Answered step by step

Verified Expert Solution

Question

1 Approved Answer

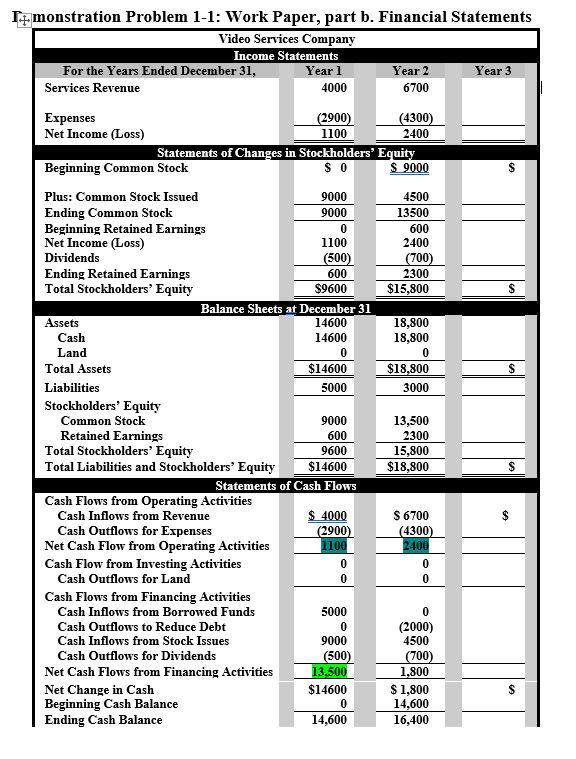

Based on the Accounting Equation events, prepare a financial report. I am confused with year 2 net change in cash scenario. It looks like my

Based on the Accounting Equation events, prepare a financial report. I am confused with year 2 net change in cash scenario. It looks like my ending balance is not matching. Help! Thank you i will rate

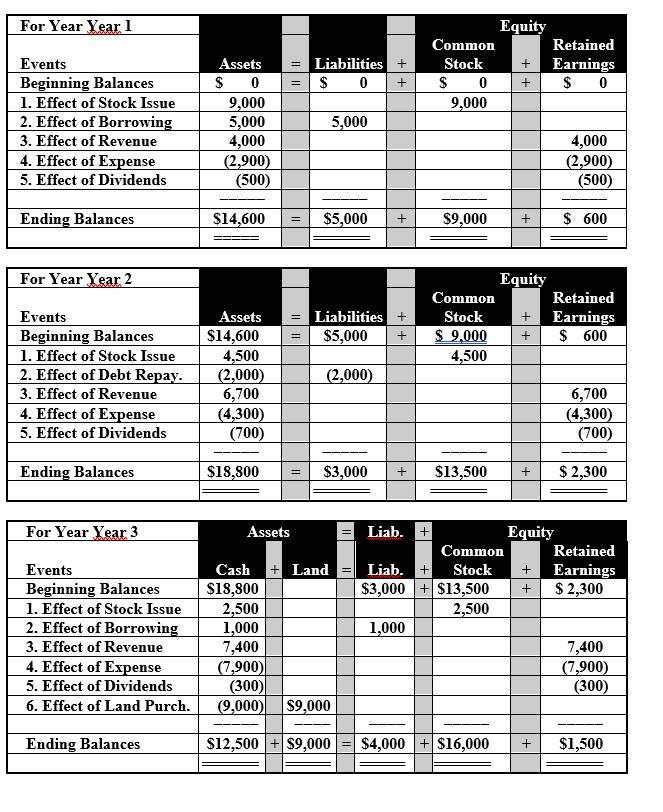

For Year Year 1 = Liabilities + $ 0 + Equity Common Retained Stock + Earnings $ 0 + $ 0 9,000 = Events Beginning Balances 1. Effect of Stock Issue 2. Effect of Borrowing 3. Effect of Revenue 4. Effect of Expense 5. Effect of Dividends Assets $ 0 9,000 5,000 4,000 (2,900) (500) 5,000 4,000 (2,900) (500) Ending Balances $14,600 = $5,000 + $9,000 + $ 600 For Year Year 2 Liabilities + $5,000 + Equity Common Retained Stock + Earnings $ 9.000 + $ 600 4,500 = Events Beginning Balances 1. Effect of Stock Issue 2. Effect of Debt Repay. 3. Effect of Revenue 4. Effect of Expense 5. Effect of Dividends Assets $14,600 4,500 (2,000) 6,700 (4,300 (700) (2,000) 6,700 (4,300) (700) Ending Balances $18,800 = $3,000 + $13,500 + $2,300 For Year Year 3 Events Beginning Balances 1. Effect of Stock Issue 2. Effect of Borrowing 3. Effect of Revenue 4. Effect of Expense 5. Effect of Dividends 6. Effect of Land Purch. Assets Liab. + Equity Common Retained Cash + Land = Liab. + Stock + Earnings $18,800 $3,000 + $13,500 + $ 2,300 2,500 2,500 1,000 1,000 7,400 7,400 (7,900) (7,900) (300) (300) 9,000 $9,000 Ending Balances $12,500 + $9,000 = $4,000 + $16,000 + $1,500 Imonstration Problem 1-1: Work Paper, part b. Financial Statements Video Services Company Income Statements For the Years Ended December 31, Year 1 Year 2 Year 3 Services Revenue 4000 6700 S S S Expenses (2900) (4300) Net Income (Loss) 1100 2400 Statements of Changes in Stockholders' Equity Beginning Common Stock $0 $ 9000 Plus: Common Stock Issued 9000 4500 Ending Common Stock 9000 13500 Beginning Retained Earnings 0 600 Net Income (Loss) 1100 2400 Dividends (500) (700) Ending Retained Earnings 600 2300 Total Stockholders' Equity $9600 $15,800 Balance Sheets at December 31 Assets 14600 18,800 Cash 14600 18,800 Land 0 0 Total Assets $14600 $18.800 Liabilities 5000 3000 Stockholders' Equity Common Stock 9000 13,500 Retained Earnings 600 2300 Total Stockholders' Equity 9600 15,800 Total Liabilities and Stockholders' Equity $14600 $18,800 Statements of Cash Flows Cash Flows from Operating Activities Cash Inflows from Revenue $ 4000 $ 6700 Cash Outflows for Expenses (2900 (4300) Net Cash Flow from Operating Activities 1100 2400 Cash Flow from Investing Activities 0 0 Cash Outflows for Land 0 0 Cash Flows from Financing Activities Cash Inflows from Borrowed Funds 5000 0 Cash Outflows to Reduce Debt 0 (2000) Cash Inflows from Stock Issues 9000 4500 Cash Outflows for Dividends (500) (700) Net Cash Flows from Financing Activities 13,500 1,800 Net Change in Cash $14600 $ 1,800 Beginning Cash Balance 0 14,600 Ending Cash Balance 14,600 16,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started