| Based on the figures from your solution, would you recommend that BBC upgrade the production line as proposed? Why? |

| Would your answer to Question 1 change if BBC did not expect any savings in operating expenses from the renovations? That is, costs are the same percentage of revenues as those that would exist with the existing equipment. Explain, making reference to both NPV and IRR and using specific figures. |

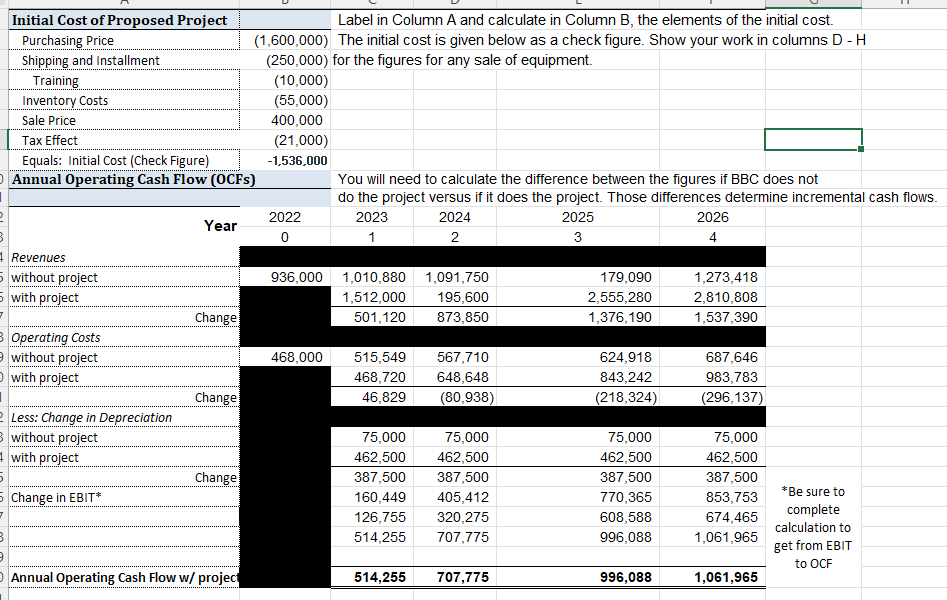

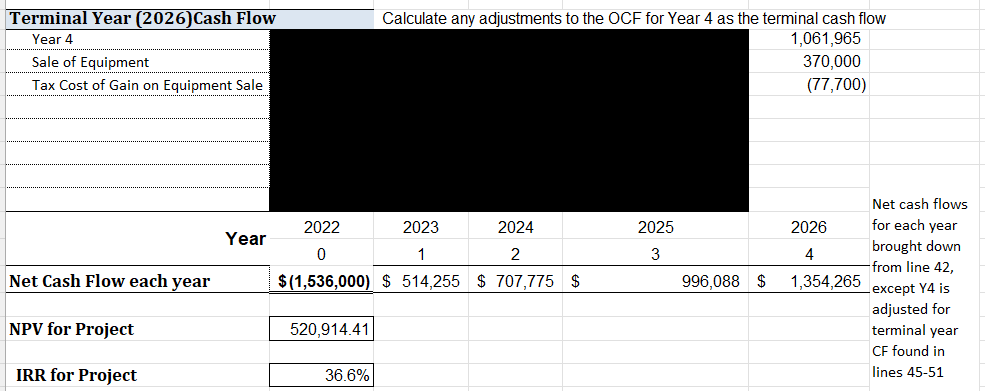

4 Initial Cost of Proposed Project Label in Column A and calculate in Column B, the elements of the initial cost. Purchasing Price (1,600,000) The initial cost is given below as a check figure. Show your work in columns D-H Shipping and Installment (250,000) for the figures for any sale of equipment. Training (10,000) Inventory Costs (55,000) Sale Price 400,000 Tax Effect (21,000) Equals: Initial Cost (Check Figure) -1,536,000 Annual Operating Cash Flow (OCFs) You will need to calculate the difference between the figures if BBC does not do the project versus if it does the project. Those differences determine incremental cash flows. 2022 2023 2024 2025 2026 Year 0 1 2 3 4 Revenues without project 936,000 1,010,880 1,091,750 179,090 1,273,418 with project 1,512,000 195,600 2,555,280 2,810,808 Change 501,120 873,850 1,376,190 1,537,390 Operating costs without project 468,000 515,549 567,710 624,918 687,646 with project 468,720 648,648 843,242 983,783 Change 46,829 (80,938) (218,324) (296,137) 2 Less: Change in Depreciation 3 without project 75,000 75,000 75,000 75,000 with project 462,500 462,500 462,500 462,500 Change 387,500 387,500 387,500 387,500 5 Change in EBIT* 160,449 405,412 770,365 853,753 *Be sure to 126,755 complete 320,275 608,588 674,465 calculation to 514.255 707,775 996,088 1,061,965 get from EBIT to OCF Annual Operating Cash Flow w/ project 514,255 707,775 996,088 1,061,965 7 7 Terminal Year (2026)Cash Flow Year 4 Sale of Equipment Tax Cost of Gain on Equipment Sale Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 1,061,965 370,000 (77,700) 2022 2023 2024 2025 Year 1359 0 1 2 Net Cash Flow each year $(1,536,000) $ 514,255 $ 707,775 $ 996,088 $ Net cash flows 2026 for each year brought down 4 from line 42, 1,354,265 except Y4 is adjusted for terminal year CF found in lines 45-51 NPV for Project 520,914.41 IRR for Project 36.6% 4 Initial Cost of Proposed Project Label in Column A and calculate in Column B, the elements of the initial cost. Purchasing Price (1,600,000) The initial cost is given below as a check figure. Show your work in columns D-H Shipping and Installment (250,000) for the figures for any sale of equipment. Training (10,000) Inventory Costs (55,000) Sale Price 400,000 Tax Effect (21,000) Equals: Initial Cost (Check Figure) -1,536,000 Annual Operating Cash Flow (OCFs) You will need to calculate the difference between the figures if BBC does not do the project versus if it does the project. Those differences determine incremental cash flows. 2022 2023 2024 2025 2026 Year 0 1 2 3 4 Revenues without project 936,000 1,010,880 1,091,750 179,090 1,273,418 with project 1,512,000 195,600 2,555,280 2,810,808 Change 501,120 873,850 1,376,190 1,537,390 Operating costs without project 468,000 515,549 567,710 624,918 687,646 with project 468,720 648,648 843,242 983,783 Change 46,829 (80,938) (218,324) (296,137) 2 Less: Change in Depreciation 3 without project 75,000 75,000 75,000 75,000 with project 462,500 462,500 462,500 462,500 Change 387,500 387,500 387,500 387,500 5 Change in EBIT* 160,449 405,412 770,365 853,753 *Be sure to 126,755 complete 320,275 608,588 674,465 calculation to 514.255 707,775 996,088 1,061,965 get from EBIT to OCF Annual Operating Cash Flow w/ project 514,255 707,775 996,088 1,061,965 7 7 Terminal Year (2026)Cash Flow Year 4 Sale of Equipment Tax Cost of Gain on Equipment Sale Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 1,061,965 370,000 (77,700) 2022 2023 2024 2025 Year 1359 0 1 2 Net Cash Flow each year $(1,536,000) $ 514,255 $ 707,775 $ 996,088 $ Net cash flows 2026 for each year brought down 4 from line 42, 1,354,265 except Y4 is adjusted for terminal year CF found in lines 45-51 NPV for Project 520,914.41 IRR for Project 36.6%