Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the exel data below figure out the following: As the loan officer, you must pass along the news in a denial business letter

Based on the exel data below figure out the following:

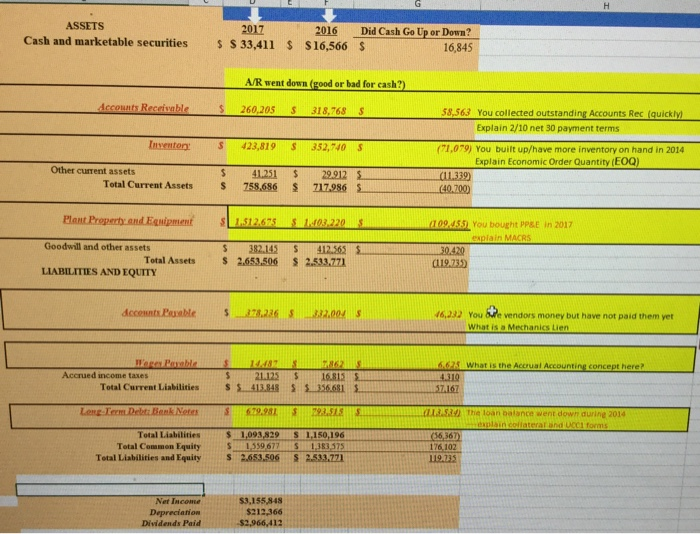

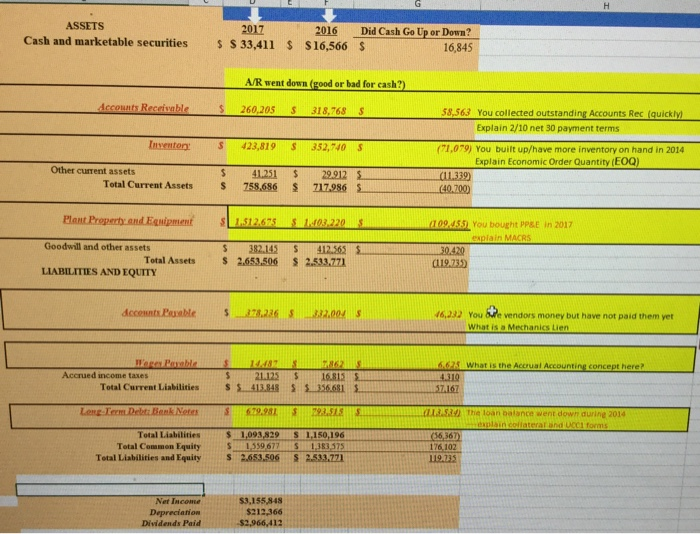

ASSETS Cash and marketable securities 2017 $ $ 33,411 $ 2016 $16,566 Did Cash Go Up or Down? S 16,845 A/R went down (good or bad for cash?) decounts Receivable 260,205 5 318,768 $ 58,563 You collected outstanding Accounts Rec (quickly Explain 2/10 net 30 payment terms Inventor 423,819 $ 352,740 S Other current assets Total Current Assets (+1,079) You built up/have more inventory on hand in 2014 Explain Economic Order Quantity (EOQ) (11.339) (40.700 41.251 758,686 $ $ 29,912 S 217,986 S Plant Proper and Equipment 1.512,675 $ 1.403,220 S 4 09.455) You bought PPEE in 2017 5 30.410 Goodwill and other assets Total Assets LIABILITIES AND EQUITY $ $ 382.145 2.653,506 412.565 2.533.771 (119.735) decent Post 378,236 5 3320045 16,232 You Se vendors money but have not paid them yet Hege Poble Accrued income taxes Total Current Liabilities 2015 413.843 S S 316.68.1 Leneem Debt: Bank Notes 291515 Total Liabilities Total Common Equity Total Liabilities and Equity $ $ S 1,093,829 1,559677 2.653.506 $ S S 1,150,196 1.33,575 2.533.771 113.534) the loan balance went down during 2014 implain collateral and reforms (16,367) 176.10Z 119.735 Net Income Depreciation Dividends Paid 53,155848 $212,366 $2,966,412 As the loan officer, you must pass along the news in a denial business letter that is most professional and written in an objective manner. Please use values in the letter whenever possible.

Using analysis of the excel data sheet below, explain in your denial letter why you are denying the loan renewal based on:

1. Accounts Receivable

2. Accounts Payable

3. Inventory

FYI Explain how the six highlighted accounts impacted cash flow from one year to the next. The account either added or reduced the cash balance from one year to the next.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started