Answered step by step

Verified Expert Solution

Question

1 Approved Answer

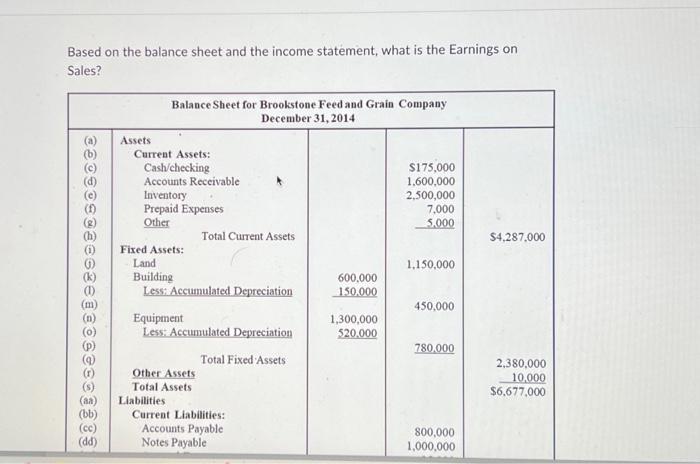

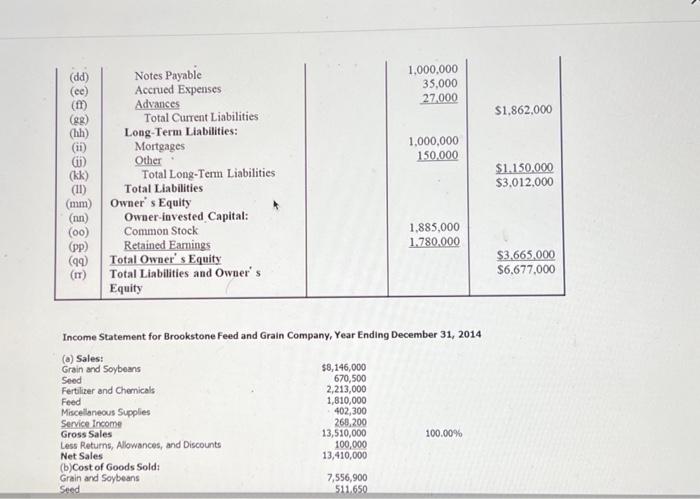

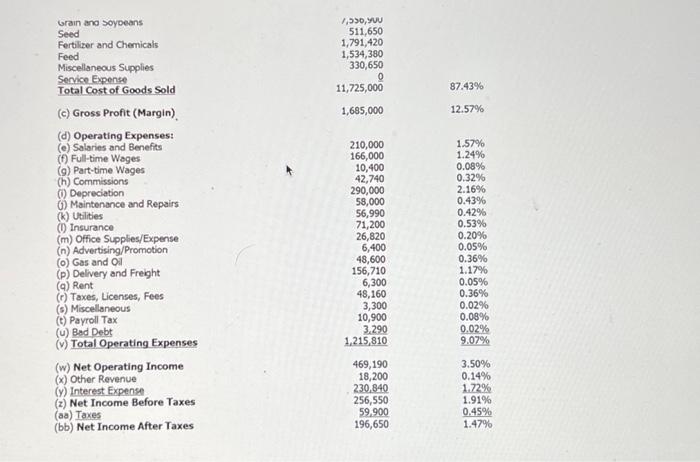

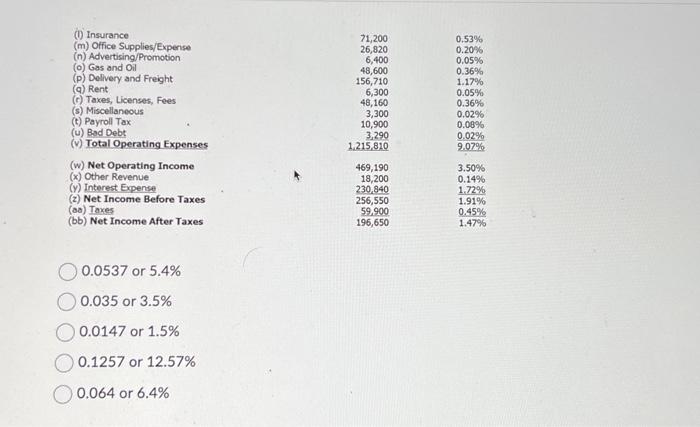

Based on the balance sheet and the income statement below, what is the Return on Equity? Question 2 (10 points) Based on the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started