Answered step by step

Verified Expert Solution

Question

1 Approved Answer

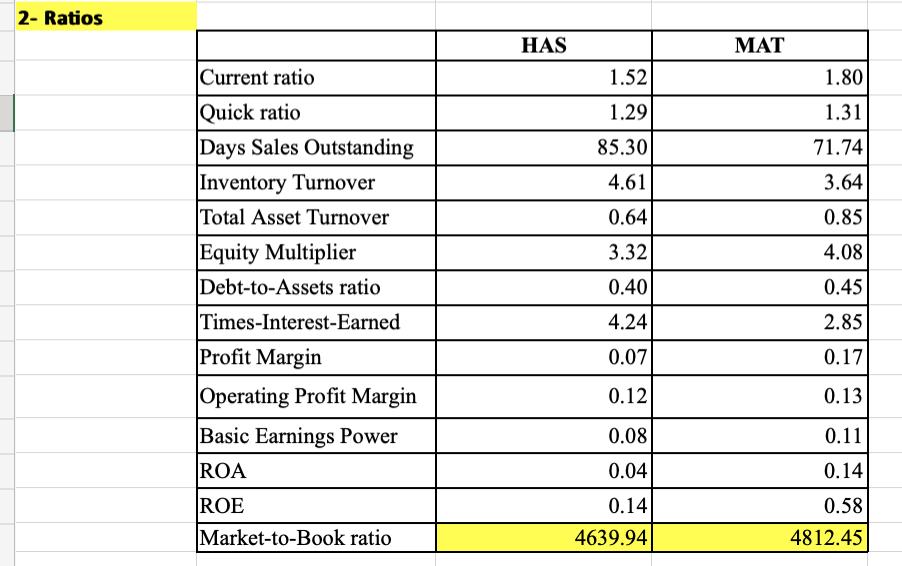

Based on the companies’ market-to-book ratios, which company is doing better overall? What other ratios or financial information can help you justify its better market-value

Based on the companies’ market-to-book ratios, which company is doing better overall? What other ratios or financial information can help you justify its better market-value performance?

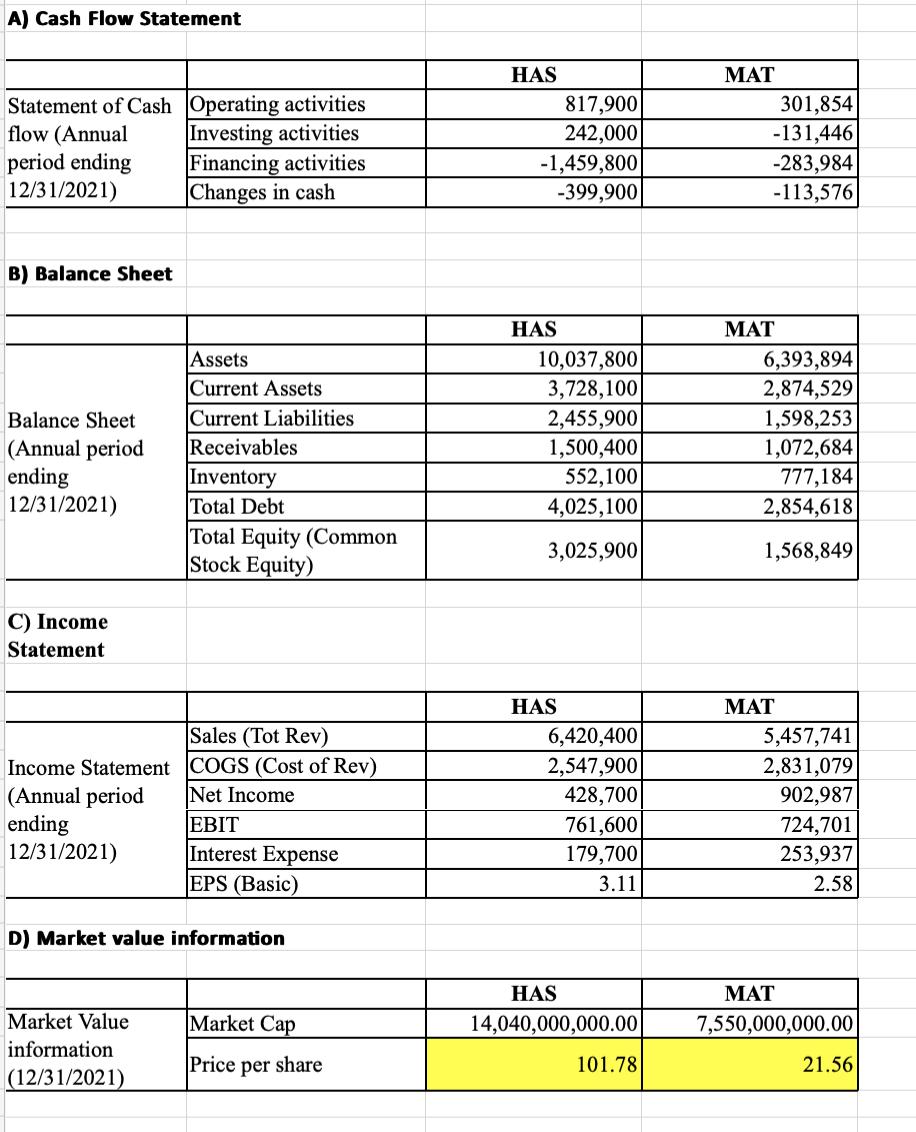

A) Cash Flow Statement Statement of Cash Operating activities Investing activities Financing activities Changes in cash flow (Annual period ending 12/31/2021) B) Balance Sheet Balance Sheet (Annual period ending 12/31/2021) C) Income Statement Income Statement (Annual period ending 12/31/2021) Assets Current Assets Current Liabilities Receivables Inventory Total Debt Total Equity (Common Stock Equity) Market Value information (12/31/2021) Sales (Tot Rev) COGS (Cost of Rev) Net Income EBIT Interest Expense EPS (Basic) D) Market value information Market Cap Price per share HAS -1,459,800 -399,900 HAS 817,900 242,000 10,037,800 3,728,100 2,455,900 1,500,400 552,100 4,025,100 3,025,900 HAS 6,420,400 2,547,900 428,700 761,600 179,700 3.11 HAS 14,040,000,000.00 101.78 MAT 301,854 -131,446 -283,984 -113,576 MAT 6,393,894 2,874,529 1,598,253 1,072,684 777,184 2,854,618 1,568,849 MAT 5,457,741 2,831,079 902,987 724,701 253,937 2.58 MAT 7,550,000,000.00 21.56

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 The market to book ratio is better in case of MAT company It does not exceed by large amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started