Based on the Below information reflect on the business decision Blue Wolf made regarding the purchase of the Neenah plant. Draw on the knowledge you have gained in this module to complete this activity. Address the following questions in your reflection:

- How realistic are Blue Wolfs plans to buy and turn the plant around?

- If you were a Blue Wolf stakeholder or board member, would you accept, reject, or alter the course of action? Why?

- Which factors are key to consider in order to make an informed decision about this case? Why?

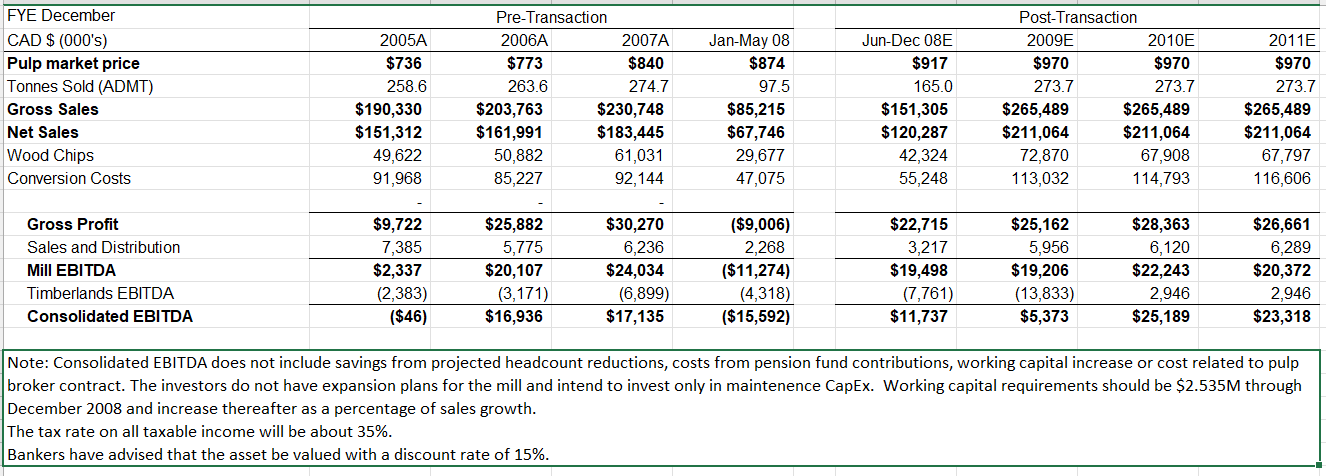

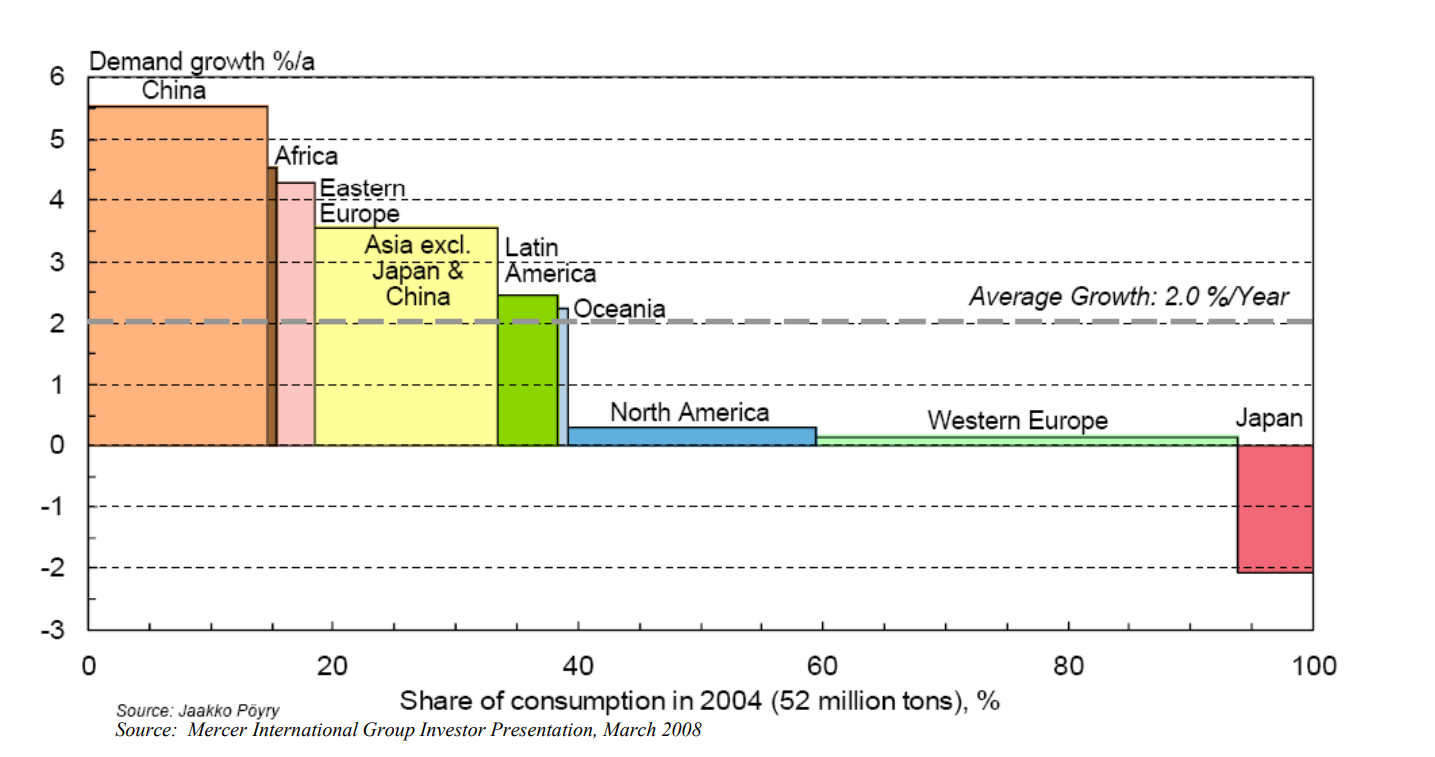

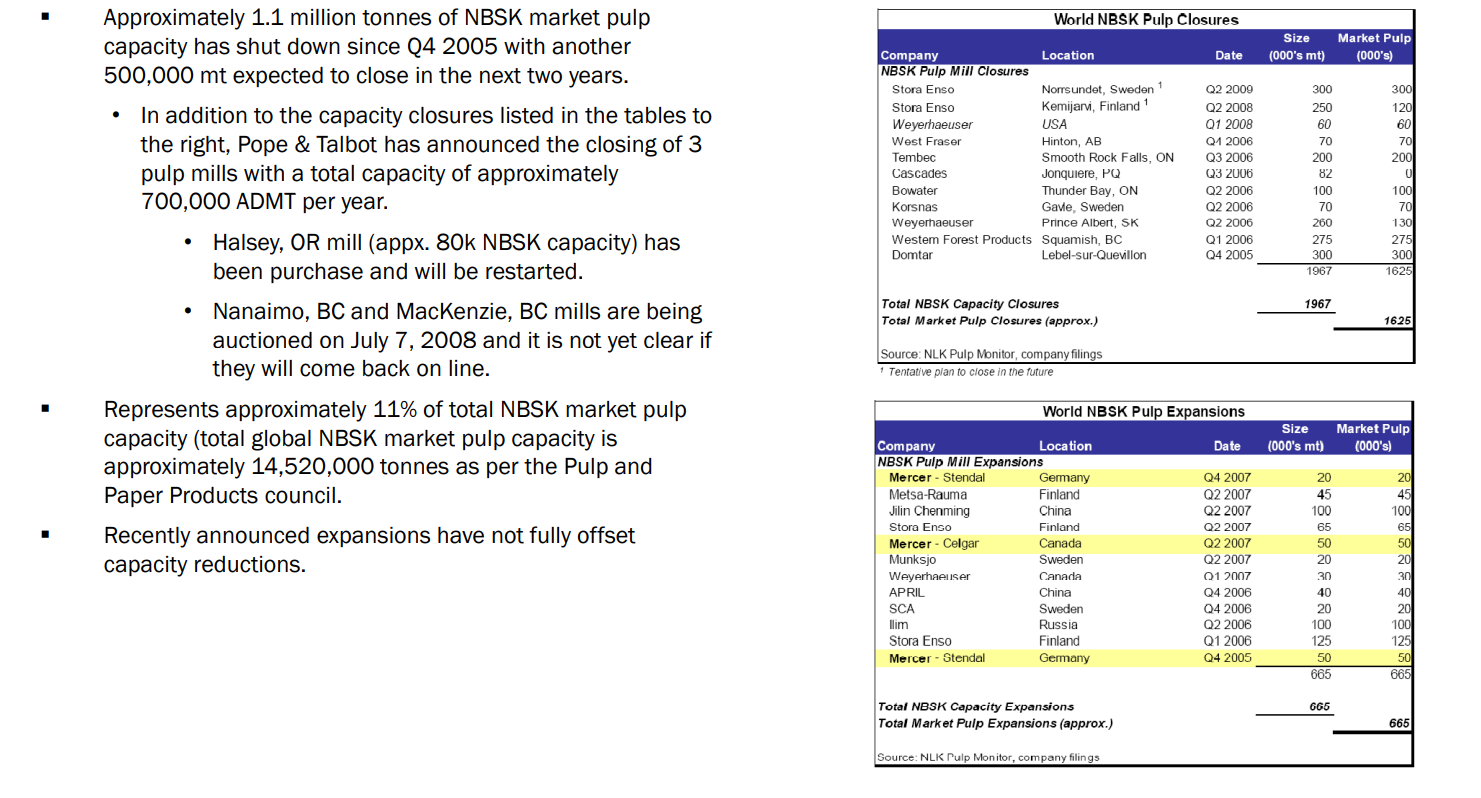

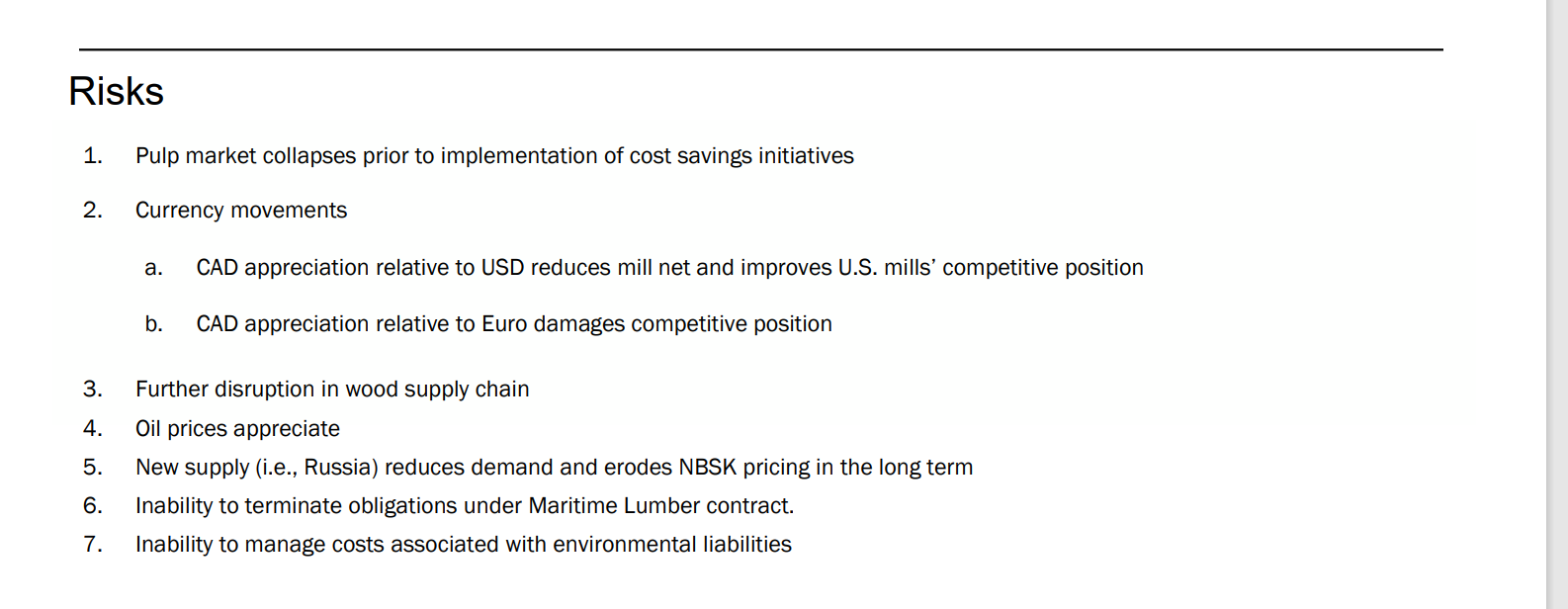

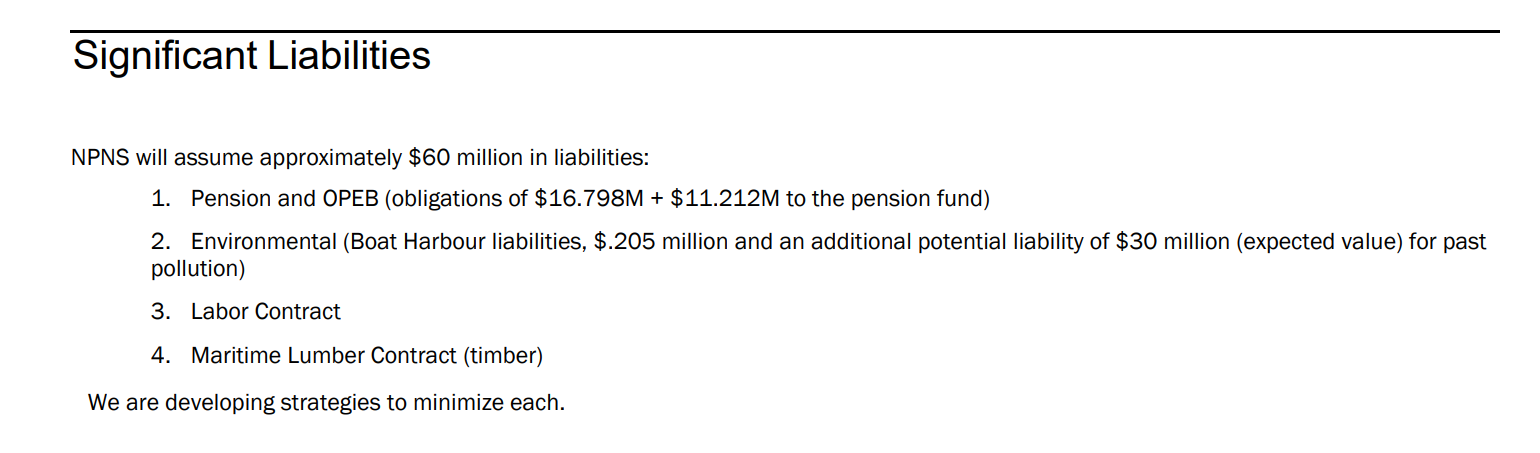

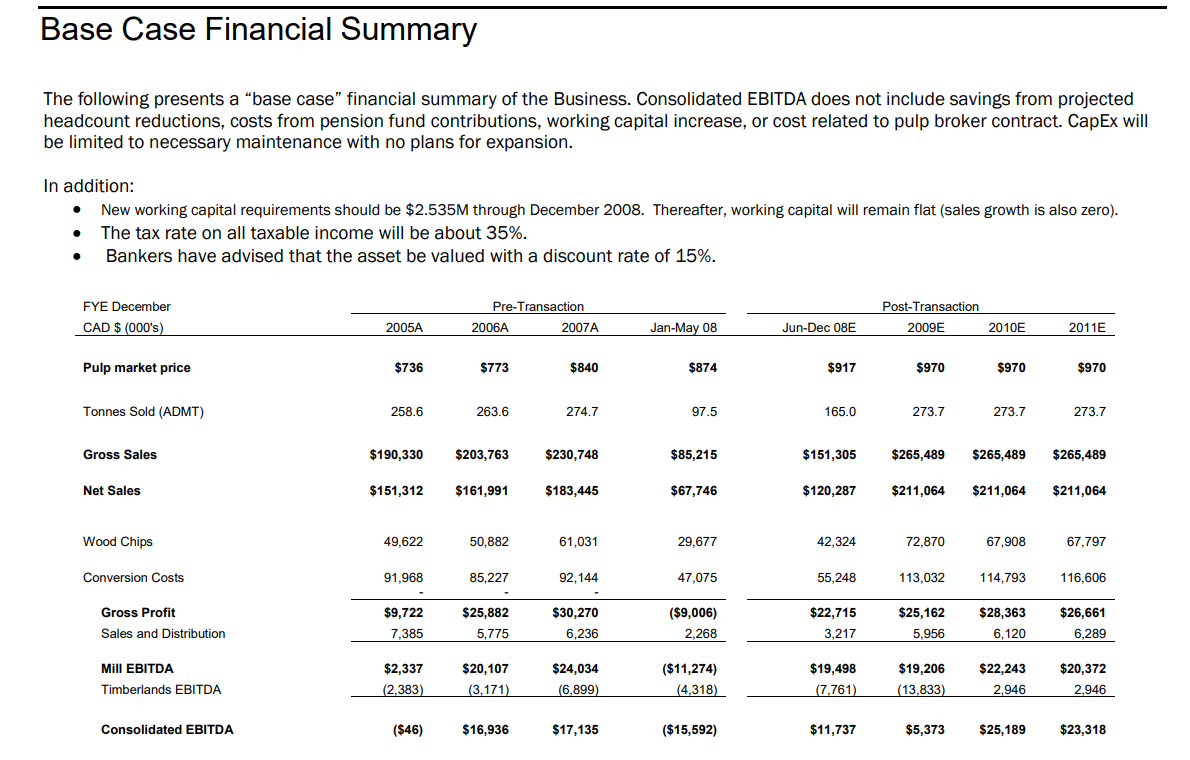

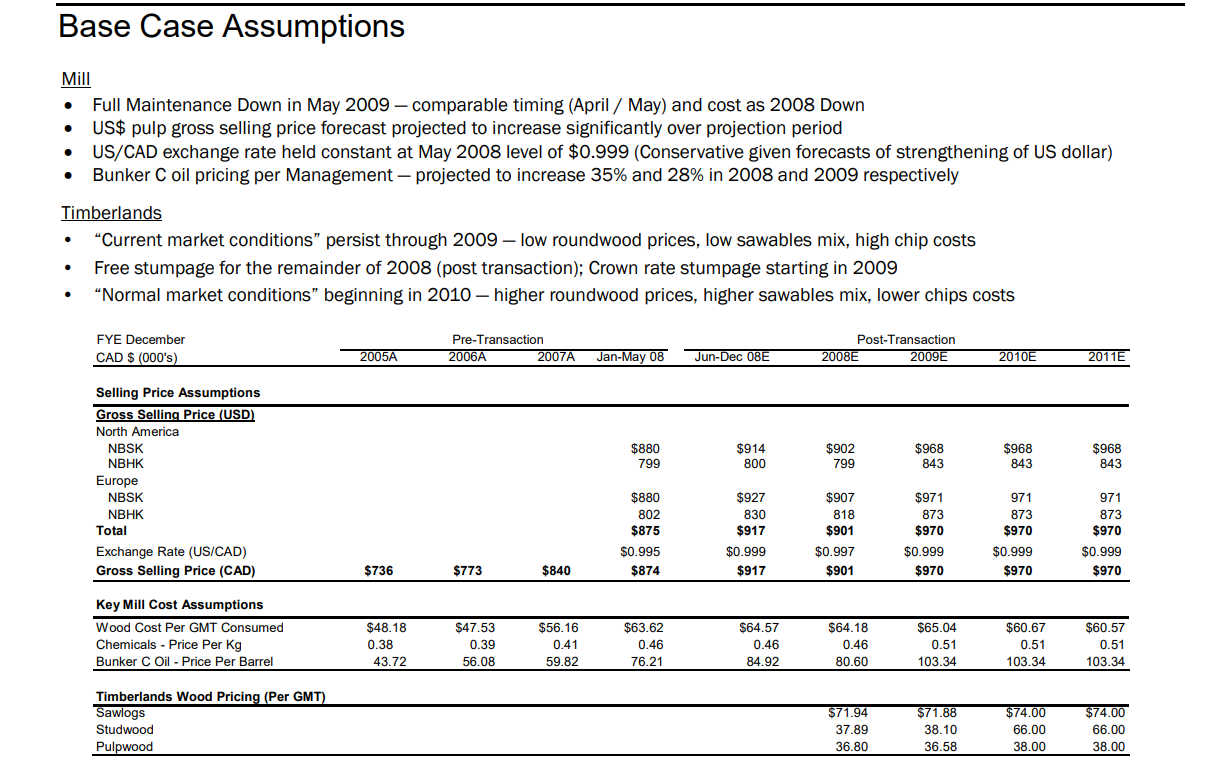

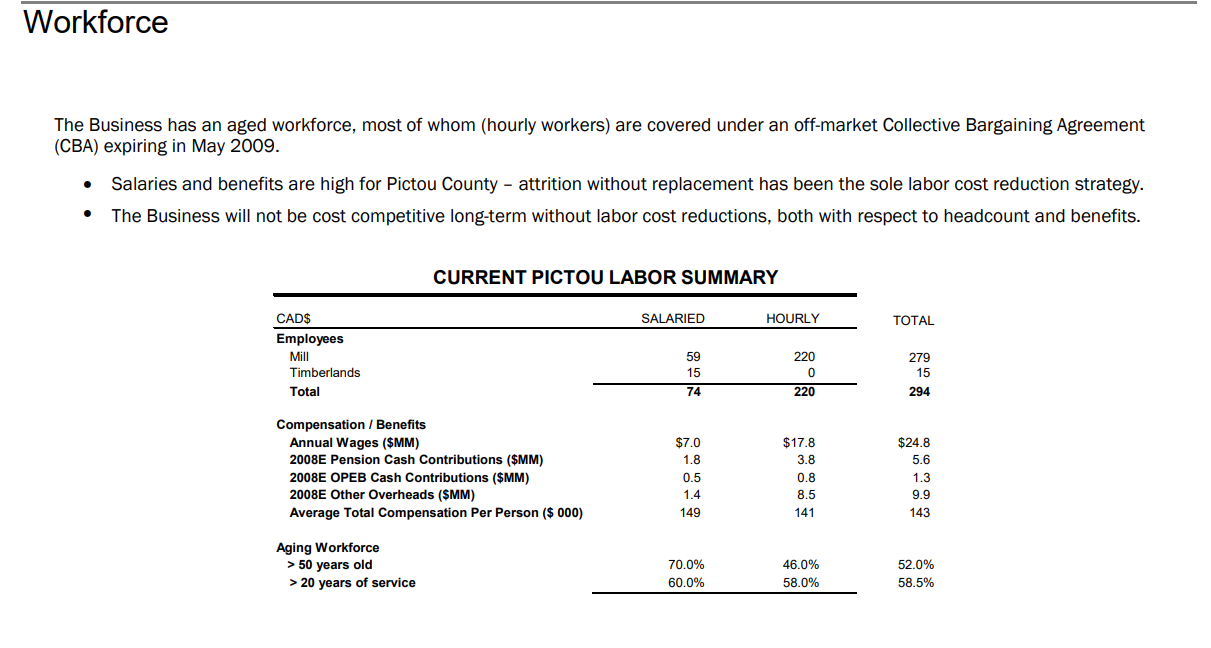

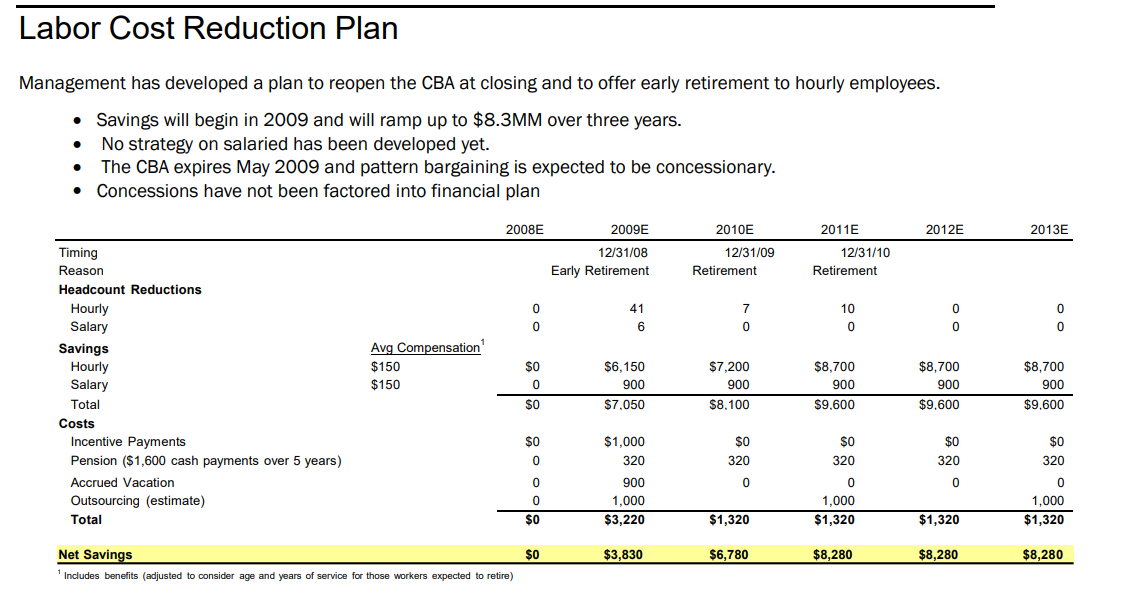

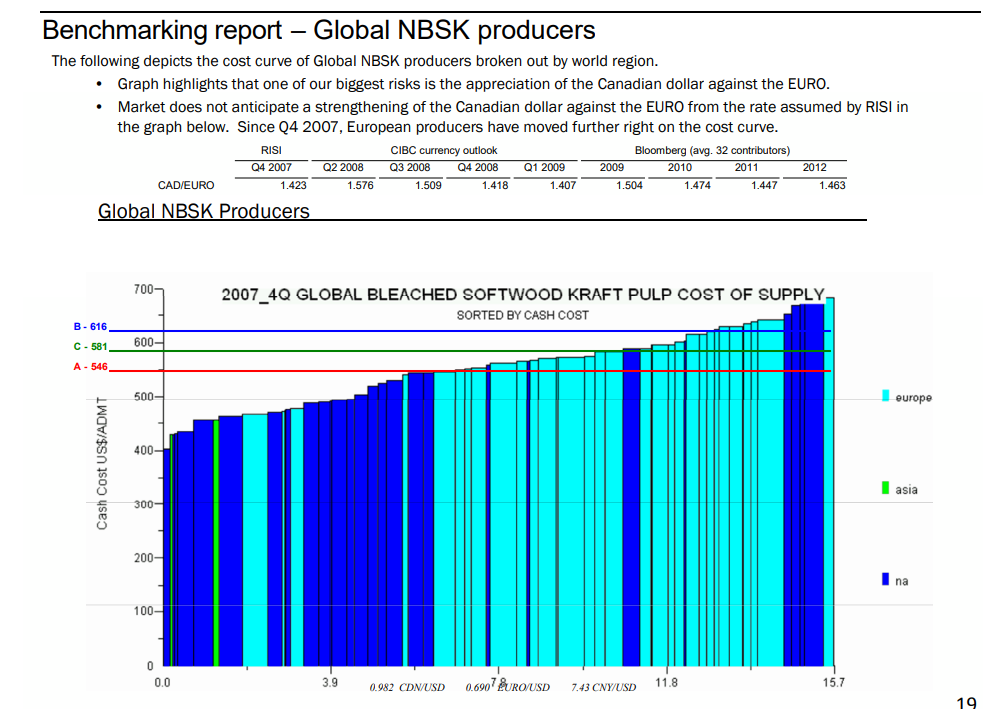

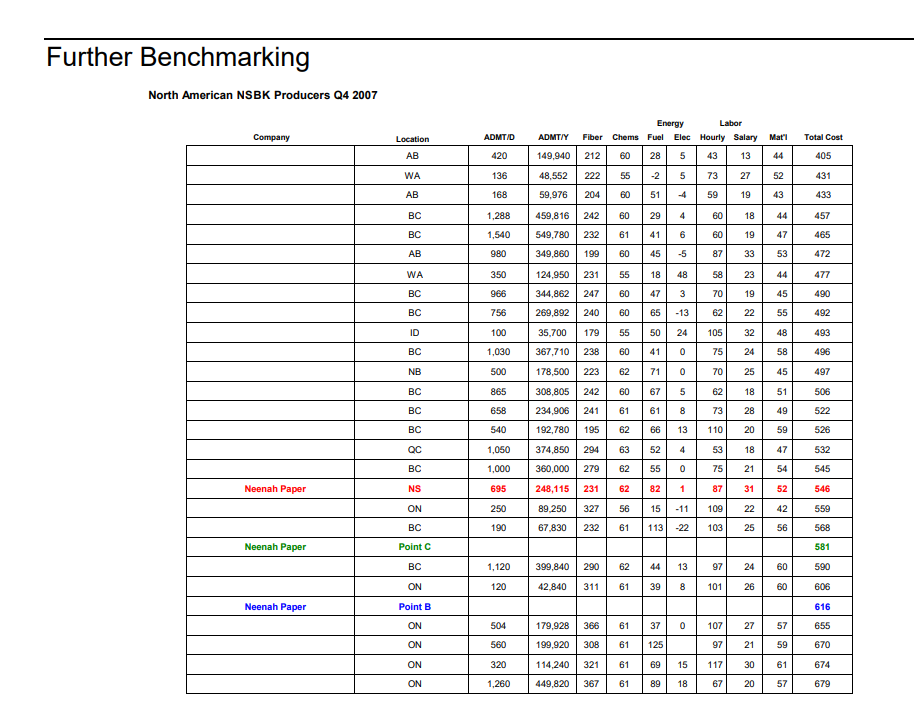

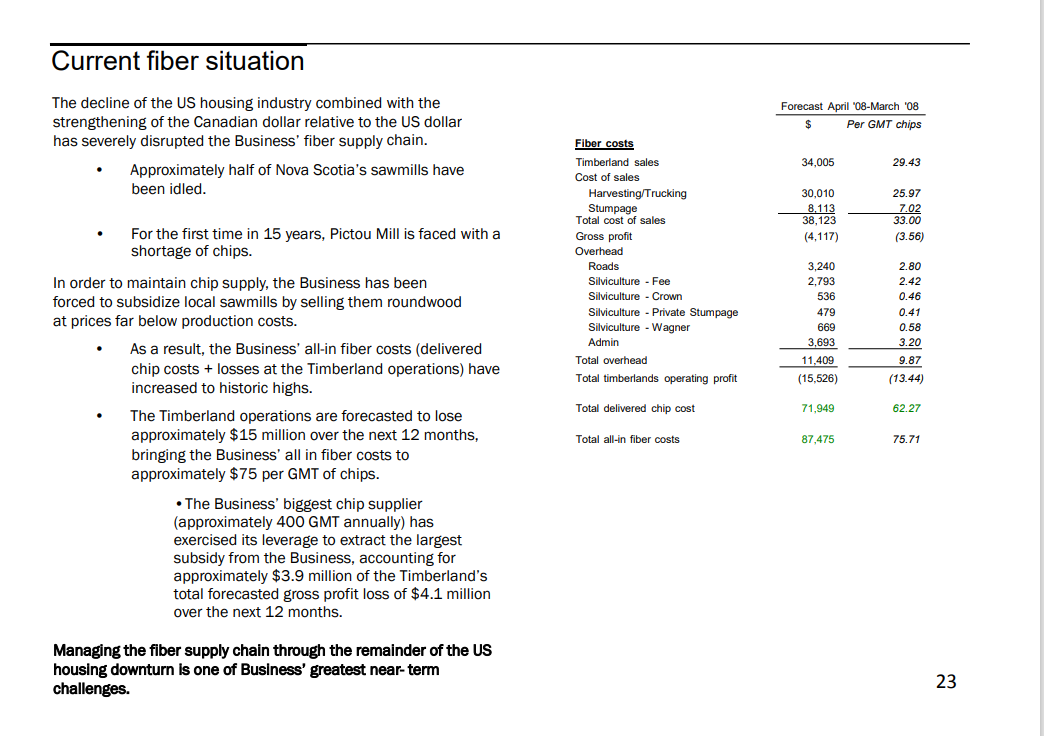

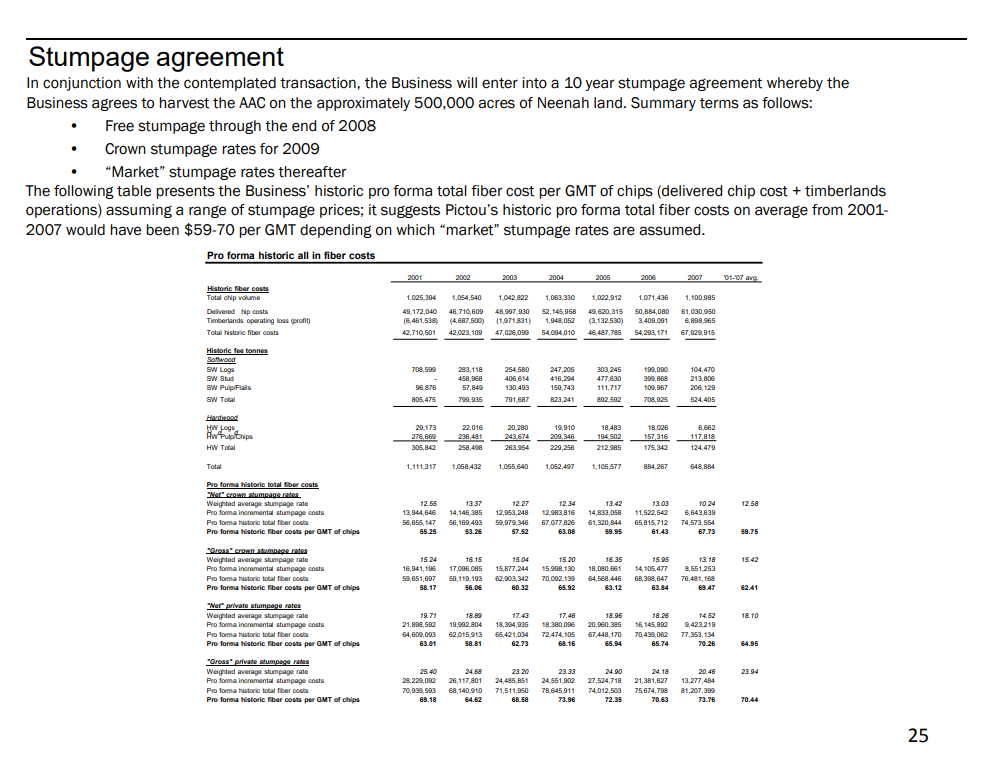

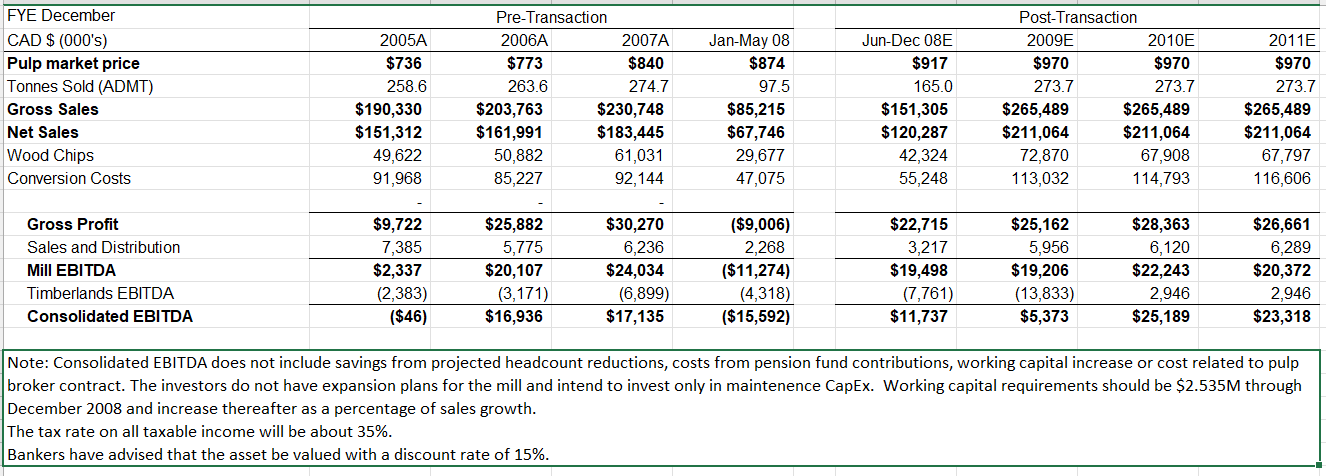

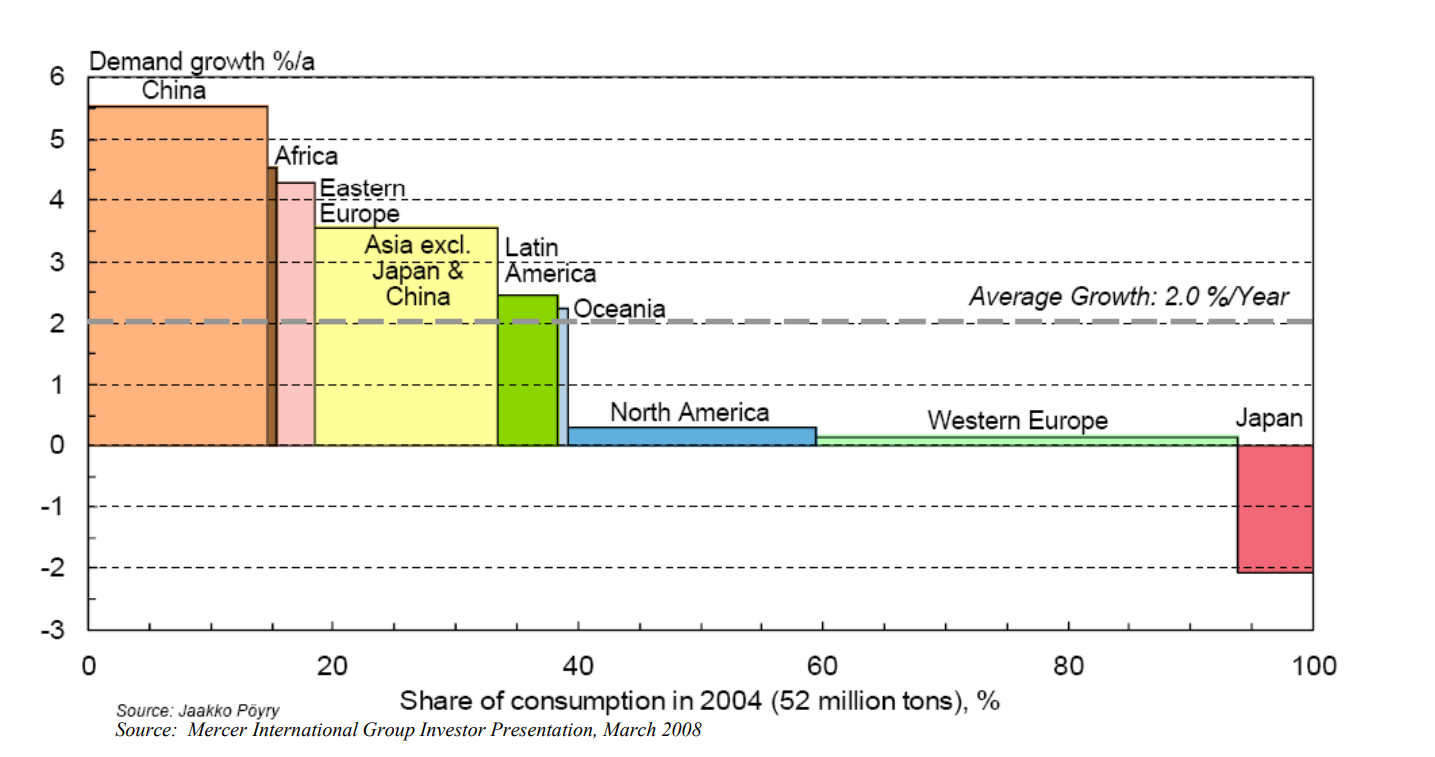

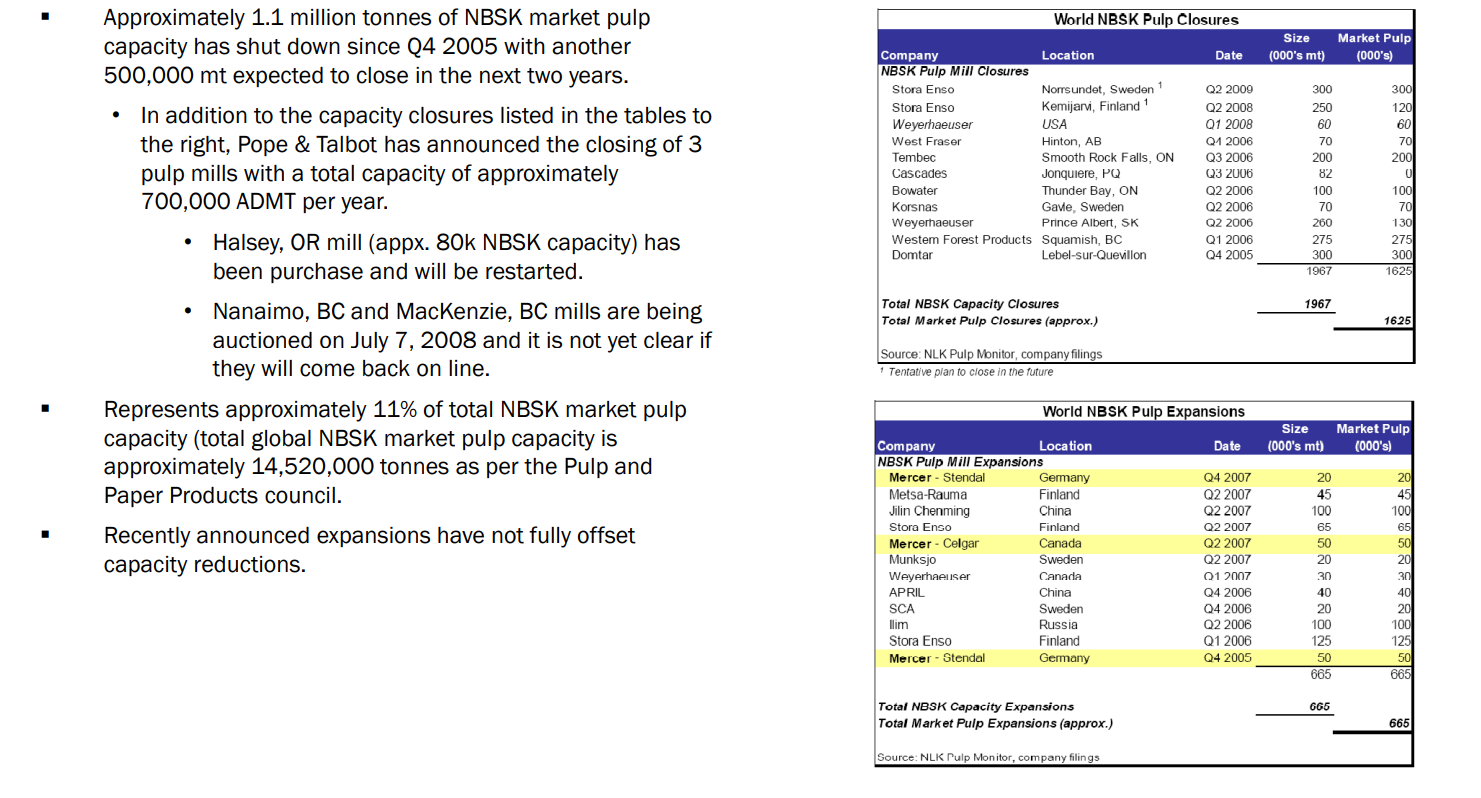

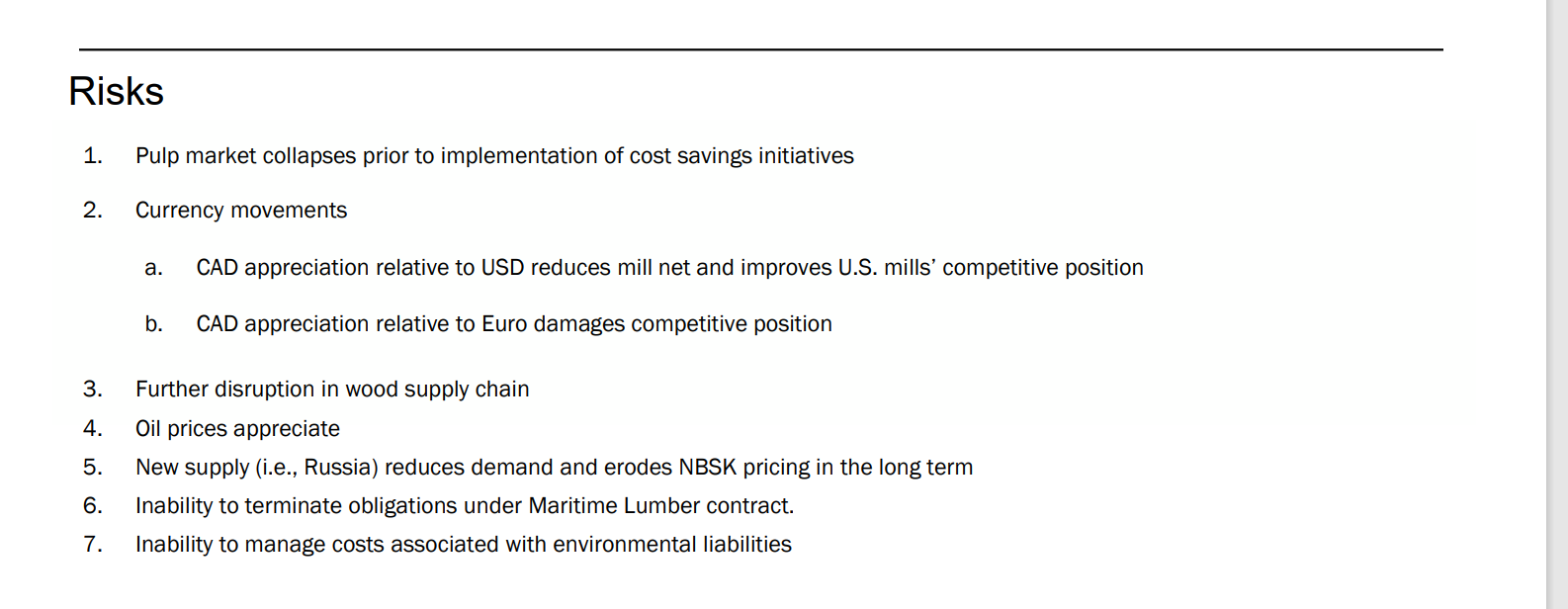

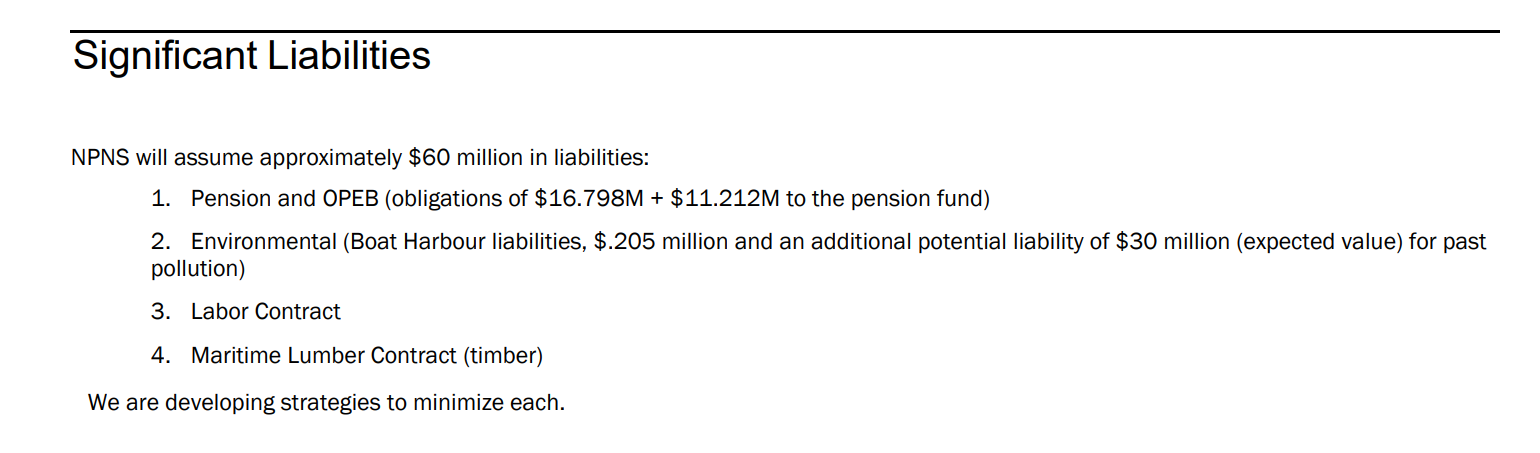

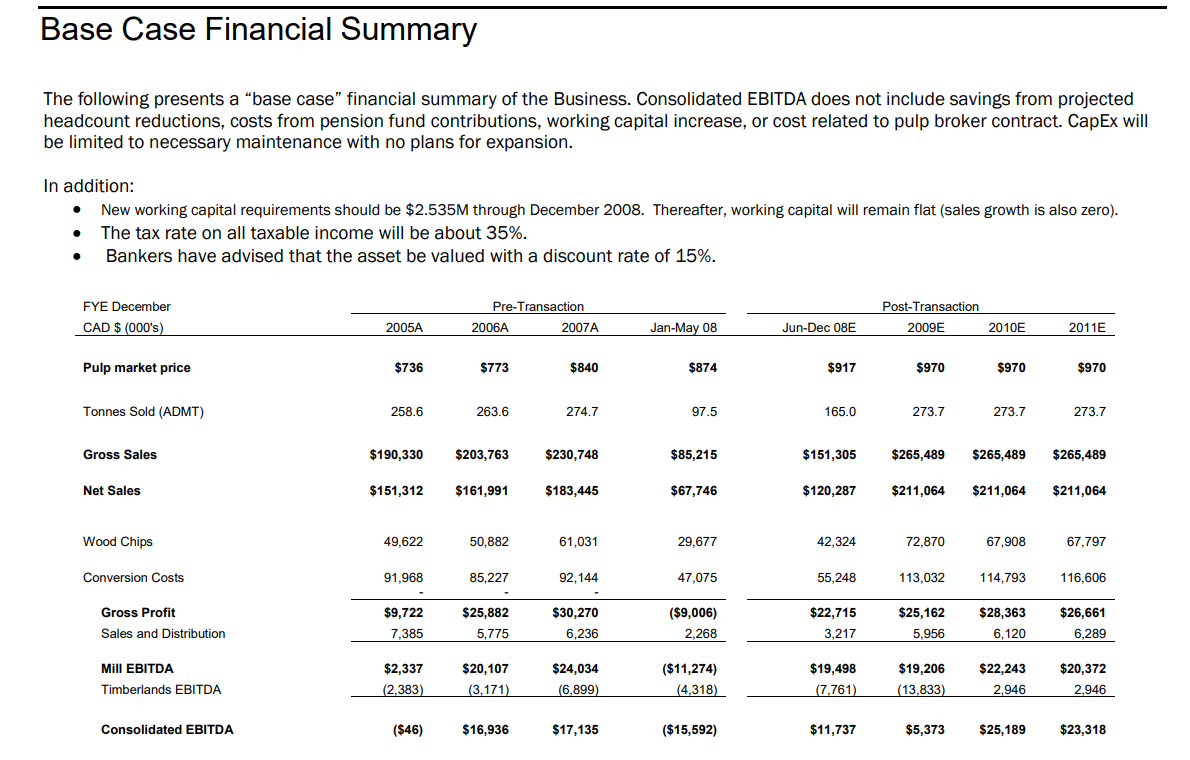

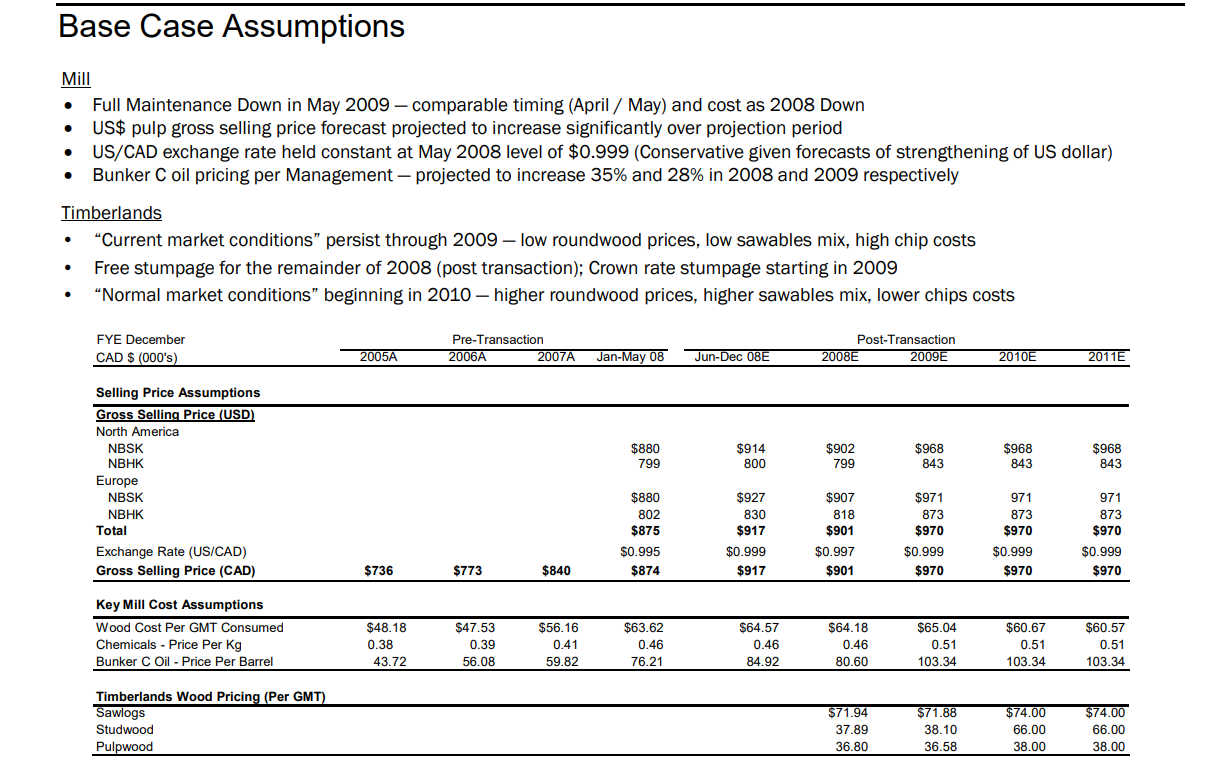

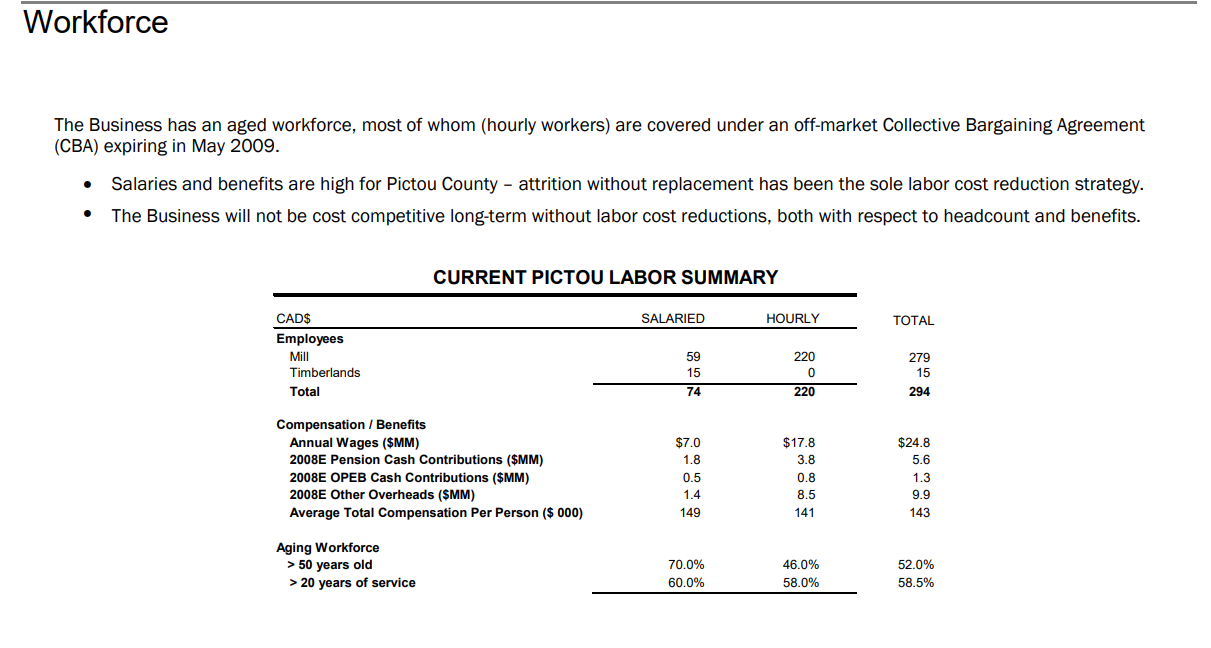

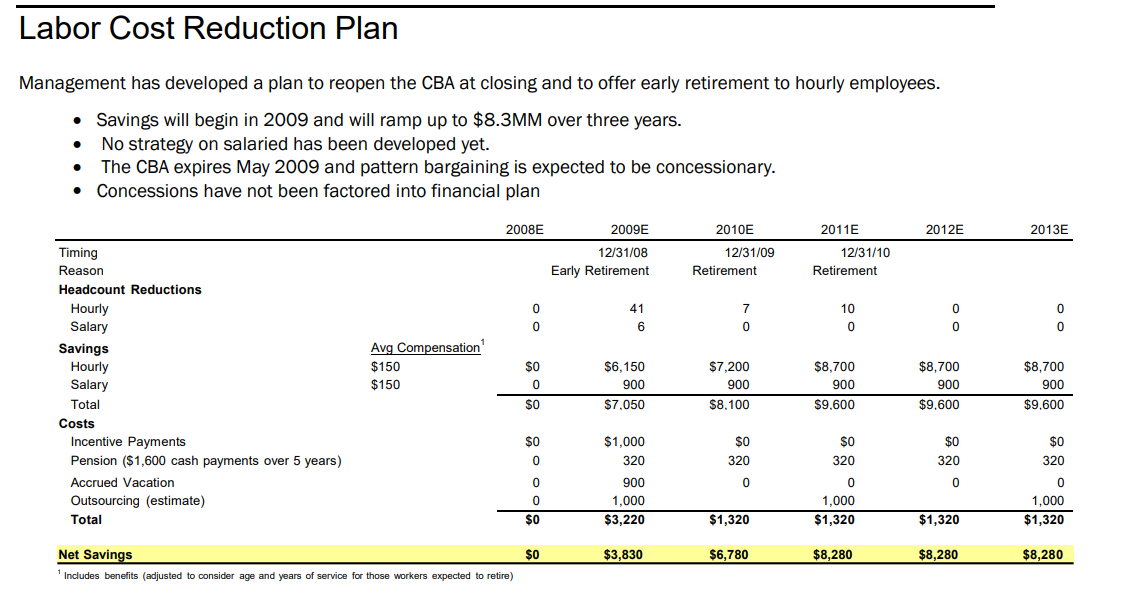

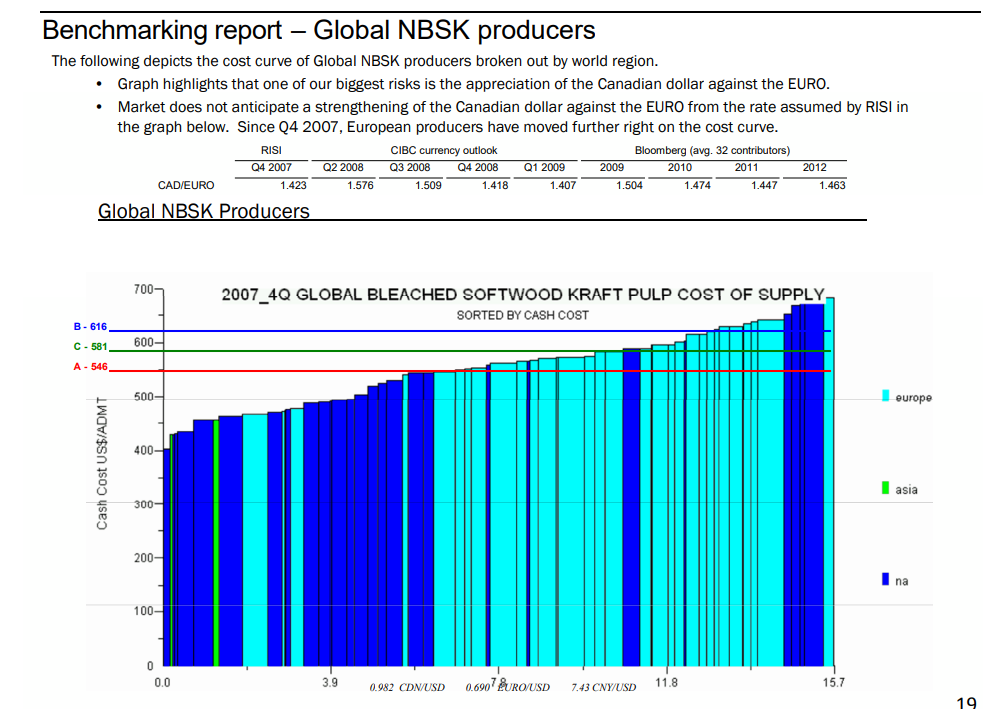

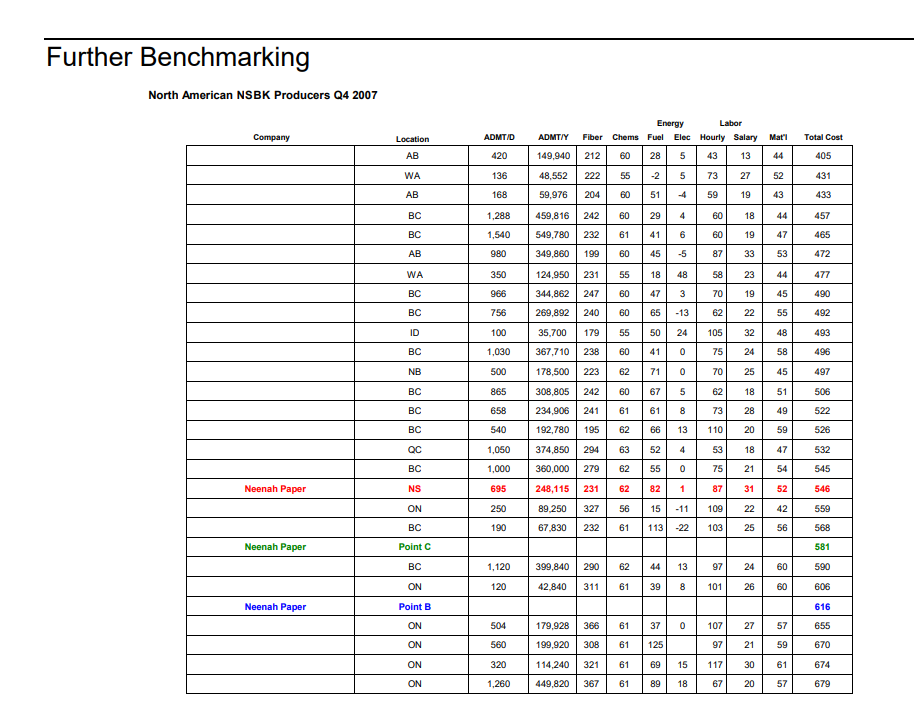

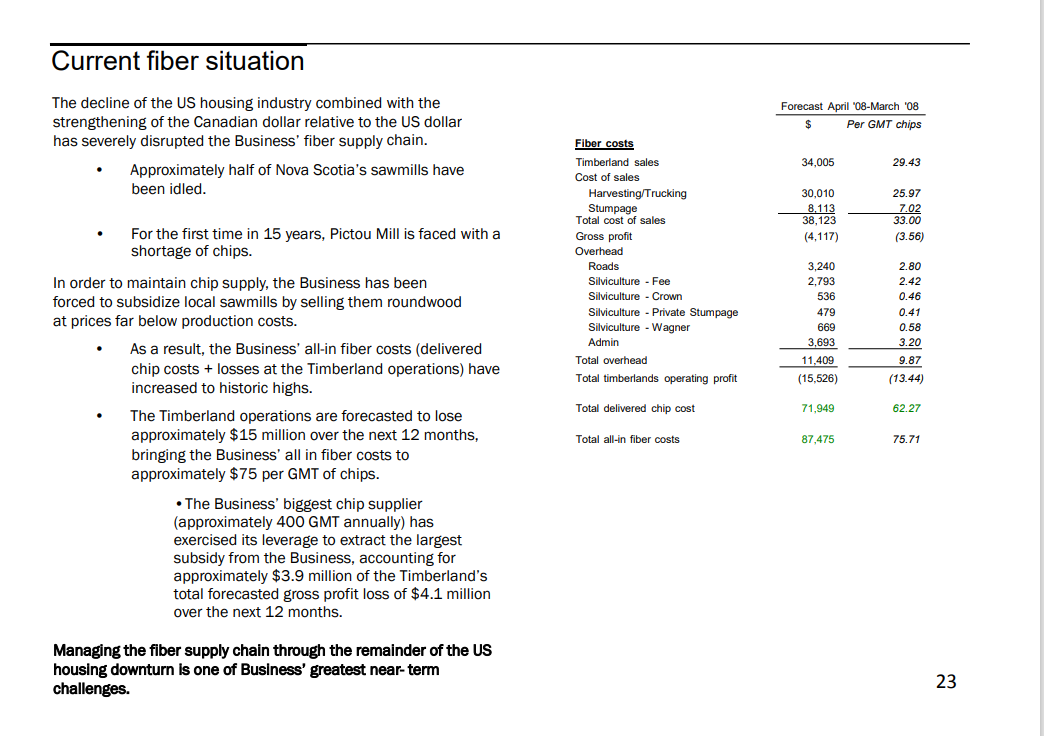

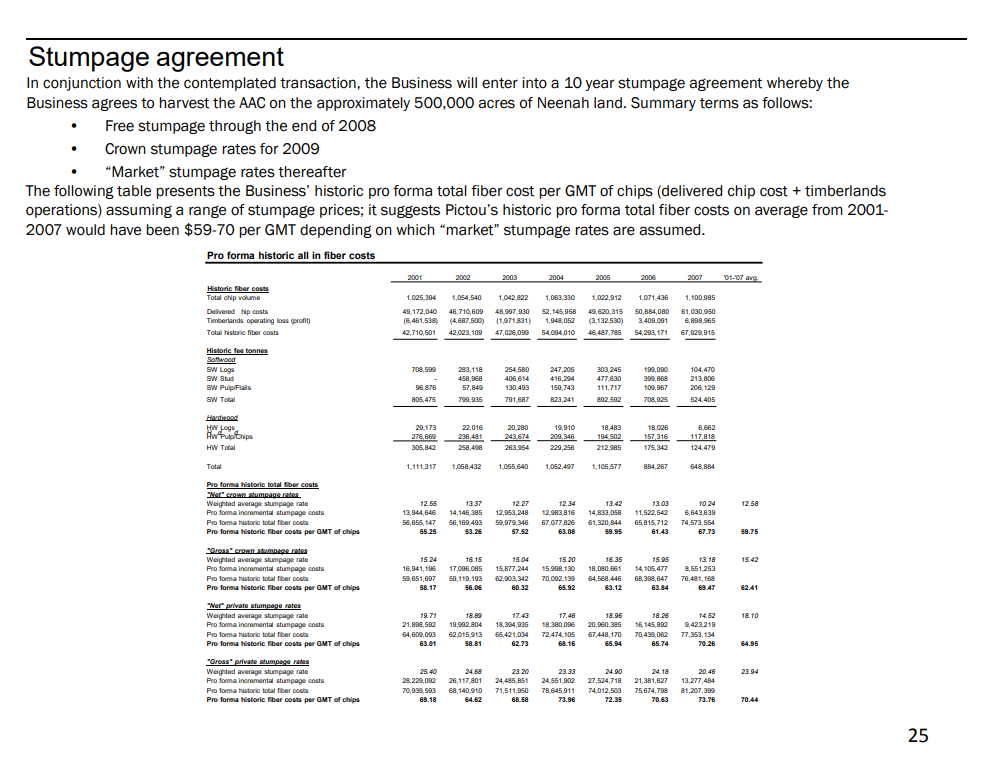

Note: Consolidated EBITDA does not include savings from projected headcount reductions, costs from pension fund contributions, working capital increase or cost related to pulp broker contract. The investors do not have expansion plans for the mill and intend to invest only in maintenence CapEx. Working capital requirements should be $2.535M through December 2008 and increase thereafter as a percentage of sales growth. The tax rate on all taxable income will be about 35%. Bankers have advised that the asset be valued with a discount rate of 15%. Source: Jaakko Pyry Share of consumption in 2004 (52 million tons), % Source: Mercer International Group Investor Presentation, March 2008 - Approximately 1.1 million tonnes of NBSK market pulp capacity has shut down since Q4 2005 with another 500,000 mt expected to close in the next two years. - In addition to the capacity closures listed in the tables to the right, Pope \& Talbot has announced the closing of 3 pulp mills with a total capacity of approximately 700,000 ADMT per year. - Halsey, OR mill (appx. 80k NBSK capacity) has been purchase and will be restarted. - Nanaimo, BC and MacKenzie, BC mills are being auctioned on July 7,2008 and it is not yet clear if they will come back on line. - Represents approximately 11% of total NBSK market pulp capacity (total global NBSK market pulp capacity is approximately 14,520,000 tonnes as per the Pulp and Paper Products council. Recently announced expansions have not fully offset capacity reductions. 1. Pulp market collapses prior to implementation of cost savings initiatives 2. Currency movements a. CAD appreciation relative to USD reduces mill net and improves U.S. mills' competitive position b. CAD appreciation relative to Euro damages competitive position 3. Further disruption in wood supply chain 4. Oil prices appreciate 5. New supply (i.e., Russia) reduces demand and erodes NBSK pricing in the long term 6. Inability to terminate obligations under Maritime Lumber contract. 7. Inability to manage costs associated with environmental liabilities NPNS will assume approximately $60 million in liabilities: 1. Pension and OPEB (obligations of $16.798M+$11.212M to the pension fund) 2. Environmental (Boat Harbour liabilities, $.205 million and an additional potential liability of $30 million (expected value) for past pollution) 3. Labor Contract 4. Maritime Lumber Contract (timber) We are developing strategies to minimize each. Base Case Financial Summary The following presents a "base case" financial summary of the Business. Consolidated EBITDA does not include savings from projected headcount reductions, costs from pension fund contributions, working capital increase, or cost related to pulp broker contract. CapEx will be limited to necessary maintenance with no plans for expansion. In addition: - New working capital requirements should be $2.535M through December 2008. Thereafter, working capital will remain flat (sales growth is also zero). - The tax rate on all taxable income will be about 35%. - Bankers have advised that the asset be valued with a discount rate of 15%. Base Case Assumptions Mill - Full Maintenance Down in May 2009 - comparable timing (April / May) and cost as 2008 Down - US\$ pulp gross selling price forecast projected to increase significantly over projection period - US/CAD exchange rate held constant at May 2008 level of $0.999 (Conservative given forecasts of strengthening of US dollar) - Bunker C oil pricing per Management - projected to increase 35% and 28% in 2008 and 2009 respectively Timberlands - Current market conditions" persist through 2009 - low roundwood prices, low sawables mix, high chip costs - Free stumpage for the remainder of 2008 (post transaction); Crown rate stumpage starting in 2009 - "Normal market conditions" beginning in 2010 - higher roundwood prices, higher sawables mix, lower chips costs The Business has an aged workforce, most of whom (hourly workers) are covered under an off-market Collective Bargaining Agreement (CBA) expiring in May 2009. - Salaries and benefits are high for Pictou County - attrition without replacement has been the sole labor cost reduction strategy. - The Business will not be cost competitive long-term without labor cost reductions, both with respect to headcount and benefits. Labor Cost Reduction Plan Management has developed a plan to reopen the CBA at closing and to offer early retirement to hourly employees. - Savings will begin in 2009 and will ramp up to $8.3MM over three years. - No strategy on salaried has been developed yet. - The CBA expires May 2009 and pattern bargaining is expected to be concessionary. - Concessions have not been factored into financial plan 1 Includes benefits (adjusted to consider age and years of service for those workers expected to retire) Benchmarking report - Global NBSK producers The following depicts the cost curve of Global NBSK producers broken out by world region. - Graph highlights that one of our biggest risks is the appreciation of the Canadian dollar against the EURO. - Market does not anticipate a strengthening of the Canadian dollar against the EURO from the rate assumed by RISI in the graph below. Since Q4 2007, European producers have moved further right on the cost curve. North American NSBK Producers Q4 2007 Current fiber situation The decline of the US housing industry combined with the strengthening of the Canadian dollar relative to the US dollar has severely disrupted the Business' fiber supply chain. - Approximately half of Nova Scotia's sawmills have been idled. - For the first time in 15 years, Pictou Mill is faced with a shortage of chips. In order to maintain chip supply, the Business has been forced to subsidize local sawmills by selling them roundwood at prices far below production costs. - As a result, the Business' all-in fiber costs (delivered chip costs + losses at the Timberland operations) have increased to historic highs. - The Timberland operations are forecasted to lose approximately $15 million over the next 12 months, bringing the Business' all in fiber costs to approximately $75 per GMT of chips. -The Business' biggest chip supplier (approximately 400 GMT annually) has exercised its leverage to extract the largest subsidy from the Business, accounting for approximately $3.9 million of the Timberland's total forecasted gross profit loss of $4.1 million over the next 12 months. Fiber costs Timberland sales Cost of sales Harvesting/Trucking Stumpage Total cost of sales Gross profit Overhead Roads Silviculture - Fee Silviculture - Crown Silviculture - Private Stumpage Silviculture - Wagner Admin Total overhead Total timberlands operating profit Total delivered chip cost Total all-in fiber costs 23 Managing the fiber supply chain through the remainder of the US housing downturn is one of Business' greatest near-term challenges. Stumpage agreement In conjunction with the contemplated transaction, the Business will enter into a 10 year stumpage agreement whereby the Business agrees to harvest the AAC on the approximately 500,000 acres of Neenah land. Summary terms as follows: - Free stumpage through the end of 2008 - Crown stumpage rates for 2009 - "Market" stumpage rates thereafter The following table presents the Business' historic pro forma total fiber cost per GMT of chips (delivered chip cost + timberlands operations) assuming a range of stumpage prices; it suggests Pictou's historic pro forma total fiber costs on average from 2001 2007 would have been $5970 per GMT depending on which "market" stumpage rates are assumed. Note: Consolidated EBITDA does not include savings from projected headcount reductions, costs from pension fund contributions, working capital increase or cost related to pulp broker contract. The investors do not have expansion plans for the mill and intend to invest only in maintenence CapEx. Working capital requirements should be $2.535M through December 2008 and increase thereafter as a percentage of sales growth. The tax rate on all taxable income will be about 35%. Bankers have advised that the asset be valued with a discount rate of 15%. Source: Jaakko Pyry Share of consumption in 2004 (52 million tons), % Source: Mercer International Group Investor Presentation, March 2008 - Approximately 1.1 million tonnes of NBSK market pulp capacity has shut down since Q4 2005 with another 500,000 mt expected to close in the next two years. - In addition to the capacity closures listed in the tables to the right, Pope \& Talbot has announced the closing of 3 pulp mills with a total capacity of approximately 700,000 ADMT per year. - Halsey, OR mill (appx. 80k NBSK capacity) has been purchase and will be restarted. - Nanaimo, BC and MacKenzie, BC mills are being auctioned on July 7,2008 and it is not yet clear if they will come back on line. - Represents approximately 11% of total NBSK market pulp capacity (total global NBSK market pulp capacity is approximately 14,520,000 tonnes as per the Pulp and Paper Products council. Recently announced expansions have not fully offset capacity reductions. 1. Pulp market collapses prior to implementation of cost savings initiatives 2. Currency movements a. CAD appreciation relative to USD reduces mill net and improves U.S. mills' competitive position b. CAD appreciation relative to Euro damages competitive position 3. Further disruption in wood supply chain 4. Oil prices appreciate 5. New supply (i.e., Russia) reduces demand and erodes NBSK pricing in the long term 6. Inability to terminate obligations under Maritime Lumber contract. 7. Inability to manage costs associated with environmental liabilities NPNS will assume approximately $60 million in liabilities: 1. Pension and OPEB (obligations of $16.798M+$11.212M to the pension fund) 2. Environmental (Boat Harbour liabilities, $.205 million and an additional potential liability of $30 million (expected value) for past pollution) 3. Labor Contract 4. Maritime Lumber Contract (timber) We are developing strategies to minimize each. Base Case Financial Summary The following presents a "base case" financial summary of the Business. Consolidated EBITDA does not include savings from projected headcount reductions, costs from pension fund contributions, working capital increase, or cost related to pulp broker contract. CapEx will be limited to necessary maintenance with no plans for expansion. In addition: - New working capital requirements should be $2.535M through December 2008. Thereafter, working capital will remain flat (sales growth is also zero). - The tax rate on all taxable income will be about 35%. - Bankers have advised that the asset be valued with a discount rate of 15%. Base Case Assumptions Mill - Full Maintenance Down in May 2009 - comparable timing (April / May) and cost as 2008 Down - US\$ pulp gross selling price forecast projected to increase significantly over projection period - US/CAD exchange rate held constant at May 2008 level of $0.999 (Conservative given forecasts of strengthening of US dollar) - Bunker C oil pricing per Management - projected to increase 35% and 28% in 2008 and 2009 respectively Timberlands - Current market conditions" persist through 2009 - low roundwood prices, low sawables mix, high chip costs - Free stumpage for the remainder of 2008 (post transaction); Crown rate stumpage starting in 2009 - "Normal market conditions" beginning in 2010 - higher roundwood prices, higher sawables mix, lower chips costs The Business has an aged workforce, most of whom (hourly workers) are covered under an off-market Collective Bargaining Agreement (CBA) expiring in May 2009. - Salaries and benefits are high for Pictou County - attrition without replacement has been the sole labor cost reduction strategy. - The Business will not be cost competitive long-term without labor cost reductions, both with respect to headcount and benefits. Labor Cost Reduction Plan Management has developed a plan to reopen the CBA at closing and to offer early retirement to hourly employees. - Savings will begin in 2009 and will ramp up to $8.3MM over three years. - No strategy on salaried has been developed yet. - The CBA expires May 2009 and pattern bargaining is expected to be concessionary. - Concessions have not been factored into financial plan 1 Includes benefits (adjusted to consider age and years of service for those workers expected to retire) Benchmarking report - Global NBSK producers The following depicts the cost curve of Global NBSK producers broken out by world region. - Graph highlights that one of our biggest risks is the appreciation of the Canadian dollar against the EURO. - Market does not anticipate a strengthening of the Canadian dollar against the EURO from the rate assumed by RISI in the graph below. Since Q4 2007, European producers have moved further right on the cost curve. North American NSBK Producers Q4 2007 Current fiber situation The decline of the US housing industry combined with the strengthening of the Canadian dollar relative to the US dollar has severely disrupted the Business' fiber supply chain. - Approximately half of Nova Scotia's sawmills have been idled. - For the first time in 15 years, Pictou Mill is faced with a shortage of chips. In order to maintain chip supply, the Business has been forced to subsidize local sawmills by selling them roundwood at prices far below production costs. - As a result, the Business' all-in fiber costs (delivered chip costs + losses at the Timberland operations) have increased to historic highs. - The Timberland operations are forecasted to lose approximately $15 million over the next 12 months, bringing the Business' all in fiber costs to approximately $75 per GMT of chips. -The Business' biggest chip supplier (approximately 400 GMT annually) has exercised its leverage to extract the largest subsidy from the Business, accounting for approximately $3.9 million of the Timberland's total forecasted gross profit loss of $4.1 million over the next 12 months. Fiber costs Timberland sales Cost of sales Harvesting/Trucking Stumpage Total cost of sales Gross profit Overhead Roads Silviculture - Fee Silviculture - Crown Silviculture - Private Stumpage Silviculture - Wagner Admin Total overhead Total timberlands operating profit Total delivered chip cost Total all-in fiber costs 23 Managing the fiber supply chain through the remainder of the US housing downturn is one of Business' greatest near-term challenges. Stumpage agreement In conjunction with the contemplated transaction, the Business will enter into a 10 year stumpage agreement whereby the Business agrees to harvest the AAC on the approximately 500,000 acres of Neenah land. Summary terms as follows: - Free stumpage through the end of 2008 - Crown stumpage rates for 2009 - "Market" stumpage rates thereafter The following table presents the Business' historic pro forma total fiber cost per GMT of chips (delivered chip cost + timberlands operations) assuming a range of stumpage prices; it suggests Pictou's historic pro forma total fiber costs on average from 2001 2007 would have been $5970 per GMT depending on which "market" stumpage rates are assumed