Answered step by step

Verified Expert Solution

Question

1 Approved Answer

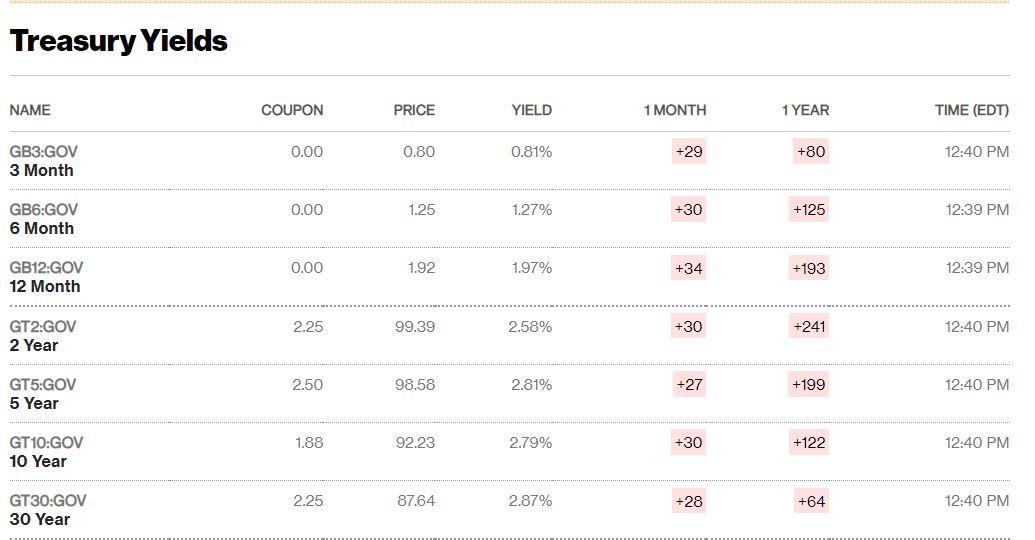

Based on the data in the table complete parts a and b below: Bank prime loan charges 3.50% currently. Find yield for 12-month Treasury bills

Based on the data in the table complete parts a and b below:

- Bank prime loan charges 3.50% currently. Find yield for 12-month Treasury bills from the table and indicate the size of current default risk premiums for bank prime loans.

- Prepare a yield curve or term structure of interest rates based on todays yields on U.S. Treasury securities. Briefly comment on the shape of current yield curve (i.e., is it normal or inverted? Steep or flat? What does it tell you about the current status of the US economy?)

Treasury Yields NAME COUPON PRICE YIELD 1 MONTH 1 YEAR TIME (EDT) 0.00 0.80 0.81% +29 +80 12:40 PM GB3:GOV 3 Month 0.00 1.25 1.27% +30 +125 12:39 PM GB6:GOV 6 Month 0.00 1.92 1.97% +34 +193 12:39 PM GB12:GOV 12 Month 2.25 99.39 2.58% +30 +241 12:40 PM GT2:GOV 2 Year 2.50 98.58 2.81% +27 +199 12:40 PM GT5:GOV 5 Year 1.88 92.23 2.79% +30 +122 12:40 PM GT10:GOV 10 Year 2.25 87.64 2.87% +28 +64 12:40 PM GT30:GOV 30 Year Treasury Inflation Protected Securities (TIPS) NAME COUPON PRICE YIELD 1 MONTH 1 YEAR TIME (EDT) 0.13 102.98 -0.47% +68 +117 12:42 PM GTIIS:GOV 5 Year 0.13 102.52 -0.13% +37 +65 GTI 10:GOV 10 Year 12:42 PM 2.13 134.03 0.27% +23 +49 12:41 PM GT||20:GOV 20 Year 0.13 95.40 0.29% +25 +31 12:41 PM GT1130:GOV 30 Year Treasury Yields NAME COUPON PRICE YIELD 1 MONTH 1 YEAR TIME (EDT) 0.00 0.80 0.81% +29 +80 12:40 PM GB3:GOV 3 Month 0.00 1.25 1.27% +30 +125 12:39 PM GB6:GOV 6 Month 0.00 1.92 1.97% +34 +193 12:39 PM GB12:GOV 12 Month 2.25 99.39 2.58% +30 +241 12:40 PM GT2:GOV 2 Year 2.50 98.58 2.81% +27 +199 12:40 PM GT5:GOV 5 Year 1.88 92.23 2.79% +30 +122 12:40 PM GT10:GOV 10 Year 2.25 87.64 2.87% +28 +64 12:40 PM GT30:GOV 30 Year Treasury Inflation Protected Securities (TIPS) NAME COUPON PRICE YIELD 1 MONTH 1 YEAR TIME (EDT) 0.13 102.98 -0.47% +68 +117 12:42 PM GTIIS:GOV 5 Year 0.13 102.52 -0.13% +37 +65 GTI 10:GOV 10 Year 12:42 PM 2.13 134.03 0.27% +23 +49 12:41 PM GT||20:GOV 20 Year 0.13 95.40 0.29% +25 +31 12:41 PM GT1130:GOV 30 Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started