Answered step by step

Verified Expert Solution

Question

1 Approved Answer

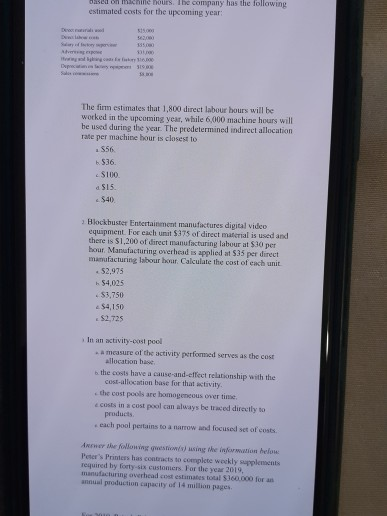

based on machine hours. The company has the following estimated costs for the upcoming year 335.00 www Depreca. The firm estimates that 1.800 direct labour

based on machine hours. The company has the following estimated costs for the upcoming year 335.00 www Depreca. The firm estimates that 1.800 direct labour hours will be worked in the upcoming year, while 6,000 machine hours will be used during the year. The predetermined indirect allocation rate per machine hour is closest to S56 6.536 SIDO $15 $40 Blockbuster Entertainment manufactures digital video equipment. For each unit $375 of direct material is used and there is $1,200 of direct manufacturing labour at $30 per hour Manufacturing overhead is applied at $35 per direct manufacturing labour hour. Calculate the cost of each unit 52,975 1 $4,025 53.750 $4,150 $2.725 In an activity-cost pool . a measure of the activity performed serves as the cost allocation the costs have a case-and-effect relationship with the cost-allocation base for that activity the cost pools are homogeneous over time costs in a cost pool can always be traced directly to products each pool pertains to a narrow and focused set of costs. Anne Hellowing using the information below Peter's Printers has contracts to complete weekly plements required by forty-six customers. For the year 2019, manufacturing overhead cost estimates to S160.000 for al production capacity of 14 million pages based on machine hours. The company has the following estimated costs for the upcoming year 335.00 www Depreca. The firm estimates that 1.800 direct labour hours will be worked in the upcoming year, while 6,000 machine hours will be used during the year. The predetermined indirect allocation rate per machine hour is closest to S56 6.536 SIDO $15 $40 Blockbuster Entertainment manufactures digital video equipment. For each unit $375 of direct material is used and there is $1,200 of direct manufacturing labour at $30 per hour Manufacturing overhead is applied at $35 per direct manufacturing labour hour. Calculate the cost of each unit 52,975 1 $4,025 53.750 $4,150 $2.725 In an activity-cost pool . a measure of the activity performed serves as the cost allocation the costs have a case-and-effect relationship with the cost-allocation base for that activity the cost pools are homogeneous over time costs in a cost pool can always be traced directly to products each pool pertains to a narrow and focused set of costs. Anne Hellowing using the information below Peter's Printers has contracts to complete weekly plements required by forty-six customers. For the year 2019, manufacturing overhead cost estimates to S160.000 for al production capacity of 14 million pages

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started