Based on the case please answer the following question:

What recommendations would you make to Fitbit management to address the most important strategic issues facing the company?

There are spaces for up to six action recommendations and supporting justifications. Each recommended action must be supported with convincing, analysis-based justifications founded on the relevant concepts and tools that apply to this case.

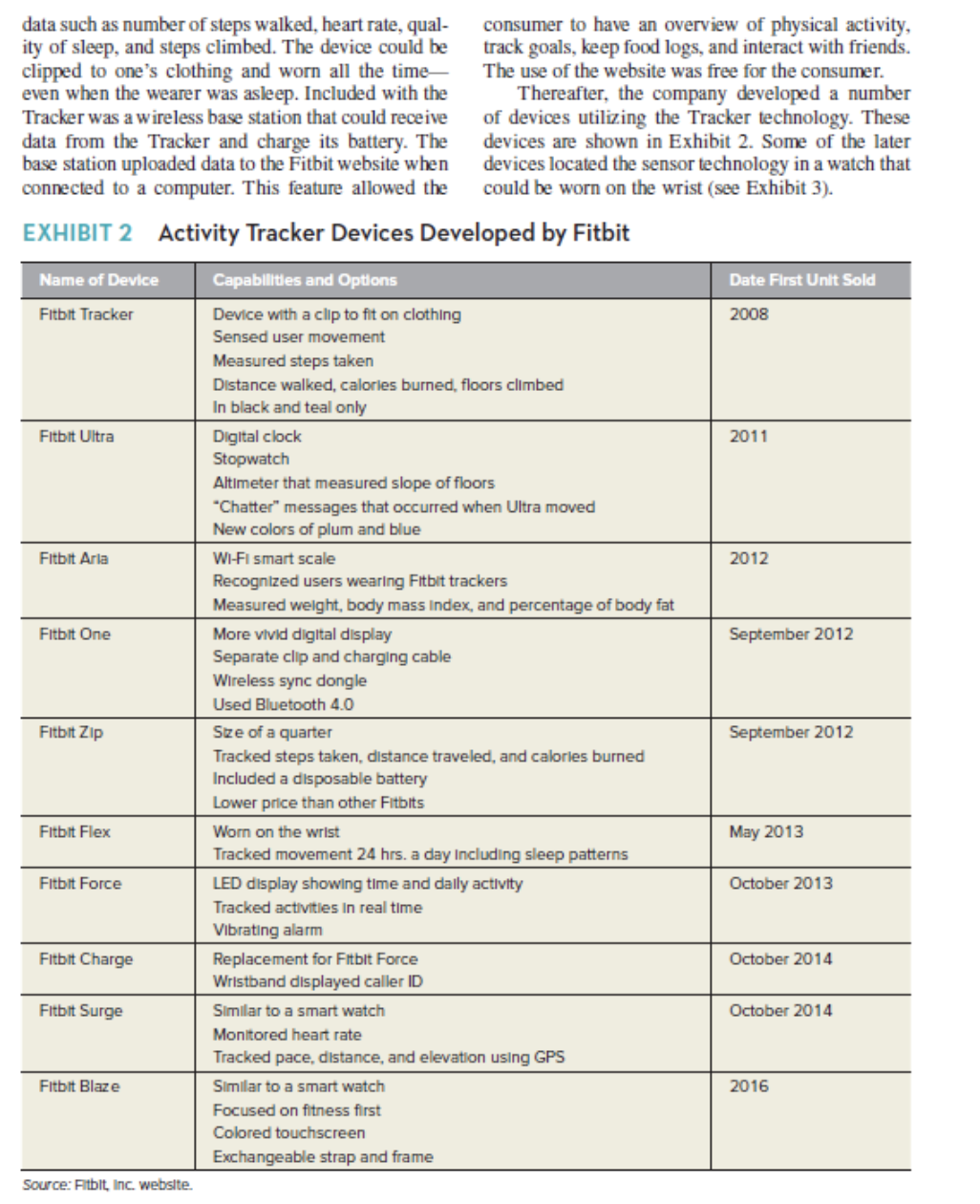

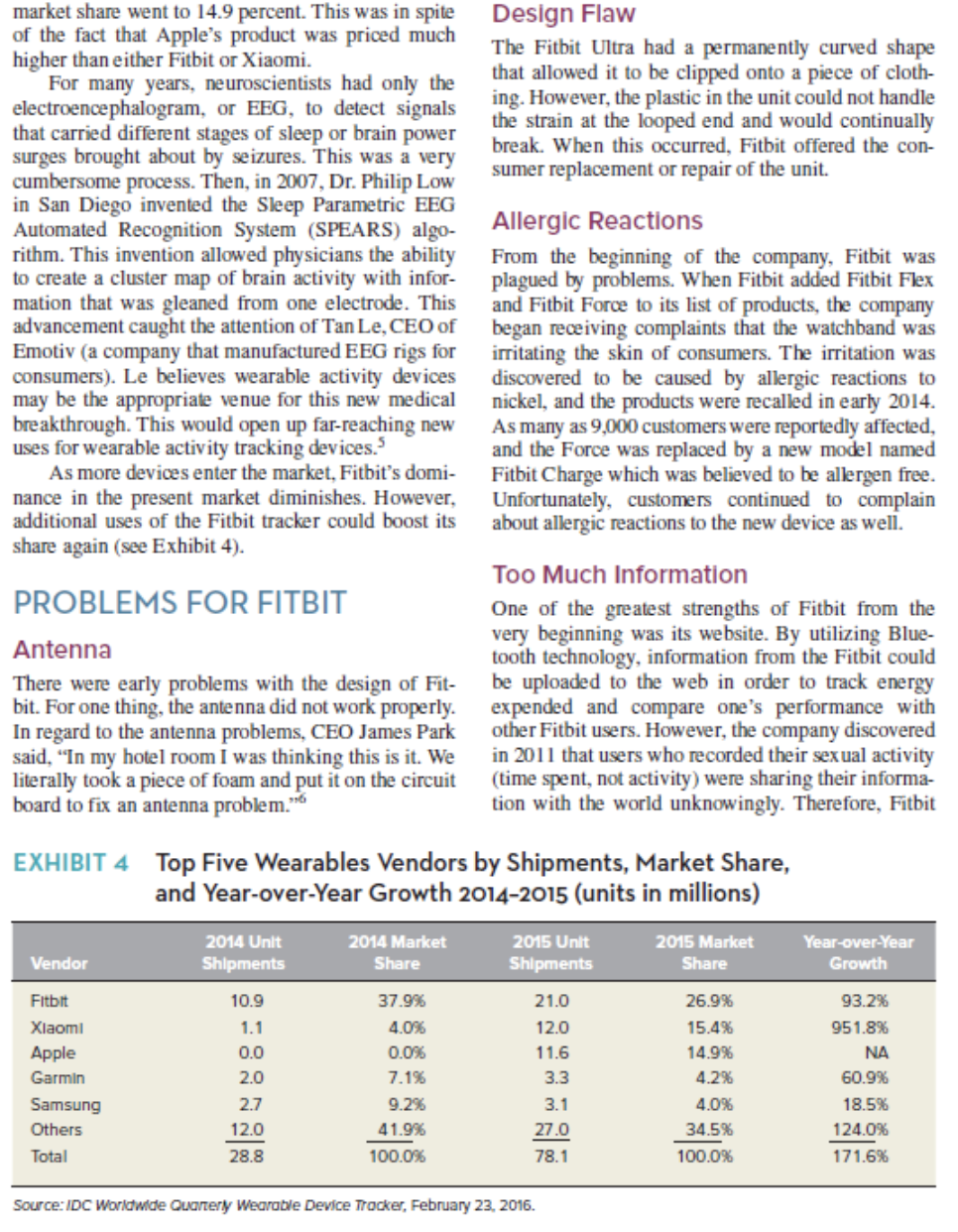

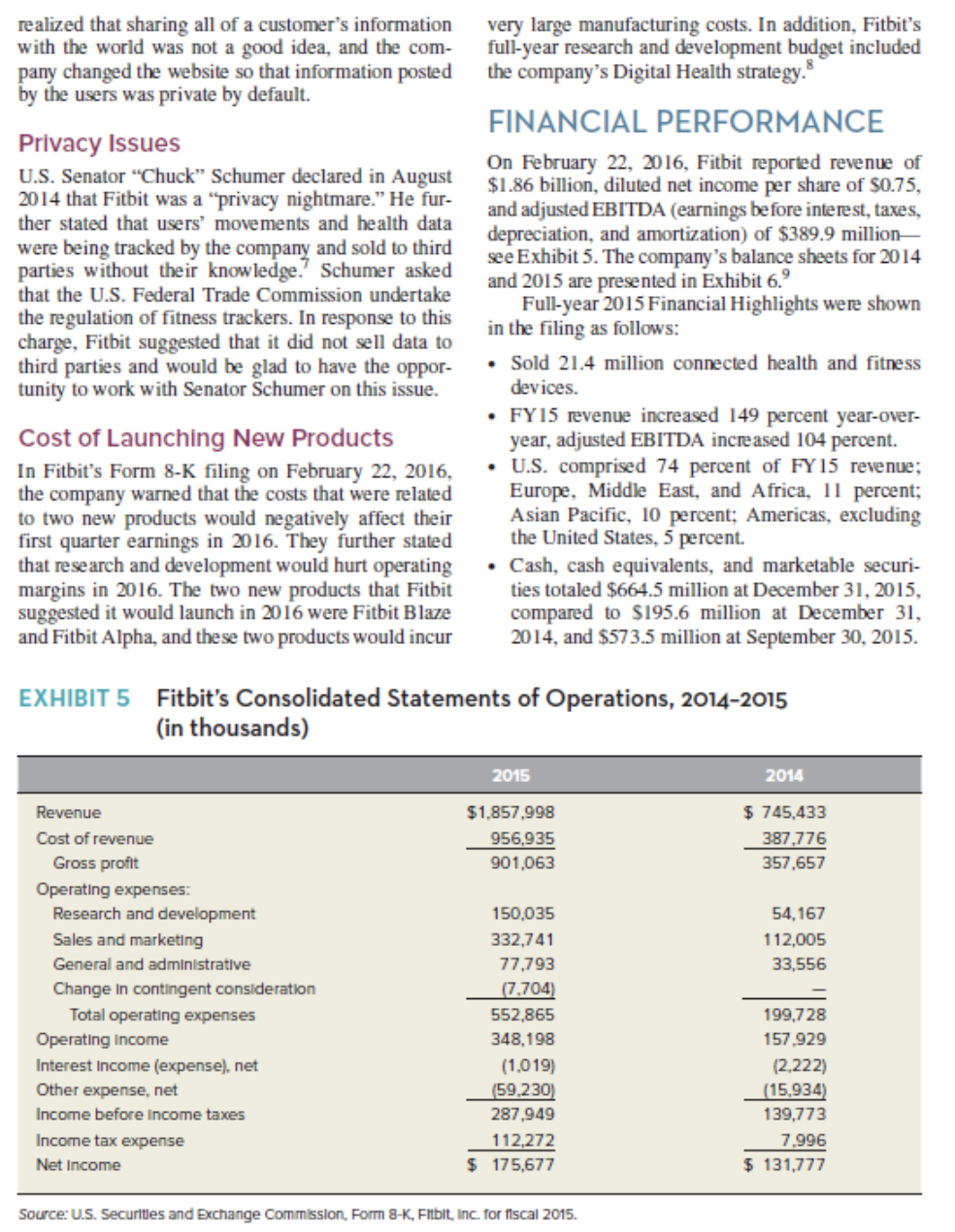

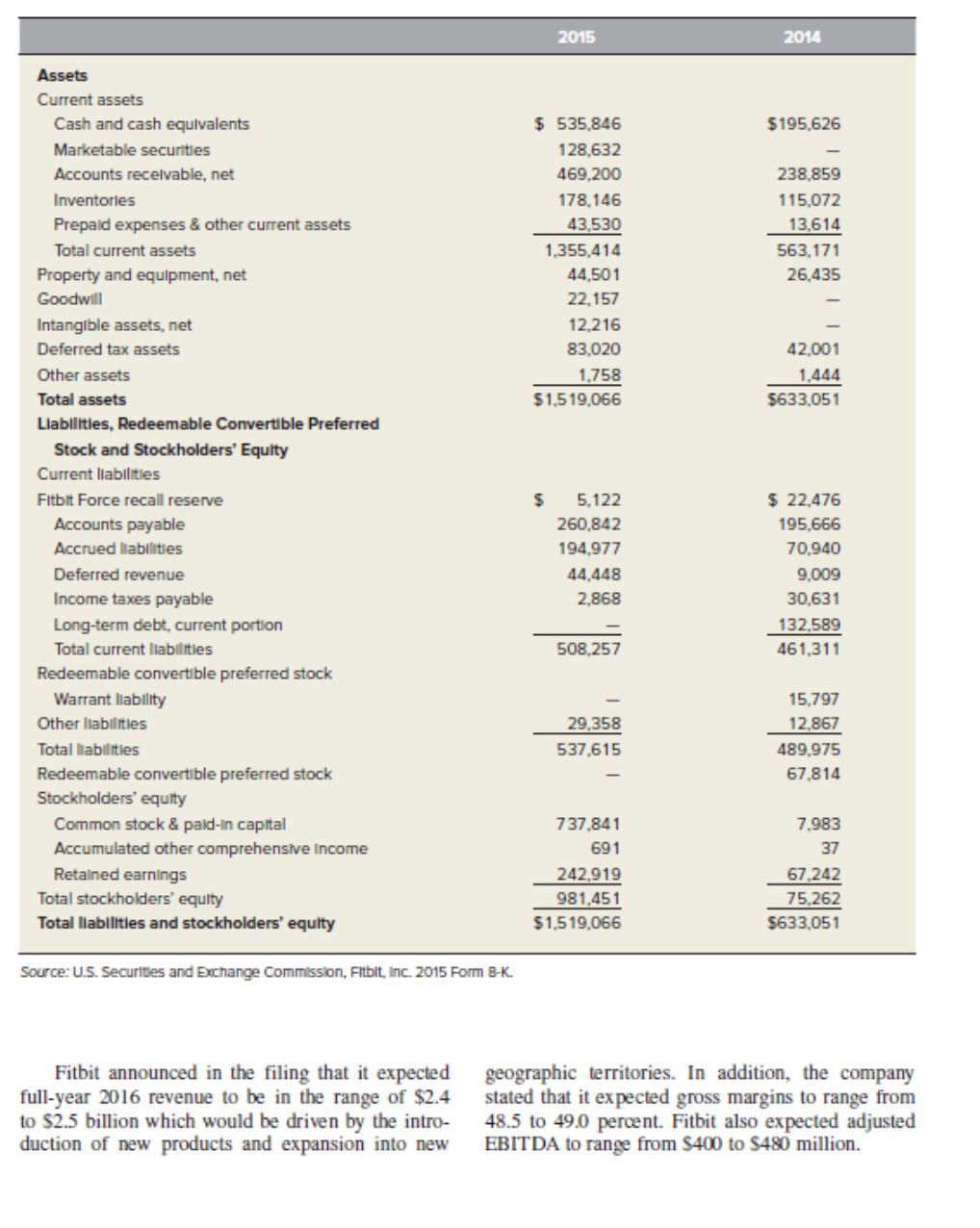

Fitbit, Inc.: Has the Company Outgrown Its Strategy? Rochelle R. Brunson Marlene M. Reed Baylor University Baylor University itbit revolutionized the personal fitness activ- -ity in 209 with the introduction of its Tracker TechCrunch50 Conference drumming up preorders for their product. Neither man had any manufactur wearable activity monitor. By 2016 the com- ing experience, so they traveled to Asia and sought pany was a hit in the marketplace with Fitbit devices out suppliers and a company to produce the device becoming nearly ubiquitous with fitness enthusi for them. asts and health-conscious individuals wearing the devices and checking them throughout the day. The Fitbit put its product named "Tracker" on the market at the end of 2009, and the company shipped company's sales of activity monitors had increased approximately 5,000 units at that time. They had from 5,000 units that year to 21.4 million connected additional orders for 2,000 units on the books. health and fitness devices by year-end 2015. The The product Park and Friedman developed was company executed a successful IPO (initial public called an "activity monitor" which was a wireless- offering) in 2015 that boosted liquidity by $4.1 billion enabled wearable technology device (see Exhibit 1). and recorded revenues of $1.86 billion by the con- The purpose of the Fitbit was to measure personal clusion of its first year as a public company. Fitbit's chief managers expected 2016 revenues in the range of $2.4 to $2.5 billion. However, on the last day EXHIBIT 1 Fitbit Ultra of February 2016 the price of Fitbit stock plunged nearly 20 percent after the company announced that the sales and earnings in the first quarter would fall short of analysts' forecasts. The missed forecasted milestone created a dilemma for founders James Park and Eric Friedman, who were now faced with finding a strategy to turn things around at the now publicly traded company. BACKGROUND ON FITBIT 8756 Fitbit was founded in October 2007 by James Park (CEO) and Eric Friedman (CTO). The two men started the company after noticing the potential for using sensors in small wearable devices to track Don's Kar lunov individuals' physical activities. Before they had a prototype, Park and Friedman took a circuit board in Source: Fitbit, Inc. website. a wooden box around to venture capitalists to raise money. In 2008, Park and Friedman addressed the @Copyright Rochelle R. Brunson and Marlene M. Reed. All rights reserveddata such as number of steps walked, heart rate, qual- consumer to have an overview of physical activity, ity of sleep, and steps climbed. The device could be track goals, keep food logs, and interact with friends. clipped to one's clothing and worn all the time- The use of the website was free for the consumer. even when the wearer was asleep. Included with the Thereafter, the company developed a number Tracker was a wireless base station that could receive of devices utilizing the Tracker technology. These data from the Tracker and charge its battery. The devices are shown in Exhibit 2. Some of the later base station uploaded data to the Fitbit website when devices located the sensor technology in a watch that connected to a computer. This feature allowed the could be worn on the wrist (see Exhibit 3). EXHIBIT 2 Activity Tracker Devices Developed by Fitbit Name of Device Capabilities and Options Date First Unit Sold Fitbit Tracker Device with a clip to fit on clothing 2008 Sensed user movement Measured steps taken Distance walked, calories burned, floors climbed In black and teal only Fitbit Ultra Digital clock 2011 Stopwatch Altimeter that measured slope of floors "Chatter" messages that occurred when Ultra moved New colors of plum and blue Fitbit Arla WI-FI smart scale 2012 Recognized users wearing Fitbit trackers Measured weight, body mass Index, and percentage of body fat Fitbit One More vivid digital display September 2012 Separate clip and charging cable Wireless sync dongle Used Bluetooth 4.0 Fitbit Zip Size of a quarter September 2012 Tracked steps taken, distance traveled, and calories burned Included a disposable battery Lower price than other Fitbits Fitbit Flex Worn on the wrist May 2013 Tracked movement 24 hrs. a day Including sleep patterns Fitbit Force LED display showing time and dally activity October 2013 Tracked activities In real time Vibrating alarm Fitbit Charge Replacement for Fitbit Force October 2014 Wristband displayed caller ID Fitbit Surge Similar to a smart watch October 2014 Monitored heart rate Tracked pace, distance, and elevation using GPS Fitbit Blaze Similar to a smart watch 2016 Focused on fitness first Colored touchscreen Exchangeable strap and frame Source: Fitbit, Inc. websiteEXHIBIT 3 Fitbit Watch However, another study undertaken by Sasaki et al. in 2015 and reported in the Journal of Physi- cal Activity and Health found that the Fitbit wire- less activity tracker worn on the hip systematically underestimated the activity energy expended. These researchers suggested that the Fitbit manage- ment should consider refining the energy expendi- ture prediction algorithm to correct this consistent 26 underestimation of activity in order to maximize the physical activity benefits for weight management and other health-related concerns. MISSION OF FITBIT According to Fitbit, "The mission of Fitbit is to . Tom Emrich empower and inspire you to live a healthier, more Source: Fitbit, Inc. website. active life. We design products and experiences that fit seamlessly into your life so that you can achieve On May 17, 2015, Fitbit filed for an IPO with your health and fitness goals, whatever they may be." the Securities and Exchange Commission with an NYSE (New York Stock Exchange) listing. The THE ACTIVITY TRACKING IPO brought in $4.1 billion. The stock was initially priced at $20 but shortly thereafter the shares were INDUSTRY trading for $35. By the end of February 2016 the There are a number of companies that would be shares had fallen to $14. A study in 2015 by Diaz et al., published in considered competitors of Fitbit in the activity tracking-companies such as Garmin (originally the International Journal of Cardiology, investi- producing GPS equipment for cars) and Under gated the Fitbit to see how reliable the device was, Armour (originally producing undergarments for and whether it could be used to monitor patients' men). There are also companies such as Apply who physical activity between clinic visits. The research indicated that the Fitbit One and Fitbit Flex reliably produce smart watches that perform many of the same tasks as Fitbit's devices. estimated step counts and energy expenditure during Another company entering the market late was walking and running. These researchers also found Jawbone. This company was formed in 1999, and its that the hip-based Fitbit outperformed the Fitbit watch. ! consumer devices were Bluetooth headphones and speakers initially and later fitness trackers. With the Another study in 2015 by Cadmus-Bertram et increased competition in the activity tracking indus- al., published in the American Journal of Preven- try in 2015, Jawbone dropped to seventh place in the tative Medicine, had essentially the same outcome second quarter from fifth place in the first quarter as the Diaz study. Their study examined the Fitbit among makers of wearable tracking devices. Tracker and website as a low-touch physical activ- Xiaomi, a Chinese company, shipped 12 million ity intervention. They were attempting to evaluate wearable activity trackers in 2015. That gave the the feasibility of integrating the Fitbit Tracker and company a 15.5 percent global market share which website into a physical activity intervention for post- was second to Fitbit with Apple, Garmin, and Sam- menopausal women. Their conclusions were that the sung behind the two leaders. In 2014, Xiaomi had Fitbit was well accepted in their sample of women and was associated with increased physical activity shipped 1.1 million units and garnered only 4 percent of the world market share. at 16 weeks. In other words, merely wearing the Fit- The presence of Apple in the market had been bit seemed to heighten the amount of physical exer- almost as noteworthy as Xiaomi's. The Apple watch cise in which the women engaged. was first marketed in 2015, and in that year itsmarket share went to 14.9 percent. This was in spite of the fact that Apple's product was priced much Design Flaw higher than either Fitbit or Xiaomi. The Fitbit Ultra had a permanently curved shape For many years, neuroscientists had only the that allowed it to be clipped onto a piece of cloth- electroencephalogram, or EEG, to detect signals ing. However, the plastic in the unit could not handle that carried different stages of sleep or brain power the strain at the looped end and would continually surges brought about by seizures. This was a very break. When this occurred, Fitbit offered the con- cumbersome process. Then, in 2007, Dr. Philip Low sumer replacement or repair of the unit. in San Diego invented the Sleep Parametric EEG Automated Recognition System (SPEARS) algo- Allergic Reactions rithm. This invention allowed physicians the ability to create a cluster map of brain activity with infor- From the beginning of the company, Fitbit was mation that was gleaned from one electrode. This plagued by problems. When Fitbit added Fitbit Flex advancement caught the attention of Tan Le, CEO of and Fitbit Force to its list of products, the company Emotiv (a company that manufactured EEG rigs for began receiving complaints that the watchband was consumers). Le believes wearable activity devices irritating the skin of consumers. The irritation was may be the appropriate venue for this new medical discovered to be caused by allergic reactions to breakthrough. This would open up far-reaching new nickel, and the products were recalled in early 2014. uses for wearable activity tracking devices. As many as 9,000 customers were reportedly affected, As more devices enter the market, Fitbit's domi- and the Force was replaced by a new model named Fitbit Charge which was believed to be allergen free. nance in the present market diminishes. However, additional uses of the Fitbit tracker could boost its Unfortunately, customers continued to complain share again (see Exhibit 4). about allergic reactions to the new device as well. PROBLEMS FOR FITBIT Too Much Information One of the greatest strengths of Fitbit from the Antenna very beginning was its website. By utilizing Blue- tooth technology, information from the Fitbit could There were early problems with the design of Fit- be uploaded to the web in order to track energy bit. For one thing, the antenna did not work properly. expended and compare one's performance with In regard to the antenna problems, CEO James Park other Fitbit users. However, the company discovered said, "In my hotel room I was thinking this is it. We in 201 1 that users who recorded their sexual activity literally took a piece of foam and put it on the circuit (time spent, not activity) were sharing their informa- board to fix an antenna problem." tion with the world unknowingly. Therefore, Fitbit EXHIBIT 4 Top Five Wearables Vendors by Shipments, Market Share, and Year-over-Year Growth 2014-2015 (units in millions) 2014 Unit 2014 Market 2015 Unit 2015 Market Year-over-Year Vendor Shipments Share Shipments Share Growth Fitbit 10.9 37.9% 21.0 26.9% 93.2% Xlaoml 1.1 4.0% 12.0 15.4% 951.8% Apple 0.0 0.0% 11.6 14.9% NA Garmin 2.0 7.1% 3.3 4.2% 60.9% Samsung 2.7 9.2% 3.1 4.0% 18.5% Others 12.0 4 1.9% 27.0 34.5% 124.0% Total 28.8 100.0% 78.1 100.0% 171.6% Source: IDC Worldwide Quarterly Wearable Device Tracker, February 23, 2016.realized that sharing all of a customer's information very large manufacturing costs. In addition, Fitbit's with the world was not a good idea, and the com- full-year research and development budget included pany changed the website so that information posted the company's Digital Health strategy. by the users was private by default. Privacy Issues FINANCIAL PERFORMANCE U.S. Senator "Chuck" Schumer declared in August On February 22, 2016, Fitbit reported revenue of 2014 that Fitbit was a "privacy nightmare." He fur- $1.86 billion, diluted net income per share of $0.75, ther stated that users' movements and health data and adjusted EBITDA (earnings before interest, taxes, were being tracked by the company and sold to third depreciation, and amortization) of $389.9 million- parties without their knowledge.' Schumer asked see Exhibit 5. The company's balance sheets for 2014 that the U.S. Federal Trade Commission undertake and 2015 are presented in Exhibit 6." the regulation of fitness trackers. In response to this Full-year 2015 Financial Highlights were shown charge, Fitbit suggested that it did not sell data to in the filing as follows: third parties and would be glad to have the oppor- . Sold 21.4 million connected health and fitness tunity to work with Senator Schumer on this issue. devices. Cost of Launching New Products . FY15 revenue increased 149 percent year-over- year, adjusted EBITDA increased 104 percent. In Fitbit's Form 8-K filing on February 22, 2016, . U.S. comprised 74 percent of FY15 revenue; the company warned that the costs that were related Europe, Middle East, and Africa, 11 percent; to two new products would negatively affect their Asian Pacific, 10 percent; Americas, excluding first quarter earnings in 2016. They further stated the United States, 5 percent. that research and development would hurt operating . Cash, cash equivalents, and marketable securi- margins in 2016. The two new products that Fitbit ties totaled $664.5 million at December 31, 2015, suggested it would launch in 2016 were Fitbit Blaze compared to $195.6 million at December 31, and Fitbit Alpha, and these two products would incur 2014, and $573.5 million at September 30, 2015. EXHIBIT 5 Fitbit's Consolidated Statements of Operations, 2014-2015 (in thousands) 2015 2014 Revenue $1,857,998 $ 745,433 Cost of revenue 956,935 387,776 Gross profit 901,063 357,657 Operating expenses: Research and development 150,035 54,167 Sales and marketing 332,741 1 12,005 General and administrative 77,793 33,556 Change In contingent consideration (7,704) Total operating expenses 552,865 199,728 Operating Income 348,198 157,929 Interest Income (expense), net (1,019) (2,222) Other expense, net (59,230) (15,934) Income before Income taxes 287,949 139,773 Income tax expense 112,272 7,996 Net Income $ 175,677 $ 131,777 Source: U.S. Securities and Exchange Commission, Form 8-K, Fitbit, Inc. for fiscal 2015.2015 2014 Assets Current assets Cash and cash equivalents $ 535,846 $195,626 Marketable securities 128,632 Accounts receivable, net 469,200 238,859 Inventories 178,146 115,072 Prepaid expenses & other current assets 43,530 13,614 Total current assets 1,355,414 563,171 Property and equipment, net 44,501 26,435 Goodwill 22,157 Intangible assets, net 12,216 Deferred tax assets 83,020 42,001 Other assets 1,758 1.444 Total assets $1,519,066 $633,051 Liabilities, Redeemable Convertible Preferred Stock and Stockholders' Equity Current liabilities Fitbit Force recall reserve $ 5,122 $ 22,476 Accounts payable 260,842 195,666 Accrued liabilities 194,977 70,940 Deferred revenue 44,448 9.009 Income taxes payable 2,868 30,631 Long-term debt, current portion 132,589 Total current liabilities 508,257 461,311 Redeemable convertible preferred stock Warrant liability 15,797 Other liabilities 29,358 12,867 Total liabilities 537.615 489,975 Redeemable convertible preferred stock 67.814 Stockholders' equity Common stock & paid-In capital 737,841 7.983 Accumulated other comprehensive Income 691 37 Retained earnings 242,919 67.242 Total stockholders' equity 981,451 75,262 Total Ilabilities and stockholders' equity $1,519,066 $633,051 Source: U.S. Securities and Exchange Commission, Fitbit, Inc. 2015 Form 8-K. Fitbit announced in the filing that it expected full-year 2016 revenue to be in the range of $2.4 geographic territories. In addition, the company stated that it expected gross margins to range from to $2.5 billion which would be driven by the intro- 48.5 to 49.0 percent. Fitbit also expected adjusted duction of new products and expansion into new EBITDA to range from $400 to $480 million.ANALYSTS' ASSESSMENTS the target price to buy the stock from $33 to $18. After the 20 percent drop in the price of Fitbit stock These analysts suggest that the company's new late in February 2016, a number of Wall Street ana- products are unproven, so they don't know how much they will add to sales. 12 lysts gave their assessments of future movements of the company's stock. An analyst with Global Equities Research, Trip Chowdry, suggested that DECISION TIME he believed the stock could fall another 50 percent. James Park and Eric Friedman were facing a deci- He speculated, "Gradually the market for single- sion about a strategy to improve the analysts' purpose devices (fitness tracker) is heading toward assessments of Fitbit. One comment that many zero, and there is nothing FIT can do to reverse the people had made about Fitbit was that it needed trend." In addition, Chowdry commented that to be more than a one-product company. Since the unlike Apple, Inc., Fitbit doesn't have a group of activity tracking feature was being used in many developers or a way of generating income as the App other devices by a variety of companies, Fitbit had Store does. Even though the Fitbit tracker products to think of new uses of the tracker as well as new were much cheaper than Apple's ($129 as com- devices. As one journalist suggested, "Stand-alone pared to $349 for the cheapest Apple Watch Sport), fitness trackers are iPod in a world that's moving to Apple had an inventory of more products than Fitbit. iPhones."13 Activity tracking is just a feature used by Fitbit, and After all, Park had recently commented, "The this feature was being used in many other devices by next big leap will come when we tie into more a variety of companies. detailed clinical research and create devices that can Pacific Coast analysts downgraded the compa- make lightweight medical diagnoses. You look at ny's stock to sector weight from overweight because blood glucose meters today, I wouldn't necessarily of expected weakness in sales in the coming year, say that those are the most attractive or consumer and the limitation it has in differentiating its prod- friendly devices. I would say consumer focused ucts. The Pacific Coast analysts suggested, "We do companies, whether it's us or Apple, probably have not expect any incrementally competitive product an inherent advantage in the future." One possi- announcements from Apple in the next year, but bility for the company was to become a platform- we have to assume those will come at some point in rather than just a product. That would entail moving 2017 or 2018." Therefore, these analysts believe into niche markets with devices that are designed for Apple remains a serious threat to Fitbit in the future. very specific and unique purposes. Some of the pos- Leerink analysts downgraded Fitbit's stock to sibilities would be moving further into health care market perform from outperform and also reduced and corporate health care. 15 ENDNOTES 'Katth M. Diaz, David J. Krupka, Molinda J. Trackar for Prediction of Energy Expandituro," Chang, James Paacock, Yao Ma, Joff Goldsmith, "U.S. Socurtties and Exchange Commission, Journal of Physical Activity and Hoalth 12 Form 8-K Filing for fiscal your 2015 for Fitbit, Inc. Joseph E. Schwartz, and Karina W. Davidson, "Fit "bid, p. 5. bit: An Accurate and Raliable Device for Wireless (2015). pp. 149-154. Fitbit home page, www.fitbit.com/about " Caltlin Huston, "Fitbit's Stock Is Tanking and Physical Activity Tracking," Intorational Journal of Cardiology, no. 185 (2015), pp. 138-140. (accessed March 3, 2016) Batsy Isaacson, "A Fitbit for Your Brain Is It May Have More to Drop," MarketWatch, Fab- Lisa A. Cadmus-Bartram, Boss H. Marcus, Around the Comer," Nowswook.com, April 13, ruary 23, 2016, www.marketwatch.com/story/ fitbits-stock-Is-tanking-and-It-may-have- Ruth E. Patterson, Barbara A. Parker, and more-to-drop/ [accessed March 11, 2016). Brittany L Morey, "Randomized Trial of a 2016, www.newswook.com/human-brain-oog Fitbit-Based Physical Activity Intervention technology-nouroscience-443368. "Ibid. p. 2. "Gary Marshall, "The Story of Fitbit: How a Ibid., p. 3. for Women," American Journal of Preventive Medicina 49, no. 3 (2015). pp. 414-418. Woodon Box Became a $4 Billion Company," " Jamas Stables, "Fitbit Charge HR 2 Jaffar Eldi Sasaki, Amanda Hickey, Marianna December 30, 2015, www.wareable.com/ Rovlaw, Fitbit Rovlow, Dacambar 15, 2015, Mavila, Jacquelynne Tedesco, Denish John, fitbit/youre-fitbit-and-you-know-It-how-a- ww.waroable.com/fitbit/fitbit-charge- wooden-box-bocame-a-dollar-4-billion- Sarah Korey Koodle, and Patty S. Frondson, company (accessed March 2, 2016)- hr-review/ (accessed March 1, 2016)- " Ibid., p. 6. "Validation of the Fitbit Wireless Activity Ibid., p. 5. Ibid., p. 7