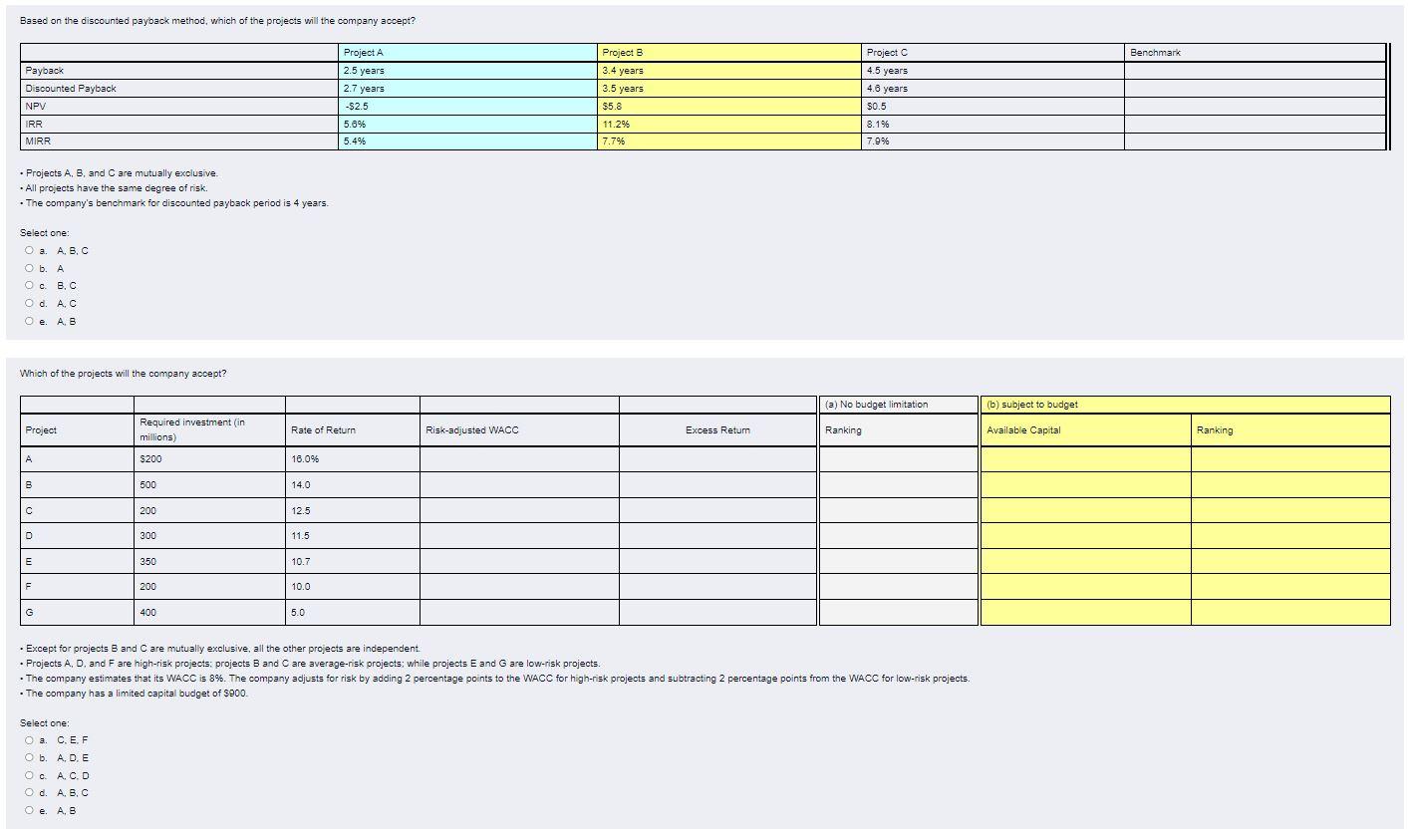

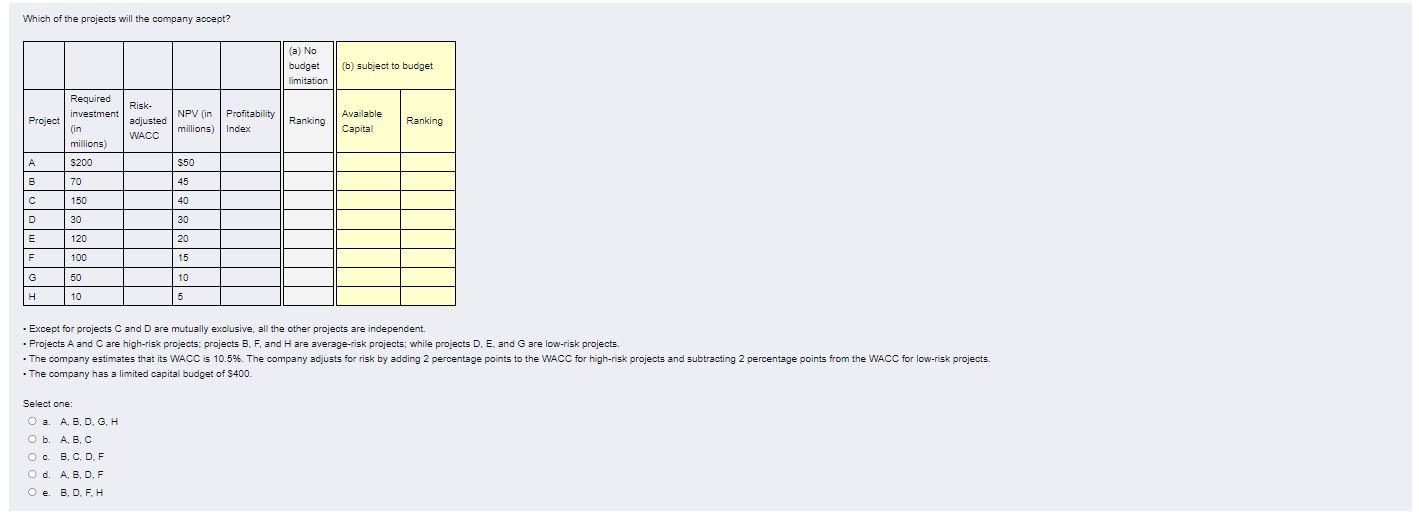

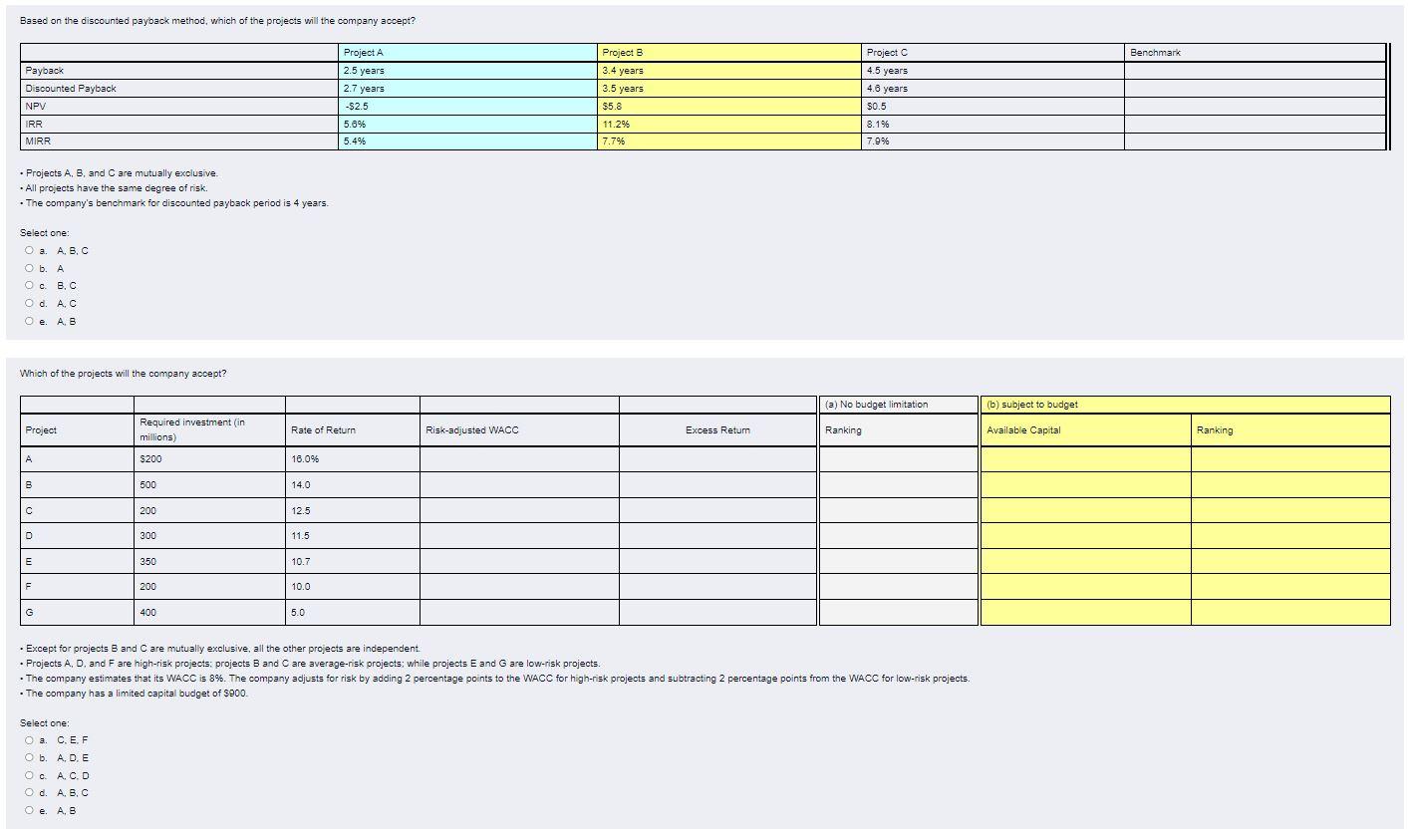

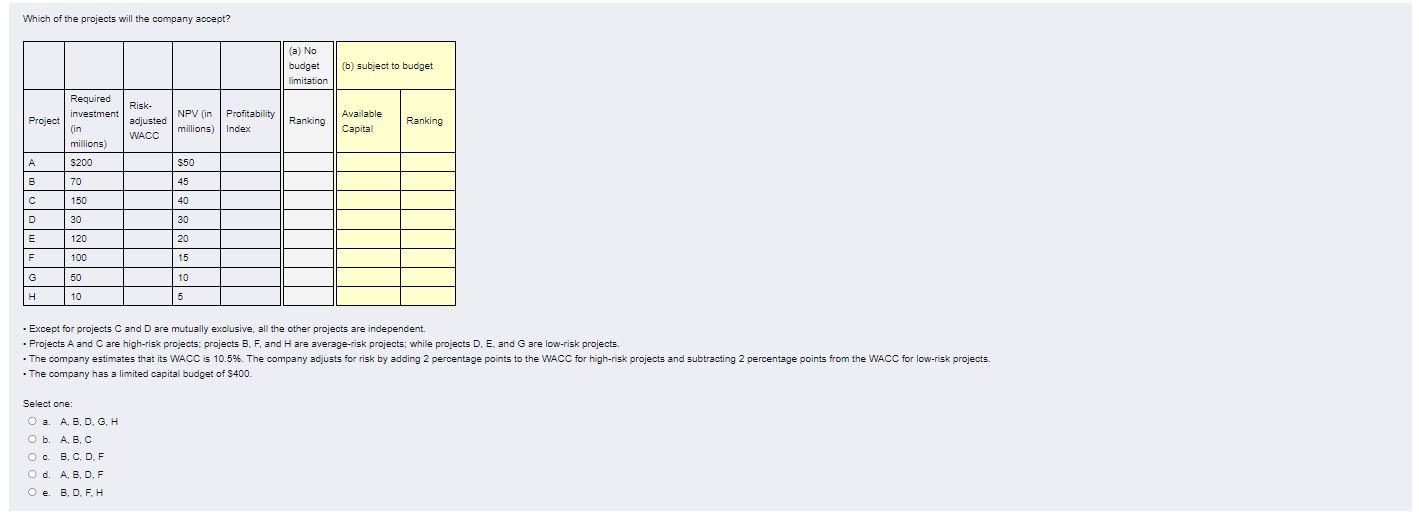

Based on the discounted payback method, which of the projects will the company accept? Project A Project B Benchmark 3.4 years Payback Discounted Payback NPV 2.5 years 2.7 years 3.5 years Project 4.5 years 4.8 years $0.5 8.19% $5.8 IRA -$2.5 5.6% % 5.4% 11.2% 7.796 MIRR 7.99% - Projects A, B, and C are mutually exclusive . All projects have the same degree of risk. . The company's benchmark for discounted payback period is 4 years. Select one: O a A, B, C OLA OCBC Od O d. A.C O e AB . Which of the projects will the company accept? (a) No budget limitation (b) subject to budget Project Required investment in millions) Rate of Return Risk-adjusted WACO Excess Return Ranking Available Capital Ranking A $200 16.0% B 500 14.0 200 12.5 D 300 11.5 E E 350 10.7 F 200 10.0 G 400 5.0 . Except for projects B and C are mutually exclusive, all the other projects are independent. Projects A, D, and F are high-risk projects: projects B and C are average-risk projects; while projects E and G are low-risk projects. . The company estimates that its WACC is 3%. The company adjusts for risk by adding 2 percentage points to the WACC for high-risk projects and subtracting 2 percentage points from the WACC for low-risk projects. . The company has a limited capital budget of 8900 Select one: O O a. C. EF O b. A, D, E O A.C.D Od ABC O e A, 8 . Which of the projects will the company accept? (a) No budget limitation (b) subject to budget Required Project investment Risk- adjusted WACC NPV (in | Profitability millions) Index Ranking Available Capital Ranking lin millions) $200 A $50 B 70 45 150 40 D D 30 30 E 120 20 F 100 15 G 10 50 10 H 5 - Except for projects C and D are mutually exclusive, all the other projects are independent. Projects A and C are high-risk projects: projects B. F. and H are average-risk projects; while projects D. E. and G are low-risk projects. The company estimates that its WACC is 10.5%. The company adjusts for risk by adding 2 percentage points to the WACC for high-risk projects and subtracting 2 percentage points from the WACC for low-risk projects. . The company has a limited capital budget of S400 Select one: a. A, B, D, G, H O b. ABC Oc B, C, DF d. A, B, D, F O e BDF, H