Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the EBITDA reported for Target, what is an estimate for Targets enterprise value using Walmarts enterprise value/EBITDA multiple? Using Targets financial data and

Based on the EBITDA reported for Target, what is an estimate for Target’s enterprise value using Walmart’s enterprise value/EBITDA multiple?

Using Target's financial data and their implied value using multiples, what is an estimate for their share price?

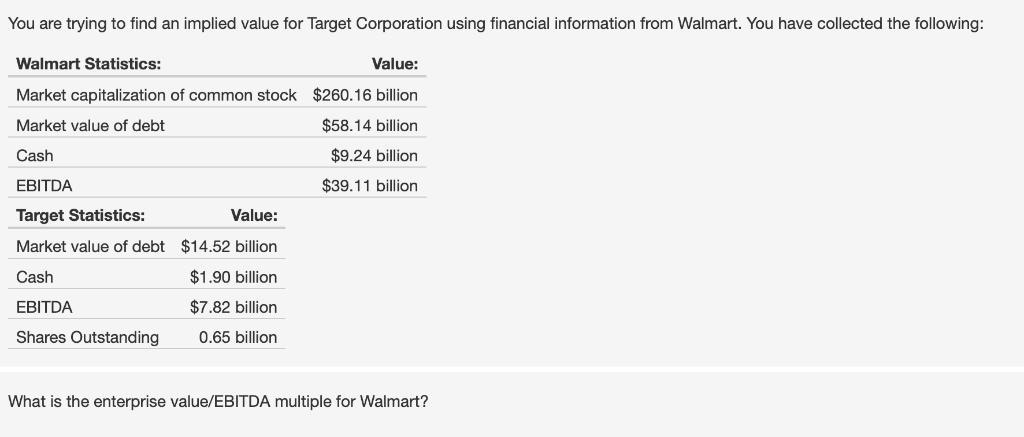

You are trying to find an implied value for Target Corporation using financial information from Walmart. You have collected the following: Walmart Statistics: Value: Market capitalization of common stock $260.16 billion Market value of debt $58.14 billion Cash $9.24 billion EBITDA $39.11 billion Target Statistics: Market value of debt Cash EBITDA Shares Outstanding Value: $14.52 billion $1.90 billion $7.82 billion 0.65 billion What is the enterprise value/EBITDA multiple for Walmart?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a What is the enterprise valueEBITDA multiple for Walmart EVEBITDA EV ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started