especially active during the 1960 s, and many well-known theories emerged. Two theories of motivation in particular influence the design of compensation systems. Expectancy theory and equity theory are particularly relevant to the perceptions employees have of the total rewards provided by the organization. 53 The ideas behind these two theories were introduced in Chapter 5 . that his or I lead to an of perfor- Expectancy Theory The expectancy theory of motivation was first introduced linked to a by Victor Vroom at Yale in 1964 and was later expanded by Porter and Lawler. Expectancy theory states that an employee's motivation is based on the probability that his or her efforts will lead to an expected level of performance that is linked to a valued reward. Figure 11-7 shows the important relationships in expectancy theory within the context of pay. In particular, this theory emphasizes the importance of finding valued rewards for the employee. Rewards that are not appreciated by the employee have little power to motivate performance. Additionally, a break between the promise and delivery of the reward will decrease motivation. For example, an employee who is promised a bonus to increase sales and achieves the desired Equity theory result but who is then told that budget cuts prevent the company from giving the States that individuals bonus will be much less likely to put extra effort into future performance. Managers judge fairness (equity) who understand the key linkages in these expectations can better monitor employee in compensation by comparing their inputs motivation and adjust reward systems accordingly. 55 and outcomes against the inputs and outcomes of Equity Theory The equity theory of motivation was first introduced by John referent others Stacey Adams in 1963. This theory states that individuals judge fairness (equity) in 418 SECTION 4 Compensation compensation by comparing their inputs and outcomes against the inputs and outcomes of referent others. These referent others are workers that the individual uses as a reference point to make these comparisons. Inputs include time, effort, loyalty, commitment, skill, knowledge, and enthusiasm. Outcomes include pay, job security, benefits, praise, recognition, and thanks. Figure 11-8 shows the important ratios in equity theory. FIGURE 11-8 Equity Theory Source: Adapted from John Stacey Adams, "Inequity in Social Exchange," Advances in Experimental Social Psychology 62(1965),335343. e Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require CHAPTER 11 Total Rewards and Compensation 419 The comparisons are personal and are based on individual perceptions, not necessarily facts. Individuals who believe that they are not being rewarded fairly (such as getting lower outcomes than peers for the same inputs) can restore equity in two ways. They can reduce inputs or seek greater outcomes. Reducing inputs is a simple matter of investing less effort in work, refusing to work extra hours, or decreasing loyalty and commitment to the organization. For example, if Miranda feels that her pay is lower than that of her coworker Allan, she may refuse to work overtime or stop offering ideas and suggestions to improve company operations. Seeking additional outcomes is more difficult. The individual must request a pay increase or praise and recognition from a supervisor, who may or may not cooperate. Monitoring changes in employee behavior may help uncover perceptions of inequity. Managers should continually monitor equity relationships to identify areas that may harm employee motivation and retention. 11-4b Compensation Fairness and Equity Most people work for monetary rewards. Whether they receive base pay or variable pay, the extent to which employees perceive their compensation to be fair often affects their performance and how they view their jobs and their employers. These perceptions can in turn affect other important work outcomes such as job satisfaction, organizational commitment, absenteeism, turnover, and retention. This is why HR professionals and other business leaders need to be particularly aware of both external and internal equity concerns if they want to effectively manage these outcomes. External Equity If an employer's rewards are not viewed as equitable compared to other organizations, the employer is likely to experience higher turnover. This also creates greater difficulty in recruiting qualified and high-demand individuals. Depending on external labor markets, a lack of pay competitiveness from an external perspective can result in the employment of individuals who lack some of the knowledge, skills, and abilities (KSAs) necessary for them to do work effectively. It can also result in the employment of individuals who are less motivated to make valuable contributions to the organization, which can hurt firm performance. Organizations can track external equity by using pay surveys and looking at the compensation policies of competing employers. Internal Equity Internal equity means that employees are compensated fairly within the organization with regard to the KSAs they use in their jobs, as well as their responsibilities, accomplishments, and job performance. Given how fairness is emphasized, employees evaluate their ratio of effort to reward in comparison to coworkers on an ongoing basis. These evaluations often affect how willing employees are to make valuable contributions to the organization. This is why the different pay levels of employees should be compared internally to make sure that compensation is fair, particularly when individuals ask for pay increases. 56 Internal equity can also relate to differences between the pay levels of managers and employees. The Securities and Exchange Commission has proposed a rule that would require public firms to indicate how their CEOs' compensation compares to the median levels received by workers. 57 Perceptions of justice are also important managerial considerations because they indicate whether employees believe that workplace fairness is valued in a company. Two cocktail waitresses employed at Casino Queen pursued a racial discrimination and retaliation lawsuit because they believed that the way they were unfairly assigned shifts and treated at work hurt their income levels and employment experiences. 58 Procedural justice and distributive justice are particularly important issues that are related to internal equity. Figure 11-9 illustrates these two types of justice. Procedural justice is the perceived fairness of the processes and procedures used to make decisions about employees, including their pay. As it applies to compensation, the entire process of determining base pay for jobs, measuring performance, allocating pay increases, and determining incentives must be perceived as fair. If the processes used to allocate pay are considered to be fair, then employees should be more satisfied with the compensation that they receive. A related issue is distributive justice, which is the perceived fairness of how rewards and other outcomes are distributed. For example, if a hard-working employee whose performance is outstanding receives the same across-the-board raise as an employee with attendance problems and mediocre performance, an inequity may be perceived. Likewise, if two employees have similar performance records but one receives a significantly greater pay raise, the other may perceive an inequity because of supervisory favoritism or other factors not related to the job. To address concerns about both types of justice, some organizations establish compensation appeals procedures. Typically, employees are encouraged to contact the HR department after discussing their concerns with their immediate supervisors and managers. Pay Secrecy Another equity issue concerns the degree of secrecy organizations have regarding their pay systems. Pay information that may be kept secret in "closed" systems relates to information about individual pay amounts, pay raises, and incentive payouts. Some firms have policies that prohibit employees from discussing their pay with other employees, and violations of these policies can lead to disciplinary action. However, such policies may violate the National Labor Relations Act. Beyond the legal issues, however, companies should examine the ethics of severely restricting employee discussion of pay. If an organization has implemented competitive pay practices and has a fair and reasonable pay structure, employee concerns about inequity can be reduced by sharing this information. Explaining pay grades and pay decision rules can enhance employee perceptions of fair and ethical treatment, as well as help them understand why different jobs are paid at different Lead-the-Market Strategy A third-quartile strategy uses an aggressive approach to "lead the market." This strategy generally enables a company to attract and retain sufficient workers with the required capabilities and be more selective when hiring. Since it is a higher-cost approach, organizations often look for ways to increase the productivity of employees who are receiving above-market wages. Match-the-Market Strategy Most employers position themselves in the second quartile (median), the middle of the market, as determined by pay data from surveys of other employers' compensation plans. Choosing this level is an attempt to balance employer cost pressures and the need to attract and retain employees by providing compensation levels that "meet the market" for the company's jobs. Selecting a Quartile Pay structures and levels can affect organizational performance and staffing quality. Deciding which quartile position to target is a function of many considerations-financial resources available, competitiveness pressures, and the market availability of employees with different capabilities. For instance, some employers with extensive benefits programs or broad-based incentive programs may choose a first-quartile strategy so that their overall compensation costs and levels are not excessive. The decisions about compensation mix and competitive position are related and should be addressed as part of a comprehensive total rewards strategy. 11-4d Competency-Based Pay Most compensation programs are designed to reward employees for carrying out their tasks, duties, and responsibilities. The job requirements determine which employees have higher base rates. Employees receive more for doing jobs that require a greater variety of tasks, more knowledge and skills, greater physical effort, or more demanding working conditions. However, the design of some compensation programs emphasizes competencies rather than the tasks performed. Competency-based pay Competency-based pay rewards individuals for the capabilities they demonstrate Rewards individuals for and acquire. In knowledge-based pay (KBP) or skill-based pay (SBP) systems, emthe capabilities they ployees start at a base level of pay and receive increases as they learn to do other jobs dernonstrate and acquire or gain additional skills and knowledge, and thus become more valuable to the employer. For example, a manufacturing firm operates plastic molding presses of various sizes. Operating larger presses requires more skills than smaller presses. Under a KBP or SBP system, press operators increase their pay as they learn how to operate the more complex presses, even though sometimes they may operate only smaller machines. Given the inherent advantages, these plans can lead to greater workforce flexibility and productivity. 61 Research also suggests that beneficial and fair competency approaches lead to increased work effort and organizational citizenship. 62 114e Individual versus Team Rewards As some organizations have shifted to using work teams, the concern is how to develop compensation programs that support the team concept. Determining how to compensate individuals whose performance may be a result of team efforts and achievements is complicated. For base pay, employers may compensate individuals on the basis of competencies, experience, and other job factors. Then they use team incentive rewards on top of base pay. Equity concerns are particularly challenging, and designing team rewards requires careful thought and planning. 63 Team-based incentives are discussed in Chapter 12. right 2017 Cengage Leaming. All Rights Reserved. May not be copiod, seaned, or duplicaled, in whole or in port. Due to elodronic rights, some third party camient may be suppressed from the eBicok and or eChapter(s). review has deemed that any suppressed ooetem does not materially affect the overall leaming experiesoe. Cengage Leeming reserves the right to remove sdditional conteat on any tiese if subseguear righas restrictions require it 424 SECTion 4 Compensation \begin{tabular}{ll} \hline LO4Understandthechallengesofmenalingglobalcompensationsystams. & Alloftheissuesdiscussedherecanbecomeconfusingwhendealingwithglobalcompensation.Thegrowingworldeconomyhasledtoanincreaseinthenumberof \end{tabular} employees working internationally. Therefore, organizations with employees work- Lo4 Understand the challenges of 11-5 Global Compensation Issues the challenges of managing global compensation All of the issues discussed here can become confusing when dealing with global systems. compensation. The growing world economy has led to an increase in the number of employees working internationally. Therefore, organizations with employees working throughout the world face some special compensation issues. Variations in laws, living costs, tax policies, and other factors must be considered when designing the compensation for local employees and managers, as well as managers and professionals on international assignment. Fluctuations in the values of various currencies must be tracked and adjustments made as exchange rates rise or fall. With these and numerous other concerns, developing and managing a global compensation system becomes extremely complex. One significant global issue in compensation design is how to compensate employees from different countries. Local wage scales vary significantly among countries, and there are differences between developed nations where employees earn a high level of pay and developing nations where compensation rates are a fraction of those in developed nations. Costs of living standards vary a great deal between nations and compensation differences may reflect differences in purchasing power among nations. These variations in compensation levels have led to significant Oftshoring offshoring, which involves moving jobs to lower-wage countries. The movement of Moving jobs to lower- call center and information technology (IT) jobs to India and manufacturing jobs to wage countries China, the Philippines, and Mexico are examples. 64 However, U.S. manufacturers have begun to resbore (return operations to the United States) production as wages in China and Mexico have risen. 65 This shows that compensation levels certainly play a role in helping companies decide where to locate their operations. Many organizations have started to globalize their pay policies to attract and retain employees from an international talent pool. This requires management to balance the desire for consistent practices throughout the company with the need for differentiating practices based on local input and customs. This also requires companies to monitor the pay level and policy trends in other countries. For instance, evidence suggests that the differences in top manager pay that have allegedly existed between the United States and many European countries are not as large as once thought. 66 Union-led agreements and political support in Germany have also encouraged wages in that country to steadily increase, while wages is Spain have decreased. 67 Finally, employees in Venezuela and Argentina are predicted to receive the highest pay hikes in the world, but inflationary pressures will eat away most or all of these gains. The most significant pay raises are expected to be experienced in Asian and Latin American countries, while some European countries such as Greece and Switzerland may experience the lowest increases in wages. 68 11-5a International Assignees Multinational companies may staff their operations with a mixture of employees from around the world, and expatriates are often used to fill foreign positions. Regardless of how staffing is determined, compensation practices should be designed to maximize employee commitment and productivity. It has been estimated that the total employer costs for an expatriate, including all allowances, is three to four times the expatriate's salary, with the duration of a typical expatriate assignment at two or three years. The expense of sending expatriates abroad clearly warrants special attention in the global compensation approach. Fyright 2017 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party sontent may be suppressed from the ellook andior eChapter(s CHAPTER 11 Total Rewards and Compensation 425 Expatriate employees may have unique needs and preferences in terms of how the compensation package is structured. A married employee with children might have drastically different requirements than an unmarried employee. Because of the intricacies of devising an effective compensation plan for international assignees, companies often use consultants knowledgeable in this field. A wide range of allowances and perquisites may be considered for inclusion Expatriate employees may have unique needs and preferences in terms of how the compensation package is structured. A married employee with children might have drastically different requirements than an unmarried employee. Because of the intricacies of devising an effective compensation plan for international assignees, companies often use consultants knowledgeable in this field. A wide range of allowances and perquisites may be considered for inclusion in expatriate compensation. Hardship or hazard pay may be provided for expatriates assigned to dangerous or undesirable locations. Education assistance may be provided for the expatriate's dependents to make up for quality of education differences between the home and host country. Housing assistance in the form of free company-owned housing to make up for the difference in housing costs between locations may be granted. Multinational enterprises seek to find creative solutions that improve expatriate success while keeping costs under control. 69 The two primary approaches to international compensation for expatriates are the home country-based approach and the host country-based approach. 70 The Home country-based home country-based approach is the most commonly used method. The overall obapproach jective is to maintain the standard of living the expatriate had in the home country. Maintains the standard Housing, taxes, and discretionary spending expenses are calculated based on those of living the expatriate items in the home country. The company then pays the expatriate the difference so had in the home country that he or she "remains whole." The home country approach can result in higher employer costs and more administrative complexity than other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts