Question

Based on the data attached here: a) What was each company's ROE in 2020 , and which one was better? Why is this perhaps surprising?

Based on the data attached here:

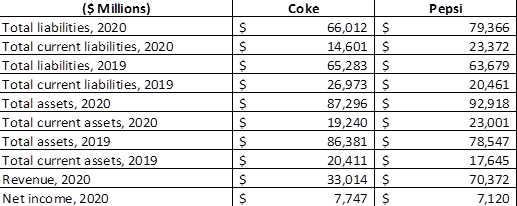

a) What was each company's ROE in 2020, and which one was better? Why is this perhaps surprising? b) For both companies, what are the working capitals and current ratios for BOTH 2020 and 2019? How did those values improve or worsen from 2019 to 2020? Provide a DETAILED explanation as to why these changes occured.

c) For both companies, what are their ROAs in 2020 (just use net income/total average assets & ignore any interest and tax for this problem)? Which company had a higher ROA? What does it tell us about each company?

d) Based on each company's return on equity ratio, debt-to-equity ratio, current ratio, net income as a percentage of revenue and working capital, and return on assets ratio, compare these 2 companies. If you had $20,000, which one would you invest in? Name at least 3 specific other items (NOT THE ABOVE RATIOS), that would help inform your choice. e) Name 3 specific ways that these companies could better their current ratio. Explain in detail how each of your ideas will affect this calculation.

\begin{tabular}{|l|ll|lr|} \multicolumn{1}{c|}{ (\$ Millions) } & \multicolumn{2}{c|}{ Coke } & \multicolumn{2}{c|}{ Pepsi } \\ \hline Total liabilities, 2020 & $ & 66,012 & $ & 79,366 \\ \hline Total current liabilities, 2020 & $ & 14,601 & $ & 23,372 \\ \hline Total liabilities, 2019 & $ & 65,283 & $ & 63,679 \\ \hline Total current liabilities, 2019 & $ & 26,973 & $ & 20,461 \\ \hline Total assets, 2020 & $ & 87,296 & $ & 92,918 \\ \hline Total current assets, 2020 & $ & 19,240 & $ & 23,001 \\ \hline Total assets, 2019 & $ & 86,381 & $ & 78,547 \\ \hline Total current assets, 2019 & $ & 20,411 & $ & 17,645 \\ \hline Revenue, 2020 & $ & 33,014 & $ & 70,372 \\ \hline Net income, 2020 & $ & 7,747 & $ & 7,120 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started