Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the cash flows shown in the chart below, compute the IRR and MIRR for Project Erie . Suppose that the appropriate cost of

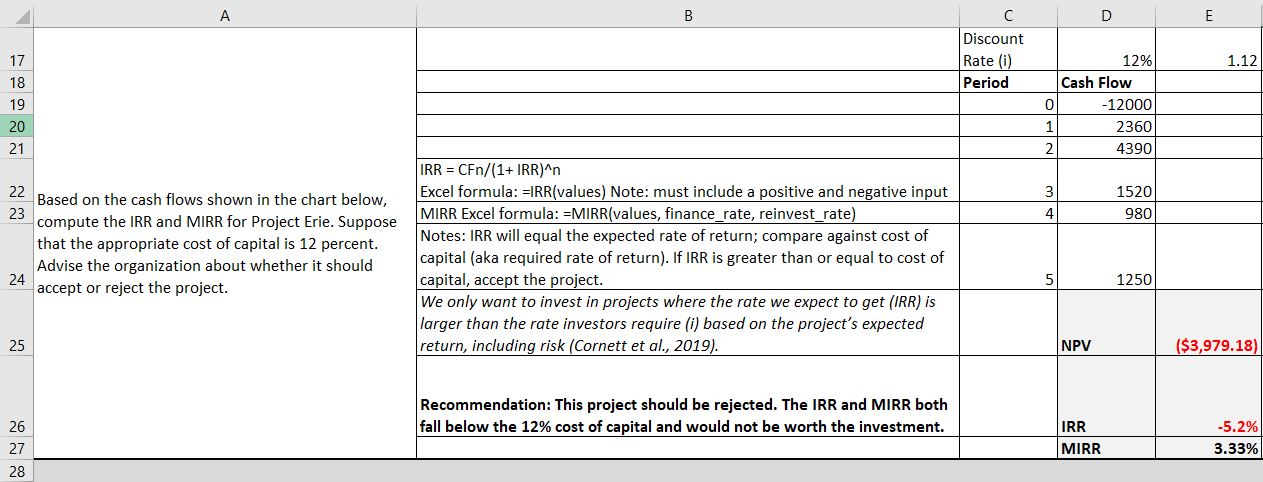

- Based on the cash flows shown in the chart below, compute the IRR and MIRR for Project Erie. Suppose that the appropriate cost of capital is 12 percent. Advise the organization about whether it should accept or reject the project.

also calculate VPN .

17 18 19 20 21 22 23 24 25 26 27 28 A Based on the cash flows shown in the chart below, compute the IRR and MIRR for Project Erie. Suppose that the appropriate cost of capital is 12 percent. Advise the organization about whether it should accept or reject the project. B IRR = CFn/(1+ IRR)^n Excel formula: =IRR(values) Note: must include a positive and negative input MIRR Excel formula: =MIRR(values, finance_rate, reinvest_rate) Notes: IRR will equal the expected rate of return; compare against cost of capital (aka required rate of return). If IRR is greater than or equal to cost of capital, accept the project. We only want to invest in projects where the rate we expect to get (IRR) is larger than the rate investors require (i) based on the project's expected return, including risk (Cornett et al., 2019). Recommendation: This project should be rejected. The IRR and MIRR both fall below the 12% cost of capital and would not be worth the investment. Discount Rate (i) Period 0 1 2 3 4 5 NPV D Cash Flow IRR MIRR 12% -12000 2360 4390 1520 980 1250 E 1.12 ($3,979.18) -5.2% 3.33%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Based on the cash flows provided the IRR for Project Erie can be calculated using the formu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started