Answered step by step

Verified Expert Solution

Question

1 Approved Answer

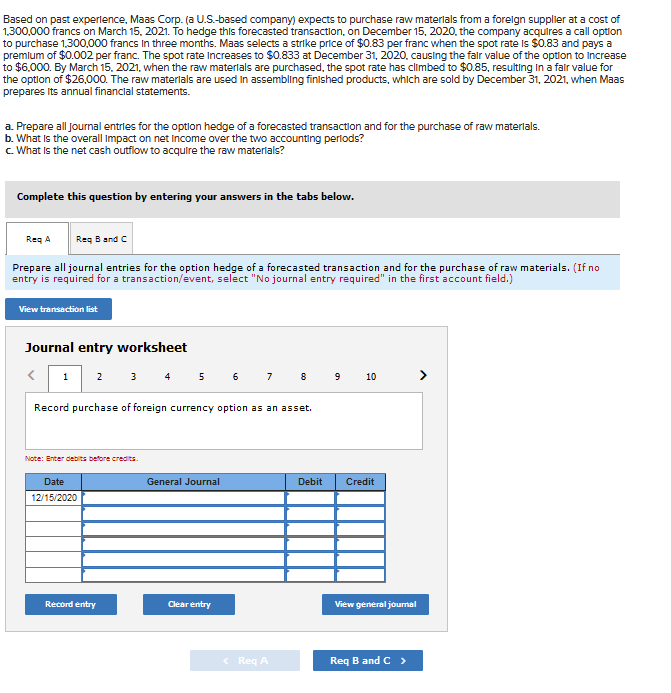

Based on past experlence, Maas Corp. (a U.S.-based company) expects to purchase raw materlals from a forelgn supplier at a cost of 1,300,000 francs on

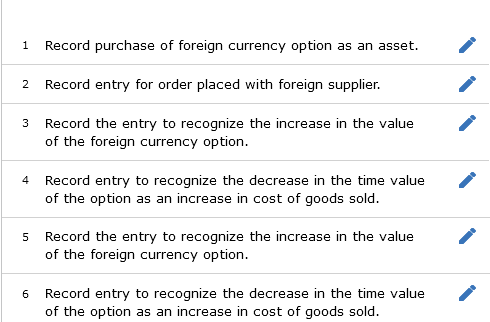

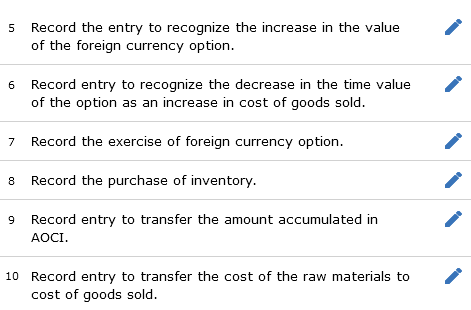

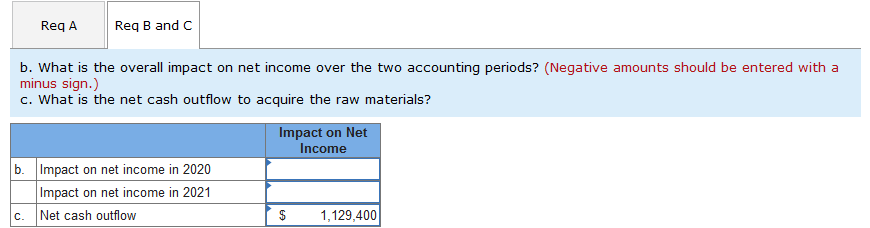

Based on past experlence, Maas Corp. (a U.S.-based company) expects to purchase raw materlals from a forelgn supplier at a cost of 1,300,000 francs on March 15, 2021. To hedge this forecasted transaction, on December 15, 2020, the company acquires a call optlon to purchase 1,300,000 francs in three months. Maas selects a strlke price of $0.83 per franc when the spot rate Is $0.83 and pays a premlum of $0.002 per franc. The spot rate Increases to $0.833 at December 31,2020 , causing the falr value of the option to Increase to $6,000. By March 15,2021 , when the raw materlals are purchased, the spot rate has climbed to $0.85, resulting In a falr value for the optlon of $26,000. The raw materlals are used in assembling finished products, which are sold by December 31, 2021, when Maas prepares its annual financlal statements. a. Prepare all journal entries for the optlon hedge of a forecasted transaction and for the purchase of raw materlals. b. What is the overall Impact on net Income over the two accounting perlods? c. What is the net cash outflow to acquire the raw materlals? Complete this question by entering your answers in the tabs below. Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 2345678910 Record purchase of foreign currency option as an asset. Note: Enter debits before credts. 1 Record purchase of foreign currency option as an asset. 2 Record entry for order placed with foreign supplier. 3 Record the entry to recognize the increase in the value of the foreign currency option. 4 Record entry to recognize the decrease in the time value of the option as an increase in cost of goods sold. 5 Record the entry to recognize the increase in the value of the foreign currency option. 6 Record entry to recognize the decrease in the time value of the option as an increase in cost of goods sold. 5 Record the entry to recognize the increase in the value of the foreign currency option. 6 Record entry to recognize the decrease in the time value of the option as an increase in cost of goods sold. 7 Record the exercise of foreign currency option. 8 Record the purchase of inventory. 9 Record entry to transfer the amount accumulated in AOCI. 10 Record entry to transfer the cost of the raw materials to cost of goods sold. b. What is the overall impact on net income over the two accounting periods? (Negative amounts should be entered with a minus sign.) c. What is the net cash outflow to acquire the raw materials

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started