Answered step by step

Verified Expert Solution

Question

1 Approved Answer

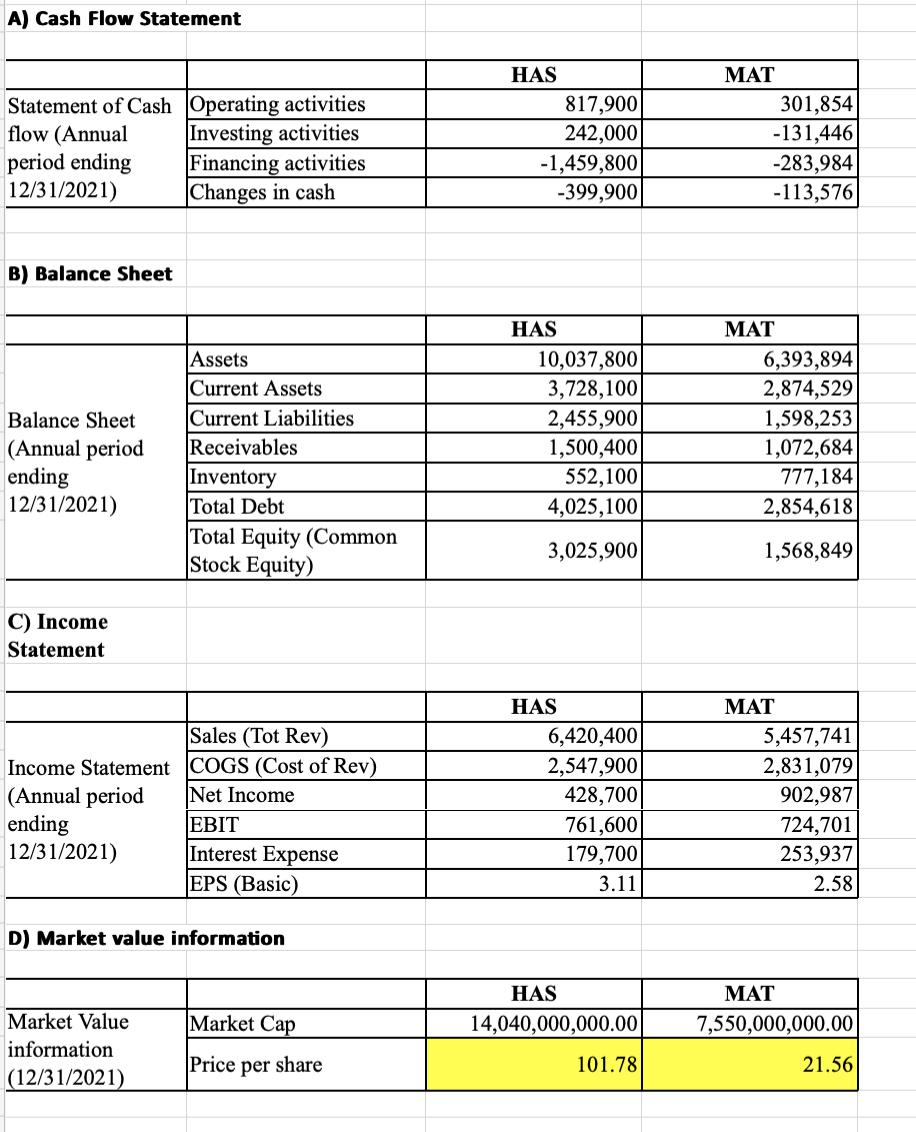

Based on the debt management ratios you obtained, which company is doing better in this dimension? Explain. A) Cash Flow Statement Statement of Cash Operating

Based on the debt management ratios you obtained, which company is doing better in this dimension? Explain.

A) Cash Flow Statement Statement of Cash Operating activities Investing activities Financing activities Changes in cash flow (Annual period ending 12/31/2021) B) Balance Sheet Balance Sheet (Annual period ending 12/31/2021) C) Income Statement Income Statement (Annual period ending 12/31/2021) Assets Current Assets Current Liabilities Receivables Inventory Total Debt Total Equity (Common Stock Equity) Market Value information (12/31/2021) Sales (Tot Rev) COGS (Cost of Rev) Net Income EBIT Interest Expense EPS (Basic) D) Market value information Market Cap Price per share HAS -1,459,800 -399,900 HAS 817,900 242,000 10,037,800 3,728,100 2,455,900 1,500,400 552,100 4,025,100 3,025,900 HAS 6,420,400 2,547,900 428,700 761,600 179,700 3.11 HAS 14,040,000,000.00 101.78 MAT 301,854 -131,446 -283,984 -113,576 MAT 6,393,894 2,874,529 1,598,253 1,072,684 777,184 2,854,618 1,568,849 MAT 5,457,741 2,831,079 902,987 724,701 253,937 2.58 MAT 7,550,000,000.00 21.56

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

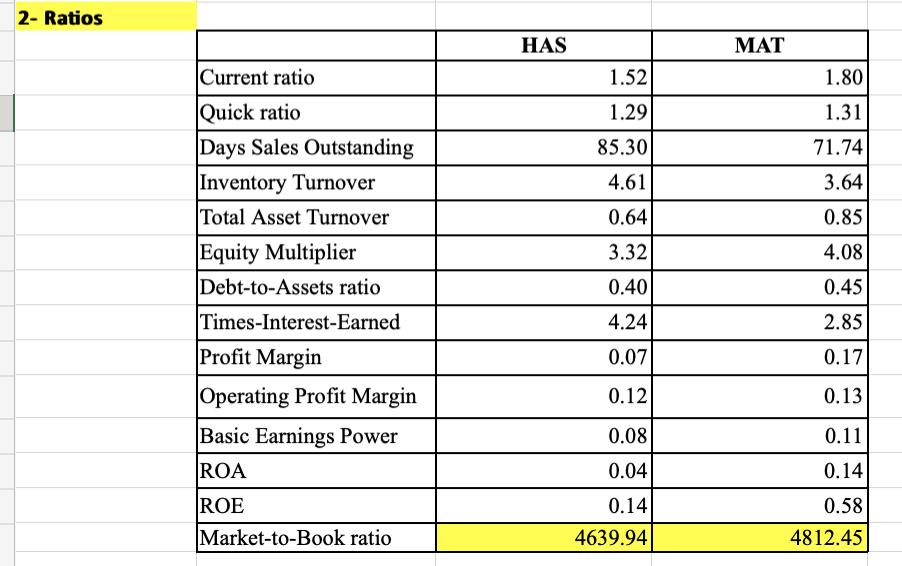

HAS is doing better in debt management as per the debt management ratios provided The giv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started