Question

Based on past experience, Maas Corp. (a U.S.-based company) expects to purchase raw materials from a foreign supplier at a cost of 1,500,000 francs on

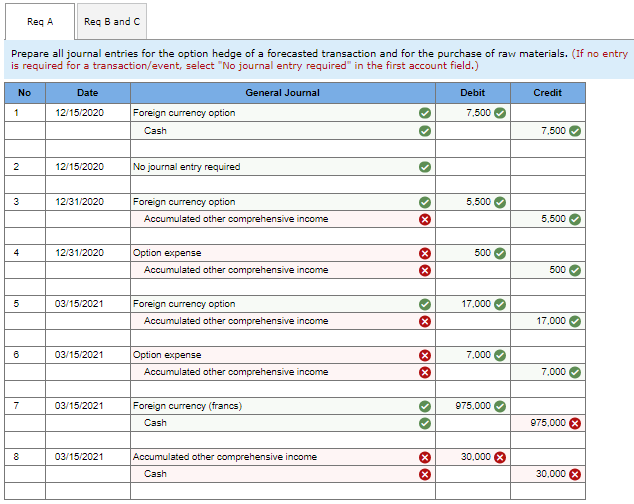

Based on past experience, Maas Corp. (a U.S.-based company) expects to purchase raw materials from a foreign supplier at a cost of 1,500,000 francs on March 15, 2021. To hedge this forecasted transaction, on December 15, 2020, the company acquires a call option to purchase 1,500,000 francs in three months. Maas selects a strike price of $0.63 per franc when the spot rate is $0.63 and pays a premium of $0.005 per franc. The spot rate increases to $0.634 at December 31, 2020, causing the fair value of the option to increase to $13,000. By March 15, 2021, when the raw materials are purchased, the spot rate has climbed to $0.65, resulting in a fair value for the option of $30,000. The raw materials are used in assembling finished products, which are sold by December 31, 2021, when Maas prepares its annual financial statements.

-

Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials.

-

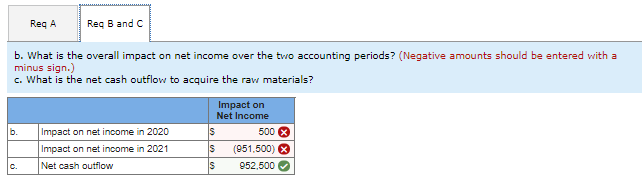

What is the overall impact on net income over the two accounting periods?

-

What is the net cash outflow to acquire the raw materials?

Please answer all questions and make sure the answers are correct~! Thank you :)

Req A Reg Band C Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Date General Journal Debit Credit 1 12/15/2020 7.500 Foreign currency option Cash 7.500 2 12/15/2020 No journal entry required 3 12/31/2020 5,500 Foreign currency option Accumulated other comprehensive income IX 5,500 4 12/31/2020 500 Option expense Accumulated other comprehensive income x x 500 5 03/15/2021 17.000 Foreign currency option Accumulated other comprehensive income x 17.000 6 03/15/2021 7,000 Option expense Accumulated other comprehensive income x x 7.000 7 03/15/2021 975,000 Foreign currency (francs) Cash 975,000 03/15/2021 30,000 Accumulated other comprehensive income Cash XX 30.000 X Reg A Reg Band c b. What is the overall impact on net income over the two accounting periods? (Negative amounts should be entered with a minus sign.) C. What is the net cash outflow to acquire the raw materials? Impact on Net Income Impact on net income in 2020 S 500 X Impact on net income in 2021 (951,500) X Net cash outflow IS 952,500 b. S cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started